|

市场调查报告书

商品编码

1636212

危险废弃物管理:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Hazardous Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

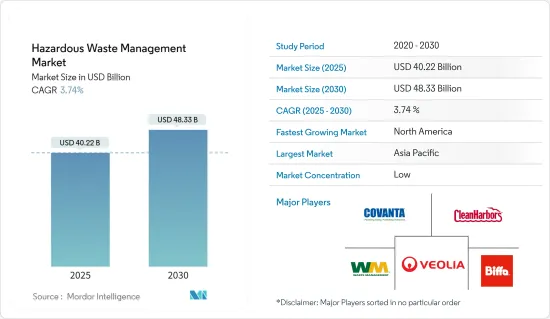

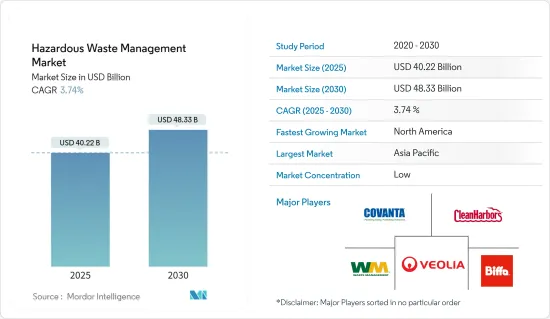

危险废弃物管理市场规模预计到 2025 年为 402.2 亿美元,预计到 2030 年将达到 483.3 亿美元,预测期内(2025-2030 年)复合年增长率为 3.74%。

主要亮点

- 危险废弃物管理包括处理、管理和处置威胁人类健康或环境的材料的实践和程序。这包括废弃物收集、回收、处理、运输、处置和处置场监测。主要目标是降低风险并保护健康和环境。

- 危险废弃物管理市场由多种因素驱动。由于对污染和健康风险的担忧,世界各国政府越来越关注废弃物处理。因此,正在製定更严格的法规来控制废弃物处理做法并鼓励负责任的管理。

- 技术进步大大加强了危险废弃物管理。废弃物处理和处置方面的技术创新正在催生更有效率、更环保的方法。着名的技术包括蒸气高压釜、化学处理、臭氧化、热解和电子束技术。例如,Pero 是一项新技术,旨在帮助企业减少对环境的影响并更有效地管理废弃物收集。 Pero 透过多种方式帮助公司实现目标。首先,Pero 系统监控垃圾箱的装满程度,并提供有关垃圾箱内容和位置的即时资讯。

- 2023 年 4 月,Recycle Track Systems (RTS) 收购了 RecycleSmart Solutions,巩固了其作为加拿大首屈一指的先进废弃物转移、有机回收和回收管理技术独立提供者的地位。此次收购涵盖了 Recycle Smart 的尖端 Pello废弃物感测器技术,这是物联网 (IoT) 平台不可或缺的一部分。

危险废弃物管理市场趋势

预计亚太地区将在未来几年主导市场

- 中国、印度和东南亚国家等国家的快速工业化导致危险废弃物产生量激增,特别是在製造业、采矿、电子等产业。例如,自 1990 年代以来,中国的废弃物排放增加了约两倍。这一增长是由多种因素造成的。过去几十年来,中国的都市化稳步提高。中国国家统计局的资料显示,到2023年,约66.2%的人口将居住在都市区。

- 根据国际货币基金组织(IMF)的数据,中国强劲的经济成长进一步刺激了工业废弃物的产生,2023年中国的GDP约为17.7兆美元就证明了这一点。虽然矿渣、飞灰等传统工业废弃物的产生量保持稳定,但随着工业的进步,危险废弃物的产生量却在迅速增加。值得注意的是,需要更先进的处理来安全处置这些危险产品。 2024年3月,杰尔集团宣布推出分散式危险废弃物处理装置“GreenWell”,达到了一个重要里程碑。这项创新解决方案的开发是为了解决集中危险废弃物处理的挑战,避免中间步骤并实现现场处理。

