|

市场调查报告书

商品编码

1636227

印度生物质 -市场占有率分析、行业趋势和统计、成长预测(2025-2030)India Biomass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

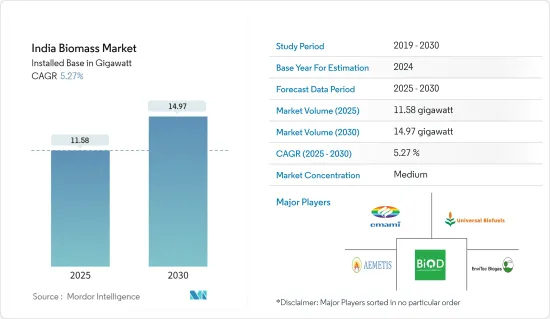

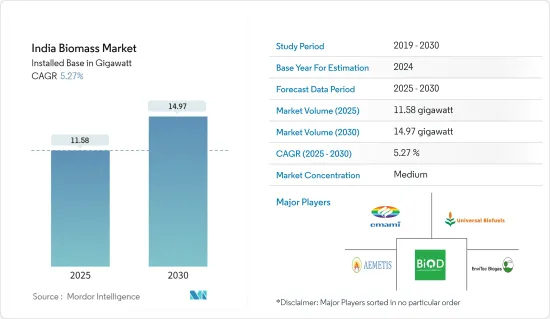

印度生质装置市场规模预计将从2025年的11.58吉瓦成长到2030年的14.97吉瓦,预测期间(2025-2030年)复合年增长率为5.27%。

主要亮点

- 从中期来看,丰富的原材料供应、政府主导的促进生物质生产的倡议以及采取严格措施增加可再生资源的使用以尽量减少温室气体排放等因素将是推动市场增长的主要因素。

- 同时,可行的替代能源的可用性预计将在预测期内抑製印度生物质市场的成长。

- 然而,印度的混燃机制、远离燃煤发电厂以及未开发的生物质潜力预计将成为市场成长的重大机会。

印度生物质市场趋势

发电业预计将主导市场

- 生质能发电是利用林业/农业废弃物、垃圾、垃圾垃圾掩埋沼气、沼气等生质燃料发电的技术。整个过程包括将燃料的化学能转化为蒸气、机械能和电力形式的热势能。

- 生物质包括植物和动物,例如森林木材、农业和林业加工过程中的残留物、有机工业废弃物以及人类和动物废物。生质能发电是可再生的,二氧化碳排放忽略不计,而且成本低于石化燃料。

- 虽然生物质发电是可再生的,但它会鼓励森林砍伐,而且并不完全清洁。发电需要大量的空间和水。根据研究,每年约1.5亿吨生质残渣的潜在发电量约为5,000万千瓦,相当于每年约470吉焦。

- 2023年印度生质能源产能将接近10.75吉瓦。印度也开始了雄心勃勃的能源转型之旅,目标是到 2030 年实现 50% 的累积发电装置容量来自非石化燃料燃料能源,并在 2070 年实现净零发电。为了实现雄心勃勃的可再生能源目标并使国内能源产业自力更生,最佳利用现有可再生能源至关重要。

- 此外,2023 年 6 月,电力部宣布修订生物质混烧政策,以促进永续能源实践。该修正案将允许发电厂以标准价格购买生物质颗粒燃料,减少进口依赖并促进生物质作为可再生能源的引入。

- 鑑于上述情况,预计发电业将在预测期内主导印度生物质市场。

政府的有利支持促进市场成长

- 印度凭藉着快速发展的产业、丰富的潜力和强大的政府支持,正成为可再生能源领域的全球领导者。不断增长的人口以及到 2030 年实现 450 吉瓦可再生能源容量(包括 10 吉瓦生质能源)的目标,为印度的投资和扩张提供了充足的机会。

- 在政府的资助下,Emami Agrotech Ltd、Universal Biofuel 和 Aemetis 等印度生物质市场的公司正在增加投资。此外,剩余生物质的供应,尤其是来自农业的剩余生物质,正在推动市场成长。

- 此外,到2023年,印度的沼气能源容量约为14兆瓦。过去六年产能一直停滞不前,但预计未来几年将会增加。

- 2024年2月,印度政府将向压缩沼气(CBG)生产商提供财政援助,用于采购核准物质聚合机械,以支持2023-2024财年至2026-2027财年的生物质收集。

- 自 1990 年代以来,新能源和可再生能源部 (MNRE) 一直在实施促进生物质发电和甘蔗渣热电联产的计画。 2018年5月启动的「生物质汽电共生计画」旨在开发热电联产汽电共生,透过糖厂、碾米厂和造纸厂等其他产业的热电汽电共生技术来最佳利用。在促进。

- 根据国际能源总署统计,2023年印度清洁能源投资达680亿美元。 2024年初,新能源和可再生能源部(MNRE)启动了国家生质能源计划,第一期投资8.58亿印度卢比(约1.029亿美元),以促进印度生质能源发展,并通知可能持续五年。从2021年4月到2026年3月。

- 综上所述,政府支持是印度生物质市场成长的关键驱动力。

印度生质产业概况

印度生物质市场较为分散。市场上营运的主要企业包括(排名不分先后)Emami Agrotech Ltd、Universal Biofuels Private Limited、BIOD ENERGY (INDIA) PVT LTD、EnviTec Biogas AG 和 Aemetis Inc。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2029年装置容量及预测(单位:GW)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 政府利好支持带动市场

- 原料供应充足

- 抑制因素

- 市面上有有效替代品

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第五章市场区隔

- 原料

- 农业废弃物

- 木材/木材残渣

- 都市固态废弃物

- 其他原料

- 目的

- 发电

- 加热

- 其他的

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Emami Agrotech Ltd

- Universal Biofuels Private Limited

- BIOD ENERGY (INDIA) PVT. LTD

- EnviTec Biogas AG

- Aemetis Inc.

