|

市场调查报告书

商品编码

1408589

废金属回收:市场占有率分析、产业趋势与统计、2024-2029 年成长预测Scrap Metal Recycling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

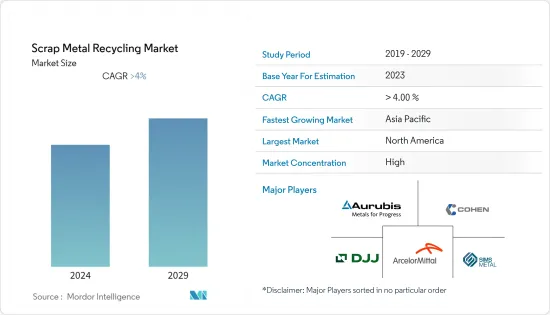

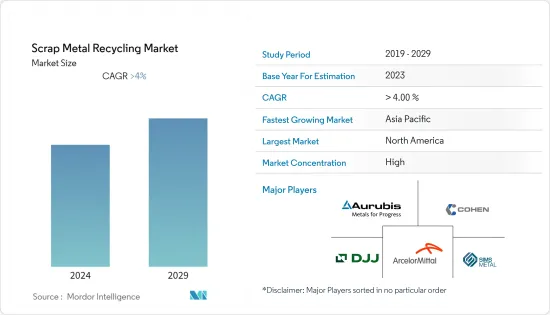

预计到年终,废金属回收市场将达到94,739万吨,预计未来五年将达到11,6433万吨,预测期内复合年增长率为4%。

COVID-19 对金属需求产生了负面影响。供应链中断和汽车、建筑和製造业等工业生产下降导致产量大幅下降,导致废金属产量下降。不过,自从限制解除以来,该产业已经出现反弹。汽车需求的成长正在恢復市场的成长轨迹。

主要亮点

- 市场研究的主要驱动因素是汽车、建筑和包装等各行业对金属的需求不断增长。此外,环境意识和永续性可能有利于市场成长。

- 另一方面,许多新兴国家缺乏基础设施和收集系统,预计将对预测期内废金属回收市场的成长产生负面影响。

- 对电子废弃物回收的日益关注、对永续材料的需求增加以及对循环经济的关注预计将为市场提供新的成长机会。

- 预计北美地区将在预测期内主导市场。严格的环境法规、强大的基础设施和完善的回收生态系统支持了这一成长。

废金属回收市场趋势

汽车产业主导市场

- 再生金属在汽车产业中发挥着重要作用,有助于永续性发展并减少对环境的影响。

- 再生钢在汽车行业的主要用途之一是生产车身和车架。它们也用于製造汽车中使用的各种钣金零件,例如门、引擎盖、挡泥板和行李箱盖。此外,底盘和底盘部件通常由回收钢製成。许多悬吊部件和安全部件(例如座椅框架和安全梁)通常由回收钢製成。

- 由于其重量轻、强度高,铝也是汽车产业的重要材料。再生铝用于製造引擎缸体、车轮和车身面板等零件。回收铝所需的能源比从铝土矿原矿中生产铝所需的能源要少得多,这使其成为环保选择。再生铜也可用于汽车布线和电气元件。

- 此外,回收的铅可以重新熔化来製造新的汽车电池,从而重新开始循环。

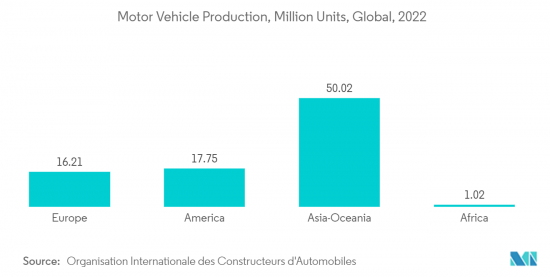

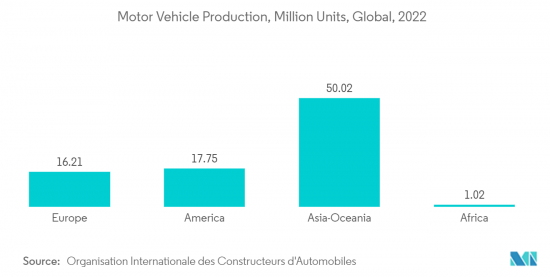

- 2022年,全球汽车产业的汽车产量将大幅成长,全球汽车产量将超过8,500万辆。 6%与前一年同期比较增长表明汽车需求的增加,这对废金属回收市场产生了影响。

- 美国汽车产量成长尤为显着,2022与前一年同期比较成长10%。加拿大产量预计将增加至122万台,墨西哥产量将增加至350万台,美国将增加至1,006万台。

- 此外,美国对国内电动车(EV) 製造的投资表明,人们越来越关注电动车生产及相关零件。汽车製造商宣布,到2022年,他们将在电动车製造上总合投资130亿美元,并且有明显的趋势转向电动车的开发和引进。