- 透过简化现场处理并消除中间步骤,这种最先进的设备显着提高了处理效率,减少了废弃物并促进了系统内的污水回收。令人印象深刻的是,该装置已经证明了其有效性,将井场含油废弃物减少了 20% 以上,基础油回收率达到 95%,并取得了显着成果。此外,它还能够在其营运框架内实现污水的零排放回收。

- 过去几十年来,亚太地区在加强危险废弃物管理法规结构取得了重大进展。各国政府正在收紧环境法规,各行业被迫采取更严格的废弃物管理做法。例如,2021年,印度中央政府启动了Swachh Bharat Mission Cities 2.0(SBM-U 2.0),并设想「无废弃物城市」。该任务的重点是城市固态废弃物的上门收集、源头分类和科学处理,目标是确保所有城市至少获得三星认证。

- 亚洲(尤其是中国)的快速工业化导致危险废弃物产生量显着增加,但废弃物处理技术的进步和严格的法律规范正在鼓励更高效、更环保的废弃物管理实践,我们正在鼓励变革。

- 中国和印度等快速工业化国家的危险废弃物产生量迅速增加,凸显了对先进废弃物管理解决方案的需求。中国显着的经济成长和都市化直接导致了危险废弃物的增加,因此需要像 GreenWell 设备这样的创新处理技术。该技术不仅提高了处理效率,还透过污水回收支持环境的永续性。此外,亚太地区法律规范的加强标誌着对环境挑战的日益承诺,迫使产业采用更好的废弃物管理方法。这些趋势显示亚太地区的工业正处于更永续成长的边缘。

根据废弃物处理类型,回收将在未来获得进一步的推动力。

- 危险废弃物收集涉及收集、管理和运输对人类健康或环境构成重大风险的材料的系统程序。这些物质根据其固有特性(例如易燃性、毒性)和监管机构的具体名称进行分类。准确的识别对于应用正确的处理和处置通讯协定至关重要。

- 2024年7月,墨西哥环境秘书处Sedema成功地将5,600多个轮胎从霍奇米尔科和古斯塔沃马德罗的非法倾倒场运送到加工厂。这些轮胎被重新用作水泥生产的替代燃料。这项与 GeoCycle Mexico 合作的倡议是 Sedema 应对轮胎处置不当带来的环境挑战策略的基石,轮胎处置不当往往会导致公共污染和野火风险增加。 Sedema 宣布了透过 Recicratron 计划加强轮胎回收的计划,这表明了墨西哥对全面废弃物管理以及摆脱石化燃料和过度矿物开采的承诺。

- 2024 年 6 月,渥太华市议会核准了固态废弃物总体规划。预计垃圾掩埋场的更新费用可能超过6亿美元。核准的30年策略包括近50项倡议。这些旨在转移废弃物并将垃圾掩埋场的寿命延长至 2049 年。渥太华的方法强调对永续废弃物管理和长期环境管理的承诺。

- 有效的危险废弃物收集需要严格的法规遵循、适当的人力资源开发以及相关人员(包括废弃物排放、运输者和处置设施)之间的合作。这种类型的合作可确保安全、合规的危险废弃物管理。

- 由于法规遵从性和创新的废弃物管理,危险废弃物收集市场正在不断发展。 Sedema 在墨西哥的努力体现了对回收废弃物、降低环境风险和促进永续性的积极态度。渥太华的总体规划体现了对减少废弃物和资源管理的承诺,解决垃圾掩埋场和未来的垃圾掩埋场问题。这些趋势凸显了综合废弃物管理、优先考虑永续性和公共卫生的更广泛趋势。

