|

市场调查报告书

商品编码

1636509

义大利电动汽车电池电解:市场占有率分析、产业趋势与成长预测(2025-2030)Italy Electric Vehicle Battery Electrolyte - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

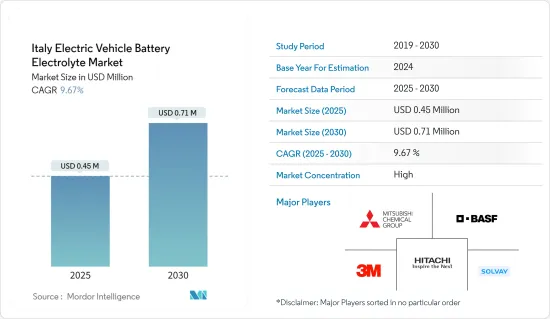

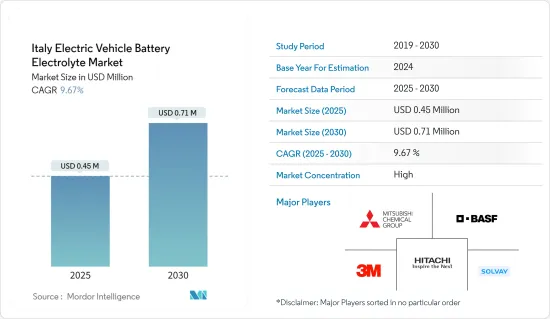

义大利电动车电池电解市场规模预计到2025年为45万美元,预计2030年将达到71万美元,预测期间(2025-2030年)复合年增长率为9.67%。

主要亮点

- 从中期来看,电动车(EV)需求不断增长和政府支持措施等因素预计将在预测期内推动市场发展。

- 另一方面,供应链问题预计将阻碍预测期内的市场成长。

- 电解质材料的技术创新预计将在未来几年为市场带来重大机会。

义大利电动汽车电池电解液市场趋势

电动车 (EV) 需求不断增长推动市场发展

- 义大利电动车(EV)市场蓬勃发展,推动了对电池电解的需求。近年来电动车註册数量的大幅增加也支持了这一趋势。註册的纯电动车 (BEV) 数量正迅速从 2017 年的 2,000 辆增加到 2023 年的 66,000 辆。同样,插电式混合动力汽车(PHEV) 的需求已从 2017 年的 29,000 辆猛增至 2023 年的 70,000 辆,这证实了义大利消费者对电动车的接受度不断提高。

- 2024年6月,义大利电动车註册量显着激增,主要得益于新Ecobonus激励措施的推出,有效激发了消费者的兴趣。光是 6 月份,就有 13,285 辆新纯电动车註册,比 2023 年同月激增 115.8%。这一增长将电动车的市场占有率推升至 8.3%,较一年前的 4.4% 大幅跃升。 2024年上半年电动车登记数量为34,709辆,较2023年同期成长6.2%,市场占有率维持在3.9%。

- 义大利政府透过各种措施明确承诺推广电动车。例如,2024年1月,政府累计9.3亿欧元用于促进国产电动车(EV)的销售。该倡议的主要目标是增加低收入家庭对电动车的可用性。透过鼓励购买国产电动车,我们预计会增加电动车的销售量,特别是低收入家庭的销售量。销量的成长预计将增加对电池组件(包括电解质)的需求。

- 除了财政激励措施外,义大利还雄心勃勃地计划在 2030 年之前安装 110,000 个公共电动车充电站。截至2023年8月,已有45,210个充电站投入运作,其中近75%为快速充电桩,主要分布在都市区和购物中心。

- 儘管包括德国和法国在内的许多主要欧洲市场正在经历电动车市场的低迷,但义大利的上升趋势标誌着向电动车的重大转变。随着电动车销量持续成长,这一趋势对电池电解市场来说也是个好兆头。

- 总而言之,政府的奖励、快速增加的註册数量以及不断扩大的充电基础设施相结合,为义大利电动车电池电解液市场的成长创造了良好的环境。

锂离子电池领域占市场主导地位

- 在电动车(EV)的日益普及、政府推动永续交通以及电池开发技术进步的推动下,锂离子电池领域已占据举足轻重的地位。电动车选择锂离子电池是因为其能量密度高、重量轻、循环寿命长。随着电动车市场的扩大,对提高电池效率、安全性和寿命的高性能电解的需求不断增加。

