|

市场调查报告书

商品编码

1637744

精密陶瓷:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Advanced Ceramics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

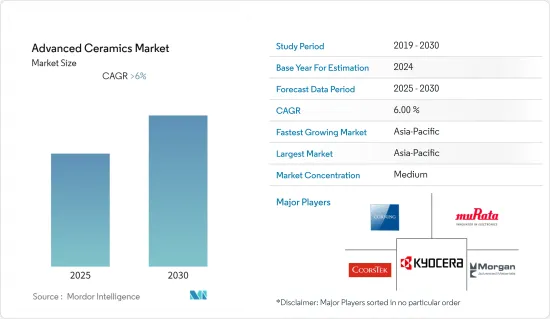

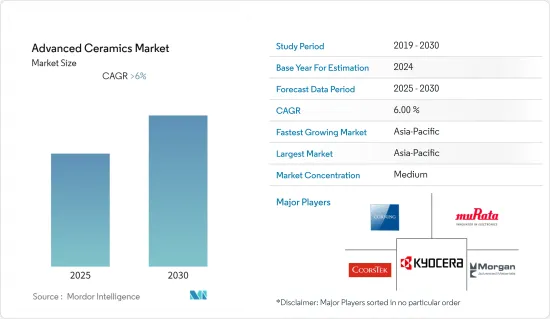

预计预测期内精密陶瓷市场复合年增长率将超过 6%。

主要亮点

- COVID-19 疫情对市场的影响明显是负面的,不过,市场目前已恢復至疫情前的水平,预计在预测期内将实现稳步增长。

- 中期推动市场发展的关键因素是这些材料作为金属和塑胶的替代品的使用越来越多,以及医疗产业的需求不断增长。

- 另一方面,设备和化学製程的高资本支出以及气候变迁、能源和环境法规和政策的不确定性正在削弱市场。

- 然而,碳化硅(SiC)、氮化镓(GaN)的应用不断扩大以及奈米技术领域的成长机会可能很快为全球市场提供有利的成长机会。

- 电子电气产业占据市场主导地位,由于精密陶瓷具有广泛的电学特性,例如绝缘、半导体、超导性、压电和磁性,预计在预测期内该行业将实现成长。

- 亚太地区占据全球市场主导地位,其中中国和日本等国家占最大的消费量。

精密陶瓷市场趋势

电子电气产业可望主导市场

- 预计未来几年碳化硅将成为电气和电子产业最大的应用之一。它们具有广泛的应用,包括电动车、高功率和高压功率设备、半导体、太阳能逆变器和 LED 照明。

- 氮化铝具有高导热性和优异的电绝缘性,使其可用于半导体、消费性和家用产品的散热应用。同样,氮化硅和氮化硼也用于各种电气和电子应用。

- 亚太地区是世界上一些最大的电子产品製造商的所在地。它占全球电子产品产量的70%以上,其中韩国、越南、印度和中国等国家占据主导地位。

- 在欧洲,德国的电子产业是该地区最大的。电气电子工业占德国工业总产值的11%。根据德国电气电子工业协会 (ZVEI) 的数据,全球电子市场规模预计将在 2021 年增至 4.6 兆欧元(约 4.82 兆美元)。

日本可望主导亚太市场

- 日本的电气电子产业是世界领先的产业之一。日本在电脑、游戏机、行动电话以及其他各种关键电脑零件的生产方面处于世界领先地位。

- 家电占日本经济产出的三分之一。日本专门製造电子元件和设备,包括被动元件、互连装置、电子基板和液晶设备。

- 随着数位化的进步拉动需求、扩大出口,日本电子设备和IT企业的全球产值预计将在2021与前一年同期比较增8%,达到37.3兆日圆(约2,720.2亿日圆)。

- 日本的航太工业为民航机和国防飞机製造飞机零件。近年来,由于货运需求的增加,民航机的产量增加。

- 日本在波音767、777、777X、787等飞机以及V2500、Trent1000、GEnx、GE9X、PW1100G-JM等引擎的研发中也扮演主导角色。

- 根据厚生劳动省统计,日本生产了所有外科医疗设备的25%以上,包括无菌血管管和导管、手术器械和无菌输血器。

- 日本人口快速老化导致患有慢性病和文明病疾病的患者数量增加,全民健康保险制度和监管措施正在推动该国医疗设备市场的发展。

精密陶瓷产业概况

精密陶瓷市场本质上是部分分散的,前五大公司占据所研究市场的大部分份额。主要市场参与者(不分先后顺序)包括京瓷、康宁、村田製造、CoorsTek 和摩根先进材料。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 越来越多地用作金属和塑胶的替代品

