|

市场调查报告书

商品编码

1637748

生物基平台化学品:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Bio-based Platform Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

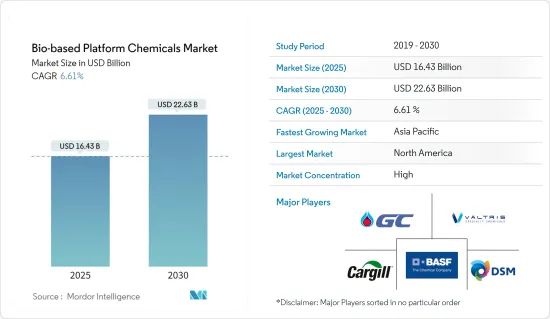

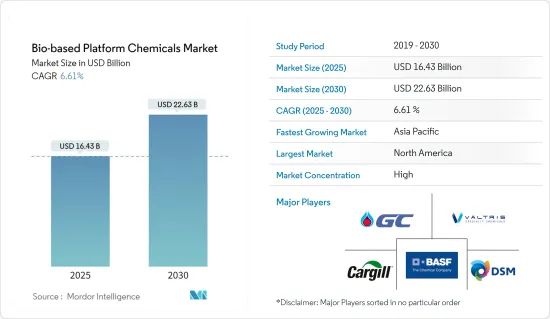

生物基平台化学品市场规模在 2025 年预计为 164.3 亿美元,预计到 2030 年将达到 226.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.61%。

主要亮点

- 新冠疫情对生物基平台化学品产业产生了负面影响。全球封锁和严格的政府规定导致我们大部分生产基地关闭,造成了毁灭性的打击。儘管如此,自 2021 年以来,业务一直在復苏,预计未来几年将大幅成长。

- 推动该市场成长的关键因素是有利的政府法规和消费者对使用环保和永续产品的倾向。

- 另一方面,与生物基平台化学品相关的高产品成本可能会阻碍所调查市场的成长。

- 新型生物基平台化学品的出现以及广泛工业应用需求的激增可能会在预测期内为研究市场提供机会。

- 北美因在製药业的巨额投资和提倡使用环保产品的严格法规而占据全球市场主导地位。

生物基平台化学品市场趋势

生物伊康酸(IA)板块强劲成长

- 伊康酸(IA)也称为亚甲基琥珀酸和亚甲基丁二酸。它是透过发酵过程产生的有机化合物。此外,它还在各种化学品的生产中用作主要来自石化产品(包括丙烯酸)的替代品。

- 阻碍采用伊康酸的主要因素之一是与替代品相比其成本高。因此,IA 主要用于需求较低的领域。

- IA 可溶于多种醇,包括甲醇、乙醇和 2-丙醇,并且可以生物分解性。此外,它也用于生产单酯,例如伊康酸。它也与取代的吡咯烷酮发生反应,用于洗髮精、清洁剂、药物等。伊康酸及其衍生物在化学、纺织和製药工业中有广泛的应用。

- 据个人护理协会欧洲化妆品协会 (Cosmetics Europe) 称,每天有 5 亿欧洲消费者使用化妆品和个人保健产品来保护他们的健康、增进他们的幸福感并提高他们的自尊。其范围包括止汗剂、香水、化妆品、洗髮精、肥皂、防晒油、牙膏和美容品。

- 根据欧洲化妆品协会的数据,欧洲是化妆品和个人用品的主要市场之一,2022 年零售额约为 880 亿欧元(856.4 亿美元)。 2022 年欧洲化妆品和个人护理的主要市场是德国(139.2 亿美元)、法国(125.5 亿美元)和义大利(111.9 亿美元)。

- 生物基伊康酸主要用作高吸水聚合物生产中丙烯酸的替代品。预计在预测期内,石化燃料的枯竭和永续发展的需要将推动用于生产高吸水聚合物的生物基伊康酸的需求。

- 高吸水聚合物在多个终端用户产业的应用日益广泛,这是推动生物基伊康酸需求的因素之一。高吸水聚合物 (SAP) 是一种能够吸收和保留大量液体和水溶液的材料。这使得它们非常适合用于吸收性应用,例如婴儿尿布、成人失禁垫片、吸收性医用敷料和缓释性药物。

- 世界卫生组织(WHO)、世界银行集团和联合国儿童基金会等组织正在提高人们对卫生重要性的认识,特别是妇女和青春期女孩的月经卫生管理(MHM)。

- 在印度,世界银行集团在「清洁印度」运动下启动了一项旗舰卫生计画。这项活动旨在提高社区民众,包括男孩和男人的意识,打破围绕月经的禁忌。政府机构的这些措施正在增加对生物伊康酸的需求,从而支持生物基平台化学品市场的成长。

- 因此,化妆品和个人保健产品需求的激增预计将进一步推动生物基平台化学品市场的需求。

北美占据市场主导地位

- 由于政府法规鼓励使用生物基产品以及在技术改进领域的不断研究和创新,北美地区占据了全球市场占有率的主导地位,预计在 2020 年期间仍将是生物基平台化学品市场的主要参与者。期内,市占率可能会保持稳定。

