|

市场调查报告书

商品编码

1636584

欧洲资料中心电源:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe Data Center Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

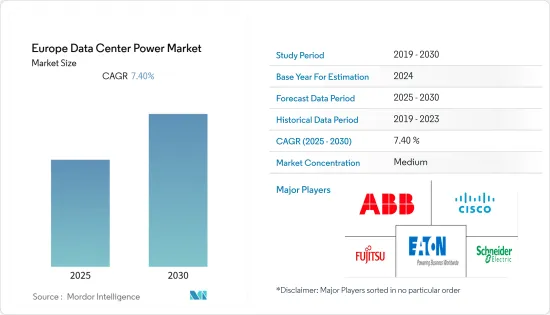

预测期内,欧洲资料中心电力市场预计复合年增长率为 7.40%

主要亮点

- COVID-19 的蔓延对各地区资料中心的营运产生了负面影响。英国、德国、荷兰、法国和爱尔兰等一些国家受到的打击最为严重,因为许多国家的政府在上半年暂停了建筑工程。例如,法国政府已停止所有非必要的建筑计划,以避免病毒传播。

- 疫情过后,随着高效能电力基础设施支出的增加以及老旧过时的资料中心向现代化设施的转型,该地区实现了强劲增长。据欧盟称,到2030年,欧洲资料中心预计将占欧盟电力需求的3.2%,较2018年增长18.5%。未来几年,由于伺服器数量的增加,市场预计将产生30倍的资料,导致能源消耗增加。

- 许多欧洲政策制定者认为资料中心是能源消耗成长最快的领域之一。欧洲政策制定者制定了《欧盟行为准则》,以告知和激励资料中心营运商在不影响资料中心关键功能的情况下以经济有效的方式降低能源消耗。预计这些因素将进一步推动市场成长。

- 此外,可再生能源采购的增加预计将推动欧洲资料中心电力市场的发展。为了确保资料中心对欧洲的永续发展仍然至关重要,资料中心市场供应商和产业协会已同意在 2030 年将资料中心实现气候中立。包括Interxion(Digital Realty)、OVHcloud、Equinix、Scaleway Datacenter、Aruba等产业协会在内的欧洲云端运算和资料中心营运商已签署《气候中和资料中心协定》。

- 然而,欧洲国家能源价格上涨和能源供应中断给资料中心营运商带来了挑战。自疫情爆发以来,资料中心营运商的资料处理、流量和储存需求同时激增。在资料中心电力需求激增的同时,电力供应却日益稀缺。这些因素可能会限制该地区资料中心电力市场的成长。

欧洲资料中心电力市场趋势

超级资料中心和云端运算的日益普及预计将推动市场

- 欧洲国家正日益采用云端处理服务,导致IT基础设施元件的增加。许多科技公司正在推出云端服务,协助许多企业的数位转型,推动预测期内欧洲资料中心电力市场的需求。

- 此外,云端处理服务的需求和采用的快速成长也间接促进了市场的成长。例如,根据欧盟统计局的资料,欧盟企业对云端处理服务的使用率从 2020 年的 36% 增加到 2021 年的 41%。

- 此外,云端服务的快速普及和连网型设备的日益普及,正推动资料中心市场随着整合和新参与者的出现而创下新高。预计这些案例将对市场成长产生正面影响。例如,营运商中立主机託管提供商Telehouse Europe去年三月在伦敦开设了第五个主机託管资料中心。新的Telehouse South位于码头区,将提供2MW的电力和可容纳多达668个机架的IT设备的空间。

- 此外,多个资料中心基础设施位于欧洲最重要的网路交换点附近:法兰克福、伦敦、阿姆斯特丹、巴黎、苏黎世、斯德哥尔摩和马德里。此外,欧洲其他地区的资料中心投资也呈现强劲成长,包括靠近无碳能源的地区和适合营运资料中心的气候条件的地区。

- 此外,北欧国家拥有丰富的可再生能源资源、低廉的电价、良好的气候条件和优良的基础设施,多年来吸引了大量外国投资。例如,Lefdal Mine 资料中心是挪威西海岸独特的山区设施,采用水冷,每机架 10KW,PUE 低于 1.15,非常适合满足当前和未来的需求。

预计德国将占据较大市场占有率

- 由于拥有大量资料中心、云端服务供应商和网路结构,预计预测期内德国将显着推动资料中心电力市场的发展。此外,由于资料中心电力消耗的增加导致营运成本的增加,国内资料中心正致力于实施高效的资料中心电源解决方案。

- 德国常被认为是欧洲资料中心消费量最高的国家。它还拥有欧洲最大的资料中心市场,约占整个欧洲市场的25%。因此,能源安全和可用性也是欧洲资料中心面临的问题。

- 例如,根据Cloudscene的资料,截至去年,德国共有495个资料中心,其中大部分主机託管设施位于法兰克福及其周边地区。此外,法兰克福拥有 129 个资料中心,其次是汉堡(52 个)和慕尼黑(51 个)。预计在预测期内,大量的资料中心将推动该国对高效资料中心电源解决方案的需求。

