|

市场调查报告书

商品编码

1636581

纺织品印花:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Textile Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

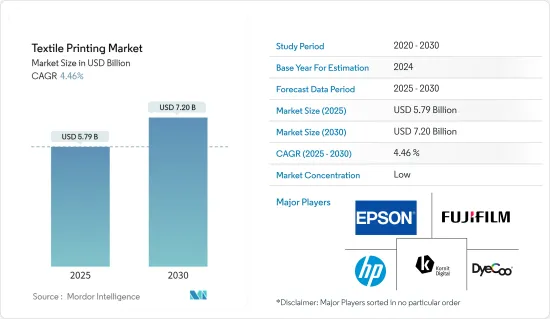

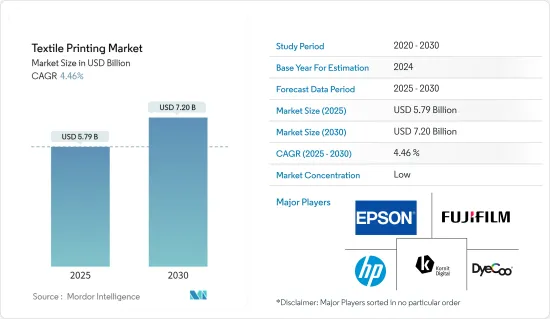

纺织品印花市场规模预计在 2025 年为 57.9 亿美元,预计到 2030 年将达到 72 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.46%。

随着技术进步以及电子商务和快时尚的成长推动对客製化、高品质面料的需求不断增加,纺织品印花市场正在迅速发展。一个重要的趋势是数位印刷技术的日益普及,它比传统方法具有更大的灵活性和效率。

截至 2024 年 1 月,数位织物印花已在中国长江Delta地区(纺织品生产和出口的主要枢纽)取得重大进展。此方法利用喷墨技术将精确、生动的图案列印到织物上,同时环保技术最大限度地减少对环境的影响。

人工智慧设计工具和永续印刷方法等创新也在重塑这个产业。在 2024 年 5 月 28 日至 6 月 7 日于杜塞尔多夫举行的 Drupa展览会上,杜塞尔多夫展览公司将举办 Drupa 成像高峰会,作为「Drupa Next Age」论坛的一部分。在高峰会上,杰出的行业领袖讨论了人工智慧(AI)对成像技术和印刷的影响。

值得关注的演讲包括来自Google Cloud 的Dennis Oberfeld,他强调了AI 将如何改变图像製作;以及来自AI Imagelab 的Andreas,他对当前的AI 工具及其在图像製作中的应用提供了见解。其中。

纺织品印花市场趋势

H&M 和京瓷为创作者和环境推出织品印花创新技术

2023 年 10 月,H&M 集团旗下的按需布料印刷平台 Creator Studio 推出了一款人工智慧解决方案,让消费者能够创建和列印客製化图形。此项创新旨在利用 H&M 的供应链和履约能力来提供永续的高品质产品,从而增强创作者的能力并简化内容创作流程。 H&M 旗下拥有 COS、Monki 和 &Other Stories 等品牌,正透过整合人工智慧来优化采购和销售资料,从而加强其以技术主导的方法。

2024年2月,京瓷推出了Forearth,这是一款旨在解决纺织业环境挑战(例如水污染和二氧化碳排放)的喷墨印表机。该印表机旨在透过最大限度地减少织物和水的使用来减少废弃物。

京瓷副总经理谷口翔指出,洗衣服每年会向海洋释放相当于500亿宝特瓶的微纤维,凸显纤维污染的严重性。透过推进印染印花技术,Forearth 提供了一个有前景的解决方案来减少时尚产业对环境的影响。

越南纺织品需求强劲,为纺织品印花产业带来成长机会

产业资料显示,2022年越南将进口价值约45.7亿美元的使用人造纤维材料的纺织品,成为全球此类别最大的进口国。孟加拉是第二大进口国,进口额约 21.4 亿美元。 2022年这些纺织品的全球进口总值为401亿美元。

