|

市场调查报告书

商品编码

1636218

Gears of the World -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Global Gear - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

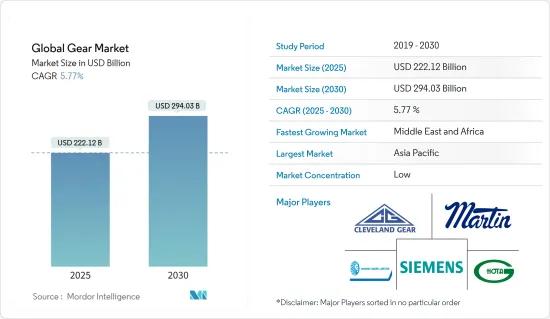

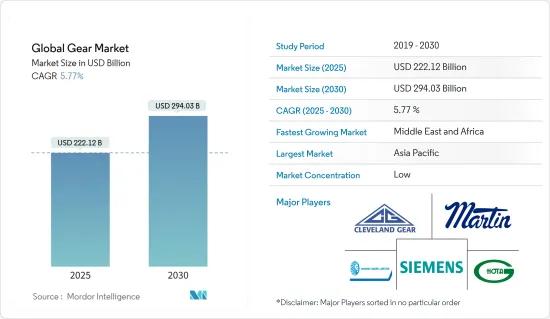

预计2025年全球齿轮市场规模为2,221.2亿美元,预估至2030年将达2,940.3亿美元,预测期内(2025-2030年)复合年增长率为5.77%。

主要亮点

- 从中期来看,工业自动化的兴起和全球风力发电装置的增加等因素预计将成为预测期内全球齿轮市场的最大驱动力之一。

- 预计在预测期内,齿轮的高生产成本将威胁全球齿轮市场。

- 然而,我们正在不断努力生产客製化齿轮,以有效满足客户的需求。预计这一因素将在未来为市场创造一些机会。

- 预计亚太地区在预测期内将显着成长,并实现最高的年增长率。这是由于该地区製造业的成长和对风能设施的关注。

全球齿轮市场趋势

油田设备领域确认成长

- 油田设备领域涵盖整个石油和天然气价值链的广泛应用,占据全球齿轮市场的大部分。在这一领域,齿轮用于钻孔机、泵浦和压缩机等关键机械,这些机械对于石油和天然气资源的探勘、开采、加工和运输至关重要。

- 上游领域,即探勘和生产(E&P)领域,是油田设备领域齿轮的重要消费者。齿轮在钻孔机、泥浆泵、绞车、井口系统等多种设备中发挥重要作用。上游市场对齿轮的需求主要受到全球石油和天然气价格、探勘技术进步(如地震探勘和水平钻井)以及对深海和超深海探勘的日益关注的推动。

- 近年来,由于亚太和非洲经济扩张对原油的需求增加,原油产量呈现显着成长。对俄罗斯的製裁也增加了石油产量,以满足不断增长的需求。

- 根据能源研究所《世界能源统计回顾》显示,2022年至2023年原油产量显着成长2%。同样,过去10年的复合年增长率也超过1.1%,显示原油呈现上升趋势。这种增长推动了对设备的需求并推动了对工业齿轮的需求。

- 中游部门包括管线、卡车车队、油轮和仓储设施。齿轮对于该领域使用的泵浦、压缩机和其他设备至关重要,特别是在管道运作和液化天然气加工厂中。中游市场齿轮需求的主要驱动因素包括管道基础设施的扩张、液化天然气(LNG)全球贸易的增加以及对更高效的运输和储存解决方案的需求。

- 例如,2024年6月,石油天然气公司(ONGC)和印度石油公司(IOC)签署了一项协议,将在中央邦哈塔天然气田附近建立一个紧凑型液化天然气(LNG)设施。该工厂将采用先进技术生产液化天然气,这是一种比传统石化燃料更环保的替代品。液化天然气需求的成长预计将推动齿轮市场的成长,因为专用齿轮对于液化天然气工厂的营运和维护至关重要。这一发展预计将刺激齿轮製造技术的创新和投资。

- 下游领域是油田设备市场齿轮的另一个重要终端使用者。齿轮用于精製和加工厂内的各种设备,包括泵浦、压缩机、搅拌机和输送机系统。推动下游领域齿轮需求的因素包括全球对精製石油产品的需求不断增加、对更有效率、更环保的精製製程的需求以及石化产业的成长。

- 因此,鑑于上述几点,石油和天然气设备最终用户产业预计在预测期内将成长。

亚太地区主导市场

- 亚太地区是全球齿轮市场的重要组成部分。随着人口的快速成长和经济的强劲,印度、中国、韩国和东协地区国家正在积极加强工业和製造业。这些共同努力正在为齿轮市场创造良好的市场环境。

- 汽车业是亚太地区齿轮的主要最终用户之一,日本、韩国、中国和印度等国家是主要的汽车製造地。对齿轮的需求涉及广泛的应用,从变速箱和差速器到转向机构和引擎零件。

- 根据国际汽车工业协会预测,2022年至2023年亚太地区汽车产量将大幅成长。 2023年,该地区生产汽车55,115,837辆,恢復10%的成长速度。 2019年至2023年的复合年增长率超过12%,显示该地区对齿轮的需求不断增加。

