|

市场调查报告书

商品编码

1636254

医疗设备/设备物流-市场占有率分析、产业趋势/统计、成长预测(2025-2030)Medical Devices And Equipment Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

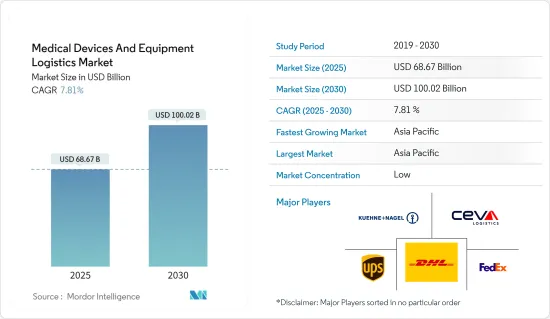

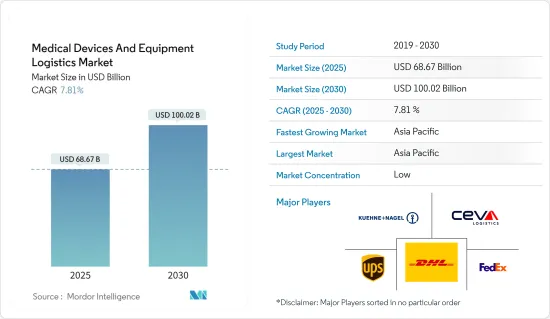

医疗设备和设备物流市场规模预计到2025年为686.7亿美元,预计到2030年将达到1000.2亿美元,预测期内(2025-2030年)复合年增长率为7.81%。

在先进医疗服务需求快速成长和医疗设备技术进步的推动下,医疗设备及器械物流市场正在迅速扩大。製造商和医疗保健提供者日益简化其供应链业务,以确保关键设备及时在全球交付。自动化、即时追踪系统和先进的库存管理技术进一步增强了这种效率驱动力,以提高透明度并降低成本。

2024 年 2 月,GobalMed Logistix (GMLx) 宣布将把亚特兰大园区扩大 200%,新建一座 65,000 平方英尺的设施,成为头条新闻。此举是对医疗设备物流和第三方服务日益增长的需求的直接回应,代表了行业物流能力的重大进步。

与 Wing 合作,美敦力 (Medtronic) 无人机交付检查等突破性倡议正在彻底改变最后一英里的医疗物流,预计将提供更快、更具适应性的供应链解决方案。此外,随着医疗基础设施领域不断扩大,特别是在新兴国家,物流供应商正在建立强大的物流网络来满足不断增长的需求。

例如,总部位于英国的 Apian 于 2023 年 12 月与 Zipline 合作,以加强 NHS 的医疗保健供应交付,突显医疗保健物流领域的持续创新浪潮。

医疗设备物流市场趋势

医疗设备製造商整合尖端物流解决方案

Medtronic)是一家医疗设备和治疗产品的跨国製造商,产品包括胰岛素帮浦、心律调节器和糖尿病治疗产品。从2022年开始,美敦力将对其物流和供应链业务进行重大改革,预计2024年取得成果。该公司专注于三个主要领域:全球营运和供应链(GOSC)、核心技术以及针对大型企业客户的商业策略。这代表着方向的重大转变。

2024 年 7 月,美敦力成为爱尔兰首批使用无人机送货公司 Wing 向医院运送医疗用品和医疗设备的公司之一。这些公司正在与 Blackrock Health 和都柏林圣文森特私人医院合作启动无人机送货试验,以展示无人机如何在医疗保健领域使用。

美敦力 (Medtronic) 和 Wing 的努力突显了在医疗设备市场中整合尖端物流解决方案日益增长的重要性。竞争对手和产业相关人员可能会效仿,加速采用旨在简化供应链和改善客户服务的创新技术。

英国医疗设备製造业引领物流业

2022 年,英国国家统计局报告称,英国医疗设备和牙科产品製造业的附加价值毛额(GVA) 升至约 29.8 亿英镑(38.1 亿美元)。这种持续成长凸显了该行业的经济重要性,并反映了英国国内医疗设备生产和需求的成长。

随着产业的扩张,强大的供应链和分销网络变得至关重要。这些网路对于医疗产品的高效全球运输至关重要,确保快速到达医疗机构并遵守严格的法规。该行业产量的增加也刺激了对尖端物流技术的投资,例如温控仓库、自动化库存系统和专业运输解决方案。

