|

市场调查报告书

商品编码

1636556

亚太地区电子废弃物管理:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)APAC E-Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

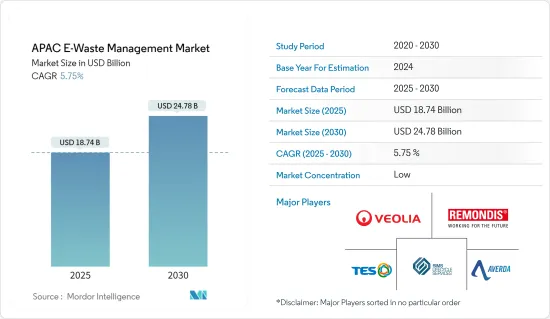

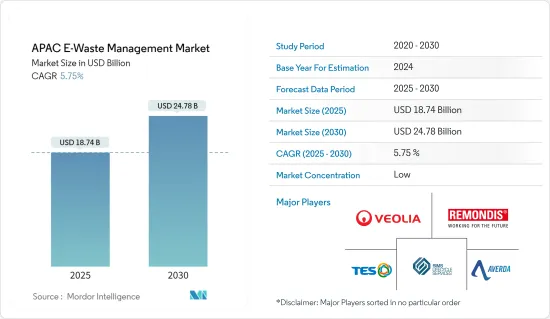

亚太地区电子废弃物管理市场规模预计在 2025 年达到 187.4 亿美元,预计到 2030 年将达到 247.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.75%。

由于科技的快速进步、消费性电子产品的日益普及以及强劲的经济成长,亚太地区的电子废弃物正在大幅增加。中国、印度和日本是主要贡献者。

2023年8月,日本宣布与东南亚国协建立伙伴关係,共同因应电子废弃物挑战。该合作由环境部长会议建立,重点致力于制定电子废弃物的法规。日本将透过2024财政年度预算支持建立废弃物管理企业的註册和认证制度。

该倡议旨在改善东南亚地区的电子废弃物,由于废弃物进口管理鬆懈,该地区受到环境污染和健康风险的困扰。日本也希望从电子废弃物中回收有价值的金属,以支持其电动车产业并缓解该国有限的金属资源。

同时,2024年5月,韩国私募股权和环境相关企业增加了对垃圾掩埋场领域的投资。 Afilma Capital 以 5,000 亿韩元(3.68 亿美元)收购了领先的垃圾掩埋场营运商 Gentec。 Gentec 在忠清南道唐津市经营一个大型垃圾掩埋场。这种日益增长的兴趣反映了人们对废弃物管理的信心日益增强,也预示着电子废弃物处理技术可能取得进步。

亚太地区电子废弃物管理市场趋势

印度EPR认证平台提升废弃物垃圾回收效率

22财年,印度排放了超过160万吨电子废弃物,其中52.7万吨被收集和处理。截至 2024 年 3 月,政府计划推出一个用于交易生产者延伸责任 (EPR) 证书的线上平台,以应对这一日益严峻的挑战。强制实施 EPR 要求生产商负责回收废弃的产品,从而鼓励生产更多可回收和可再利用的产品。

中央污染控制委员会 (CPCB) 正在监督该平台,以提高 EPR 认证市场的透明度和效率。公司可以透过内部管理废弃物或从超过回收标准的营业单位获得 EPR 证书来履行其回收义务。 CPCB 将根据未达到 EPR 目标的环境补偿百分比为这些证书制定指导方针和价格。

自 2022 年《电子废弃物(管理)规则》中引入 EPR 规定以来,政府已处理了 5,615 份 EPR 申请,核准了4,865 份,收到了 285 份来自回收商的申请,并批准了 196 份。值得注意的是,政府已经超额完成了 10.5 亿吨废弃电器及电子设备(WEEE)的回收目标。政府目前正寻求利用即将推出的平台来加强这些努力。

中国在北京举办活动重点关注电子废弃物创新与永续性工作

业内专家表示,2022年,全球最大的电子废弃物生产国中国排放了超过1,200万吨电子废弃物。时间快转到2024年4月,北京捷佳苑外交居住(DRC)举办了一场活动,展示中国在废弃物分类和回收方面的突破。此次博览会展示了尖端的人工智慧废弃物分类机,并介绍了由再生材料製成的产品。值得注意的是,该活动包括针对儿童的互动活动,并强调了回收的重要性。