危险废弃物管理产业概述

危险废弃物管理市场适度分散且竞争激烈。威立雅、Biffa、卡万塔控股、Clean Harbors、苏伊士集团等是危险废弃物管理市场的主要企业。

此外,市场主要企业正在采取扩大新设施等倡议,以增加其在市场上的影响力。例如,2022年5月,特立尼达和多巴哥固体废弃物管理公司(SWMCOL)推出了回收旧行动电话的收集站。此次新产品的推出是该公司「帮助电子产品寿命更长」计划的一部分,该计画是一项减少、再利用和回收的倡议。

同样,2023年12月,Sabesp宣布了一项策略,从2024年到2028年在该业务上投资97亿美元。该公司预计大部分投资将用于下水道服务,其余投资将用于扩大供水覆盖范围、减少水损失和其他营运业务。此外,参与者还透过合併、收购、策略联盟和推出新计画来扩展业务并满足客户需求。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态与洞察

- 市场概况

- 市场驱动因素

- 全球环境法规的收紧增加了对合规危险废弃物管理和处理解决方案的需求

- 工业活动和都市化的增加将增加危险废弃物排放并推动对废弃物管理服务的需求

- 透过废弃物处理技术的创新,包括先进的回收和废弃物能源工艺,提高效率并减少对环境的影响

- 市场限制因素

- 面临经济压力的产业往往难以平衡废弃物管理的成本效益。

- 物料输送对人类健康和环境构成风险,需要严格的安全程序和紧急时应对计画

- 市场机会

- 新兴市场的工业化和都市化推动危险废弃物管理服务的成长

- 废弃物处理技术的进步为提供高效、永续解决方案的公司创造了机会

- 策略联盟促进知识共用和技术投资

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按类型

- 固体的

- 液体

- 污泥

- 废弃物

- 化学品

- 生物医学

- 放射性废弃物

- 其他废弃物(腐蚀性、易燃性等)

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 竞争状况

- 公司简介

- Suez

- Valicor

- Veolia

- Waste Connections

- Waste Management

- Republic Services

- Biffa

- Clean Harbors

- Covanta Holding

- Daiseki

- Hitachi Zosen

- Remondis SE & Co. Kg

- Urbaser

- Biomedical Solutions

- 其他公司

第七章 市场的未来

第8章附录

- 按活动分類的 GDP 分布

- 进出口

The Hazardous Waste Management Market size is estimated at USD 40.22 billion in 2025, and is expected to reach USD 48.33 billion by 2030, at a CAGR of 3.74% during the forecast period (2025-2030).

Key Highlights

- Hazardous waste management involves practices and procedures to handle, control, and dispose of substances that threaten human health or the environment. It includes waste collection, recycling, treatment, transportation, disposal, and monitoring of disposal sites. The primary objective is to mitigate risks and safeguard health and the environment.

- The hazardous waste management market is driven by several factors. Governments worldwide are intensifying their focus on waste disposal due to concerns over pollution and health risks. Consequently, stricter regulations are being enacted to govern waste disposal practices and encourage responsible management.

- Technological advancements have significantly bolstered hazardous waste management. Innovations in waste treatment and disposal have ushered in more efficient and eco-friendly methods. Notable technologies include steam autoclave treatment, chemical treatment, ozone treatment, pyrolysis, and electron beam technology. For instance, Pello is a new technology that has been developed to help businesses reduce their environmental impact and manage their waste collection more efficiently. Pello helps companies achieve these goals in a number of different ways. Firstly, the Pello system monitors the fill level of trash cans and provides real-time information on the dumpsters' contents and location.

- In April 2023, Recycle Track Systems (RTS) acquired RecycleSmart Solutions, solidifying its position as Canada's premier independent provider of advanced waste diversion, organic capture, and recycling management technology. The acquisition encompassed Recycle Smart's cutting-edge Pello waste sensor technology, an integral part of its Internet of Things (IoT) platform.