- 此外,该地区的製造业和汽车产业也正在成为人工智慧、物联网和其他先进技术的关键整合者。此外,其他各终端用户产业也正在采用云端处理解决方案。云端处理和先进的资料管理和监控技术的采用预计将大幅增加对安装资料中心电源的需求。

欧洲资料中心电力产业概况

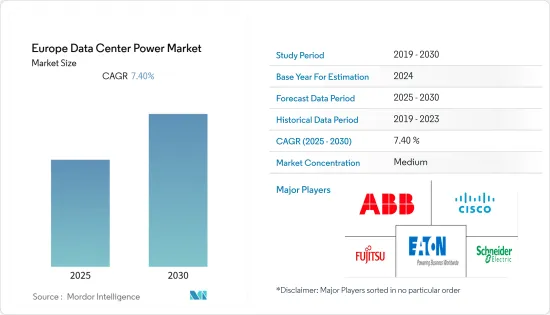

由于初始投资高、资源可用性低,欧洲资料中心电力市场集中度中等。该市场由几家大公司主导,包括Schneider Electric、富士通有限公司、思科技术公司、伊顿公司和 ABB 有限公司。这些占据了绝对市场份额的大公司正致力于扩大海外基本客群。这些公司正在利用策略合作措施来扩大市场占有率并提高盈利。然而,随着技术进步和产品创新,中小企业透过赢得新契约和探索新市场来扩大其市场占有率。

2022年11月,法国工业设备公司罗格朗宣布收购英国不断电系统(UPS)供应商Power Control。 Power Control 为资料中心等多个产业提供 UPS 产品、工业电力系统、发电机和电池。此次收购将使罗格朗和 Power Control 能够帮助客户确保他们拥有合适的 UPS 和其他核心电源解决方案,以应对未来几个月可能出现的供应波动。

微软 2022 年 6 月宣布,已与爱尔兰伊顿公司签署协议,将其资料中心备用电源系统作为电网的一部分,并支援可再生能源的整合。微软表示将在主要市场使用其智慧UPS系统并参与电网稳定倡议。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 超级资料中心和云端运算的日益普及

- 降低营运成本的需求日益增加

- 市场限制

- 安装和维护成本高

第六章 技术简介

第七章 市场区隔

- 按类型

- 解决方案

- 电源分配单元

- UPS

- 公车专用道

- 其他解决方案

- 按服务

- 咨询

- 系统整合

- 专业服务

- 解决方案

- 按最终用户应用

- IT

- 製造业

- BFSI

- 政府

- 电信

- 其他最终用户

- 按国家

- 英国

- 德国

- 义大利

- 其他欧洲国家

第八章 竞争格局

- 公司简介

- Schneider Electric SE

- Fujitsu Ltd

- Cisco Technology Inc.

- ABB Ltd

- Eaton Corporation

- Tripp Lite

- Rittal GmbH & Co. KG

- Schleifenbauer

- Vertiv Co.

- Legrand SA

- Black Box Corporation

第九章投资分析

第十章:市场的未来

The Europe Data Center Power Market is expected to register a CAGR of 7.40% during the forecast period.

Key Highlights

- The spread of COVID-19 negatively affected significant regional data center operations. Some countries, such as the UK, Germany, the Netherlands, France, and Ireland, were impacted most, as many governments halted their construction work in the year's first half. For instance, the government of France stopped all non-essential construction projects to avoid spreading the virus.

- Post-pandemic, the region has been witnessing strong growth with an increase in efficient power infrastructure spending, shifting old, outdated data centers to modern facilities. According to the EU, by 2030, data centers in Europe are expected to account for 3.2% of electricity demand within the EU, an 18.5% jump from 2018. In coming years, the market is expected to generate 30 times more data with an increased number of servers, leading to higher energy consumption.

- Many European policymakers have identified data centers as one of the fastest-rising sectors regarding energy consumption. European policymakers have formulated an EU code of conduct to inform and encourage data center operators to reduce energy consumption cost-effectively without impacting the critical functionality of data centers. Such factors are further expected to drive market growth.

- Further, increasing renewable energy procurement is analyzed to drive Europe's data center power market. To ensure data centers are an essential part of the sustainable future of Europe, data center market vendors and trade associations have agreed to make data centers climate-neutral by 2030. European cloud and data center operators, including Interxion (Digital Realty), OVHcloud, Equinix, Scaleway Datacenter, Aruba, and other industry associations, have signed the Climate Neutral Data Center Pact.

- However, the current spike in energy prices and disruptions to the energy supply in European countries is raising challenges for data center operators, which are simultaneously experiencing a drastic increase in demand for data processing, traffic, and storage since the pandemic. While data center power demand is rapidly increasing, power availability is increasingly lacking. Such factors can limit the growth of the data center power market in the region.

Europe Data Center Power Market Trends

Rising Adoption of Mega Data Centers and Cloud Computing is Expected to Drive the Market

- The growing adoption of cloud computing services in European countries has led to increased IT infrastructure components. Many technology companies are launching their cloud services and helping many businesses in their digital transformation journey, thus driving the demand for the Europe data center power market over the forecast period.

