|

市场调查报告书

商品编码

1636437

英国电动汽车电池製造:市场占有率分析、产业趋势与成长预测(2025-2030)United Kingdom Electric Vehicle Battery Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

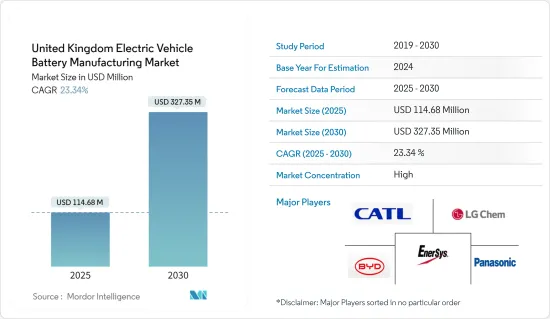

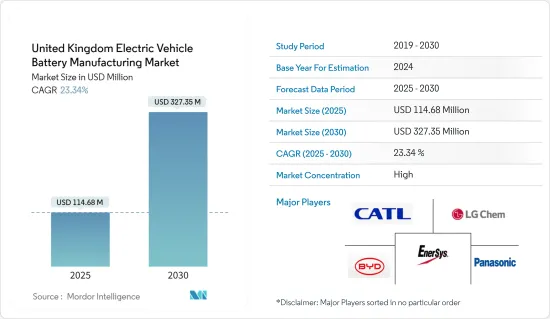

英国电动车电池製造市场规模预计到2025年为1.1468亿美元,2030年将达到3.2735亿美元,预测期间(2025-2030年)复合年增长率为23.34%。

主要亮点

- 从中期来看,由于对增加电池产能的投资,英国电动车电池製造市场预计将成长。此外,原物料和电动车电池价格的下跌,加上政府的支持政策,正在进一步提振这个市场。

- 相反,原料蕴藏量有限对市场拓展构成挑战。

- 然而,电池材料的持续技术进步和英国雄心勃勃的长期电动车雄心为该市场的参与者创造了巨大的机会。

英国电动车电池製造市场趋势

锂离子电池领域占市场主导地位

- 在锂离子电池产业的早期,消费性电子产品是主要市场。然而,随着时间的推移,在英国电动车销量激增的推动下,电动车 (EV) 製造商已成为锂离子电池的主要主导。

- 过去十年,英国锂离子电池技术快速发展,主要是在汽车领域。锂离子二次电池因其优异的容量重量比而在英国成为首选。此外,电动车的锂电池不会产生氮氧化物、二氧化碳或其他温室气体,因此它们对环境的影响比传统内燃机 (ICE) 汽车低得多。认识到这些好处,包括英国在内的多个国家正在透过补贴和政府措施来促进电动车的采用和电池製造的成长。

- 2023年,电动车(EV)电池组的平均价格将降至139美元/kWh,较2022年下降13%。这一下降是在几年前价格上涨趋势之后发生的。持续的技术进步和製造效率的提高预计将导致电池组价格持续下降,到2025年将进一步急剧下降至113美元/千瓦时,到2030年将下降至80美元/千瓦时。这些趋势正在推动英国锂离子电池製造业的崛起。

- 据国际能源总署 (IEA) 称,英国电动车销量 90% 以上依赖锂离子技术,这反映了该国电动车电池製造市场的成长。 2023年销量达31万辆,比2022年的27万辆成长14.8%。这证实了锂离子电池在英国电动车电池製造领域的主导地位。

- 2024年3月,专门生产锂离子电动车电池的中国公司亿纬锂能宣布了超过12亿欧元的重大投资计画。这项投资将在英国考文垂郊区建造一座占地 570 万平方英尺的巨型工厂,预计将成为英国电气化中心的基石。这些重大投资展示了英国电动车电池製造市场的强劲成长轨迹。