- 同样,该地区的工业领域正在显着增长,随着工业领域的扩张,对齿轮的需求也在增加。齿轮在各种应用中都至关重要,包括工具机、物料输送设备以及建筑和采矿中使用的重型机械。亚太地区,特别是中国、印度和东南亚等国家的快速工业化,正在推动对工业齿轮的巨大需求。

- 例如,23财年,印度製造业出口创历史新高,达4,474.6亿美元,比上年度(22财年)的4,220亿美元成长6.03%。製造业占印度GDP的17%,僱用了超过2,730万人,对国家经济至关重要。印度政府的目标是透过各种措施和措施,到2025年将製造业的市场占有率提高到25%。

- 此外,航太和国防工业是亚太地区齿轮的另一个重要终端用户。日本、韩国、中国和印度等国家正在扩大航太製造能力。这种扩张推动了对飞机引擎、起落架系统和各种控制机构中精密齿轮的需求。

- 因此,如上所述,亚太地区预计将在预测期内主导市场。

全球齿轮产业概况

全球齿轮市场是细分的。市场的主要参与企业包括(排名不分先后)Cleveland Gear Co、Siemens AG、Martin Sprocket & Gear Inc.、Hota Industrial Mfg. 和 Bharat Gears Ltd。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 工业自动化日益受到关注

- 增加风力发电部署

- 抑制因素

- 製造成本高

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 齿轮类型

- 正齿轮

- 螺旋齿轮

- 行星齿轮

- 齿条和小齿轮

- 蜗轮

- 锥齿轮

- 其他齿轮

- 最终用户产业

- 油田设备

- 矿山机械

- 工业机械

- 发电厂

- 施工机械

- 其他的

- 2029 年之前的市场规模和需求预测(按地区)

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 北欧的

- 俄罗斯

- 土耳其

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 澳洲

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 卡达

- 南非

- 其他中东/非洲

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Cleveland Gear Co.

- Siemens AG

- Martin Sprocket & Gear Inc.

- Hota Industrial Mfg. Co. Ltd

- OKUBO GEAR Co. Ltd

- Bharat Gears Ltd

- Elecon Engineering Company Limited

- Precipart

- Kohara Gear Industry Co. Ltd

- Aero Gear Inc.

- 其他知名公司名单

- 市场排名/份额(%)分析

第七章 市场机会及未来趋势

- 客製化服务增加

简介目录

Product Code: 50003481

The Global Gear Market size is estimated at USD 222.12 billion in 2025, and is expected to reach USD 294.03 billion by 2030, at a CAGR of 5.77% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as rising industrial automation and the growing global wind energy installation are expected to be among the most significant drivers for the global gear market during the forecast period.

- High production costs for gears are expected to threaten the global gear market during the forecast period.

- However, continued efforts are being made to manufacture customized gears to effectively meet the client's demand. This factor is expected to create several opportunities for the market in the future.

- Asia-Pacific is expected to grow significantly and register the highest annual growth rate during the forecast period. This is due to the region's growing manufacturing industry and focus on wind energy installations.

Global Gear Market Trends

The Oilfield Equipment Segment to Witness Growth

- The oilfield equipment segment represents a significant portion of the global gear market, encompassing a wide range of applications across the entire oil and gas value chain. This segment utilizes gears in critical machinery such as drilling rigs, pumps, compressors, and other equipment essential for the exploration, extraction, processing, and transportation of oil and gas resources.

- The upstream segment, or the exploration and production (E&P) segment, is a significant consumer of gears in the oilfield equipment segment. Gears play a crucial role in various equipment such as drilling rigs, mud pumps, drawworks, and wellhead systems. The demand for gears in the upstream segment is primarily driven by global oil and gas prices, technological advancements in exploration techniques (e.g., seismic imaging and horizontal drilling), and the increasing focus on deepwater and ultra-deepwater exploration.

- Crude oil production has witnessed significant growth in recent years due to the rising demand for crude oil due to expanding economies in Asia-Pacific and Africa. Additionally, due to sanctions on Russia, oil production has increased to meet the rising demand.

- According to the Energy Institute Statistical Review of World Energy, crude oil production witnessed a significant growth of 2% between 2022 and 2023. Similarly, the average annual growth rate over the past decade has been more than 1.1%, indicating an increasing growth in crude oil. This growth drives the demand for equipment, which fuels the demand for gear in the industry.

- The midstream segment includes pipelines, trucking fleets, tanker ships, and storage facilities. Gears are essential in pumps, compressors, and other equipment used in this segment, particularly in pipeline operations and LNG processing plants. The primary driving factors for gear demand in the midstream segment include the expansion of pipeline infrastructure, increasing global trade of liquefied natural gas (LNG), and the need for more efficient transportation and storage solutions.