Hazardous Waste Management Market Trends

Asia-Pacific Expected to Dominate the Market Over the Coming Years

- Rapid industrialization in countries like China, India, and Southeast Asian nations has driven a surge in hazardous waste production, notably in industries such as manufacturing, mining, and electronics. China, for instance, has witnessed a nearly threefold increase in waste output since the 1990s. This rise can be attributed to multiple factors. Over the past few decades, China's urbanization rate has steadily climbed. By 2023, data from the National Bureau of Statistics of China revealed that approximately 66.2% of the population was residing in urban areas.

- China's robust economic growth, evidenced by its 2023 GDP of roughly USD 17.7 trillion, as per the International Monetary Fund (IMF), further bolstered industrial waste production. While the volume of conventional industrial waste, such as tailings and fly ash, has remained stable, hazardous waste production has surged in tandem with industrial progress. Notably, these hazardous by-products necessitate more advanced treatment for safe disposal. A significant milestone was reached in March 2024 when Jereh Group introduced its GreenWell distributed hazardous waste treatment equipment. This innovative solution, tailored to address challenges in centralized hazardous waste disposal, allows for on-site treatment, bypassing the need for intermediary steps.

- By streamlining on-site treatment and eliminating intermediary steps, this state-of-the-art equipment significantly enhances processing efficiency, reduces waste, and facilitates wastewater recycling within the system. Impressively, it has already demonstrated its efficacy, cutting oily waste at well sites by over 20% and achieving an outstanding 95% recovery rate for basic oil. Furthermore, it enables zero-discharge recycling of wastewater within its operational framework.

- Over the past few decades, Asia-Pacific has made notable strides in enhancing its regulatory frameworks for managing hazardous waste. Governments have intensified environmental regulations, compelling industries to adopt more robust waste management practices. For instance, in 2021, the Central Government of India launched the Swachh Bharat Mission Urban 2.0 (SBM-U 2.0), envisioning "Garbage Free Cities." The mission targets all urban local bodies to secure at least a 3-star certification, emphasizing door-to-door collection, source segregation, and scientific processing of municipal solid waste.

- While rapid industrialization in Asia, particularly in China, has led to a notable uptick in hazardous waste generation, advancements in waste treatment technology and stringent regulatory frameworks are heralding a shift toward more efficient and eco-friendly waste management practices.

- The surge in hazardous waste production in rapidly industrializing countries like China and India underscores the critical need for advanced waste management solutions. China's significant economic growth and urbanization have directly contributed to increased hazardous waste, necessitating innovative treatment technologies like the GreenWell equipment. This technology not only improves processing efficiency but also supports environmental sustainability through wastewater recycling. Additionally, the strengthening of regulatory frameworks across the Asia-Pacific indicates a growing commitment to addressing environmental challenges, compelling industries to adopt better waste management practices. These developments suggest a positive trend toward more sustainable industrial growth in the region.

By Disposal Type, Collection Gaining More Traction Over the Coming Years

- Hazardous waste collection involves structured procedures to gather, manage, and transport materials that pose significant risks to human health and the environment. These materials are classified based on inherent traits (flammable, toxic, etc.) or specific designations by regulatory bodies. Accurate identification is crucial for applying proper handling and disposal protocols.

- In July 2024, Sedema, Mexico's Secretariat of the Environment, successfully transported over 5,600 tires from illegal dumps in Xochimilco and Gustavo Madero to a treatment plant. These tires will be repurposed as an alternative fuel in cement production. Partnering with Geocycle Mexico, this move is a cornerstone in Sedema's strategy to combat environmental challenges from improper tire disposal, which often leads to public pollution and heightened wildfire risks. Sedema announced plans to bolster its tire collection via the Reciclatron Program, showcasing Mexico's commitment to holistic waste management and a shift away from fossil fuels and excessive mineral extraction.

- In June 2024, Ottawa's city council greenlit a Solid Waste Master Plan, responding to mounting pressures on the Trail Road Landfill, nearing its 2035 capacity. Concerns arise as replacing it could exceed USD 600 million. The endorsed strategy, spanning three decades, includes nearly 50 initiatives. These aim to divert waste, extending the landfill's life to 2049. Ottawa's approach highlights its dedication to sustainable waste management and long-term environmental stewardship.