- 2024年4月,大型汽车零件製造商ADVIK收购了英国领先的锂离子电池公司Aceleron Energy Ltd.的业务资产,成为头条新闻。这项策略性收购不仅扩大了ADVIK的产品组合和基本客群,也凸显了对下一代能源储存解决方案的承诺。此次收购由 ADVIK 的英国分部 ADVIK Technologies Limited 管理,将把 Aceleron 的尖端锂离子电池技术整合到 ADVIK 的产品组合中。除了专利技术之外,此次收购还将为 ADVIK 在英国提供额外的测试和原型製作设施,从而加强其已经由 10 家工厂组成的广泛网路。

- 从这些发展来看,锂离子电池产业显然有望主导英国市场。

政府政策和奖励正在推动电动车销售激增

- 英国颁布了多项法律、政策和立法来减少温室气体 (GHG)排放,特别是二氧化碳。此外,英国针对纯电动车推出了多项激励措施,为电动车电池製造商创造了有利条件。

- 其中最前沿的是「净零排放策略」(Build Back Greener),该策略最后更新于 2022 年 4 月。该蓝图是 2020 年 11 月倡议日推出的绿色工业革命 10 点计画的直接延续,旨在到 2050 年实现政府雄心勃勃的净零排放目标。旨在实现这一目标。 2023 年 3 月,这些倡议得到了重大更新,并透过一项广泛的政策公告予以强调,其中包括详细的 Power Up Britain:净零成长计划

- 2023 年 3 月,英国政府发布了碳预算计画(CBDP),详细介绍了其排放策略。该计划是对高等法院裁决的回应,其中包括强制实施零排放车辆(ZEV)的立法。

- 英国政府于 2022 年 3 月做出了一项具有里程碑意义的决定,宣布打算逐步淘汰石化燃料汽车,并计划在 2035 年建立一支完全由零排放汽车组成的车队。这些趋势正在改变消费者的偏好,越来越多的人转向电动车。

- 此外,政府正在专注于扩大电动车充电基础设施。国际能源总署的资料显示,英国电动车充电站数量正在迅速增加,从2022年的36,900个增加到2023年的53,000个。

- 2024 年 1 月,英国推出了世界上最具野心的电动车转型法规结构。英国零排放汽车 (ZEV) 指令于 2024 年生效,为製造商设定了 2030 年的生产目标。该公司的目标是到 2030 年,英国销售的 70% 的新车和 80% 的新车成为零排放车辆,该公司正在推动到 2035 年实现完全转型。这一轨迹显示英国电动车电池製造市场具有巨大的成长潜力。

- 综上所述,英国政府齐心协力提高电动车份额,对该国电池製造业来说是个好兆头。

英国电动车电池製造业概况

英国电动车电池製造市场正在变得半固体。该市场的主要企业包括(排名不分先后)比亚迪有限公司、金霸王公司、EnerSys公司、松下控股公司、当代新能源科技有限公司和LG化学有限公司。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 投资增加电池产能

- 电池原物料成本下降

- 有利的政府政策

- 抑制因素

- 原料库存不足

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第二章 市场区隔

- 透过电池

- 锂离子

- 铅酸电池

- 镍氢电池

- 其他的

- 依电池形状分类

- 方形

- 袋型

- 圆柱形

- 搭车

- 客车

- 商用车

- 其他的

- 透过促销

- 电池电动车

- 油电混合车

- 插电式混合动力电动车

第三章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- BYD Co. Ltd

- Contemporary Amperex Technology Co. Limited

- Duracell Inc

- EnerSys

- GS Yuasa Corporation

- LG Chem Ltd

- Exide Industries

- Panasonic Corporation

- List of Other Prominent Companies

- 市场排名分析

第四章 市场机会与未来趋势

- 电动车的长期目标

简介目录

Product Code: 50003704

The United Kingdom Electric Vehicle Battery Manufacturing Market size is estimated at USD 114.68 million in 2025, and is expected to reach USD 327.35 million by 2030, at a CAGR of 23.34% during the forecast period (2025-2030).

Key Highlights

- In the medium term, the United Kingdom's Electric Vehicle Battery Manufacturing Market is poised for growth, driven by investments aimed at boosting battery production capacity. Additionally, a drop in the prices of raw materials and EV batteries, combined with supportive government policies, further bolsters this market.