- 此外,与石油基平台化学品相关的严格法规和石化燃料蕴藏量的枯竭为该地区的生物基平台化学品市场提供了进一步的成长机会。

- 此外,该地区的食品和饮料、化妆品、药品和化肥等终端用户产业受到严格监管,以避免对公民的健康产生不利影响。在这方面,与石油基原料相比,这些产业可能会转向生物基原料。

- 美国医疗保健产业是该国最先进的产业之一。根据医疗保险和医疗补助服务中心的数据,到2028年,全国医疗保健支出预计将平均增加5.4%,总额达到6.2兆美元。此外,美国的人均医疗保健支出大约是德国的两倍、韩国的四倍。

- 根据美国人口普查局的数据,美国医疗保健商店的销售额将从 2021 年的 3,870 亿美元增长到 2022 年的近 3,993.7 亿美元。

- 根据欧洲製药工业和协会联合会的预测,2022年全球医药市场规模预计将达到12,877.36亿美元,其中北美将占52.3%的份额。

- 因此,该地区製药和个人护理行业的显着增长正在推动对生物基平台化学品的需求。

- 此外,生物基平台化学品的研究和开发以及在这些行业中有益应用的探索可能会导致该地区强制使用此类生物基平台化学品。

- 因此,预计所有这些因素都将在预测期内推动该地区对生物基平台化学品的需求。

生物基平台化学品产业概况

生物基平台化学品市场是一个整合的市场,少数参与者占据了相当大一部分市场需求。市场的主要企业包括BASF SE、嘉吉公司、DSM、PTT Global Chemical Public Company Limited 和 Champlor(Valtris Specialty Chemicals)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 对生物基平台化学品有利的政府法规

- 消费者倾向于使用环保和永续产品

- 其他驱动因素

- 限制因素

- 生产成本高

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章 市场区隔(以金额为准的市场规模)

- 依产品类型

- 生物甘油

- 麸胺酸

- 生物伊康酸

- 生物3-羟基丙酸

- 生物琥珀酸

- 其他产品类型

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率分析(%)**/排名分析

- 主要企业策略

- 公司简介

- Aktin Chemicals, Inc.

- BASF SE

- Braskem

- Cargill, Incorporated

- Champlor(Valtris Specialty Chemicals)

- DSM

- DuPont

- Evonik Industries AG

- GFBiochemicals Ltd.

- LyondellBasell Industries Holdings BV

- NIPPON SHOKUBAI CO., LTD.

- Novozymes

- PTT Global Chemical Public Company Limited

- Tokyo Chemical Industry Co., Ltd.

第七章 市场机会与未来趋势

- 新型生物基平台化学品的出现

- 广泛工业应用的需求快速成长

The Bio-based Platform Chemicals Market size is estimated at USD 16.43 billion in 2025, and is expected to reach USD 22.63 billion by 2030, at a CAGR of 6.61% during the forecast period (2025-2030).

Key Highlights

- The COVID-19 pandemic had a negative impact on the bio-based platform chemicals sector. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the business has been recovering since 2021 and is expected to rise significantly in the coming years.

- The major factors driving the growth of the market studied are favorable government regulations and consumer inclination towards the use of environmentally friendly and sustainable products.

- On the flip side, the high product cost associated with bio-based platform chemicals is likely to hinder the growth of the studied market.

- The emergence of novel bio-based platform chemicals and the surge in demand from a wide range of industrial applications are likely to provide opportunities for the studied market during the forecast period.

- North America dominated the global market, which is fueled by huge investments in its pharmaceutical industry and stringent regulations promoting the use of environmentally friendly products.

Bio-based Platform Chemicals Market Trends

Bio-Itaconic acid (IA) Segment to Witness Strong Growth

- Itaconic acid (IA) is also known as methylene succinic acid or methylene butanedioic acid. It is an organic compound manufactured through the fermentation process. Furthermore, it is primarily used as an alternative to petrochemical-derived products (including acrylic acid) during the production of various other chemicals.

- One of the major factors hindering the adoption of itaconic acid is the high cost, as compared to its substitutes. Thus, IA is primarily used in areas where less volume of it is required.

- IA can dissolve in many alcohols, including methanol, ethanol, and 2-propanol, as well as biodegradable in nature. Moreover, it is used to produce monoesters, including monomethyl itaconate. It reacts with substituted pyrrolidones, which are used in applications such as shampoos, detergents, pharmaceuticals, etc. Itaconic acid and its derivatives have major applications in the chemical, textile, and pharmaceutical industries.

- According to Cosmetics Europe, the personal care association, Europe's 500 million consumers use cosmetic and personal care products every day to protect their health, enhance their well-being and boost their self-esteem. Ranging from antiperspirants, fragrances, make-up, and shampoos, to soaps, sunscreens and toothpaste, and cosmetics.