- Further, the demand and adoption of cloud computing services are growing at a rapid pace, thus, indirectly benefitting the market's growth. For instance, according to the data from Eurostat, the use of cloud computing services in EU businesses increased from 36% in 2020 to 41% in 2021.

- Moreover, the rapid adoption of cloud services and rising penetration of connected devices are driving the data center market to new records, including consolidations and the emergence of new players. Such instances will positively impact the market's growth. For instance, in March last year, Carrier-neutral colocation provider Telehouse Europe opened its fifth colocation data center in London. Located in the Docklands, the new Telehouse South delivers 2 MW of power and space for up to 668 racks of IT equipment.

- Further, several data center infrastructure is located close to the most significant European internet exchange points, i.e., Frankfurt, London, Amsterdam, Paris, Zurich, Stockholm, and Madrid. Moreover, there has also been considerable data center investment growth in other regions of Europe, e.g., close to carbon-free energy resources or in areas with perfect climate conditions to run data centers.

- Moreover, due to the vast resources of renewable energy, low power prices, favorable climate conditions, and good infrastructure, Nordic countries have added to a surge of foreign investments in the region over the years. For instance, Lefdal Mine Datacenter is a unique mountain hall facility on the west coast of Norway with a water-based cooling system, allowing 10 KW/rack with a PUE of less than 1.15, which is an ideal facility to meet the current and future demands.

Germany is Expected to Hold Significant Market Share

- Germany is expected to drive the data center power market significantly over the forecast period, owing to the availability of many data centers, cloud service providers, and network fabrics. Further, rising power consumption by data centers has increased operational costs; thus, data centers in the country are focusing on implementing highly efficient data center power solutions.

- Germany is often cited as the European country with the highest data center energy consumption. It also has the most significant data center market, holding approximately 25% of Europe's total capacity. As a result, energy security and availability are also becoming issues for European data centers.

- For instance, as per data from the Cloudscene, there are 495 German data centers as of last year, and most of these colocation facilities are located in and around Frankfurt. Further, there are 129 data centers in Frankfurt, followed by 52 in Hamburg and 51 in Munich. Such a high number of data centers is expected to create high demand for efficient data center power solutions in the country over the forecast period.

- In addition, the regional manufacturing and automotive sector are also emerging as a critical integrators of AI, IoT, and other advanced technologies. Further, various other end-user industries are also adopting cloud computing solutions. Implementing cloud computing and advanced data management and monitoring technologies will significantly drive the demand for the installation of data center power equipment.

Europe Data Center Power Industry Overview

The Europe data center power market is moderately concentrated due to higher initial investments and low availability of resources. It is dominated by a few major players like Schneider Electric SE, Fujitsu Ltd, Cisco Technology Inc., Eaton Corporation, and ABB Ltd. These major players, with a prominent share in the market, focus on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market share and increase their profitability. However, with technological advancements and product innovations, mid-size to smaller companies have increased their market presence by securing new contracts and tapping new markets.

In November 2022, French industrial firm Legrand announced the acquisition of the UK's uninterrupted power supply (UPS) provider, Power Control. Power Control provides UPS products and industrial power systems, generators, and batteries to several industries, including data centers. The acquisition would allow Legrand and Power Control to help customers ensure they have proper UPS and other mission-critical power solutions to meet potential supply volatility over the coming months.

In June 2022, Microsoft announced signing a deal with Ireland-based Eaton that will make its data centers' backup power supplies systems part of the electricity grid, supporting the integration of renewable energy sources. Microsoft said it would use the smart UPS systems in key markets and participate in grid-stabilizing initiatives.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Adoption of Mega Data Centers and Cloud Computing

- 5.1.2 Increasing Demand to Reduce Operational Costs

- 5.2 Market Restraints

- 5.2.1 High Cost of Installation and Maintenance

6 TECHNOLOGY SNAPSHOT

7 MARKET SEGMENTATION

- 7.1 Type

- 7.1.1 Solutions

- 7.1.1.1 Power Distribution Unit

- 7.1.1.2 UPS

- 7.1.1.3 Busway

- 7.1.1.4 Other Solutions

- 7.1.2 Services

- 7.1.2.1 Consulting

- 7.1.2.2 System Integration

- 7.1.2.3 Professional Service

- 7.1.1 Solutions

- 7.2 End-user Application

- 7.2.1 Information Technology

- 7.2.2 Manufacturing

- 7.2.3 BFSI

- 7.2.4 Government

- 7.2.5 Telecom

- 7.2.6 Other End-user Applications

- 7.3 Country

- 7.3.1 United Kingdom

- 7.3.2 Germany

- 7.3.3 Italy

- 7.3.4 Rest of Europe

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Schneider Electric SE

- 8.1.2 Fujitsu Ltd

- 8.1.3 Cisco Technology Inc.

- 8.1.4 ABB Ltd

- 8.1.5 Eaton Corporation

- 8.1.6 Tripp Lite

- 8.1.7 Rittal GmbH & Co. KG

- 8.1.8 Schleifenbauer

- 8.1.9 Vertiv Co.

- 8.1.10 Legrand SA

- 8.1.11 Black Box Corporation