|

市场调查报告书

商品编码

1639419

中东和非洲危险废弃物自动化市场占有率分析、产业趋势、统计数据、成长预测(2025-2030 年)Middle-East and Africa Hazardous Waste Handling Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

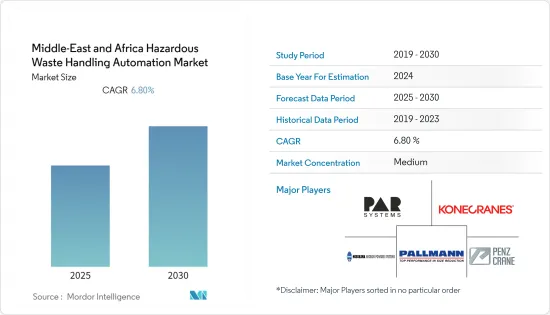

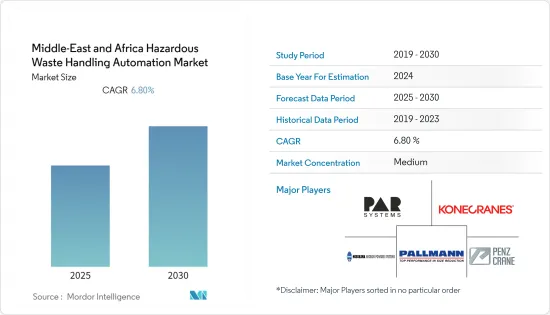

预计预测期内中东和非洲危险废弃物处理自动化市场复合年增长率将达到 6.8%。

危险废弃物由于其毒性、易燃性、传染性或放射性等特性,对人类健康、其他生物或环境构成实际或潜在的危险。

危险废弃物管理是中东和非洲地区的新兴议题。这是因为,已开发国家企业多年来一直在非洲倾倒危险废弃物,而非洲地区的危险废弃物管理监管措施仍不符合国际法。然而,该地区各国政府意识到日益严重的健康问题,现已倡议禁止这种做法。

中东地区的石油产品和频繁的战争产生了大量危险废弃物,如炮弹、弹药筒和其他战争残骸。

其中一些废弃物可以手动处理,而其他一些则需要专业知识和自动化解决方案,以尽量减少人类与废弃物的接触。使用这种自动化解决方案进行废弃物处理也使流程更加高效,并减少对人工的依赖。这消除了人们对正确处理危险物质的担忧。

用于危险废弃物自动化处理的各种产品包括起重机、机械手、尺寸缩小臂等。

随着新冠肺炎疫情影响到中东和北非地区,废弃物,包括被感染的口罩、手套和其他防护设备。这进一步增加了该地区对有效的危险废弃物处理方法的需求。

此外,由美国国际开发署(USAID) 及其各合作伙伴主导的「Power Africa」等倡议旨在 2030 年在非洲新增 2,500 万至 3,000 万个太阳能发电设施。这些努力预计将产生大量废弃物,包括过期的铅酸电池和电源备用系统。预计这将推动对确保高效和安全处理的自动化危险废弃物处理解决方案的需求。

中东和非洲危险废弃物处理自动化市场趋势

对自动化处理解决方案的需求可能会增加安全处理和一次性电子废弃物

电子垃圾(E- 废弃物)是指行动电话、电脑、萤光和白炽灯、汽车用电子设备,以及电视机、冰箱、洗衣机等大型家电产品废弃后的残余物,定义为无法正常运作或接近使用寿命的东西。

根据联合国的报告,每年产生约 5,000 万吨电子废弃物,预计到 2050 年,这一数字将增加一倍以上,达到 1.1 亿吨,成为全球成长最快的废弃物。然而,目前只有不到20%的旧电子产品被回收。非洲是世界上正规电子废弃物最低的地区之一。

根据《环境健康展望》杂誌发表的一项研究,光是尼日利亚拉各斯港每月就接收10万台二手电脑。加纳也面临管理进口电子废弃物的挑战。通常情况下,这些电子废弃物最终都会被送到垃圾掩埋场。

电子设备中的重金属和其他有害化学物质,如铅、镉、汞、溴化阻燃剂和聚氯乙烯(PVC),会污染地下水并对其他环境和公共卫生造成风险。

为了避免此类风险并确保人们的安全,该地区的政府已采取措施,单独或与外部机构合作,安全处置危险废弃物。例如,位于杜拜的中东首个全面运作的永续社区——永续城市(TSC)为其社区引入了新的电子废弃物收集和管理解决方案。与EFATE合作设立的24小时电子废弃物投放站将为居民和大众提供免费、有效率的电子废弃物管理解决方案。

