|

市场调查报告书

商品编码

1636211

亚太地区 EPCM(工程、采购和施工管理):市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Asia Pacific Engineering, Procurement, And Construction Management (EPCM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

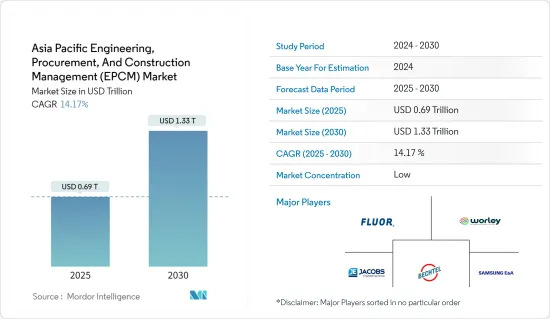

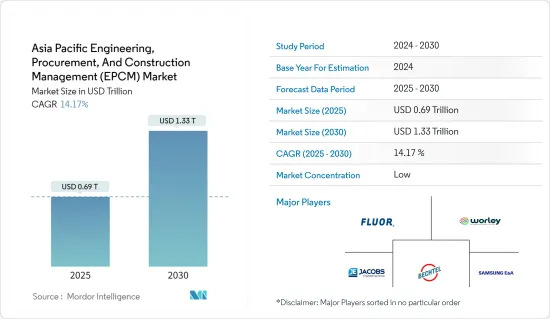

预计2025年亚太地区EPCM(工程、采购和施工管理)市场规模将达6,900亿美元,预测期内(2025-2030年)复合年增长率为14.17%,至2030年将达到1.33兆美元。将达到10亿美元。

在快速工业化、都市化和基础设施扩张的推动下,亚太地区的 EPCM(工程、采购和施工管理)市场正在经历显着成长。推动这一成长的关键产业包括能源、采矿、石油和天然气以及建筑。

在整个亚太地区,各国政府正在对各种基础设施开发进行大量投资。其中包括交通(公路、铁路、机场等)、城市发展、智慧城市的推广。不断增长的能源需求正在推动对发电的投资,重点是太阳能和风电场等可再生能源。特别是在中国和印度等国家,工业正在迅速扩张,製造业和工业设备对EPCM服务的需求不断增加。亚太地区矿产资源丰富,矿业计划快速成长,需要全面的EPCM服务。

中国在区域市场中脱颖而出,引领了基础设施、能源和工业领域的大规模投资。其雄心勃勃的「一带一路」倡议(BRI)进一步巩固了其在EPCM市场的地位。同时,印度在城市发展、可再生能源和工业企业方面进行了大量投资,并取得了长足进展。印度製造和智慧城市使命等重要政府计画对于推动这一成长至关重要。澳洲以其强大的采矿业而闻名,越来越多地采用先进的 EPCM 解决方案来满足众多计划的需求。此外,对可再生能源和基础设施的关注也推动了市场扩张。另一方面,日本和韩国对智慧城市和永续能源解决方案非常感兴趣,并致力于将最尖端科技融入其基础设施计划中。

亚太地区EPCM(工程、采购和施工管理)市场趋势

政府加强亚太地区 EPC 市场的倡议

亚太地区国家政府正在推出各种倡议来促进工程、采购和施工(EPC)市场的成长。这些倡议主要针对基础设施、能源和工业扩张。

中国的「一带一路」倡议是其策略的基石,旨在加强亚洲、欧洲和非洲的互联互通与合作。这项措施将带来大规模的运输、能源和贸易路线投资。

中国已为2021年至2025年西藏基础建设计划累计300亿美元的巨额预算。到2025年,西藏的公路里程将超过1300公里,其中公路里程将达到惊人的12万公里。西藏「十四五」规划中的重要计划包括川藏铁路雅安至宁芝、和田至日喀则和吉隆至日喀则段的初步建设,以及广泛的成武上海高速铁路网。

