|

市场调查报告书

商品编码

1636614

中型散货箱:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Intermediate Bulk Container - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

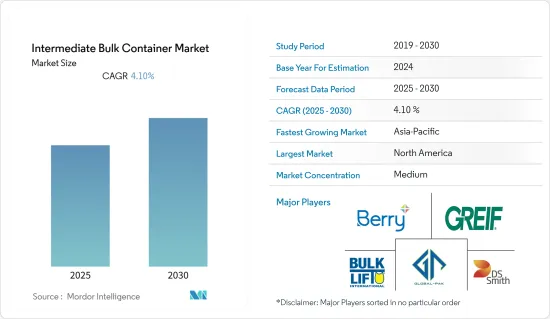

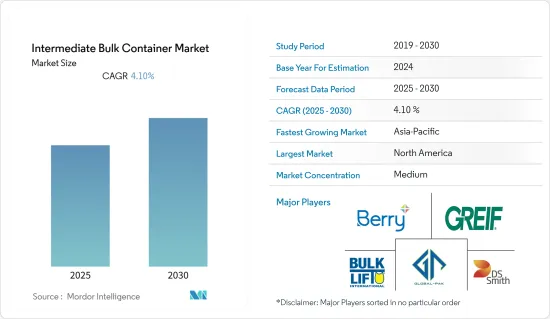

预计预测期内中型散货箱市场复合年增长率为 4.10%。

主要亮点

- 全球对轻型散装包装的需求不断增长,以及製造业和建设业的扩张(尤其是在新兴市场),是推动中型散货箱市场发展的因素之一。

- 化学、食品、製药和其他行业的工业产量不断增加,推动了全球 FIBC(柔性中型散货箱)的成长。此外,政府推出了越来越多的倡议,促进贸易和货物交换,这对市场产生了积极影响。

- 然而,再製造和重新装瓶的中型散货箱的日益普及对新製造的IBC的需求提出了挑战。

- 各行业,特别是化学工业的投资增加是推动IBC需求的主要因素。例如,根据美国化学工业的主要贸易协会美国工业理事会 (ACC) 的分析,美国化学工业在经历了由新冠疫情引发的异常深度但短暂的衰退后,正在艰难復苏。

中型散货箱市场趋势

化工产业成长可望推动IBC市场

- 化学工业的积极前景预计将为IBC包装提供重大支持。据估计,需求将受到最丰富的化学品市场中国推动。

- 此外,北美食品工业的快速发展直接影响了作物生产和生长中安全农药的使用增加。这推动了严重依赖中型散装容器的大型工业生产商对农业化学品包装的辅助需求。

- 硬质中型散货箱的使用日益增多,用于在陆地和水中长距离运输危险和贵重化学品而不会发生洩漏。这些 IBC 也易于加固,以防止气体洩漏。

- 在运输危险化学品方面,世界各地都实施严格的联合国 (UN) 法规。对于危险化学品,IBC 通常要承受巨大的压力。因此,在使用化学品时使用安全耐用的包装材料非常重要。这导致一次性IBC的需求增加。

亚太地区预计将经历最快成长

- 预计在预测期内,亚太地区将实现高于其他地区的最高成长率。因此,亚太地区中型散货箱市场预计将为供应商提供庞大的商机。

- 2019年,中国是全球最大的化学品出口国,出口额达740亿美元。根据福斯石油公司统计,2019年中国润滑油市场规模达约730万吨,成为全球最大的润滑油消费国。

- 日本也是世界第四大出口国和进口国,对外贸易占其GDP的36.8%。该国主要出口机动车辆(13.9%)、机动车辆零件及配件(4.6%)、电子积体电路及微型组件(3.9%)、船舶(1.9%)及石油(1.6%)。主要贸易伙伴为中国、美国、韩国、澳洲、香港、沙乌地阿拉伯、泰国等。工业成长和贸易繁荣正在推动对 IBC 的需求。