- 义大利强劲的汽车产业目前正在转向电动车,并正在加强其锂离子电池产业。随着主要汽车製造商加大对电动车生产的投资,锂离子电池的产量正在显着增加。为了证明这一势头,Statevolt 于 2023 年 1 月宣布计划在义大利建立一座专门用于电动车的 45GWh 锂离子电池工厂。这个汽车产业的转变与义大利致力于遏制碳排放和支持清洁能源的承诺完美契合,并呼应了欧盟更广泛的雄心。

- 电动车电池电解市场受锂离子电池价格大幅下滑影响较大。 2023年,锂离子电池的平均价格将降至每千瓦时(kWh)约139美元,较2013年大幅下降82%以上。预测表明,到 2025 年,该价格可能进一步降至 113 美元/千瓦时以下,并目标在 2030 年降至 80 美元/千瓦时。

- 随着电池成本的下降,电动车的整体价格也会随之下降,从而提高消费者的承受能力和可用性。由于价格下降,电动车的需求预计将增加,因此对顶级电池电解的需求正在增长。

- 此外,随着价格下降,製造商越来越多地投资于先进的电解配方,以提高电池的性能和安全性。体现这一趋势的是,史丹佛大学专门研究先进电池电解液的分支机构Feon Energy 于2024 年6 月为其创新电解液获得了610 万美元的种子资金,这将有助于锂金属电池获得UN38. 3 认证。这些进步将推动电解质领域的创新,为提高电池效率、减轻重量和提高能量密度的产品铺平道路。

- 鑑于这些动态,在技术创新和电池价格下降的推动下,义大利锂离子电池领域,特别是电动车电池电解领域,呈上升趋势,从而推动了电动车的普及。

义大利电动汽车电池电解液产业概况

义大利电动车电池电解市场正变得半固体。主要参与企业包括(排名不分先后)三菱化学集团公司、3M、日立、Solvay SA 和BASF SE。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车 (EV) 需求不断增长

- 政府支持措施

- 抑制因素

- 供应链挑战

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第五章市场区隔

- 电池类型

- 锂离子电池

- 铅酸电池

- 其他的

- 电解质类型

- 液体电解质

- 凝胶电解质

- 固体电解质

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Mitsubishi Chemical Group

- 3M

- Arkema

- Daikin Industries

- Dow Chemical Company

- BASF SE

- Solvay SA

- Asahi Kasei Corporation

- Hitachi, Ltd.

- Cabot Corporation

- 市场排名/份额分析

- 其他知名公司名单

第七章 市场机会及未来趋势

- 电解质材料的创新

简介目录

Product Code: 50003839

The Italy Electric Vehicle Battery Electrolyte Market size is estimated at USD 0.45 million in 2025, and is expected to reach USD 0.71 million by 2030, at a CAGR of 9.67% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the growing demand for electric vehicle (EVs) and suppotive government initiatives are expected to drive the market during the forecast period.

- On the other hand, supply chain challanges are likely to hinder the market growth during the forecast period.

- Nevertheless, innovations in electrolyte materials are expected to provide significant opportunities for the market in the coming years.

Italy Electric Vehicle Battery Electrolyte Market Trends

Growing Demand for Electric Vehicles (EVs) to Drive the Market

- Italy's electric vehicle (EV) market is booming, driving up the demand for battery electrolytes. This trend is underscored by a significant uptick in EV registrations over recent years. Registrations for Battery Electric Vehicles (BEVs) surged from a mere 2,000 units in 2017 to an impressive 66,000 units in 2023. Likewise, Plug-in Hybrid Electric Vehicles (PHEVs) saw their demand leap from 29,000 units in 2017 to 70,000 units in 2023, underscoring the growing acceptance of EVs among Italian consumers.

- In June 2024, Italy experienced a notable spike in EV registrations, primarily due to the rollout of the new Ecobonus incentive, which has effectively piqued consumer interest. June alone witnessed the registration of 13,285 new fully electric vehicles, marking a staggering 115.8% jump from the same month in 2023. This upswing elevated the market share of electric vehicles to 8.3%, a significant leap from the previous year's 4.4%. In the first half of 2024, electric vehicle registrations totaled 34,709, reflecting a 6.2% growth from the same timeframe in 2023, and sustaining a market share of 3.9%.

- The Italian government's dedication to promoting EV adoption is evident through various initiatives. For example, in January 2024, the government earmarked 930 million euros to bolster the sales of locally produced electric vehicles (EVs). A primary objective of this initiative is to champion electromobility among lower-income households. By incentivizing the purchase of domestically produced EVs, especially for these families, the government anticipates a boost in overall EV sales. Such an uptick in sales is poised to drive up the demand for battery components, notably electrolytes.