在印度,智慧城市使命是一项关键倡议,旨在将 100 个城市转变为智慧城市中心。这些城市预计将拥有升级的城市基础设施、永续的资源以及智慧技术的强大整合。国家基础设施管道 (NIP) 是一个全面的蓝图,概述了到 2025 年投资额将接近 1.5 兆美元,涵盖交通、能源、水和卫生设施。

此外,「印度製造」是政府的重大倡议,鼓励国内外公司在印度设立製造地。该倡议的重点是加强工业基础设施和吸引投资,特别是在电子、汽车和製药等产业。

总之,亚太地区各国政府正透过策略措施积极加强工程、采购和施工(EPC)市场。中国的「一带一路」倡议就是一个很好的例子,体现了中国致力于加强全球互联互通与合作的决心。值得注意的是,中国正在交通、能源和贸易路线上进行大规模投资,特别是西藏的基础设施计划,突显了对区域发展的承诺。同时,印度正透过智慧城市使命和广泛的国家基础设施管道(NIP)等措施重塑其城市结构。

印度在快速成长的 EPCM(工程、采购和施工管理)市场中领先亚太国家

印度是亚太地区领先的 EPCM(工程、采购和施工管理)服务成长最快的市场之一。印度政府正在推行雄心勃勃的基础设施计划,包括智慧城市使命、Bharatmala Pariyojana 高速公路和 Sagarmala 港口计划。这些倡议凸显了该国对基础设施的承诺,并为 EPCM 服务铺平了道路。随着都市化进程的推进,从地铁到机场、智慧城市等城市基础建设亟待加强。除此之外,加强製造业的「印度製造」措施正在刺激新工厂和工业设施的建设,增加对EPCM服务的需求。

印度对外国直接投资 (FDI) 的欢迎态度正在吸引全球参与者,并不断增加对基础设施开发和 EPCM 专业知识的需求。此外,印度积极的可再生能源目标,特别是太阳能、风能和水力发电,为 EPCM 公司创造了肥沃的土壤。

随着印度扩大和现代化其发电和配电网路以满足不断增长的能源需求,EPCM 市场将受到进一步刺激。 PMAY(Pradhan Mantri Awas Yojana)等住宅倡议也推动了住宅建设和相关基础设施的需求。此外,从道路到电气化计划农村基础设施的重大投资正在进一步扩大EPCM服务的范围。

印度基础设施产业预计将强劲成长,计划到2025年投资1.4兆美元。政府雄心勃勃的国家基础设施管道(NIP)计划概述了向能源、公路、铁路和城市发展等一系列行业注入巨额资金。这项前所未有的推动预计将创造相关产业、创造就业机会并重振经济。具体重点领域是扩大公共数位基础设施、清洁和可再生能源计划以及建立有弹性的城市基础设施。这项雄心勃勃的事业旨在增强印度的全球竞争力并提高其广大人口的生活品质。

在该国积极的基础设施计划、雄心勃勃的可再生能源目标和有利的外国直接投资政策的推动下,印度的EPCM市场正在显着增长。

亚太地区EPCM(工程、采购和施工管理)产业概况

亚太地区的EPCM(工程、采购和施工管理)市场是一个分散的市场,参与者众多。市场上的公司包括福陆公司、沃利公司、雅各布斯工程集团、柏克德公司和三星工程公司。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 越来越多地采用再生能源来源和永续基础设施计划

- 快速工业化与都市化

- 市场限制因素

- 与建筑材料相关的成本上涨

- 供应链中断

- 市场机会

- 采用智慧基础设施技术

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- PESTLE分析

- 洞察市场创新

第五章市场区隔

- 按服务

- 设计

- 采购

- 建造

- 其他服务

- 按行业分类

- 住宅、工业、基础设施(交通)、能源和公共产业

- 产业

- 基础设施(交通)

- 能源/公共产业

- 按国家/地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太地区其他国家

第六章 竞争状况

- 市场集中度概况

- 公司简介

- Fluor Corporation

- Worley

- Jacobs Engineering Group

- Bechtel Corporation

- Samsung Engineering

- Hyundai Engineering & Construction

- Chiyoda Corporation

- JGC Corporation

- China State Construction Engineering Corporation

- Larsen & Toubro(L&T)

- Kent

- Nuberg EPC

第7章 未来趋势

The Asia Pacific Engineering, Procurement, And Construction Management Market size is estimated at USD 0.69 trillion in 2025, and is expected to reach USD 1.33 trillion by 2030, at a CAGR of 14.17% during the forecast period (2025-2030).