- For instance, in June 2024, India's State-owned Oil and Natural Gas Corporation (ONGC) and Indian Oil Corporation (IOC) inked a deal to establish a compact liquefied natural gas (LNG) facility adjacent to the Hatta gas field in Madhya Pradesh. The plant, leveraging advanced technology, is poised to churn out LNG, heralded as a greener substitute to conventional fossil fuels. This increased demand for LNG will drive growth in the gears market, as specialized gears are essential for operating and maintaining LNG plants. This development is expected to stimulate innovation and investment in gear manufacturing technologies.

- The downstream segment is another critical end user of gears in the oilfield equipment market. Gears are used in various equipment within refineries and processing plants, such as pumps, compressors, mixers, and conveyor systems. The driving factors for gear demand in the downstream segment include the increasing global demand for refined petroleum products, the need for more efficient and environmentally friendly refining processes, and the growth of the petrochemical industry.

- Therefore, as per the above points, the oil and gas equipment end-user industry is expected to grow during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is a pivotal segment in the global gear market. With a burgeoning population and robustly growing economies, nations such as India, China, South Korea, and those in the ASEAN region are actively strengthening their industrial and manufacturing industries. This concerted effort creates a favorable market environment for the gears market.

- The automotive industry is one of the primary end users of gears in Asia-Pacific, with countries like Japan, South Korea, China, and India being major automotive manufacturing hubs. The segment's demand for gears spans a wide range, from transmission systems and differentials to steering mechanisms and engine components.

- According to the International Organization of Motor Vehicle Manufacturers, automobile manufacturing in Asia-Pacific significantly rose between 2022 and 2023. In 2023, the region manufactured 5,51,15,837 automobiles, resuming a 10% growth rate. The annual average growth rate between 2019 and 2023 was over 12%, signifying the rising demand for gears in the region.

- Similarly, the industrial segment is experiencing significant growth in the area, and the demand for gears is increasing with the expanding industrial segment. Gears are crucial in various applications, such as machine tools, material handling equipment, and heavy machinery used in construction and mining. The rapid industrialization across Asia-Pacific, particularly in countries like China, India, and Southeast Asia, has driven substantial demand for industrial gear.

- For instance, in the financial year 2023, India's manufacturing exports hit a record high, reaching USD 447.46 billion, marking a 6.03% growth from the previous year's (FY22) USD 422 billion. The manufacturing industry, contributing to 17% of India's GDP and employing over 27.3 million workers, is pivotal in the nation's economy. With various initiatives and policies, the Indian government aims to elevate manufacturing's market share to 25% by 2025.

- Additionally, the aerospace and defense industry represents another significant end user of gears in Asia-Pacific. Countries such as Japan, South Korea, China, and India are expanding their aerospace manufacturing capabilities. This expansion drives the demand for high-precision gears in aircraft engines, landing gear systems, and various control mechanisms.

- Therefore, as mentioned above, Asia-Pacific is expected to dominate the market during the forecast period.

Global Gear Industry Overview

The global gear market is fragmented. Some key players in this market (in no particular order) are Cleveland Gear Co., Siemens AG, Martin Sprocket & Gear Inc., Hota Industrial Mfg. Co. Ltd, and Bharat Gears Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Rising Focus on Industrial Automation

- 4.5.1.2 Growing Wind Energy Installation

- 4.5.2 Restraints

- 4.5.2.1 High Production Cost

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Gear Type

- 5.1.1 Spur Gear

- 5.1.2 Helical Gear

- 5.1.3 Planetary Gear

- 5.1.4 Rack and Pinion Gear

- 5.1.5 Worm Gear

- 5.1.6 Bevel Gear

- 5.1.7 Other Gear Types

- 5.2 End-user Industry

- 5.2.1 Oilfield Equipment

- 5.2.2 Mining Equipment

- 5.2.3 Industrial Machinery

- 5.2.4 Power Plants

- 5.2.5 Construction Machinery

- 5.2.6 Other End-user Industries

- 5.3 Geography [Market Size and Demand Forecast till 2029 (for regions only)]

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 NORDIC

- 5.3.2.7 Russia

- 5.3.2.8 Turkey

- 5.3.2.9 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Australia

- 5.3.3.4 Japan

- 5.3.3.5 South Korea

- 5.3.3.6 Malaysia

- 5.3.3.7 Thailand

- 5.3.3.8 Indonesia

- 5.3.3.9 Vietnam

- 5.3.3.10 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 Nigeria

- 5.3.4.4 Egypt

- 5.3.4.5 Qatar

- 5.3.4.6 South Africa

- 5.3.4.7 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Colombia

- 5.3.5.4 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Cleveland Gear Co.

- 6.3.2 Siemens AG

- 6.3.3 Martin Sprocket & Gear Inc.

- 6.3.4 Hota Industrial Mfg. Co. Ltd

- 6.3.5 OKUBO GEAR Co. Ltd

- 6.3.6 Bharat Gears Ltd

- 6.3.7 Elecon Engineering Company Limited

- 6.3.8 Precipart

- 6.3.9 Kohara Gear Industry Co. Ltd

- 6.3.10 Aero Gear Inc.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Customization Offerings

02-2729-4219

+886-2-2729-4219