- According to Cosmetics Europe, Europe is amongst the major markets for cosmetics and personal products, and retail sales of these products were valued at around Euro 88 billion (USD 85.64 billion) in 2022. The major market in Europe for cosmetics and personal care are Germany (USD 13.92 billion), France (USD 12.55 billion), and Italy (USD 11.19 billion) in 2022.

- Bio-based itaconic acid is used instead of acrylic acid, primarily in the production of superabsorbent polymers. The depletion of fossil fuels and the need for sustainable development is likely to augment the demand for bio-based itaconic acid for the production of superabsorbent polymers during the forecast period.

- The increasing application of superabsorbent polymers in several end-user industries is one of the factors driving the demand for bio-based itaconic acid. Superabsorbent polymers (SAPs) are materials that possess the ability to absorb and retain large volumes of liquid or aqueous solutions. This makes them ideal for use in water-absorbing applications, such as baby nappies, adult incontinence pads, absorbent medical dressings, and controlled-release drugs.

- Organizations, such as the World Health Organization, World Bank Group, and UNICEF, are raising awareness about the importance of hygiene, especially menstrual hygiene management (MHM) for women and adolescent girls.

- In India, the World Bank Group initiated a flagship sanitation operation under the Swachh Bharath Mission. With this operation, awareness is increasing among the community, including boys and men, to break the taboo around menstruation. Such initiatives by government bodies are increasing the demand for bio-itaconic acid, in turn fueling the growth of the bio-based platform chemicals market.

- Thus, the surge in demand from cosmetics and personal care products is further expected to boost the demand for bio-based platform chemicals market.

North America Region to Dominate the Market

- North America region dominated the global market share and is likely to continue holding the major share in the bio-based platform chemicals market during the forecast period, owing to government regulations promoting the use of bio-based products and continuous research and innovations in the field of technological modification.

- Moreover, stringent regulations related to petroleum-based platform chemicals and depletion of fossil fuel reserves further provide a growth opportunity for the bio-based platform chemicals market in the region.

- In addition, end-user industries such as food and beverage, cosmetics, pharmaceuticals, and fertilizer in the region are strictly regulated in order to avoid negative effects on the health of citizens. In this regard, these industries are more likely to shift to bio-based raw materials when compared to petroleum-based raw materials.

- The healthcare sector in the United States is by far one of the most advanced sectors in the country. According to the Centers for Medicare & Medicaid Services, by 2028, it is anticipated that national health spending will have increased by an average of 5.4%, totaling USD 6.2 trillion. Moreover, Health spending per person in the United States was roughly double that of Germany and four times that of South Korea.

- According to US Census Bureau, the health and personal care store sales in the United States in 2022 accounted for nearly USD 399.37 billion, which will be USD 387.0 billion in 2021.

- According to the European Federation of Pharmaceutical Industries and Association, the world pharmaceutical market was valued at USD 1,287,736 million in 2022, in which North America accounted for a significant share of 52.3%.

- Thus, the significant growth in the pharmaceutical and personal care sector in this region is boosting the demand for biobased platform chemicals.

- Further, research and development of bio-based platform chemicals and exploration of their beneficial applications in such industries can lead to the mandate of the use of such bio-based platform chemicals in the region.

- Hence, all such factors are likely to drive the demand for bio-based platform chemicals in the region during the forecast period.

Bio-based Platform Chemicals Industry Overview

The bio-based platform chemicals market is a consolidated market, where few players account for a significant portion of the market demand. Some of the major players in the market include BASF SE, Cargill, Incorporated, DSM, PTT Global Chemical Public Company Limited, and Champlor (Valtris Specialty Chemicals), amongst others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Favorable Government Regulations for Bio-Based Platform Chemicals

- 4.1.2 Consumer Inclination Towards the Use of Environmental Friendly and Sustainable Products

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Cost of Production

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Bio Glycerol

- 5.1.2 Bio Glutamic Acid

- 5.1.3 Bio Itaconic Acid

- 5.1.4 Bio-3-Hydroxypropionic Acid

- 5.1.5 Bio Succinic Acid

- 5.1.6 Other Product Types

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 South Africa

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aktin Chemicals, Inc.

- 6.4.2 BASF SE

- 6.4.3 Braskem

- 6.4.4 Cargill, Incorporated

- 6.4.5 Champlor (Valtris Specialty Chemicals)

- 6.4.6 DSM

- 6.4.7 DuPont

- 6.4.8 Evonik Industries AG

- 6.4.9 GFBiochemicals Ltd.

- 6.4.10 LyondellBasell Industries Holdings B.V.

- 6.4.11 NIPPON SHOKUBAI CO., LTD.

- 6.4.12 Novozymes

- 6.4.13 PTT Global Chemical Public Company Limited

- 6.4.14 Tokyo Chemical Industry Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emergence of Novel Bio-Based Platform Chemicals

- 7.2 Surge in Demand from Wide Range of Industrial Applications