|

市场调查报告书

商品编码

1637723

亚太地区 WiGig -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Asia Pacific WiGig - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

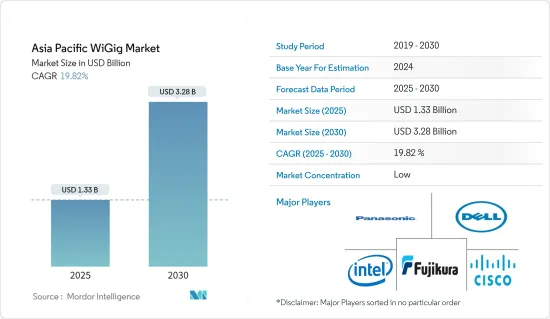

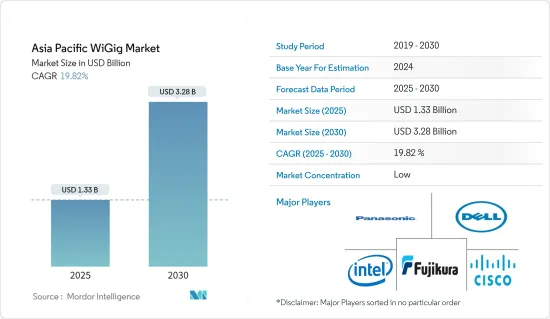

亚太地区 WiGig 市场规模预计 2025 年为 13.3 亿美元,预计到 2030 年将达到 32.8 亿美元,预测期内(2025-2030 年)复合年增长率为 19.82%。

主要亮点

- 近年来,高速网路和5G网路越来越受到关注。中国、日本、台湾、印度和澳洲等新兴经济体是该地区的主要驱动力。中国拥有完善的5G生态系统,预计在预测期内将进一步成长。然而,5G技术有望成为与目前行动宽频共存的热点技术。预计该国将出现温和成长。

- 随着物联网 (IoT) 和机器类型通讯(MTC) 的出现,预计无线流量在不久的将来将呈指数级增长。这意味着假设频率效率相同,当前频宽会增加。例如,5.4GHz 工业、科学和医疗 (ISM) RF频宽约为 500MHz,主要用于无线保真 WiFi。此频宽已经达到饱和,这是 WiGig 背后的驱动力之一。

- WiGig 预计将成为无需实体有线连线即可快速轻鬆地进行资料分发的领先选择之一。 WiGig不穿墙,通讯很短,因此对于近距离通讯有效,无意取代或直接取代WiFi或蜂窝网路。许多家用电子电器可能支援多模式 WiFi 和 WiGig。

- 由于 WiGig 的高速连接、卓越的可靠性和减少的延迟等功能,医疗保健系统受益于改进的回应时间、患者监控、资料收集和分析、远端协作、资源分配等。它还为该地区领先的数位化、资料驱动和云端基础的创新公共紧急应变平台树立了典范。

- 印度电讯监管局 (TRAI) 指出,可用于 WiFi 的免执照频段非常拥挤。根据 DigiAnalysis 的分析,截至 2022 年,印度约有 50 万个可用的公共热点,预计到 2030 年将达到约 5,000 万个。同时,全球有超过 4500 万个可用热点。因此,该委员会表示需要将这项基础设施扩展至每 150 人至少一个热点,从而产生额外 800 万个热点的需求。

亚太地区 WiGig 市场趋势

显示设备推动市场成长

- 无线Gigabit(WiGig) 技术的运作频率为 60GHz。这使得每秒可无线传输5 Gigabit的音讯和视讯资料,是目前最大无线传输速度的 10 倍,成本仅为十分之一,通常在 10 公尺的范围内。由于其易于操作和高速,WiGig 技术市场越来越受欢迎,尤其是在游戏领域。根据 StatCounter 统计,截至 2024 年 1 月,行动装置(不包括平板电脑)在全球网页浏览量中占据主导地位,占据近 60% 的市场占有率。

- WiGig技术也用于体育场馆的广播视讯讯号传输和毫米波视讯讯号传输。该技术还可用于即时传输全高清视讯。该技术可用于以无线方式虚拟连接笔记型电脑和其他具有扩充座所需的所有扩充功能的计算机,包括二次性显示器和储存计算机。

- 此外,家用电子电器领域正在推动 WiGig 市场的发展。行动电话、平板电脑或电脑可以将内容无线传输到同一房间内的高画质电视或显示器。例如,华硕的 ROG Phone 使用带有显示底座的 WiGig 将任何行动电话无线连接到大萤幕电视。 TwinView 底座配备 6.59 吋、120Hz 触控萤幕、第二个 5,000mAh 大电池和内建风扇。

- 在预测期内,市场的显示设备部分将享受充足的成长机会,特别是随着虚拟实境(VR)/扩增实境(AR)技术的出现。韩国政府宣布,未来三年将投资约190亿韩元开发扩增实境平台。作为促进 AR/VR 平台开发和吸引观众观看 AR/VR 内容的努力的一部分,文化部计划利用云端运算创建一个大型虚拟文化场馆,以提供广泛的内容服务。