沙乌地阿拉伯有望占据主要市场占有率

沙乌地阿拉伯是中东和北非地区最大的国家之一,其多个行业产生大量危险废弃物。这些产业大部分属于石油天然气和汽车产业。

据石油输出国组织称,沙乌地阿拉伯持有全球约17%的已探明石油蕴藏量。石油和天然气产业约占国内生产总值的50% 和出口收益的70% 。石油以外的天然资源包括天然气、铁矿石、黄金和铜。

由于可支配收入的增加,该国电子设备的消费量大幅增加,这也是该国产生电子废弃物的主要因素。

根据联合国训练研究所的《阿拉伯国家 2021 年区域电子废弃物监测报告》,沙乌地阿拉伯是阿拉伯国家中最大的电子废弃物排放,2019 年排放了595 千吨电子废弃物(或 13.2 公斤/小时)。

政府推出了多项措施来规范废弃物的安全处理。例如,政府将于2021年9月公布新的《废弃物管理法》,旨在规范废弃物、分类、储存、进出口、安全处置和所有其他与废弃物有关的活动。预计这些趋势将在预测期内推动该地区的市场成长。

中东和非洲危险废弃物自动化产业概况

由于对安全危险废弃物处理解决方案的需求不断增长,中东和非洲危险废弃物处理自动化市场竞争日益激烈。市场的主要企业包括 PAR Systems、Konecranes 和 Pallmann Maschinenfabrik GmbH &Co.KG。

- 2022 年 1 月 - Ramky Enviro Engineers Middle East 与拉斯海马酋长国废弃物管理局(公共服务部)建立战略伙伴关係关係,在阿联酋拉斯海马酋长国建立专门的工业危险废弃物管理设施。

- 2022 年 1 月 - 科尼与 Pesmel 合作,提供自动化仓库货柜处理技术,这将彻底改变物流中心和配送中心的物料输送。自动化货柜追踪是管理系统的一部分,可以轻鬆地与设施的整体物流管理系统整合。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 政府和行业监管

- 人们对废弃物管理的兴趣日益浓厚

- 市场限制

- 成本高

第六章 市场细分

- 按自动化产品

- 机械手臂

- 伸缩桅杆

- 起重机

- 桁架

- 粉碎系统

- 其他自动化产品

- 依废弃物类型

- 列出的废弃物

- 特殊废弃物

- 一般废弃物

- 混合废弃物

- 利用工业废弃物

- 製造业

- 化学废弃物

- 活力

- 消费者护理

- 政府

- 其他行业

- 按地区

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 以色列

- 南非

- 其他中东和非洲地区

第七章 竞争格局

- 公司简介

- PAR Systems

- Konecranes

- DX Engineering

- Floatograph Technologies

- Pallmann Maschinenfabrik GmbH & Co. KG

- Hosokawa Micron Powder Systems

- PENZ Crane GmbH

- ACE Inc.

- Terex MHPS GmbH

- Hiab

- Ramky Enviro Engineers Ltd

第八章投资分析

第九章:市场的未来

The Middle-East and Africa Hazardous Waste Handling Automation Market is expected to register a CAGR of 6.8% during the forecast period.

Hazardous waste poses an actual or potential hazard to humans' health and other living organisms or the environment, owing to its toxic, flammable, infectious, and radioactive properties.

The management of hazardous waste is one of the emerging issues in the Middle-East and African region as companies from the developed regions have been dumping their toxic waste in Africa for many years, as regulating measures for hazardous waste management in the region are still not on a par with international legislation. However, the governments in the region are now taking initiatives and are banning this practice as a result of their awareness of growing health concerns.

In the Middle East, a large percentage of hazardous waste is produced from petroleum products and from frequent wars, including shellings, casings, and other types of war remain.

Some of these wastes can be handled manually, while some may require expertise and automation solutions to minimize human contact with the waste. The use of such automation solutions for handling waste also improves process efficiency and reduces the reliance on manual intervention. Thus, concerns about the proper handling of these harmful substances can be eliminated.

Different products used in hazardous waste handling automation include cranes, manipulator arms, and size reduction arms.

As the outbreak of COVID-19 impacted the Middle-East and African region, many types of additional medical and hazardous wastes were generated, including infected masks, gloves, and other protective equipment. This has further augmented the demand for effective hazardous waste handling practices in the region.

Moreover, initiatives such as Power Africa, taken by the United States Agency for International Development (U.S.A.I.D.) and various partners, aim to have 25 million to 30 million new solar connections across Africa by 2030. Such initiatives are expected to generate a significant amount of waste, including expired lead-acid batteries and power backup systems. This is expected to drive the demand for automated hazardous waste handling solutions for efficient and safe handling.

Middle-East and Africa Hazardous Waste Handling Automation Market Trends

Demand for Automated Handling Solutions May Increase Safer Handling and Disposable of E-waste

Electronic waste (e-waste) is defined as the remains of electronic gadgets such as mobile phones, computers, fluorescent and incandescent light bulbs, electronic gadgets used in automobiles, and large household appliances such as television sets, refrigerators, washing machines, etc., which are not working or are nearing their end of life.