- Beyond financial incentives, Italy is ambitiously aiming to set up 110,000 public electric vehicle charging points by 2030. As of August 2023, 45,210 charging points were already operational, with nearly 75% being fast chargers, predominantly situated in urban locales and shopping centers.

- While many major European markets, including Germany and France, saw stagnation in their EV markets, Italy's upward trajectory signals a pronounced shift towards electric mobility. This trend bodes well for the battery electrolyte market as EV sales continue their ascent.

- In summary, the confluence of government incentives, surging registrations, and an expanding charging infrastructure is cultivating a robust environment for the growth of Italy's EV battery electrolyte market, all fueled by the nation's escalating appetite for electric vehicles.

Lithium-Ion Batteries Segment to Dominate the Market

- Driven by the rising adoption of electric vehicles (EVs), government pushes for sustainable transportation, and technological strides in battery development, the lithium-ion battery segment is pivotal. Valued for their high energy density, lightweight nature, and extended cycle life, lithium-ion batteries are the preferred choice for EVs. As the EV market expands, there's a growing demand for high-performance electrolytes that boost battery efficiency, safety, and lifespan.

- Italy's robust automotive sector, now pivoting towards electric mobility, bolsters the lithium-ion battery segment. With major automakers pouring investments into EV production, lithium-ion battery manufacturing is witnessing a notable uptick. A testament to this momentum, Statevolt announced in January 2023 its plans to set up a 45 GWh lithium-ion battery facility in Italy, specifically for EVs. This automotive shift aligns seamlessly with Italy's dedication to curbing carbon emissions and championing clean energy, echoing the broader ambitions of the European Union.

- The electric vehicle battery electrolyte market is significantly swayed by the plummeting prices of lithium-ion batteries. In 2023, the average price of lithium-ion batteries dipped to approximately USD 139 per kilowatt-hour (kWh), showcasing a remarkable decline of over 82% since 2013. Forecasts suggest a further drop to below USD 113/kWh by 2025, with a potential target of USD 80/kWh by 2030.

- As battery costs decrease, the overall price of electric vehicles follows suit, enhancing their affordability and accessibility for consumers. This anticipated rise in EV demand, spurred by lower prices, underscores the growing need for top-tier battery electrolytes.

- Furthermore, as prices decline, manufacturers are more inclined to invest in cutting-edge electrolyte formulations that bolster battery performance and safety. Highlighting this trend, Feon Energy, a Stanford University offshoot specializing in advanced battery electrolytes, clinched USD 6.1 million in seed funding in June 2024 for its innovative electrolytes and achieved UN 38.3 certification for its lithium-metal batteries. Such advancements catalyze innovation in the electrolyte domain, paving the way for products that amplify battery efficiency, lighten weight, and boost energy density.

- Given these dynamics, Italy's lithium-ion battery segment, especially in the realm of electric vehicle battery electrolytes, is on an upward trajectory, buoyed by technological innovations and falling battery prices that facilitate the broader embrace of electric vehicles.

Italy Electric Vehicle Battery Electrolyte Industry Overview

The Italy electric vehicle battery electrolyte market is semi-consolidated. Some of the major players include (not in particular order) Mitsubishi Chemical Group, 3M, Hitachi Ltd., Solvay SA, and BASF SE, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Demand for Electric Vehicles (EVs)

- 4.5.1.2 Supportive Government Initiatives

- 4.5.2 Restraints

- 4.5.2.1 Supply Chain Challanges

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-Ion Batteries

- 5.1.2 Lead-Acid Batteries

- 5.1.3 Others

- 5.2 Electrolyte Type

- 5.2.1 Liquid Electrolyte

- 5.2.2 Gel Electrolyte

- 5.2.3 Solid Electrolyte

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Mitsubishi Chemical Group

- 6.3.2 3M

- 6.3.3 Arkema

- 6.3.4 Daikin Industries

- 6.3.5 Dow Chemical Company

- 6.3.6 BASF SE

- 6.3.7 Solvay SA

- 6.3.8 Asahi Kasei Corporation

- 6.3.9 Hitachi, Ltd.

- 6.3.10 Cabot Corporation

- 6.4 Market Ranking/Share Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovations in Electrolyte Materials

02-2729-4219

+886-2-2729-4219