- Effective hazardous waste collection demands strict regulatory compliance, proper personnel training, and collaboration among stakeholders, including waste generators, transporters, and disposal facilities. This collaboration ensures safe and compliant hazardous waste management.

- The hazardous waste collection market is evolving, driven by regulatory compliance and innovative waste management. Sedema's initiative in Mexico showcases a proactive stance on repurposing waste, reducing environmental risks, and promoting sustainability. Ottawa's Master Plan mirrors a commitment to waste reduction and resource management, addressing both immediate and future landfill concerns. These cases underscore a broader trend toward integrated waste management, prioritizing sustainability and public health.

Hazardous Waste Management Industry Overview

The hazardous waste management market is moderately fragmented and competitive. Veolia, Biffa, Covanta Holding, Clean Harbors, and Suez Group are among the key players in the hazardous waste management market.

Moreover, key players in the market are taking initiatives such as expanding new facilities to strengthen their market presence. For instance, in May 2022, The Trinidad and Tobago Solid Waste Management Company (SWMCOL) launched collection sites for recycling old mobile phones. The new launch was a part of the company's project, 'Helping Electronics Live Longer,' which is a measure to reduce, reuse, and recycle.

Similarly, in December 2023, Sabesp announced a strategy to invest USD 9.7 billion in its operations over 2024-28. The majority of the company's expected investments will be in sewerage services, while the rest will be spent on expanding water supply coverage, controlling water losses, and other operational tasks. In addition, players are expanding their businesses through mergers, acquisitions, strategic partnerships, and new project launches to meet customer needs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent Global Environmental Regulations Drive Demand for Compliant Hazardous Waste Management and Disposal Solutions

- 4.2.2 Increased Industrial Activities and Urbanization Driving up Hazardous Waste Production, Fueling Demand for Waste Management Services

- 4.2.3 Innovations in Waste Treatment Technologies, such as Advanced Recycling and Waste-to-Energy Processes, Enhance Efficiency and Reduce Environmental Impact

- 4.3 Market Restraints

- 4.3.1 Industries Under Economic Pressure Often Struggle to Balance Cost-efficient Waste Management

- 4.3.2 Handling Hazardous Materials Risks Human Health and the Environment, Requiring Strict Safety Protocols and Emergency Response Plans

- 4.4 Market Opportunities

- 4.4.1 Industrialization and Urbanization in Emerging Markets are Driving Growth in Hazardous Waste Management Services

- 4.4.2 Advancements in Waste Treatment Technologies Create Opportunities for Companies Offering Efficient and Sustainable Solutions

- 4.4.3 Strategic Collaborations can Enhance Knowledge Sharing and Technology Investments

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Solid

- 5.1.2 Liquid

- 5.1.3 Sludge

- 5.2 By Waste

- 5.2.1 Chemicals

- 5.2.2 Biomedical

- 5.2.3 Radioactive

- 5.2.4 Other Waste (Corrosive, Flammable, etc.)

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 United Arab Emirates

- 5.3.4.2 Saudi Arabia

- 5.3.4.3 Rest of Middle East

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration & Major Players)

- 6.2 Company Profiles

- 6.2.1 Suez

- 6.2.2 Valicor

- 6.2.3 Veolia

- 6.2.4 Waste Connections

- 6.2.5 Waste Management

- 6.2.6 Republic Services

- 6.2.7 Biffa

- 6.2.8 Clean Harbors

- 6.2.9 Covanta Holding

- 6.2.10 Daiseki

- 6.2.11 Hitachi Zosen

- 6.2.12 Remondis SE & Co. Kg

- 6.2.13 Urbaser

- 6.2.14 Biomedical Solutions

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 GDP Distribution by Activity

- 8.2 Imports and Exports