这一显着的进口数字凸显了越南对纺织材料的强劲需求,并使该国成为全球纺织品市场的重要参与者。这种强劲的需求是由蓬勃发展的服饰製造业推动的,该行业需要为国内和国际市场提供先进的印刷解决方案,这表明印染行业具有巨大的潜力。随着越南继续发展成为纺织品生产中心,印染市场预计将拥有巨大的成长和创新机会,以满足对高品质印花织物日益增长的需求。

Duy Tran 是越南中部一家领先的自动化印刷公司,就是这种可能性的一个例子。该公司为领先的服饰和纺织品製造商提供服务,与 50 多个全球品牌合作超过 500 个计划,并僱用 300 多名技术工人。 Duy Tran 的技术进步和能力凸显了越南印染市场蓬勃发展的机会,这项机会受到本地需求和国际伙伴关係的推动。

纺织品印花产业概况

纺织品印花市场竞争激烈,领先的公司采用各种策略来获得市场占有率并保持技术创新的前沿。该领域的主要企业包括Epson、康丽数位、FUJIFILM和 DyeCoo Textile Systems。这些公司重视高性能、可客製化的印染印表机,可以满足各种印染需求。

在创新中心 B 栋,Epson正在加强其数位印染印刷能力,并利用其 SureColor F 系列印表机优先考虑高生产力和环保性。 Kornit Digital 专注于按需、永续的印刷解决方案,并拥有用于直接服装和直接织物应用的高效能印表机。同时,DyeCoo Textile Systems 支援无水染色技术,旨在减少对环境的影响。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

- 分析方法

- 研究阶段

第三章执行摘要

第四章 市场洞察

- 当前市场状况

- 科技趋势

- 供应链/价值链分析洞察

- 产业监管见解

- 洞察产业技术进步

第五章 市场动态

- 市场驱动因素

- 客製化需求日益增长

- 电子商务的成长

- 市场限制

- 初期投资高

- 环境问题

- 市场机会

- 永续印刷解决方案

- 智慧纺织集成

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第六章 市场细分

- 依印刷技术

- 网版印刷

- 数位印刷

- 热转印

- 其他(块、模板等)

- 按应用

- 服饰/服饰

- 工业纺织品

- 家用纺织品及其他

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 南美洲

- 中东和非洲

第七章 竞争格局

- 市场集中度概览

- 公司简介

- Epson

- Kornit Digital

- Fujifilm

- DyeCoo Textile Systems

- HP Inc.

- Roland DG

- MS Printing Solutions

- Mimaki

- Spoonflower

- Juki Corporation*

- 其他公司

第八章 市场机会与未来趋势

第 9 章 附录

The Textile Printing Market size is estimated at USD 5.79 billion in 2025, and is expected to reach USD 7.20 billion by 2030, at a CAGR of 4.46% during the forecast period (2025-2030).

The textile printing market is rapidly evolving, driven by technological advancements and the rising demand for customized, high-quality fabrics spurred by e-commerce and fast fashion growth. Key trends include the increasing adoption of digital printing technologies, which offer greater flexibility and efficiency than traditional methods.

As of January 2024, digital fabric printing is making significant inroads in China's Yangtze River Delta region, a primary textile production and export hub. This method employs inkjet technology, allowing for precise, vibrant designs on fabric while minimizing environmental impact through its eco-friendly technologies.

Innovations such as AI-powered design tools and sustainable printing practices are also reshaping the industry. At the Drupa trade fair in Dusseldorf, held from May 28 to June 7, 2024, Messe Dusseldorf introduced the Drupa Imaging Summit as part of the "Drupa Next Age" forum. The summit featured prominent industry leaders discussing the impact of artificial intelligence (AI) on imaging technologies and printing.

Notable presentations included Dennis Oberfeld from Google Cloud, who highlighted how AI is transforming image creation, and Andreas Jurgensen of AI Imagelab, who offered insights into current AI tools and their applications in image production.

