|

市场调查报告书

商品编码

1636228

废铅酸电池:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Lead Acid Battery Scrap - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

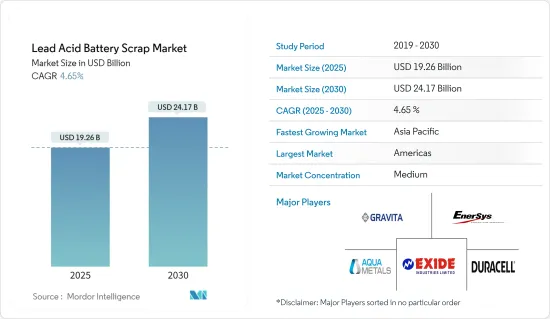

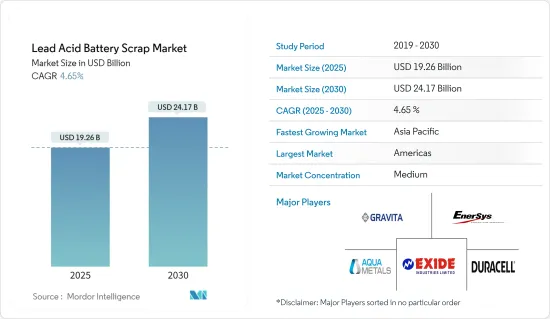

预计2025年铅酸电池废料市场规模为192.6亿美元,预估至2030年将达241.7亿美元,预测期间(2025-2030年)复合年增长率为4.65%。

主要亮点

- 从中期来看,由电池废料製成的新型铅酸电池的使用将增加在UPS系统、启动灯和汽车点火电源等小型电力存储以及预计的大型电网规模电力系统中的使用。

- 同时,高成本、缺乏健全的供应链以及与铅酸电池废料相关的低产量比率预计将阻碍未来几年的市场成长。

- 铅酸电池废料回收的技术创新以及全球对铅酸电池回收日益增长的环境关注预计将为市场成长提供重大机会。

废弃铅酸蓄电池市场趋势

液态电池占据市场主导地位

- 富液式电池广泛应用于汽车、固定式(大型)不断电系统和独立能源系统。也称为通风铅酸电池 (VLA),它们的顶部/方面有负极(海绵铅)和正极(二氧化铅)端子,顶部有通风盖。

- 根据国际能源总署(IEA)电动车展望报告,2023年全球电动车(BEV和PHEV)销量将超过1,330万辆,预计到2024年将进一步成长35%至1700万辆。电动车在整个汽车市场的份额从2020年的约4%上升到2023年的18%。电动车的兴起预计将为充斥的电池废料市场提供动力,因为这些电池可以在新电池和其他产品的生产中重复使用。

- 此外,电解铅酸电池技术的最新进展,例如增强型电解铅酸电池 (EFB),其循环寿命与吸收性玻璃毡 (AGM) 电池相当,但电池重量更高(重 2(约 3 公斤) )但成本显着降低。在 EFB 技术中,在铅板製造过程中添加碳添加剂,以提高充电接受能力并提高荷电状态降低时的循环耐久性(用于点火器应用)。

- 根据国际汽车製造商组织的数据,2023 年全球汽车产量将达到 9,400 万辆。汽车销量的增加将需要铅酸电池并推动市场成长。

- 因此,政府推动电池报废活动、增加电动车和能源储存系统铅酸电池使用量的倡议预计将在预测期内推动电解型铅酸电池的使用。

亚太地区主导市场

- 在亚太地区,中国、印度等国家是全球最大的汽车产销售市场。十多年来,中国在全球汽车产量中所占的份额一直在上升。 2023年的市占率比2008年成长约1.8倍。

- 金霸王(Duracell Inc.)、宁德时代(CATL)、Exide Industries Ltd 和Amara Raja Energy 等区域铅酸电池製造商主要透过提供低维护的2 伏特至12 伏特产品来提高其太阳能铅酸电池产品组合的可行性。这些电池本质上适合常规深循环负载,主要设计用于恶劣的光伏 (SPV) 应用。