- Monopoly Innovations Private Limited

- 其他知名企业名单

- 市场排名分析

第七章 市场机会及未来趋势

- 印度的混燃机制与未开发的生质燃料潜力

简介目录

Product Code: 50003495

The India Biomass Market size in terms of installed base is expected to grow from 11.58 gigawatt in 2025 to 14.97 gigawatt by 2030, at a CAGR of 5.27% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as abundant availability of feedstocks, government-led initiatives to boost biomass production, and the introduction of stringent policies to increase the utilization of renewable resources to minimize GHG emissions will be major drivers in the market.

- On the other hand, the availability of viable alternatives is expected to restrain the growth of the Indian biomass market during the forecast period.

- However, the co-firing mechanism, the migration out of coal-fired power plants, and the untapped biomass potential in India are expected to become vital opportunities for the growth of the market.

India Biomass Market Trends

The Power Generation Segment is Expected to Dominate the Market

- Biomass power generation is a technique to generate power with biomass fuel, including forestry and agriculture waste, garbage, landfill gas, and biogas. The complete process involves converting the chemical energy of fuel into the thermal potential energy of steam, mechanical power, and electric power.

- Biomass includes plant and animal material, such as wood from forests, material left over from agricultural and forestry processes, and organic industrial, human, and animal wastes. The power generated from biomass is renewable, with negligible carbon dioxide emission and low cost compared to fossil fuels.

- Biomass power generation is considered renewable but can contribute to deforestation and is not entirely clean. Power production requires a significant amount of space and water. Studies estimate that the electricity generation potential from the approximately 150 million tons of biomass residues produced annually is about 50 GW, equivalent to roughly 470 GJ/per year.

- The bioenergy capacity of India was nearly 10.75 GW in 2023. Also, India has embarked upon an ambitious energy transition journey with a target of 50% cumulative electric power installed electricity capacity from non-fossil fuel-based energy resources by 2030 and achieving net zero by 2070. To achieve the ambitious targets for renewable energy and self-reliance in the domestic energy industry, optimal use of available renewable energy alternatives is a must.

- Moreover, in June 2023, the Ministry of Power announced the revision of the biomass co-firing policy to promote sustainable energy practices. This revision will enable power plants to purchase biomass pellets at benchmark prices, reducing import dependencies and enhancing the adoption of biomass as a renewable energy source.

- Owing to the above points, the power generation segment is expected to dominate the Indian biomass market during the forecast period.

Favorable Government Support to Drive the Growth of the Market

- India emerges as a global leader in renewable energy with a rapidly growing industry, abundant potential, and strong government support. A large and growing population and a target of achieving 450 GW of renewable energy capacity by 2030 (including 10 GW of bioenergy) offer ample opportunities for investments and expansion in India.

- With the help of the government's financial aid, companies in the Indian biomass market, such as Emami Agrotech Ltd, Universal Biofuel, and Aemetis, are increasing their investments. Also, surplus biomass availability, especially from the agricultural industry, drives the growth of the market.

- Moreover, the biogas energy capacity in India was approximately 14 MW in 2023. Though capacity has been stagnant for the last six years, it is expected to increase in the coming years.

- In February 2024, the Government of India approved the scheme for providing financial assistance to compressed biogas (CBG) producers for procurement of biomass aggregation machinery to support the collection of biomass with a total financial outlay of INR 564.75 crore (~USD 67.7 million) for the period from FY 2023-2024 to FY 2026-2027.

- The Ministry of New and Renewable Energy (MNRE) has been running a program to promote Biomass Power and Bagasse Cogeneration in the country since the 1990s. The Biomass-based Cogeneration Program, launched in May 2018, aims to promote cogeneration for the optimal use of the country's biomass resources through cogeneration technology in sugar mills and other industries such as rice and paper mills.

- According to the International Energy Agency, clean energy investments in India reached USD 68 billion in 2023. At the beginning of 2024, the Ministry of New and Renewable Energy (MNRE) notified the National Bioenergy Programme may continue for five years from April 2021 to March 2026 with an outlay of INR 858 crore (~USD 102.9 million) under Phase-I to boost bio-energy in India.

- Owing to the above points, favorable government support in the country will drive the growth of the Indian biomass market.

India Biomass Industry Overview

The Indian biomass market is semi-fragmented. Some of the major players operating in the market (in no particular order) include Emami Agrotech Ltd, Universal Biofuels Private Limited, BIOD ENERGY (INDIA) PVT LTD, EnviTec Biogas AG, and Aemetis Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Capacity and Forecast, in GW, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Favorable Government Support to Drive the Market

- 4.5.1.2 Abundant Availability of Feedstocks

- 4.5.2 Restraints

- 4.5.2.1 Availability of Viable Alternatives in the Market

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Feedstock

- 5.1.1 Agriculture Waste

- 5.1.2 Wood and Woody Residue

- 5.1.3 Solid Municipal Waste

- 5.1.4 Other Feedstocks

- 5.2 Application

- 5.2.1 Power Generation

- 5.2.2 Heating

- 5.2.3 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1

Emami Agrotech Ltd

- 6.3.2

Universal Biofuels Private Limited

- 6.3.3 BIOD ENERGY (INDIA) PVT. LTD

- 6.3.4 EnviTec Biogas AG

- 6.3.5 Aemetis Inc.

- 6.3.6 Monopoly Innovations Private Limited

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Co-firing Mechanism and Untapped Biofuel Potential in India

02-2729-4219

+886-2-2729-4219