Textile Printing Market Trends

H&M and Kyocera Launch Fabric Printing Innovations for Creators and Environment

In October 2023, Creator Studio, an on-demand fabric printing platform owned by the H&M group, launched an AI-powered solution that allows consumers to create and print customized graphics. This innovation aims to empower creators and streamline the content creation process, utilizing H&M's supply chain and fulfillment capabilities to offer sustainable and high-quality products. H&M, which owns brands like COS, Monki, and & Other Stories, is enhancing its technology-driven approach by integrating AI to optimize sourcing and sales data.

In February 2024, Kyocera introduced the Forearth inkjet printer, designed to address the textile industry's environmental challenges, such as water pollution and carbon emissions. The printer aims to reduce waste by minimizing the impact of fabric and water use.

Kyocera's deputy general manager, Sho Taniguchi, emphasizes the severity of textile pollution, citing that washing clothes releases microfibers equivalent to 50 billion plastic bottles into the ocean annually. Forearth offers a promising solution to decrease the fashion industry's environmental footprint by advancing textile printing practices.

Vietnam's Robust Demand for Woven Fabrics Signals Growth Opportunities in Textile Printing Industry

According to industry data, in 2022, Vietnam imported approximately USD 4.57 billion worth of woven fabrics made from man-made textile materials, making it the largest importer in this category globally. Bangladesh followed as the second largest importer, with around USD 2.14 billion. These fabrics' total global import value was USD 40.1 billion in 2022.

This substantial import value underscores Vietnam's robust demand for textile materials, positioning the country as a critical player in the global textile market. This strong demand indicates significant potential for the textile printing industry, driven by a thriving garment manufacturing sector requiring advanced printing solutions for domestic and international markets. As Vietnam continues to develop as a central textile production hub, the textile printing market is expected to see substantial opportunities for growth and innovation, catering to the increasing demand for high-quality printed fabrics.

Duy Tran, a leading automated printing enterprise in central Vietnam, is an example of this potential. The company serves major garment and textile manufacturers, working with over 50 global brands on over 500 projects and employing over 300 skilled workers. Duy Tran's technical advancement and capacity highlight the burgeoning opportunities within Vietnam's textile printing market, driven by local demand and international partnerships.

Textile Printing Industry Overview

The textile printing market is fiercely competitive, with leading players adopting diverse strategies to seize market share and spearhead innovation. Key players in this arena include Epson, Kornit Digital, Fujifilm, and DyeCoo Textile Systems. These players emphasize high-performance, customizable textile printers that cater to a broad spectrum of textile printing requirements.

Epson is bolstering its digital textile printing prowess at Innovation Center Building B, prioritizing high productivity and eco-friendliness with its SureColor F-Series printers. Kornit Digital focuses on on-demand, sustainable printing solutions, boasting high-performance printers for direct-to-garment and direct-to-fabric applications. Fujifilm harnesses its imaging expertise to deliver top-notch digital textile printers, whereas DyeCoo Textile Systems champions waterless dyeing technology, aiming to mitigate environmental repercussions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Insights on Supply Chain/Value Chain Analysis

- 4.4 Insights into Governement Regualtions in the Industry

- 4.5 Insights into Technological Advancements in the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Customization

- 5.1.2 Growth in E-commerce

- 5.2 Market Restraints

- 5.2.1 High Initial Investment

- 5.2.2 Environmental Concerns

- 5.3 Market Opportunities

- 5.3.1 Sustainable Printing Solutions

- 5.3.2 Integration of Smart Textiles

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Printing Technology

- 6.1.1 Screen Printing

- 6.1.2 Digital Printing

- 6.1.3 Heat Transfer Printing

- 6.1.4 Others (Block, Stencil etc)

- 6.2 By Application

- 6.2.1 Apparel/ Clothing

- 6.2.2 Technical/ Industrial Textile

- 6.2.3 Home Textile & Others

- 6.3 By Region

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 South America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Epson

- 7.2.2 Kornit Digital

- 7.2.3 Fujifilm

- 7.2.4 DyeCoo Textile Systems

- 7.2.5 HP Inc.

- 7.2.6 Roland DG

- 7.2.7 MS Printing Solutions

- 7.2.8 Mimaki

- 7.2.9 Spoonflower

- 7.2.10 Juki Corporation*

- 7.3 Other Companies