最近的人道主义努力,例如透过 UK-Med 向受俄罗斯入侵乌克兰影响的平民提供药品,进一步凸显了工业世界在医疗援助中的作用。

总而言之,英国医疗和牙科用品製造业的 GVA 的成长凸显了物流在扩大国内外关键医疗设备的可用性和可近性方面所发挥的重要作用。

医疗设备及器材物流行业概况

医疗设备和设备物流市场竞争激烈,参与企业众多,从全球物流巨头到小众服务供应商。处于领先地位的是 UPS Healthcare、DHL Supply Chain、FedEx Healthcare Solutions、Kuehne+Nagel 和 Ceva Logistics 等物流巨头。这些工业巨头利用广泛的全球网路、最尖端科技和全套服务。相反,也有一些专业的参与企业,例如 Cardinal Health、Owens & Minor 和 DB Schenker。 这些公司透过为医疗保健行业量身定制物流解决方案(包括仓储、配送、库存管理等)而处于独特的地位。

物流运营商和医疗保健相关人员之间的合作不断加强,以扩大市场渗透率并丰富服务组合。物联网、人工智慧和区块链等技术的采用至关重要,因为它提高了物流链的效率和透明度。此外,鑑于对医疗设备物流的严格监控,对法规遵循和品质保证的坚定承诺仍然至关重要。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

- 分析方法

- 调查阶段

第三章执行摘要

第四章市场洞察

- 目前的市场状况

- 科技趋势

- 洞察供应链/价值链分析

- 产业监管洞察

- 洞察产业技术进步

- 地缘政治与疫情如何影响市场

第五章市场动态

- 市场驱动因素

- 医疗服务全球扩张

- 技术进步

- 市场限制因素

- 营运成本高

- 监理复杂性

- 市场机会

- 拓展新兴市场

- 与医疗保健提供者建立策略伙伴关係和合作

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第六章 市场细分

- 依产品类型

- 医疗设备

- 医疗设备

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 其他亚太地区

- 中东/非洲

- 海湾合作委员会国家

- 南非

- 其他中东/非洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第七章 竞争格局

- 市场集中度概览

- 公司简介

- UPS Healthcare

- DHL Supply Chain

- FedEx Healthcare Solutions

- Kuehne+Nagel

- Ceva Logistics

- Cardinal Health

- Owens & Minor

- DB Schenker

- DSV

- World Courier*

- 其他公司

第八章 市场机会及未来趋势

第九章 附录

- 总体经济指标

- 资金流向洞察(运输和仓储领域的投资)

- 电子商务及消费统计

- 对外贸易统计

The Medical Devices And Equipment Logistics Market size is estimated at USD 68.67 billion in 2025, and is expected to reach USD 100.02 billion by 2030, at a CAGR of 7.81% during the forecast period (2025-2030).

The medical devices and equipment logistics market is rapidly expanding, fueled by surging demand for advanced healthcare services and technological advancements in medical devices. Manufacturers and healthcare providers are increasingly streamlining their supply chain operations to ensure the timely global delivery of critical equipment. This efficiency drive is further empowered by automation, real-time tracking systems, and advanced inventory management techniques to boost transparency and cut costs.

In February 2024, GobalMed Logistix (GMLx) made headlines by unveiling a 200% expansion of its Atlanta campus, introducing a new 65,000-sq. ft facility. This move directly responds to the escalating need for medical device logistics and third-party services, marking a significant stride in the industry's logistics capabilities.

In collaboration with Wing, groundbreaking initiatives like Medtronic's drone delivery trials are revolutionizing last-mile healthcare logistics and promising swifter and more adaptable supply chain solutions. Moreover, the ongoing global expansion of healthcare infrastructure, especially in emerging economies, is creating a ripe environment for logistics providers to establish robust distribution networks and cater to mounting demands.

For instance, UK-based Apian partnered with Zipline in December 2023 to enhance NHS medical supply deliveries, underscoring the continuous wave of innovation in healthcare logistics.

Medical Devices and Equipment Logistics Market Trends

Medical Devices Manufacturer Integrate Cutting-edge Logistics Solutions

Medtronic is a multinational producer of medical devices and therapies, such as insulin pumps, pacemakers, and diabetes therapies. Since 2022, Medtronic has embarked on a massive overhaul of its logistics and supply chain operations that will culminate in 2024. The company has focused on three key areas: global operations and supply chain (GOSC), core technology, and commercial strategies targeting large enterprise customers. It represents a significant shift in direction.