韩国占有较大市场占有率

- 据科学资讯通讯部称,SK Telecom、KT 和 LG Uplus 等电信业者已领先世界其他地区在韩国推出 5G。截至 2023 年 4 月,SK Telecom 拥有最多的 5G 用户数量,为 1,435 万,其次是 KT,为 900 万,LG Uplus 为 643 万。

- 此外,根据IEEE通讯协会的数据,截至2023年3月,韩国5G用户数将超过2,960万,且迄今每月用户数已增加至约50万。

- 韩国科学部、ICP 和未来规划 (MSIP) 表示,韩国半导体公司可以透过快速进入 60GHz WiGig 市场来获得资料通讯市场的竞争优势。

- 虚拟实境市场是WiGig晶片组的重要应用。由于政府对市场的投资增加以及该国最终用户产业越来越多地采用 AR/VR 技术,该国也已成为 AR/VR 技术的新兴市场之一。

- 国内硬体公司也不断推出支援WiGig晶片组的产品。例如,三星发布了通讯,通讯以 60GHz 频率运行的最新 802.11ad Wi-Fi 标准中所示。

亚太 WiGig 产业概览

亚太地区 WiGig 市场呈现出显着的细分趋势,各产业参与企业都在积极争取技术进步,以克服可能阻碍当前成长轨迹的市场挑战。这些主要企业积极参与策略性倡议,例如建立伙伴关係、进行合併和收购。市场开发的显着进展包括:

2022 年 6 月,中国着名网路设备製造商 H3C 发布了首款 Wi-Fi 7 路由器。 H3C Magic BE18,000 路由器拥有令人印象深刻的 18.443Gbps 峰值吞吐量,与 Wi-Fi 6 和 6E 硬体相比,吞吐量显着增强。这项创新凸显了业界为突破无线技术界限而不断做出的努力。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 通讯产业不断进步的技术

- 高画质影片的采用增加

- 市场限制因素

- WiGig 产品的工作范围短

第 6 章 技术概览

第七章 市场区隔

- 副产品

- 显示装置

- 网路基础设施设备

- 按用途

- 游戏和多媒体

- 联网

- 其他的

- 按地区

- 中国

- 日本

- 印度

- 韩国

第八章 竞争格局

- 公司简介

- Panasonic Corporation

- Dell Technologies Inc.

- Cisco Systems Inc.

- Intel Corporation

- Fujikura Ltd

- Lenovo Group Limited

- Broadcom Inc.

- Qualcomm Technologies Inc.

- NEC Corporation

- Marvell Semiconductor, Inc.

第九章投资分析

第10章市场的未来

The Asia Pacific WiGig Market size is estimated at USD 1.33 billion in 2025, and is expected to reach USD 3.28 billion by 2030, at a CAGR of 19.82% during the forecast period (2025-2030).

Key Highlights

- In recent years, there has been an increased emphasis on high-speed internet and 5G networks. Emerging countries, including China, Japan, Taiwan, India, and Australia, are the major driving countries in the region. China has an established ecosystem for 5G and is expected to grow further in the forecast period. However, the 5G technology is expected to serve as a hotspot technology in existence with the current mobile broadband. The growth is expected to be gradual in the country.

- Due to the advent of the Internet of Things (IoT) and machine-type communication (MTC), exponential wireless traffic growth is expected in the near future. This would mean an increase in current bandwidth, assuming the same spectrum efficiency. For instance, the industrial, scientific, and medical (ISM) RF band in the 5.4 GHz region is approximately 500 MHz, mainly used by wireless fidelity WiFi. This bandwidth is already getting saturated, which is one of the driving forces of WiGig.

- WiGig is expected to be one of the main options for quick and easy data delivery without a physical wired connection. As it does not pass through walls and has a very short range, it is more useful for transfers within a short range and won't replace or directly supersede WiFi or cellular. Many consumer electronic devices will be multi-mode WiFi and WiGig capable.

- As a result of WiGig features, such as elevated speed connection, extraordinary reliability, and decreased latency, the healthcare system has benefited from improved response times, patient monitoring, data collection and analytics, remote collaboration, and resource allocation. It also sets an example for digitalized, data-driven, and Cloud-based innovative major public emergency response platforms in the region.

- The Telecom Regulatory Authority of India (TRAI) has mentioned that the delicensed bands available for WiFi are congested. According to the analysis of DigiAnalysis, in India, there are around 0.5 million public hotspots available as of 2022, which is expected to reach around 50 million by 2030. In contrast, there are over 45 million hotspots available worldwide. Hence, the board has shown a need to expand this infrastructure to at least one hotspot for 150 persons, creating a demand for another 8 million hotspots.