这项活动由北京市对外环境卫生服务中心主办,凸显了中国利用人工智慧、物联网、巨量资料和云端运算领域的进步对抗电子废弃物的决心。这次访问由中国公共外交协会下属的中国国际新闻传播中心组织,是受新冠肺炎疫情影响暂停的媒体交流活动的一部分。节目汇集了来自 90 多个国家的 100 多名记者,重点关注媒体交流并深入了解中国正在发生的发展。

透过这样的展示和倡议,中国正在建立自己在永续电子废弃物管理技术方面处于领先地位的形象。这项战略措施旨在加强中国的全球地位,扩大其在国际环境对话中的软实力和影响力。

亚太地区电子废弃物管理产业概况

亚太地区电子废弃物管理市场正面临威立雅集团、Remondis 和 Averda 等主要参与者以及 Sims Recycling Solutions 和 TES-AMM 的激烈竞争。威立雅集团和利蒙迪斯尤其突出,他们专注于先进的回收技术,并不断扩大服务组合以处理不同的电子废弃物流。

这些市场领先的公司优先考虑永续性,并与地方政府伙伴关係加强电子废弃物收集和回收基础设施。 Attero 是印度电子废弃物产业的主要企业,拥有广泛的收集网路和最先进的回收方法。这些公司透过对技术、监管环境和永续实践的策略关注,推动了亚太地区电子废弃物市场的发展,为更高效、更环保的电子废弃物管理铺平了道路。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

- 分析方法

- 研究阶段

第三章执行摘要

第四章 市场洞察

- 当前市场状况

- 科技趋势

- 供应链/价值链分析洞察

- 产业监管见解

- 洞察产业技术进步

第五章 市场动态

- 市场驱动因素

- 科技的快速进步导致电子垃圾数量增加

- 都市化和工业化

- 市场限制

- 回收成本高

- 电子废弃物的复杂性

- 市场机会

- 回收技术的进步

- 官民合作关係

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第六章 市场细分

- 依材料类型

- 金属

- 塑胶

- 玻璃

- 其他材料

- 依排放源类型

- 家用电子电器

- 工业电子

- 家电

- 其他的

- 按应用

- 垃圾掩埋场

- 回收利用

- 其他用途

- 按国家

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

第七章 竞争格局

- 市场集中度概览

- 公司简介

- Veolia Group

- Remondis

- Averda

- Sims Recycling Solutions

- TES-AMM

- Enviro-Hub Holdings Ltd

- Blue Planet Environmental Solutions Pte Ltd

- ECO Recycling Ltd(Ecoreco)

- Attero

- JOMAR Life Research Laboratory

- 其他公司

第八章 市场机会与未来趋势

第 9 章 附录

The APAC E-Waste Management Market size is estimated at USD 18.74 billion in 2025, and is expected to reach USD 24.78 billion by 2030, at a CAGR of 5.75% during the forecast period (2025-2030).

Asia-Pacific region is experiencing a significant rise in electronic waste due to rapid technological advancements, increased adoption of consumer electronics, and strong economic growth. China, India, and Japan are major contributors.

In August 2023, Japan announced a partnership with ASEAN countries to address e-waste challenges. This collaboration, established during an environment ministers' meeting, focuses on developing regulations for e-waste disposal. Japan will assist in creating registration and certification systems for waste management businesses, funded through its fiscal year 2024 budget.

This initiative aims to improve e-waste handling in Southeast Asia, which has struggled with environmental contamination and health risks due to lax waste import regulations. Japan also seeks to recover valuable metals from e-waste, supporting its electric vehicle industry and mitigating its limited domestic metal resources.

Meanwhile, in May 2024, South Korea's private equity and environmental firms increasingly invested in the landfill sector. Affirma Capital acquired Jentec, a major landfill operator, for KRW 500 billion (USD 368 million). Jentec operates a large landfill in Dangjin, South Chungcheong Province. This growing interest reflects increased confidence in waste management and suggests potential advancements in e-waste treatment technologies.

APAC E-Waste Management Market Trends

India's Upcoming EPR Certificate Platform to Boost E-Waste Recycling Efficiency

In the financial year 2022, India produced over 1.6 million metric tons of e-waste, with 527 thousand metric tons being collected and processed. As of March 2024, the government plans to roll out an online platform for trading Extended Producer Responsibility (EPR) certificates to combat this escalating challenge. EPR mandates hold producers accountable for recycling their products post-disposal, thereby promoting the creation of more recyclable and reusable goods.