According to a report by the UN, about 50 million ton of e-waste is generated every year, which will more than double to 110 million ton by 2050, making it the fastest-growing waste stream in the world. However, less than 20% of used electronics are currently recycled. Africa holds the lowest rate of formal e-waste recycling in the world.

An article published by Environmental Health Perspectives shows that 100,000 used personal computers arrive at the Nigerian port of Lagos alone each month. Ghana also faces challenges in managing the e-waste imported. Usually, these e-wastes end up in landfills.

Heavy metals and other hazardous chemicals such as lead, cadmium, mercury, brominated flame-retardants, and polyvinyl chloride (PVC), found in electronics, contaminate groundwater and pose other environmental and public conditions health risks.

To avoid such risks and ensure the safety of people, the governments in the region are taking initiatives both standalone and in collaboration with external agencies for the safe disposal of hazardous waste. For instance, Sustainable City (TSC), the Middle East's first fully-operational sustainable community located in Dubai, has introduced new electronic waste (e-waste) collection and management solutions for the community. The 24-Hour e-Waste drop-off station, created in collaboration with EFATE, will provide a free and efficient e-waste management solution to residents and the general public.

Saudi Arabia is Expected to Hold a Significant Market Share

Saudi Arabia is among the largest countries in the Middle-East and African region and generates a significant amount of hazardous waste due to the presence of several industries. The majority of these industries are from the oil and gas and automotive sectors.

According to OPEC, Saudi Arabia possesses around 17% of the world's proven petroleum reserves. The oil and gas sector accounts for about 50% of gross domestic product and about 70% of export earnings. Apart from petroleum, the Kingdom's other natural resources include natural gas, iron ore, gold, and copper.

Owing to the rising disposable income, the consumption of electronic gadgets in the country is increasing significantly, which is also the primary contributor to the generation of e-waste in the country.

According to the regional e-waste monitor report for the Arab States 2021, by UNITAR, Saudi Arabia is the largest generator of e-waste among Arab countries, with 595 kilotons (kt) (or 13.2 kg/inh) of e-waste in 2019.

To regulate the safe disposal of waste, the government is taking several initiatives. For instance, the government published a new Waste Management Law in September 2021, which aims to regulate the transport, segregation, storage, import, export, safe disposal of waste, and all other activities related to it. Such trends are expected to drive the market growth in the region during the forecast period.

Middle-East and Africa Hazardous Waste Handling Automation Industry Overview

The Middle-East and Africa hazardous waste handling automation market has increased competition due to the rising demand for such solutions for safe hazardous waste disposal. Some of the major players operating in the market include PAR Systems, Konecranes, and Pallmann Maschinenfabrik GmbH & Co. KG, among others.

- January 2022 - Ramky Enviro Engineers Middle East and Waste Management Agency (Public Services Department) of the Emirate of Ras Al Khaimah entered a strategic partnership to set up an exclusive Industrial Hazardous Waste Management facility in RAK, UAE.

- January 2022 - Konecranes partnered with Pesmel to supply automated warehouse container handling technology that revolutionizes material handling in logistics hubs and distribution centers. Automated container tracking is part of a management system that can be integrated easily with the facility's overall logistics management system.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Government and Industry Regulations

- 5.1.2 Growing Concerns about Waste Management

- 5.2 Market Restraints

- 5.2.1 High Costs Involved

6 MARKET SEGMENTATION

- 6.1 Automation Product

- 6.1.1 Manipulator Arms

- 6.1.2 Telescoping Masts

- 6.1.3 Cranes

- 6.1.4 Trusses

- 6.1.5 Size Reduction Systems

- 6.1.6 Other Automation Products

- 6.2 Type of Waste

- 6.2.1 Listed Wastes

- 6.2.2 Charecteristic Wastes

- 6.2.3 Universal Waste

- 6.2.4 Mixed Waste

- 6.3 Industry

- 6.3.1 Manufacturing

- 6.3.2 Chemical

- 6.3.3 Energy

- 6.3.4 Consumer Care

- 6.3.5 Government

- 6.3.6 Other Industries

- 6.4 Geography

- 6.4.1 Saudi Arabia

- 6.4.2 United Arab Emirates

- 6.4.3 Israel

- 6.4.4 South Africa

- 6.4.5 Rest of Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 PAR Systems

- 7.1.2 Konecranes

- 7.1.3 DX Engineering

- 7.1.4 Floatograph Technologies

- 7.1.5 Pallmann Maschinenfabrik GmbH & Co. KG

- 7.1.6 Hosokawa Micron Powder Systems

- 7.1.7 PENZ Crane GmbH

- 7.1.8 ACE Inc.

- 7.1.9 Terex MHPS GmbH

- 7.1.10 Hiab

- 7.1.11 Ramky Enviro Engineers Ltd