Asia Pacific WiGig Market Trends

Display Devices to Drive the Market Growth

- Wireless Gigabit (WiGig) technology operates at 60GHz. It allows wireless transfer of audio and video data up to 5 gigabits per second, ten times the current maximum wireless transfer rate, at one-tenth of the cost, usually within a range of 10 meters. Due to the ease of operation and high speed, the WiGig technology market is gaining traction, especially in the gaming sector. According to StatCounter, as of January 2024, mobile devices, excluding tablets, dominated global web page views, capturing close to 60% of the market share.

- WiGig technology is also being used in broadcasting video signal transmission systems in sports stadiums and mm-wave video video signal transmission systems. The technology could also be used for beaming full HD video in real time. It could be used by notebooks and other computers to wirelessly connect virtually, all the expansion needed for a docking station, including a secondary display and storage computer.

- Further, the consumer electronics sector is boosting the WiGig market. A phone, tablet, or computer could wirelessly stream content to a high-resolution TV or another monitor in the same room. For instance, Asus's ROG Phone can use WiGig along with its display dock to wirelessly connect any phone to a big-screen TV. The TwinView dock has its 6.59-inch, 120Hz touchscreen, a second massive 5,000mAh battery, and a built-in fan.

- The display devices segment of the market is presented with ample growth opportunities, especially with the advent of virtual reality (VR)/augmented reality (AR) technologies, in the forecast period. The South Korean government has announced to invest nearly KRW 19 billion in developing augmented reality platforms over the next three years. As part of efforts to boost AR/VR platform development and engage viewers in AR/VR content, the culture ministry will create a large-scale virtual cultural venue using cloud computing and provide a wide range of content services.

South Korea to Hold Significant Market Share

- The telecommunication companies, like SK Telecom, KT, and LG Uplus, were the first to launch 5G in the world in South Korea, according to the ministry of Science and ICT. SK Telecom, had the most 5G users at 14.35 million as of April 2023, followed by KT at 9 million and LG Uplus at 6.43 million.

- Moreover, according to the IEEE Communications Society, South Korean 5G users account for over the 29.6 million users as of this March 2023 and given that number of subscribers has increased to around 500,000 per month up to now, Such high penetration and quick adoption of technology indicate the demand for high-speed data transfer, which may drive WiGig chips' demand in the country.

- Ministry of Science, ICP, and Future Planning (MSIP) in South Korea has stated that the country's semiconductor companies have made an early move by entering the 60GHz WiGig market, enabling them to gain a competitive edge in the data communication market.

- The Virtual Reality market has a significant application of WiGig chipsets. The country is also emerging as one of the emerging markets for AR/VR technologies, owing to growing government investment in the market coupled with the growing adoption of AR/VR technologies among the country's end-user industries.

- The hardware companies in the country are also making continuous product launches that support WiGig chipsets. For instance, Samsung introduced its 5G New Radio (NR) Access Unit (AU), which can be used for high-speed wireless communications with high-speed wireless communications, as seen with the latest 802.11ad Wi-Fi standard operating at 60 GHz frequency.

Asia Pacific WiGig Industry Overview

The Asia Pacific WiGig market exhibits a notable degree of fragmentation, with various industry players vigorously striving to advance the technology in order to overcome market challenges that could impede its current growth trajectory. These key players are actively engaging in strategic initiatives such as forging partnerships, executing mergers, and pursuing acquisitions. Some noteworthy developments within the market include:

In June 2022, H3C, a prominent Chinese network equipment manufacturer, introduced what it purports to be the inaugural Wi-Fi 7 router. The H3C Magic BE18000 router boasts a remarkable peak throughput capacity of 18.443 Gbps, offering a tantalizing glimpse of significantly enhanced throughput compared to Wi-Fi 6 or 6E hardware. This innovation underscores the ongoing efforts within the industry to push the boundaries of wireless technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Technological Advancement in Communication Industry

- 5.1.2 Rising Adoption of High-resolution Videos

- 5.2 Market Restraints

- 5.2.1 Shorter Operating Range of WiGig Products

6 TECHNOLOGY SNAPSHOT

7 MARKET SEGMENTATION

- 7.1 By Product

- 7.1.1 Display Devices

- 7.1.2 Network Infrastructure Devices

- 7.2 By Application

- 7.2.1 Gaming and Multimedia

- 7.2.2 Networking

- 7.2.3 Other Applications

- 7.3 By Geography

- 7.3.1 China

- 7.3.2 Japan

- 7.3.3 India

- 7.3.4 South Korea

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Panasonic Corporation

- 8.1.2 Dell Technologies Inc.

- 8.1.3 Cisco Systems Inc.

- 8.1.4 Intel Corporation

- 8.1.5 Fujikura Ltd

- 8.1.6 Lenovo Group Limited

- 8.1.7 Broadcom Inc.

- 8.1.8 Qualcomm Technologies Inc.

- 8.1.9 NEC Corporation

- 8.1.10 Marvell Semiconductor, Inc.