- 在新冠肺炎疫情期间,中国和印度政府实施了严格的封锁措施。这导致生产停顿了近三个月,并造成大量订单积压。然而,随着情况的改善,大多数亚太国家的经济正在復苏,产量正在增加。这为提供按需 IBC 的 IBC 参与者创造了市场机会。

中型散货箱产业概况

中型散货箱市场竞争激烈且分散,北美占据全球市场的大部分份额。此外,随着全球市场对中型散货箱的需求不断增加,市场参与者预计未来将出现丰厚的成长机会。

- 2020 年 11 月 - Schoeller Allibert 是一家生产可回收、可重复使用和可回收塑胶包装解决方案的欧洲企业,该公司核准推出一款经联合国批准的容器,用于安全运输危险和高腐蚀性化学品。这证实了该公司对化学品製造和分销市场的承诺。

- 2020 年 9 月 - Greif 推出 GCube Connect,这是一项用于复合中型散货容器 (IBC) 的即时追踪技术,旨在帮助客户提高性能、降低成本并改善碳足迹。 GCUBE Connect 借助物联网提高了整个供应链的可视性,使客户能够接收有关其产品的即时资料,从而增加销售额、降低运费成本并优化生产计画。 。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者和消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 市场驱动因素

- 扩大中型散货箱产品出口

- 扩大化工和製药业的生产

- 市场限制

- 增加回收和再装瓶中型散装容器的采用

- 人们对塑胶使用的环境问题的担忧日益加剧

- COVID-19影响评估

第五章 市场区隔

- 按类型

- 硬质IBC

- 软式IBC

- 按最终用户

- 化工

- 製药业

- 食品饮料业

- 其他行业(农业、交通运输、物流)

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 公司简介

- Greif Inc.

- Bulk Lift International LLC

- DS Smith Plc

- Global-Pak LLC

- FlexiTuff Ventures International Ltd.

- LC Packaging International BV

- Plymouth Industries LLC

- Mauser Packaging Solutions

- Schoeller Allibert

- Schutz Packaging Systems

- Berry Global Group Inc.

第七章投资分析

第八章:未来市场展望

简介目录

Product Code: 72143

The Intermediate Bulk Container Market is expected to register a CAGR of 4.10% during the forecast period.

Key Highlights

- The rise in the need for the reduction of the weight of bulk packaging across the globe and expansion of manufacturing and construction sectors, especially in the developing regions, are some of the factors driving the intermediate bulk container market.

- The increasing industrial output by Chemical Industry, Food Industry, Pharmaceutical Industry, Others, and other industries is driving the growth of the FIBC (Flexible Intermediate Bulk Container) in across the globe. Moreover, increasing government initiatives that promote easier trade and transaction of goods affects the market positively.

- However, the increasing popularity of reconditioned and rebottled intermediate bulk containers poses a challenge to the demand of newly manufactured IBCs.

- Growing investments in various industries, but predominantly the chemical industry, prove to be a major factor, which is increasing the demand for IBCs. For instance, according to an analysis by the American Chemistry Council (ACC), the US chemical industry's main trade association, the chemical industry in the US is experiencing a recovery post an unusually deep but short recession caused by the COVID-19 pandemic.

Intermediate Bulk Container Market Trends

The Growth Of Chemical Industry Is Expected to Boost IBC Market

- The positive outlook of the chemical sector is expected to provide significant support to the IBC packaging. The demand is estimated to be driven by China, which is the most abundant chemical market.

- Moreover, the aggressive growth of the food industry in North America has directly affected the increased use of safe agrochemicals for the production and growth of crops. This has driven the ancillary demand for agrochemical packaging by large industrial producers who are largely dependent on Intermediate Bulk Containers.

- The use of rigid IBCs is increasing to carry hazardous and precious chemicals across long stretches of land and water without leakage. These IBCs can also be easily reinforced, which prevents fumes from escaping.