The Central Pollution Control Board (CPCB) oversees this platform to boost transparency and efficiency in the EPR certificate market. Companies can fulfill recycling obligations by managing waste internally or procuring EPR certificates from entities surpassing their recycling benchmarks. The CPCB will set the guidelines and pricing for these certificates, pegged to a percentage of the environmental compensation for unmet EPR targets.

Since the inception of EPR directives in the E-Waste (Management) Rules of 2022, the government has processed 5,615 EPR applications, approving 4,865, and has received 285 applications from recyclers, granting 196. Notably, the government has already surpassed its recycling goal of 1.05 billion metric tons for Waste Electrical and Electronic Equipment (WEEE). It is now looking to bolster these efforts with the upcoming platform.

China Highlights E-Waste Innovations and Sustainability Initiatives at Beijing Event

Industry experts note that in 2022, China, the world's largest producer of electronic waste, churned out over 12 million metric tons. Fast-forward to April 2024, when the Qijiayuan Diplomatic Residence Compound (DRC) in Beijing set the stage for an event spotlighting China's waste sorting and recycling strides. The exhibition featured cutting-edge AI-driven waste-sorting machinery and showcased products crafted from recycled materials. Notably, the event included interactive activities for children, emphasizing the importance of recycling.

Hosted by the Beijing Municipal Center for Foreign-related Environment Sanitation Services, the event underscored China's resolve to combat e-waste, leveraging advancements in AI, IoT, big data, and cloud computing. The China International Press Communication Center (CIPCC), under the China Public Diplomacy Association (CPDA), facilitated this visit as part of a media exchange initiative reignited after a pause during the COVID-19 pandemic. The program hosted 100+ journalists from 90+ nations, focusing on media exchange and offering insights into China's ongoing developments.

Through such showcases and initiatives, China is crafting a narrative of being a frontrunner in sustainable e-waste management technology. This strategic move aims to bolster China's global standing, amplifying its soft power and influence in international environmental dialogues.

APAC E-Waste Management Industry Overview

The e-waste management market in Asia-Pacific sees intense competition, with major firms like Veolia Group, Remondis, and Averda, alongside Sims Recycling Solutions and TES-AMM, leading the charge. Veolia Group and Remondis, in particular, stand out for their emphasis on advanced recycling technologies and broadening service portfolios to handle diverse electronic waste streams.

These market leaders prioritize sustainability, forging partnerships with local governments to bolster e-waste collection and recycling infrastructure. Attero, a prominent player in India's e-waste landscape, has a widespread collection network and cutting-edge recycling methods. Collectively, these firms are propelling the APAC e-waste market forward through a strategic focus on technology, regulatory adherence, and sustainable initiatives, paving the way for a more efficient and eco-conscious e-waste management landscape.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Insights into Supply Chain/Value Chain Analysis

- 4.4 Insights into Governement Regualtions in the Industry

- 4.5 Insights into Technological Advancements in the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Technological Advancements Drive Increasing E-Waste Volumes

- 5.1.2 Urbanization and Industrialization

- 5.2 Market Restraints

- 5.2.1 High Cost of Recycling

- 5.2.2 Complexity of E-Waste

- 5.3 Market Opportunities

- 5.3.1 Advancements in Recycling Technologies

- 5.3.2 Public-Private Partnerships

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Metal

- 6.1.2 Plastic

- 6.1.3 Glass

- 6.1.4 Other Materials

- 6.2 By Source Type

- 6.2.1 Consumer Electronics

- 6.2.2 Industrial Electronics

- 6.2.3 Household Appliances

- 6.2.4 Other Sources

- 6.3 By Application

- 6.3.1 Landfill

- 6.3.2 Recycled

- 6.3.3 Other Applications

- 6.4 By Country

- 6.4.1 China

- 6.4.2 Japan

- 6.4.3 India

- 6.4.4 South Korea

- 6.4.5 Rest of Asia-Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Veolia Group

- 7.2.2 Remondis

- 7.2.3 Averda

- 7.2.4 Sims Recycling Solutions

- 7.2.5 TES-AMM

- 7.2.6 Enviro-Hub Holdings Ltd

- 7.2.7 Blue Planet Environmental Solutions Pte Ltd

- 7.2.8 ECO Recycling Ltd (Ecoreco)

- 7.2.9 Attero

- 7.2.10 JOMAR Life Research Laboratory*

- 7.3 Other Companies