- 医疗产业需求不断成长

- 环保且可靠

- 限制因素

- 受新冠肺炎疫情影响而产生的不利情况

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 专利分析

- 定价分析

第 5 章 市场区隔(以金额为准的市场规模)

- 依材料类型

- 氧化铝

- 钛酸盐

- 锆石

- 碳化硅

- 氮化铝

- 氮化硅

- 硅酸镁

- 热解

- 其他材料类型

- 依班级类型

- 单片陶瓷

- 陶瓷基质复合材料

- 陶瓷涂层

- 按最终用户产业

- 电气和电子

- 运输

- 医疗

- 工业

- 国防和安全

- 化学

- 其他最终用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业策略

- 公司简介

- 3M(Ceradyne Inc.)

- AGC Inc.

- Applied Ceramics Inc.

- Blasch Precision Ceramics Inc.

- Ceramtec

- COI Ceramics Inc.

- Coorstek Inc.

- Corning Incorporated

- International Ceramics Inc.

- Kyocera Corporation

- MARUWA Co. Ltd

- Materion Corporation

- McDanel Advanced Ceramic Technologies

- Morgan Advanced Materials

- Murata Manufacturing Co. Ltd

- Rauschert GmbH

- Saint-Gobain

- Small Precision Tools Inc.

- Vesuvius

- Wonik QnC Corporation

第七章 市场机会与未来趋势

- 碳化硅 (SiC) 和氮化镓 (GaN) 的应用不断扩大

- 扩大奈米技术的应用

简介目录

Product Code: 46629

The Advanced Ceramics Market is expected to register a CAGR of greater than 6% during the forecast period.

Key Highlights

- The impact of the Covid-19 pandemic on the market was largely negative, but the market has now reached pre-pandemic levels and is expected to grow steadily during the forecast period.

- Over the medium term, the major factors driving the market are the rise in use as an alternative to metals and plastics and the growing demand in the medical industry.

- On the flip slide, high capital investment for the equipment and chemical processes and uncertainty in regulative policies concerning climate change, energy & environment undermine the market.

- However, increasing applications of silicon carbide (SiC), gallium nitride (GaN), and growth in usage in nanotechnology would likely create lucrative growth opportunities for the global market soon.

- The electronics and electrical industry dominated the market, and it is expected to grow during the forecast period, owing to a wide range of electrical properties of advanced ceramics, including insulating, semiconducting, superconducting, piezoelectric, and magnetic properties.

- Asia-Pacific dominated the market globally, with the largest consumption from countries such as China and Japan.

Advanced Ceramics Market Trends

The Electronics and Electrical Industry is Expected to Dominate the Market

- Silicon carbide is estimated to have one of the largest applications in the electrical and electronics industry in the coming years. It has various applications in electric vehicles, high-power and high-voltage power devices, semiconductors, solar inverters, and LED lights.

- Aluminum nitride is used in heat removal applications because of its high thermal conductivity and excellent electrical insulation properties, making it useful in semiconductors and consumer and household products. Similarly, silicon nitride and boron nitride are used in various electrical and electronic applications.

- Asia-Pacific is one of the leading manufacturers of electronics in the world. It accounts for more than 70% of global electronics production, with countries like South Korea, Vietnam, India, and China leading.

- In Europe, the German electronics industry is the largest in the region. The electrical and electronics industry accounts for 11% of the total industrial production in Germany. According to the German Electrical and Electronic Manufacturers' Association (ZVEI), the global electronics market is estimated to have risen to EUR 4.6 trillion (~USD 4.82 trillion) in 2021.