The Asia-Pacific engineering, procurement, and construction management (EPCM) market has grown substantially, propelled by rapid industrialization, urbanization, and infrastructure expansion. Key industries fueling this growth include energy, mining, oil and gas, and construction.

Across APAC, governments are channeling significant investments into a broad spectrum of infrastructure endeavors. These span transportation (comprising roads, railways, and airports), urban development, and the promotion of smart cities. The escalating energy needs are steering investments toward power generation, with a notable emphasis on renewables like solar and wind farms. Notably, the swift industrial expansion, particularly in nations such as China and India, bolsters the demand for EPCM services in manufacturing and industrial setups. Given APAC's abundant mineral resources, the region is witnessing a surge in mining projects, all necessitating comprehensive EPCM services.

China stands out in the regional market, spearheading substantial investments across the infrastructure, energy, and industrial domains. Its ambitious Belt and Road Initiative (BRI) further cements its position in the EPCM market. Meanwhile, India is making significant strides with pronounced investments in urban development, renewable energy, and industrial ventures. Key government programs like Make in India and the Smart Cities Mission are pivotal in driving this growth. Australia, known for its robust mining industry, is increasingly turning to advanced EPCM solutions to meet the demands of its numerous projects. Furthermore, the country's focus on renewable energy and infrastructure is further fueling market expansion. Japan and South Korea, on the other hand, are directing their attention toward integrating cutting-edge technologies into their infrastructure projects, with a keen eye on smart cities and sustainable energy solutions.

Asia Pacific EPCM Marke Trends

Government Initiatives Bolstering the APAC EPC Market

Governments in Asia-Pacific (APAC) countries are rolling out various initiatives to bolster growth in the engineering, procurement, and construction (EPC) market. These initiatives predominantly target infrastructure, energy, and industrial expansions.

China's Belt and Road Initiative (BRI) is a cornerstone of its strategy, aiming to enhance connectivity and collaboration across Asia, Europe, and Africa. This initiative translates into significant transportation, energy, and trade route investments.

China has earmarked a hefty USD 30 billion for infrastructure projects in Tibet from 2021 to 2025. By 2025, Tibet is set to boast over 1,300 km of expressways and a staggering 120,000 km of highways. Notable projects in Tibet's 14th Five-Year Plan encompass the Ya'an to Nyingchi leg of the Sichuan Tibet Railway, initial groundwork on the Hotan-Shigatse and Gyirong-Shigatse railway lines, and the expansive Chengdu-Wuhan-Shanghai high-speed railway network.

In India, the Smart Cities Mission is a pivotal endeavor, aiming to transform 100 cities into smart urban centers. These cities are envisioned with upgraded urban infrastructure, sustainable resources, and a strong integration of smart technologies. The National Infrastructure Pipeline (NIP) is a comprehensive blueprint outlining investments nearing USD 1.5 trillion by 2025, spanning transportation, energy, water, and sanitation.

Additionally, 'Make in India' is a flagship government initiative, beckoning both domestic and international firms to set up manufacturing bases in the country. The initiative is laser-focused on bolstering industrial infrastructure and attracting investments, particularly in industries like electronics, automotive, and pharmaceuticals.

Conclusively, governments across Asia-Pacific countries are actively bolstering the engineering, procurement, and construction (EPC) market through strategic measures. China's Belt and Road Initiative (BRI) stands out as a prime example, showcasing its dedication to enhancing global connectivity and cooperation. Notably, China is channeling significant investments into transportation, energy, and trade routes, with a particular focus on infrastructure projects in Tibet, underscoring its regional development commitment. Simultaneously, India is reshaping its urban fabric through initiatives like the Smart Cities Mission and the expansive National Infrastructure Pipeline (NIP).