In July 2024, Medtronic was among the first companies in Ireland to use the drone delivery company Wing to deliver medical supplies and devices to hospitals. The two companies are teaming up with Blackrock Health and St. Vincent's Private Hospital in Dublin to launch a drone delivery trial to demonstrate how drones can be used in healthcare.

Medtronic's initiative with Wing underscores the growing importance of integrating cutting-edge logistics solutions in the medical devices market. Competitors and industry stakeholders may follow suit, accelerating the adoption of innovative technologies to enhance supply chain efficiency and customer service.

UK Medical Devices Manufacturing Propels the Logistics Industry

In 2022, the Office for National Statistics reported that the UK manufacturing industry for medical and dental instruments and supplies saw its gross value added (GVA) climb to around GBP 2.98 billion (USD 3.81 billion). This consistent growth highlights the industry's economic significance and mirrors the escalating production and demand for medical instruments within the United Kingdom.

With the industry's expansion, robust supply chains and distribution networks become paramount. These networks are vital for the efficient global transportation of medical products, ensuring they reach healthcare facilities promptly and comply with stringent regulations. The industry's heightened manufacturing output also spurs investments in cutting-edge logistics technologies, including temperature-controlled storage, automated inventory systems, and specialized transportation solutions.

Recent humanitarian endeavors, like the country's provision of medical supplies to civilians affected by the Russian invasion of Ukraine through UK-Med, further underscore the industry's global healthcare support role.

In essence, the escalating GVA in the UK medical and dental supplies manufacturing industry accentuates the indispensable role of logistics in broadening the accessibility and availability of crucial healthcare equipment, both domestically and internationally.

Medical Devices and Equipment Logistics Industry Overview

The medical devices and equipment logistics market boasts a competitive landscape, hosting a diverse array of players, from global logistics powerhouses to niche service providers. Logistics giants like UPS Healthcare, DHL Supply Chain, FedEx Healthcare Solutions, Kuehne + Nagel, and Ceva Logistics lead the charge. These industry giants leverage their expansive global networks, cutting-edge technology, and a robust suite of services. Conversely, specialized players such as Cardinal Health, Owens & Minor, and DB Schenker carve their niche by tailoring logistics solutions for the healthcare sector, encompassing warehousing, distribution, and inventory management.

Collaborations between logistics entities and healthcare stakeholders are rising to broaden market penetration and enrich service portfolios. Embracing technologies like IoT, AI, and blockchain is pivotal, as they bolster efficiency and transparency in the logistics chain. Moreover, given the stringent oversight in medical device logistics, a steadfast commitment to regulatory compliance and quality assurance remains paramount.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Insights on Supply Chain/Value Chain Analysis

- 4.4 Insights into Governement Regualtions in the Industry

- 4.5 Insights into Technological Advancements in the Industry

- 4.6 Impact of Geopolitics and Pandemics on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Global Expansion of Healthcare Services

- 5.1.2 Technological Advancements

- 5.2 Market Restraints

- 5.2.1 High Operational Costs

- 5.2.2 Regulatory Complexity

- 5.3 Market Opportunities

- 5.3.1 Expansion into Emerging Markets

- 5.3.2 Forging Strategic Partnerships and Collaborations With Healthcare Providers

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Medical Devices

- 6.1.2 Medical Equipment

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.1.3 Mexico

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.2.4 Italy

- 6.2.2.5 Spain

- 6.2.2.6 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 Australia

- 6.2.3.5 South Korea

- 6.2.3.6 Rest of Asia-Pacific

- 6.2.4 Middle East and Africa

- 6.2.4.1 GCC

- 6.2.4.2 South Africa

- 6.2.4.3 Rest of Middle East and Africa

- 6.2.5 South America

- 6.2.5.1 Brazil

- 6.2.5.2 Argentina

- 6.2.5.3 Rest of South America

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 UPS Healthcare

- 7.2.2 DHL Supply Chain

- 7.2.3 FedEx Healthcare Solutions

- 7.2.4 Kuehne + Nagel

- 7.2.5 Ceva Logistics

- 7.2.6 Cardinal Health

- 7.2.7 Owens & Minor

- 7.2.8 DB Schenker

- 7.2.9 DSV

- 7.2.10 World Courier*

- 7.3 Other Companies

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

9 APPENDIX

- 9.1 Macroeconomic Indicators

- 9.2 Insight Into Capital Flows (Investments In Transport and Storage Sector)

- 9.3 E-commerce and Consumer Spending-related Statistics

- 9.4 External Trade Statistics