- Conversely, a limited reserve of raw materials poses a challenge to the market's expansion.

- However, with ongoing technological advancements in battery materials and the UK's ambitious long-term electric vehicle targets, significant opportunities arise for players in the market.

United Kingdom Electric Vehicle Battery Manufacturing Market Trends

Lithium-ion Battery Segment to Dominate the Market

- In the early days of the lithium-ion battery industry, consumer electronics were the primary market. However, over time, electric vehicle (EV) manufacturers have taken the lead as the main consumers of lithium-ion batteries, driven by a surge in EV sales in the United Kingdom (UK).

- Over the past decade, the United Kingdom has seen a meteoric rise in lithium-ion battery technology, predominantly in the automotive sector. The growing preference for lithium-ion rechargeable batteries in the UK can be attributed to their superior capacity-to-weight ratio. Furthermore, lithium batteries in EVs produce no NOX, CO2, or other greenhouse gases, resulting in a significantly lower environmental impact compared to traditional internal combustion engine (ICE) vehicles. Recognizing these advantages, the UK and several other nations are promoting EV adoption and battery manufacturing growth through subsidies and government initiatives.

- In 2023, average battery pack prices for electric vehicles (EVs) fell to USD 139/kWh, a notable 13% drop from 2022. This decline followed a trend of rising prices in the years prior. With ongoing technological advancements and improved manufacturing efficiencies, projections indicate a continued decrease in battery pack prices, forecasting USD 113/kWh by 2025 and an even steeper drop to USD 80/kWh by 2030. Such trends bolster the prominence of lithium-ion battery manufacturing in the UK.

- According to the International Energy Agency (IEA), sales of electric vehicles in the United Kingdom, which are over 90% reliant on lithium-ion technology, mirrored the growth of the country's EV battery manufacturing market. In 2023, sales reached 310,000 vehicles, up from 270,000 in 2022, marking a notable 14.8% increase. This underscores the dominant position of lithium-ion batteries in the UK's EV battery manufacturing landscape.

- In March 2024, EVE Energy, a Chinese firm specializing in lithium-ion electric vehicle batteries, unveiled plans for a significant investment exceeding EUR 1.2 billion. The investment is set to fund a sprawling 5.7 million square feet gigafactory on the outskirts of Coventry, United Kingdom, envisioned as a cornerstone of the United Kingdom Centre for Electrification. Such substantial investments signal a robust growth trajectory for the UK's electric vehicle battery manufacturing market.

- In April 2024, ADVIK, a leading automotive component manufacturer, made headlines by acquiring the business assets of Aceleron Energy Ltd., an advanced lithium-ion battery firm based in the UK. This strategic acquisition not only expands ADVIK's product range and customer base but also emphasizes its commitment to next-generation energy storage solutions. Managed by ADVIK Technologies Limited, the company's British division, the acquisition integrates Aceleron's state-of-the-art lithium-ion battery technology into ADVIK's portfolio. In addition to the patented technology, the deal enhances ADVIK's capabilities with extra testing and prototyping facilities in the UK, strengthening its already extensive network of ten plants.

- Given these developments, it's evident that the lithium-ion battery segment is poised to dominate the market in the United Kingdom.

Policies and incentives of the Government are driving the Surge in EV Sales

- The United Kingdom has enacted several legislations, policies, and acts to curb greenhouse gas (GHG) emissions, particularly carbon dioxide. Additionally, the United Kingdom (UK) has rolled out various incentives for battery-electric vehicles, creating favorable conditions for EV battery manufacturers.

- Leading the charge is the Net Zero Strategy (Build Back Greener), which was last updated in April 2022. This strategy, a direct continuation of the Ten-point plan for a green industrial revolution introduced on November 18, 2020, lays out a comprehensive roadmap with policies and initiatives aimed at achieving the government's ambitious net-zero emissions target by 2050. March 2023 saw a significant update to these initiatives, underscored by the extensive policy release, Powering Up Britain, which included the detailed Powering Up Britain: Net Zero Growth Plan.