- While transporting hazardous chemicals, strict regulations declared by the United Nations (UN) are effective globally. In the case of hazardous chemicals, IBCs are often put under a lot of pressure. That is why it is important to use safe and durable packaging when handling chemicals. This leads to an increase in demand for single-use IBC.

Asia Pacific Is Expected To Experience Fastest Growth

- Asia-Pacific is expected to register the highest growth rate among the other regions during the forecasted period. Therefore, the intermediate bulk container market in APAC is expected to garner significant business opportunities for the vendors.

- China was the world's leading chemical exporting country in 2019, with exports amounting to a value of USD 74 billion in 2019. According to Fuchs Petrolub, China's lubricants market amounted to some 7.3 million tons, making it the world's largest lubricant-demanding country in 2019.

- Moreover, Japan is the world's 4th largest importer & exporter of goods, and foreign trade accounts for 36.8% of the country's GDP. The country mainly exports motor vehicles (13.9%), auto parts and accessories (4.6%), electronic integrated circuits and microassemblies (3.9%), ships and boats (1.9%), and petroleum oils (1.6%). The country's main partners are China, the US, South Korea, Australia, Hong Kong, Saudi Arabia, and Thailand. The growth of such industries and booming trade have driven the demand for IBC's.

- The governments of China and India imposed strict lockdowns during the height of the COVID-19 outbreak. This eliminated production for nearly 3 months and created a significant backlog of orders. However, with conditions improving, the economy is under-recovery, and production has increased in most APAC countries. This has provided a market opportunity for the IBC players to provide on-demand IBCs.

Intermediate Bulk Container Industry Overview

The market for intermediate bulk containers is competitive and fragmented with North America occupying a major share in the global market. Moreover, the market players are anticipating lucrative growth opportunities in the future with the rising demand for the intermediate bulk container in the global market.

- November 2020- Schoeller Allibert, a European player in the production of recyclable, reusable and returnable plastic packaging solutions, launch of ChemiFlow, a UN approved Intermediate Bulk Container (IBC) designed to safely transport hazardous and highly corrosive chemicals. This has affirmed the company's commitment to the chemical manufacturing and distribution market.

- September 2020- Greif launched real time tracking technology, GCube Connect, for composite Intermediate Bulk Containers (IBCs) in its drive to help customers increase performance, reduce costs and improve their carbon footprint. GCUBE Connect helps improve visibility across the entire supply chain with the help of Internet of Things and allows customers to receive live data about their product allowing them to increase sales, reduce freight costs, optimize production planning and automate procurement and sales processes

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/ Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Growing Export of Intermediate Bulk Container Packed Products

- 4.4.2 Growing Production of Chemical and Pharmaceutical Industries

- 4.5 Market Restraints

- 4.5.1 Increasing Adoption Of Reconditioned And Rebottled Intermediate Bulk Containers

- 4.5.2 Growing Environmental Concerns over the Use of Plastic

- 4.6 Assessment on the impact of COVID-19

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Rigid IBC

- 5.1.2 Flexible IBC

- 5.2 By End User

- 5.2.1 Chemical Industry

- 5.2.2 Pharmaceutical Industry

- 5.2.3 Food and Beverage Industry

- 5.2.4 Other Industries (Agriculture, Transport and logistics)

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia

- 5.3.4 Australia and New Zealand

- 5.3.5 Latin America

- 5.3.6 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Greif Inc.

- 6.1.2 Bulk Lift International LLC

- 6.1.3 DS Smith Plc

- 6.1.4 Global-Pak LLC

- 6.1.5 FlexiTuff Ventures International Ltd.

- 6.1.6 LC Packaging International BV

- 6.1.7 Plymouth Industries LLC

- 6.1.8 Mauser Packaging Solutions

- 6.1.9 Schoeller Allibert

- 6.1.10 Schutz Packaging Systems

- 6.1.11 Berry Global Group Inc.

7 INVESTMENT ANALYSIS

8 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219