|

市场调查报告书

商品编码

1637756

欧洲热电联产 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Europe Combined Heat and Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

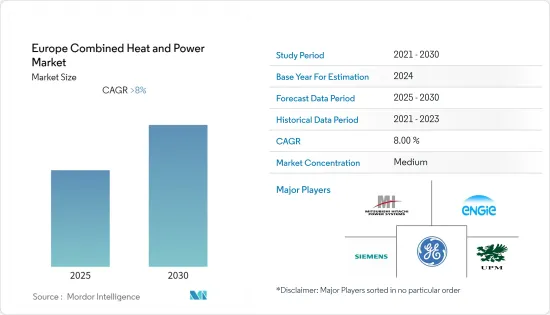

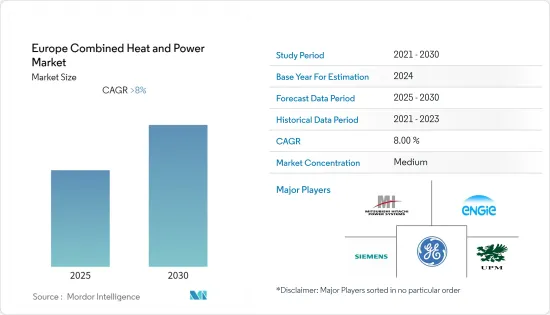

预计欧洲热电联产市场在预测期内的复合年增长率将超过 8%。

COVID-19大流行严重影响了2020年的市场。目前市场处于大流行前的水平。

主要亮点

- 从中期来看,能源需求的增加、能源成本的下降、可再生能源的整合以及碳排放的减少预计将推动研究市场的成长。

- 另一方面,电网互连和高初始资本投资预计将阻碍预测期内欧洲热电联产市场的成长。

- 该地区正在增加对小型製造设备开发的投资,这可能会在预测期内为欧洲热电联产市场创造有利的成长机会。

- 德国在市场上占据主导地位,并且可能在预测期内实现最高的复合年增长率。这一增长得益于该国投资的增加和政府的支持措施。

欧洲热电联产市场趋势

生质热电联产市场实现显着成长

- 近年来,生物质产业取得了显着成长。生物质的燃烧是排放碳过程。对于对热能和电力有持续需求的地区来说,生物质热电联产是一项有用的技术。

- 2021年欧洲生质能源产量为41,846MW。然而,从2020年到2021年,这数字增加了376兆瓦,生质能源产量在2021年达到高峰41,846兆瓦。

- 中小型热电联产厂通常使用当地可用的生物质。大型热电联产发电厂和煤/生质混燃发电厂需要从广大地区购买生物质,以及进口木材和林业剩余物。

- 目前,汽电共生提供了欧洲 11% 的电力和 15% 的热力,为欧盟二氧化碳减排目标的 21% 和能源效率目标的 15% 做出了贡献。

- 到2030年,汽电共生将提供欧洲20%的电力和25%的热量,为欧盟二氧化碳减排目标的23%和能源效率目标的18%做出贡献。到 2050 年,透过将热电汽电共生优先于所有热电联产并避免浪费宝贵的能源,欧盟能源结构中的汽电共生能力可以增加一倍。

- 在马耳他、塞浦路斯和希腊,这一比例不到5%,而在丹麦、芬兰、拉脱维亚、立陶宛和斯洛伐克,这一比例超过30%。总体而言,在欧洲层面,汽电共生在过去几年中保持稳定。

- 欧洲的热电联产业属于工业业,为纸浆和造纸、铝、化学品、陶瓷、玻璃、纺织、食品和饮料以及钢铁製造商等行业提供电力和蒸气。

德国主导市场

- 德国是欧洲最大的经济体,对热电联产有着明确的野心,制定了专门的热电联产法,目标是到 2025 年达到 120 太瓦。该国的热电联产正在快速成长。我们 16% 的电力来自汽电共生,明显高于欧洲平均 11%。

- 德国2021年发电量为584.5兆瓦时,较上年增加近2%。 2017年减少了1.9兆瓦时,高峰超过651兆瓦时。

- 欧洲各地已经启动、正在建造或已经核准了几个备受瞩目的热电联产计划。我们最大的计划之一是位于德国汉堡以北约 90 公里的港口城市基尔正在进行的市政汽电共生计划。

- 德国推出了有保证的保费并改进了支援系统,以刺激对大型区域供热网路的投资。精製和化工等主要行业之后是热负荷合适的小型零售业。

- 近年来,用于私人住宅的微型热电联产机组也进入了德国和欧洲市场。因此,该国推广热电联产的倡议正在增加,预计将在预测期内推动整体热电联产市场需求。

欧洲热电联产产业概况

欧洲热电联产市场适度分散。市场的主要企业包括(排名不分先后)2G Energy AG、通用电气公司、西门子股份公司、三菱日立电力系统欧洲有限公司和 Engie SA。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2027年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔与分析

- 目的

- 住宅

- 商业的

- 工业和公共产业用途

- 燃料类型

- 天然气

- 可再生

- 生物量

- 煤炭

- 其他燃料

- 地区

- 德国

- 英国

- 荷兰

- 欧洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Engie SA

- General Electric Company

- Siemens AG

- Mitsubishi Hitachi Power Systems Europe Ltd

- UPM

- 2G Energy AG

- Wartsila

- Fleetsolve

- Vatenfall

第七章 市场机会及未来趋势

简介目录

Product Code: 46848

The Europe Combined Heat and Power Market is expected to register a CAGR of greater than 8% during the forecast period.