- In March 2023, the UK government unveiled its Carbon Budget Delivery Plan (CBDP), detailing its emission reduction strategy. This plan was a response to a High Court ruling and encompassed the Zero Emission Vehicle (ZEV) mandate legislation.

- In a landmark decision, the UK government, in March 2022, announced its intent to phase out fossil fuel vehicles, aiming for a fleet exclusively made up of zero-emission vehicles by 2035. These moves are reshaping consumer preferences, with a growing number of individuals gravitating towards EVs.

- Moreover, the government is intensifying its focus on expanding electric vehicle charging infrastructure. Data from the International Energy Agency reveals a surge in the UK's EV charging points, jumping from 36,900 in 2022 to 53,000 in 2023, which notably includes 10,000 Superfast EV charging stations.

- In January 2024, the UK rolled out the globe's most ambitious regulatory framework for the electric vehicle transition. Effective in 2024, the UK's zero-emission vehicle (ZEV) mandate outlines production targets for manufacturers up to 2030. By 2030, the mandate aims for 70% of new vans and 80% of new cars sold in Great Britain to be zero-emission, pushing for a complete transition by 2035. This trajectory hints at significant growth prospects for the UK's EV battery manufacturing market.

- In summary, the UK government's concerted efforts to boost the share of electric vehicles bode well for the country's battery manufacturing industry.

United Kingdom Electric Vehicle Battery Manufacturing Industry Overview

The United Kingdom Electric Vehicle Battery Manufacturing Market is semi-consolidated. Some of the major players in the market (in no particular order) include BYD Company Ltd, Duracell Inc., EnerSys, Panasonic Holdings Corporation, Contemporary Amperex Technology Co. Limited, and LG Chem Ltd among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 MARKET OVERVIEW

- 1.1 Introduction

- 1.2 Market Size and Demand Forecast in USD, till 2029

- 1.3 Recent Trends and Developments

- 1.4 Government Policies and Regulations

- 1.5 Market Dynamics

- 1.5.1 Drivers

- 1.5.1.1 Investments to Enhance the battery production capacity

- 1.5.1.2 Decline in cost of battery raw materials

- 1.5.1.3 Favorable Government Policies

- 1.5.2 Restraints

- 1.5.2.1 Lack of Raw Material Reserves

- 1.5.1 Drivers

- 1.6 Supply Chain Analysis

- 1.7 PESTLE ANALYSIS

- 1.8 Investment Analysis

2 MARKET SEGMENTATION

- 2.1 Battery

- 2.1.1 Lithium-ion

- 2.1.2 Lead-Acid

- 2.1.3 Nickel Metal Hydride Battery

- 2.1.4 Others

- 2.2 Battery Form

- 2.2.1 Prismatic

- 2.2.2 Pouch

- 2.2.3 Cylindrical

- 2.3 Vehicle

- 2.3.1 Passenger Cars

- 2.3.2 Commercial Vehicles

- 2.3.3 Others

- 2.4 Propulsion

- 2.4.1 Battery Electric Vehicle

- 2.4.2 Hybrid Electric Vehicle

- 2.4.3 Plug-in Hybrid Electric Vehicle

3 COMPETITIVE LANDSCAPE

- 3.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 3.2 Strategies Adopted by Leading Players

- 3.3 Company Profiles

- 3.3.1 BYD Co. Ltd

- 3.3.2 Contemporary Amperex Technology Co. Limited

- 3.3.3 Duracell Inc

- 3.3.4 EnerSys

- 3.3.5 GS Yuasa Corporation

- 3.3.6 LG Chem Ltd

- 3.3.7 Exide Industries

- 3.3.8 Panasonic Corporation

- 3.4 List of Other Prominent Companies

- 3.5 Market Ranking Analysis

4 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 4.1 Long-term ambitious targets for electric vehicles

02-2729-4219

+886-2-2729-4219