- 2022年,欧洲汽车产量小幅下降1%至16,216,888总合。这种下降是由多种因素造成的,包括欧洲能源危机和持续的供应链中断。这些挑战对欧洲汽车产业产生负面影响,并增加其在 2023 年的脆弱性。

- 在该地区人口成长的推动下,亚洲的经济和产业不断发展。汽车产业是受益于此成长的产业之一,人口的成长增加了对高效行动解决方案的需求。亚洲因拥有一些全球最有价值的汽车製造商而享有盛誉。

- 同样,韩国的汽车产量也出现了正成长。根据韩国汽车工业协会(KAMA)预测,2022年韩国汽车产量为375万辆,比上年的362万辆产量增加9%。

- 南美洲的汽车工业取得了重大进展,但各国的生产趋势各不相同。哥伦比亚成长显着,达 51,455 辆,与前一年同期比较增长 26%。阿根廷也出现了24%的大幅成长,产量达到536,893辆。

- 考虑到这些因素,废金属回收市场预计将受益于全球汽车产量增加、北美和亚洲汽车製造激增以及电动车市场扩大导致的汽车需求增加。

北美市场占据主导地位

- 钢和铝等再生金属通常用于建筑计划。它们用于製造结构元件、钢筋、屋顶材料和外墙板。建筑中的再生金属减少了对原料的需求,节省能源并减少碳排放。

- 许多电子设备都使用金属,特别是金、银、铂和钯等贵金属。这些金属用于电路基板、连接器、接线和各种组件。废弃物电子废弃物对于回收有价值的金属和防止有害物质最终进入垃圾掩埋场至关重要。

- 在航太领域,铝和钛等回收金属用于製造机翼、机身和发动机零件等飞机零件。它们还可用于各种消费品。椅子和床架等金属家具通常含有回收材料。在家用电器中,它用于金属外壳、框架和内部零件等部件。

- 美国拥有北美最大的航空市场,也拥有世界上最大的持有队之一。航太零件对法国、中国和德国等国家的出口强劲,美国的个人消费也强劲,因此航太工业的製造活动不断增加,这也增加了该国的航太材料市场。有望带来动力。

- 此外,根据美国联邦航空管理局(FAA)的数据,到2041年,美国民航机数量预计将增加至8,756架,复合年增长率为2%。

- 航太的成长预计将对航太材料的需求产生积极影响,从而影响该国的废金属回收市场。

- 在2022年国防预算中,美国政府批准了7,682亿美元用于国防项目,比拜登政府最初的预算要求增加了约2%。

- 根据美国人口普查局的数据,美国住宅量显着增长,显示住宅建筑业蓬勃发展。 2023年5月私人住宅开工数量经季节性已调整的的年率达1,631,000套,与2023年4月的修正数字相比大幅增加21.7%。 2023年5月单户住宅开工数量也大幅增加18.5%。这些数字显示了对住宅的强劲需求以及所研究的住宅建筑市场的潜力。

- 2022年,加拿大电商用户将超过2,700万,占加拿大人口的75%。预计到 2025 年这一数字将增至 77.6%。根据国际贸易局统计,2022年3月电子商务销售额约23.4亿美元。到 2025 年,零售电子商务销售额预计将达到 403 亿美元。随着电子商务的不断扩张,对电子产品高效回收和处置的需求也将成长。

- 所有上述因素预计将在预测期内推动北美废金属回收市场的成长。

废旧金属回收业概况

废金属回收市场正在整合。主要公司(排名不分先后)包括 Aurubis AG、COHEN、The David J. Joseph Company, LLC、Sims Limited 和 ArcelorMittal。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 环保意识与永续性

- 金属回收可节省能源

- 各个最终用户产业不断增长的需求

- 抑制因素

- 许多国家缺乏基础设施和收集系统

- 品质和污染问题

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 金属类型

- 铁

- 铁

- 钢

- 有色金属

- 铜

- 铝

- 铅

- 其他的

- 铁

- 按行业分类

- 车

- 航太/国防

- 建造

- 电力/电子

- 製造业和工业部门

- 家用电器

- 其他的

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- AIM Recycling

- ArcelorMittal

- Aurubis AG

- CMR Green Technologies Ltd

- COHEN

- Greenwave Technology Solutions, Inc.