India Leads Among APAC Countries as one of the Fastest-growing EPCM Markets

India leads Asia-Pacific as one of the fastest-growing markets for engineering, procurement, and construction management (EPCM) services. The Indian government's ambitious infrastructure programs, such as the Smart Cities Mission, Bharatmala Pariyojana for highways, and the Sagarmala Project for ports, are pivotal. These initiatives underscore the nation's commitment to infrastructure, which is opening up substantial avenues for EPCM services. With urbanization on the rise, there is a pressing need for enhanced urban infrastructure, from metro rail systems to airports and smart city endeavors. Complementing this, the "Make in India" initiative, designed to bolster the manufacturing industry, is fueling the construction of new plants and industrial facilities, escalating the demand for EPCM services.

India's welcoming stance on foreign direct investment (FDI) lures global players, further amplifying the call for infrastructure development and EPCM expertise. Additionally, India's aggressive renewable energy targets, especially solar, wind, and hydroelectric power, create fertile ground for EPCM firms.

As India expands and modernizes its power generation and distribution networks to meet escalating energy needs, the EPCM market receives an added impetus. Housing initiatives like the Pradhan Mantri Awas Yojana (PMAY) are also propelling the demand for residential construction and its associated infrastructure. Furthermore, substantial investments in rural infrastructure, spanning from roads to electrification projects, are further broadening the scope of EPCM services.

India's infrastructure industry is poised for strong growth, with planned investments amounting to USD 1.4 trillion by 2025. The government's ambitious National Infrastructure Pipeline (NIP) program outlines the injection of massive capital into various industries, including energy, roads, railways, and urban development. This unprecedented push is expected to spawn associated industries, create jobs, and stimulate the economy. Specific focus areas are expanding public digital infrastructure, clean and renewable energy projects, and establishing resilient urban infrastructure. This ambitious undertaking seeks to enhance India's global competitiveness and improve the quality of life across its vast populace.

The Indian EPCM market is witnessing substantial growth, propelled by the nation's proactive infrastructure projects, ambitious renewable energy goals, and favorable foreign direct investment policies.

Asia Pacific EPCM Industry Overview

The Asia-Pacific engineering, procurement, and construction management (EPCM) market features a fragmented landscape, hosting numerous players. Prominent entities in this market include Fluor Corporation, Worley, Jacobs Engineering Group, Bechtel Corporation, and Samsung Engineering.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Adoption of Renewable Energy Sources and Sustainable Infrastructure Projects

- 4.2.2 Rapid Industrialization and Urbanization

- 4.3 Market Restraints

- 4.3.1 Rising Costs Associated with Construction Material

- 4.3.2 Supply Chain Disruptions

- 4.4 Market Opportunities

- 4.4.1 Adoption of Smart Infrastructure Technologies

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 PESTLE Analysis

- 4.8 Insights into Technology Innovation in the Market

5 MARKET SEGMENTATION

- 5.1 By Service

- 5.1.1 Engineering

- 5.1.2 Procurement

- 5.1.3 Construction

- 5.1.4 Other Services

- 5.2 By Sectors

- 5.2.1 Residential, Industrial, Infrastructure (Transportation), and Energy and Utilities

- 5.2.2 Industrial

- 5.2.3 Infrastructure (Transportation)

- 5.2.4 Energy and Utilities

- 5.3 By Country

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Japan

- 5.3.4 Australia

- 5.3.5 South Korea

- 5.3.6 Rest of APAC

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Fluor Corporation

- 6.2.2 Worley

- 6.2.3 Jacobs Engineering Group

- 6.2.4 Bechtel Corporation

- 6.2.5 Samsung Engineering

- 6.2.6 Hyundai Engineering & Construction

- 6.2.7 Chiyoda Corporation

- 6.2.8 JGC Corporation

- 6.2.9 China State Construction Engineering Corporation

- 6.2.10 Larsen & Toubro (L&T)

- 6.2.11 Kent

- 6.2.12 Nuberg EPC