- 此外,2023年印度汽车总产量约2,593万辆,较上年有所成长。同时,乘用车总销量从2,711,457辆成长至3,069,499辆。

- 印度还计划到 2030 年,其汽车销量的 30% 是电动车。为了鼓励充电站的增加,印度政府推出了赠款和津贴等多项计划,以奖励替代燃料基础设施的发展。中国政府的目标是到2030年达到排放峰值,新增电动车占道路上汽车的40%。中国和印度电动车的广泛采用可能会增加铅酸电池的使用,并有助于开发电池废料市场,因为电池可以重复使用来生产新电池和其他产品。

- 此外,2024 年 1 月,印度环境、森林和气候变迁部 (MoEFCC) 宣布了回收废弃铅/废弃铅酸电池的标准作业程序。此标准作业程序旨在规范含铅废弃物的进口、运输和回收,同时最大限度地减少环境和健康风险。

- 鑑于上述情况,亚太地区电动汽车铅酸电池的使用量正在增加,这将为预测期内铅酸电池废料市场的成长铺平道路。

废铅酸蓄电池产业概况

废弃铅酸电池市场较为分散。市场上企业发展的一些主要企业(排名不分先后)包括 Gravita India Ltd、Enersys、Exide Industries Ltd、Aqua Metals Inc. 和 Duracell Inc.。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 扩大铅酸电池在汽车产业的使用

- 人们对环境问题的兴趣日益浓厚

- 抑制因素

- 成本上升,缺乏强大的供应链

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 依电池类型

- 浸没式

- 封闭式

- 排放来源

- 车

- 不断电系统

- 电信站

- 电力

- 按地区

- 北美洲

- 美国

- 加拿大

- 其他北美地区

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 埃及

- 奈及利亚

- 卡达

- 其他中东和非洲

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Gravita India Ltd

- Enersys

- Exide Industries Ltd

- Aqua Metals Inc.

- Duracell Inc.

- AMIDT Group

- Engitec Technologies SpA

- Ecobat Technologies Ltd

- 市场排名分析

- 其他知名企业名单

第七章市场机会与未来趋势

- 电池处理的创新与研究

简介目录

Product Code: 50003496

The Lead Acid Battery Scrap Market size is estimated at USD 19.26 billion in 2025, and is expected to reach USD 24.17 billion by 2030, at a CAGR of 4.65% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, increasing usage of new lead-acid batteries produced from battery scrap in small-scale power storage such as UPS systems, starting lighting, and ignition power sources for automobiles, along with large, grid-scale power systems, are expected to drive the growth of the market.

- On the other note, higher costs, lack of a strong supply chain, and low yield related to lead acid battery scrap are expected to hinder market growth in the coming years.

- Technological innovations in lead acid battery scrap collection and increasing global environmental concerns for lead acid battery recycling will provide significant opportunities for market growth.

Lead Acid Battery Scrap Market Trends

Flooded Batteries to Dominate the Market

- Flooded batteries are widely used in automobiles, stationary (large) uninterrupted power supplies, and stand-alone energy systems. Also known as vented lead-acid (VLA) batteries, they consist of a negative (sponge lead) and a positive lead dioxide (PbO2) terminal on the top/side, along with the covering of vent caps on their top.

- According to the International Energy Agency Electric Vehicle Outlook Report, more than 13.3 million electric cars (BEV and PHEV) were sold worldwide in 2023, and sales are expected to grow by another 35% in 2024 to reach 17 million. This significant growth in electric cars' share of the overall car market rose from around 4% in 2020 to 18% in 2023. The rise in electric vehicles is expected to give impetus to the flooded battery scrap market since these batteries can be reused to produce new batteries or other products.

- Moreover, recent advancements in flooded lead-acid battery technology, such as enhanced flooded batteries (EFB), have demonstrated to achieve equivalent cycle life as absorbent glass mat (AGM) batteries at a high battery weight (2-3 kg above SLI) but significantly lower cost. EFB technology employs the addition of carbon additives in lead plate manufacturing to improve charged acceptance capability and increase cyclic durability in a reduced state of charge operation (ignition applications).