- OmniSource, LLC

- Sims Limited

- SL Recycling

- The David J. Joseph Company(Nucor Corporation)

- TKC Metal Recycling Inc.

第七章 市场机会及未来趋势

- 不断成长的电子废弃物回收市场

- 对永续材料的需求不断增长并关注循环经济

The scrap metal recycling market is estimated to reach 947.39 million tons by the end of this year and is projected to reach 1,164.33 million tons in the next five years, registering a CAGR of 4% during the forecast period.

Covid-19 negatively impacted the demand for metals. The disruption in supply chains and decline in industrial production such as automotive, construction, and manufacturing experienced a significant decline in production, leading to reduced scrap metal generation. However, since restrictions were removed, the industry has been recovering. A rise in demand for automobiles is restoring the market's growth trajectory.

Key Highlights

- A major factor driving the market studied is the growing demand for metals from various industries such as automotive, construction, and packaging. Additionally, environmental awareness and sustainability will likely favor the market's growth.

- On the flip side, the lack of infrastructure and collection systems in many developing countries will negatively affect the growth of the scrap metal recycling market during the forecast period.

- The growing focus on E-waste recycling, increasing demand for sustainable materials, and focus on circular economy will likely provide new growth opportunities for the market.

- North American region is expected to dominate the market during the forecast period. Stringent environmental regulations, strong infrastructure development, and a well-established recycling ecosystem drive this growth.

Scrap Metal Recycling Market Trends

Automotive Industry to Dominate the Market

- Recycled metals play a significant role in the automotive industry contributing to sustainability efforts and reducing environmental impacts.

- One of the primary uses of recycled steel in the automotive industry is in the production of vehicle bodies ad frames. These are also used to manufacture various sheet metal components used in vehicles, such as doors, hoods, fenders, and trunk lids. Moreover, chassis and undercarriage components are often made from recycled steel. Many of the suspension parts and safety components, such as seat frames and safety beams, are often made of recycled steel.

- Aluminum is another essential material in the automotive industry due to its lightweight and strength properties. Recycled aluminum is used to produce parts like engine blocks, wheels, and body panels. Recycling aluminum requires significantly less energy than producing it from raw bauxite ore, making it a more environmentally friendly option. Recycled copper can also be used in automotive wiring and electrical components.

- Moreover, recycled lead can be remelted to create new car batteries, starting the cycle from the beginning.

- The global automotive industry experienced a significant increase in vehicle production in 2022, with more than 85 million motor vehicles manufactured worldwide. This 6% growth compared to the previous year indicates a rising demand for automotive, influencing the scrap metal recycling market.

- The growth in America's automotive production is particularly notable, with a 10% year-on-year increase in 2022. Canada, Mexico, and the United States all witnessed production expansions, reaching production figures of 1.22 million units, 3.50 million units, and 10.06 million units, respectively.

- Furthermore, the investment in domestic electric vehicle (EV) manufacturing in the United States indicates a growing focus on EV production and associated components. With auto manufacturing companies announcing a combined investment of USD 13 billion in EV manufacturing in 2022, there is a clear push toward developing and adopting electric vehicles.

- In 2022, Europe experienced a slight decline of 1% in motor vehicle production, with a total of 16,216,888 vehicles manufactured. This decrease can be attributed to several factors, such as the energy crisis in Europe and ongoing supply chain disruptions. These challenges have had a negative impact on the European automotive sector, making it more vulnerable in 2023.

- Asia's economies and sectors, driven by the region's growing population, continuously evolve. The automotive industry is one of the sectors benefiting from this growth, as the increasing population creates a higher demand for efficient mobility solutions. Asia has gained a reputation for being home to some of the world's most valuable vehicle manufacturers.

- Similarly, South Korea has experienced positive growth in automotive production. According to the Korea Automobile Manufacturers Association (KAMA), the country produced 3.75 million vehicles in 2022, representing a notable 9% increase compared to the previous year's production of 3.62 million units.

- In South America, there have been notable developments in the automotive industry, with different countries experiencing varying production trends. Colombia witnessed a significant increase in year-on-year production, with a 26% jump, reaching 51,455 units. Argentina also experienced substantial growth, with a 24% increase and production reaching 536,893 units.