Japan is Expected to Dominate the Asia-Pacific Market

- The Japanese electrical and electronics industry is one of the world's leading industries. Japan is a world leader in the production of computers, gaming stations, cell phones, and various other key computer components.

- Consumer electronics account for one-third of the Japanese economic output. The country specializes in manufacturing electronic components and devices, such as passive components, connecting components, electronic boards, and liquid crystal devices.

- With the advance of digitalization boosting demand and expanding exports, global production by Japanese electronics and IT companies is expected to grow 8% year on year in 2021 to JPY 37,300 (~ USD 272.02) billion.

- The Japanese aerospace industry manufactures aircraft components for commercial and defense aircraft. Commercial aircraft production has been increasing over the past couple of years due to the increasing cargo demands.

- The country also plays a central role in the development of aircraft such as Boeing 767, 777, 777X, and 787 and engines such as the V2500, Trent1000, GEnx, GE9X, and PW1100G-JM.

- According to the Ministry of Health, Labour, and Welfare of Japan, the country produces over 25% of the total medical devices for surgical procedures such as sterile tubes and catheters for blood vessels, surgical procedures, and sterile blood transfusion sets.

- The rapidly aging Japanese population increases the number of patients with chronic and lifestyle-related diseases, and universal health insurance coverage and regulatory measures are driving the Japanese medical devices market.

Advanced Ceramics Industry Overview

The advanced ceramics market is partially fragmented in nature, with the top five players accounting for a major share of the market studied. The major market players (in no particular order) include Kyocera Corporation, Corning Incorporated, Murata Manufacturing Co., CoorsTek, and Morgan Advanced Materials, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rise in Use as Alternative to Metals and Plastics

- 4.1.2 Growing Demand in the Medical Industry

- 4.1.3 Eco-friendliness and Reliability of Use

- 4.2 Restraints

- 4.2.1 Unfavorable Conditions Arising due to COVID-19 Impact

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Patent Analysis

- 4.6 Price Analysis

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Material Type

- 5.1.1 Alumina

- 5.1.2 Titanate

- 5.1.3 Zirconia

- 5.1.4 Silicon Carbide

- 5.1.5 Aluminum Nitride

- 5.1.6 Silicon Nitride

- 5.1.7 Magnesium Silicate

- 5.1.8 Pyrolytic Boron Nitride

- 5.1.9 Other Material Types

- 5.2 Class Type

- 5.2.1 Monolithic Ceramics

- 5.2.2 Ceramic Matrix Composites

- 5.2.3 Ceramic Coatings

- 5.3 End-user Industry

- 5.3.1 Electrical and Electronics

- 5.3.2 Transportation

- 5.3.3 Medical

- 5.3.4 Industrial

- 5.3.5 Defense and Security

- 5.3.6 Chemical

- 5.3.7 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M (Ceradyne Inc.)

- 6.4.2 AGC Inc.

- 6.4.3 Applied Ceramics Inc.

- 6.4.4 Blasch Precision Ceramics Inc.

- 6.4.5 Ceramtec

- 6.4.6 COI Ceramics Inc.

- 6.4.7 Coorstek Inc.

- 6.4.8 Corning Incorporated

- 6.4.9 International Ceramics Inc.

- 6.4.10 Kyocera Corporation

- 6.4.11 MARUWA Co. Ltd

- 6.4.12 Materion Corporation

- 6.4.13 McDanel Advanced Ceramic Technologies

- 6.4.14 Morgan Advanced Materials

- 6.4.15 Murata Manufacturing Co. Ltd

- 6.4.16 Rauschert GmbH

- 6.4.17 Saint-Gobain

- 6.4.18 Small Precision Tools Inc.

- 6.4.19 Vesuvius

- 6.4.20 Wonik QnC Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Applications of Silicon Carbide (SiC) and Gallium Nitride (GaN)

- 7.2 Growth in Usage in Nanotechnology

02-2729-4219

+886-2-2729-4219