- According to the Organisation Internationale des Constructeurs d'Automobiles, 94 million motor vehicles were produced worldwide in 2023. The increase in automobile sales will, in turn, require lead acid batteries and drive the growth of the market.

- Therefore, government initiatives to boost battery scrap activities, growing lead acid battery utilization for electric vehicles, and energy storage systems are anticipated to drive the usage of flooded batteries during the forecast period.

Asia-Pacific to Dominate the Market

- In Asia-Pacific, countries like China and India are home to the world's largest market for the automobile industry in terms of automotive production and sales. China's share of global vehicle production has been rising for over a decade. Its share in 2023 increased nearly 1.8 times over 2008.

- Regional lead acid battery players such as Duracell Inc., CATL, Exide Industries Ltd, and Amara Raja Energy are focusing on increasing the viability and efficiency of their solar energy lead acid battery portfolios by offering products within the 2-volt to 12-volt battery range, primarily with low maintenance. These batteries are intrinsically suited for regular deep cyclic duty and are primarily designed for arduous solar photovoltaic (SPV) applications.

- Moreover, in 2023, the total production volume of vehicles in India was around 25.93 million units, an increase from the previous year. On the other hand, total passenger vehicle sales increased from 2,711,457 to 3,069,499 units.

- Also, India aims for 30% of all vehicle sales to be electric by 2030. To encourage the growth of charging stations, the Indian government has launched several schemes, such as subsidies and grants, to incentivize alternative fuel infrastructure development. The Chinese government aims to reach peak emissions by 2030 and have new electric vehicles account for 40% of cars on the road. The growing electric vehicle penetration in China and India will, in turn, create avenues for growth in the usage of lead acid batteries and may facilitate the development of the battery scrap market since these batteries can be reused to produce new batteries or other products.

- Also, in January 2024, the Ministry of Environment, Forest and Climate Change (MoEFCC) of India released the standard operating procedure for recycling lead scrap/used lead acid batteries. The SOP aims to regulate the import, transport, and recycling of lead-bearing waste while minimizing environmental and health risks.

- Owing to the above points, the growing use of lead acid batteries for electric vehicles in Asia-Pacific will create avenues for the growth of the lead acid battery scrap market during the forecast period.

Lead Acid Battery Scrap Industry Overview

The lead acid battery scrap market is semi-fragmented. Some of the major companies operating in the market (in particular order) include Gravita India Ltd, Enersys, Exide Industries Ltd, Aqua Metals Inc., and Duracell Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Usage of Lead Acid batteries in the Automotive Industry

- 4.5.1.2 Increasing Environmental Concerns

- 4.5.2 Restraints

- 4.5.2.1 Higher Costs, Lack of a Strong Supply Chain

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Flooded

- 5.1.2 Sealed

- 5.2 Source

- 5.2.1 Motor Vehicles

- 5.2.2 Uninterrupted Power Supply

- 5.2.3 Telecom Stations

- 5.2.4 Electric Power

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Spain

- 5.3.2.5 NORDIC

- 5.3.2.6 Turkey

- 5.3.2.7 Russia

- 5.3.2.8 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Malaysia

- 5.3.3.6 Thailand

- 5.3.3.7 Indonesia

- 5.3.3.8 Vietnam

- 5.3.3.9 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Egypt

- 5.3.5.5 Nigeria

- 5.3.5.6 Qatar

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Gravita India Ltd

- 6.3.2 Enersys

- 6.3.3 Exide Industries Ltd

- 6.3.4 Aqua Metals Inc.

- 6.3.5 Duracell Inc.

- 6.3.6 AMIDT Group

- 6.3.7 Engitec Technologies SpA

- 6.3.8 Ecobat Technologies Ltd

- 6.4 Market Ranking Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Innovations and Research in Battery Scrapping

02-2729-4219

+886-2-2729-4219