- Considering these factors, the scrap metal recycling market is expected to benefit from the increased demand for automobiles driven by the growing global vehicle production, the surge in North American and Asian automotive manufacturing, and the expanding EV market.

North America to Dominate the Market

- Recycled metals, such as steel and aluminum, are commonly used in construction projects. They are utilized to create structural elements, reinforcing bars, roofing materials, and facade panels. The recycled metals in construction reduce the demand for raw materials, conserves energy, and lowers carbon emissions.

- Many electronic devices contain metals, especially precious metals like gold, silver, platinum, and palladium. These metals are used in circuit boards, connectors, wiring, and various components. Recycling electronic waste is crucial for recovering valuable metals and preventing hazardous materials from ending up in landfills.

- The aerospace sector utilizes recycled metals, such as aluminum and titanium, in the manufacturing of aircraft components, including wings, fuselages, and engine parts. These can also be used in various consumer goods. Metal furniture pieces, such as chairs and bed frames, often contain recycled contents. In household appliances, these are used in components like metal casings, frames, and internal parts.

- The United States has the largest aviation market in North America and one of the world's largest fleet sizes. Strong exports of aerospace components to countries, such as France, China, and Germany, along with robust consumer spending in the United States, have been driving the manufacturing activities in the aerospace industry, which is expected to induce a positive momentum for the aerospace material market in the country.

- Additionally, in the United States, according to the Federal Aviation Administration (FAA), the commercial fleet is forecast to increase to 8,756 in 2041, with an average annual growth rate of 2% per year.

- This growth in the aerospace industry is expected to positively impact the demand for aerospace materials, thereby influencing the scrap metal recycling market in the country.

- In the 2022 defense budget, the United States government allowed USD 768.2 billion for national defense programs, which is about a 2% increase from the Biden administration's original budget request.

- According to the United States Census Bureau, housing starts have shown a notable increase in the United States, indicating a thriving residential construction sector. Privately-owned housing starts in May 2023 reached a seasonally adjusted annual rate of 1,631,000, a significant rise of 21.7% compared to the revised April 2023 estimate. Single-family housing starts also experienced a substantial growth rate of 18.5% in May 2023. These figures indicate a strong demand for housing and a potential market for the studied market in residential construction.

- In 2022, there were over 27 million eCommerce users in Canada, accounting for 75% of the Canadian population. This number is expected to grow to 77.6% in 2025. According to the International Trade Administration, in March 2022, e-commerce sales amounted to approximately USD 2.34 billion. Retail eCommerce sales are estimated to total USD 40.3 billion by 2025. As e-commerce continues to expand, there will be a corresponding need for efficient recycling and disposal of electronics.

- All the above-mentioned factors are likely to fuel the growth of North America's scrap metal recycling market over the forecast time frame.

Scrap Metal Recycling Industry Overview

The scrap metal recycling market is consolidated. Some of the major companies (in no particular order) are Aurubis AG, COHEN, The David J. Joseph Company, LLC, Sims Limited, and ArcelorMittal.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions And Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Environmental Awareness and Sustainability

- 4.1.2 Metal Recycling Leading to Energy Saving

- 4.1.3 Growing Demand from Various End-user Industries

- 4.2 Restraints

- 4.2.1 Lack of Infrastructure and Collection Systems in Many Countries

- 4.2.2 Quality and Contamination Issues

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Metal Type

- 5.1.1 Ferrous

- 5.1.1.1 Iron

- 5.1.1.2 Steel

- 5.1.2 Non-ferrous

- 5.1.2.1 Copper

- 5.1.2.2 Aluminum

- 5.1.2.3 Lead

- 5.1.2.4 Others

- 5.1.1 Ferrous

- 5.2 Industry

- 5.2.1 Automotive

- 5.2.2 Aerospace and Defense

- 5.2.3 Construction

- 5.2.4 Electrical and Electronics

- 5.2.5 Manufacturing and Industrial Sectors

- 5.2.6 Consumer Appliances

- 5.2.7 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AIM Recycling

- 6.4.2 ArcelorMittal

- 6.4.3 Aurubis AG

- 6.4.4 CMR Green Technologies Ltd

- 6.4.5 COHEN

- 6.4.6 Greenwave Technology Solutions, Inc.

- 6.4.7 OmniSource, LLC

- 6.4.8 Sims Limited

- 6.4.9 SL Recycling

- 6.4.10 The David J. Joseph Company (Nucor Corporation)

- 6.4.11 TKC Metal Recycling Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing E-waste Recycling Market

- 7.2 Increasing Demand for Sustainable Materials and Focus on Circular Economy