The COVID-19 pandemic affected the market severely in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, the increasing energy demand, lowering energy costs, integration of renewable energy, and reducing carbon emissions are expected to drive the growth of the market studied.

- On the other hand, grid interconnection and significant initial capital investment are expected to hamper the growth of Europe's combined heat and power market during the forecast period.

- Nevertheless, increasing investment in the development of small-sized manufacturing units in the region will likely create lucrative growth opportunities for Europe's combined heat and power market during the forecast period.

- Germany dominates the market and is likely to witness the highest CAGR during the forecast period. This growth is attributed to the increasing investments and supportive government policies in the country.

Europe Combined Heat and Power Market Trends

Biomass-based CHP to Witness Significant Growth in the Market

- Over the past few years, the biomass industry has grown significantly. Biomass combustion is a carbon-free process, as the resulting CO2 is previously captured by the plants being combusted. Biomass combined heat and power can be a beneficial technology for sites with a constant demand for heat and electricity.

- Europe's bioenergy production amounted to 41,846 MW in 2021. However, figures increased by 376 MW of bioenergy between 2020 and 2021, peaking at 41,846 MW of bioenergy in 2021.

- Small- and medium-sized CHP plants are usually sourced with locally available biomass. Large CHP plants and coal/biomass co-firing power plants require biomass sourced from a vast region or imported wood and forestry residues.

- Cogeneration, or combined heat and power, currently provides 11% of Europe's electricity and 15% of its heat, contributing up to 21% of the EU's CO2 reduction target and 15% of the EU's energy efficiency target.

- By 2030, cogeneration will likely provide 20% of electricity and 25% of heat in Europe, contributing up to 23% of the EU's CO2 reduction target and 18% of the EU's energy efficiency target. By 2050, the sector is likely to double the cogeneration capacity in the EU energy mix by ensuring that cogeneration is prioritized for all thermally generated electricity and heat, thus avoiding wasting valuable energy.

- The contribution of CHP to the energy mix varies significantly among European countries, from less than 5% in Malta, Cyprus, and Greece, to more than 30% in Denmark, Finland, Latvia, Lithuania, and Slovakia. Overall, at the European level, cogeneration has remained stable during the past few years.

- Europe's CHP industry is in industrial applications, providing power and steam to sectors such as pulp and paper, aluminum, chemicals, ceramics, glass, textiles, food and drink, and steel manufacturers.

Germany to Dominate the Market

- Germany, Europe's largest economy, has set a clear ambition for CHP with a dedicated law and a target of 120 TWh by 2025. The country has experienced real CHP growth. It derives 16% of its electricity from cogeneration, well above the European average of 11%.

- Germany generated 584.5 terawatt hours of electricity in 2021, an increase of nearly 2% from the previous year. Nevertheless, in 2017, these figures decreased by 1.9 terawatt hours and peaked at over 651 terawatt hours.

- Several high-profile CHP projects have come up throughout Europe, are under construction, or have been approved. One of the largest projects is the municipal cogeneration project underway in the port city of Kiel, about 90 km north of Hamburg, Germany.

- Germany upgraded its support scheme, introducing guaranteed premiums that spurred investments in large district heating networks. Key industries in refining and chemicals followed smaller retail businesses with suitable heat loads.

- Micro-CHP units for individual homes have also entered the German and European markets in the past few years. Hence, a growing initiative to promote CHP in the country is expected to drive the demand for the overall CHP market over the forecast period.

Europe Combined Heat and Power Industry Overview

Europe's combined heat and power market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include 2G Energy AG, General Electric Company, Siemens AG, Mitsubishi Hitachi Power Systems Europe Ltd, and Engie SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Degree of Competition

5 MARKET SEGMENTATION AND ANALYSIS

- 5.1 Applicaton

- 5.1.1 Residential

- 5.1.2 Commercial

- 5.1.3 Industrial and Utility

- 5.2 Fuel Type

- 5.2.1 Natural Gas

- 5.2.2 Renewable

- 5.2.3 Biomass

- 5.2.4 Coal

- 5.2.5 Other Fuel Types

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 Netherlands

- 5.3.4 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.4 Engie SA

- 6.4.1 General Electric Company

- 6.4.2 Siemens AG

- 6.4.3 Mitsubishi Hitachi Power Systems Europe Ltd

- 6.4.4 UPM

- 6.4.5 2G Energy AG

- 6.4.6 Wartsila

- 6.4.7 Fleetsolve

- 6.4.8 Vatenfall

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219