|

市场调查报告书

商品编码

1637804

风扇和鼓风机:市场占有率分析、行业趋势和统计、成长预测(2025-2030)Fans And Blowers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

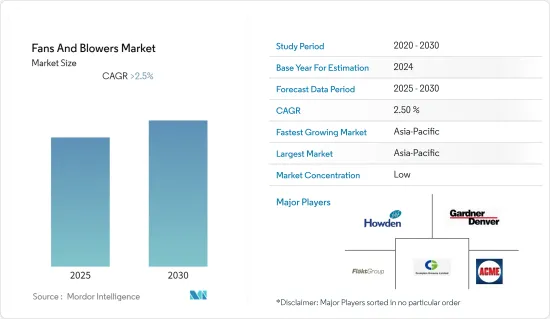

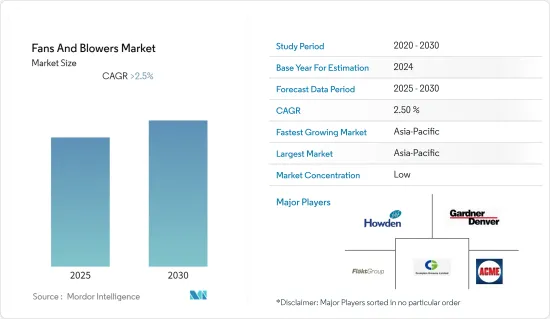

预计风扇和鼓风机市场在预测期内的复合年增长率将超过 2.5%。

由于封锁措施,各製造业暂时关闭,且 2020 年没有新的製造业或建筑计划,因此 COVID-19 大流行影响了所研究的市场。目前市场已恢復至疫情前的水准。

主要亮点

- 在预测期内,资料中心和公司办公室等商业设施的增加以及许多新兴国家工业化的不断发展预计将推动风扇和鼓风机市场的成长。

- 可再生发电厂需要最少的风扇和鼓风机基础设施。随着许多主要国家转向可再生能源发电,预计未来几年可再生能源发电在发电结构中的份额将会增加,这预计将限制对风机和鼓风机的需求。

- 都市化的加速和人口增长为市场创造了机会。建筑物的平均高度和拥挤度持续增加。预计这一趋势将在预测期内持续下去,导致对通风设备的需求增加,以弥补通风不足的情况,并预计将代表市场的成长机会。

风机和鼓风机市场趋势

工业领域预计将主导市场

- 风扇和鼓风机用于多种行业,包括化学、石油和天然气、钢铁厂和食品製造,以维持室内空气品质并提供无尘的工作环境。随着许多国家工厂和发电厂等新型製造业的建立,工业化趋势的增强预计将推动市场成长。

- 消耗空气设备最多的产业包括钢厂、化工厂和燃油发电厂,这些产业近年来成长较快。例如,2022年8月,印度政府计划在奥里萨邦兴建6座钢铁厂。该计划的投资者包括塔塔钢铁公司、安赛乐米塔尔公司、新日铁和阿达尼集团。在目前的情况下,化学工业特别是在开发中国家很发达。

- 例如,2022年4月,INEOS Nitriles计划在德国科隆建立一家生产乙腈的化学工厂。法国化工公司启动了在该国建立新化工园区和丛集的新计画。

- 市场主要企业也在投资扩建,以满足工业风扇和鼓风机的需求。例如,豪顿于 2023 年 4 月宣布将在巴西开设分店,扩大在拉丁美洲的业务。客户可以 24 小时访问我们的服务中心,其中包括硬体采购、售后支援以及针对我们的工业风扇和鼓风机产品线的专业硬体支援。

- 由于这些发展,预计工业领域在预测期内将优于其他部署领域。

亚太地区主导市场

- 由于中国、印度和日本等国家的高需求,预计亚太地区在不久的将来将占据最大的市场占有率。都市化的提高和工业单位的激增是高需求背后的一个主要因素。

- 近年来,中国和印度等国家的石油和天然气、石化计划、钢厂计划和发电工程都有成长。预计即将推出的工业计划将继续这种趋势。

- 例如,中国等国家正在发展燃料发电产业。 2022年第一季,中国许多省份地方政府核准了新增约830万千瓦燃煤电厂的新计画。其中包括湖南、陕西、甘肃、安徽、浙江和福建。

- 印度计划开展多个炼油厂计划。例如,2022年7月,拉贾斯坦邦政府与HPCL签署协议,在拉贾斯坦邦巴尔默区建立炼油石化联合体。该计划包括13台机械装置,总合为900万吨/年。计划于 2024 年投入运作。

- 预计此类计划将在预测期内推动亚太地区对风扇和鼓风机的需求。

风机和鼓风机产业概述

风扇和鼓风机市场分散。市场上的主要企业包括(排名不分先后)Acme Engineering & Manufacturing Corp.、Airmaster Fan Company Inc. 和 Continental Blower LLC。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 依技术

- 离心式

- 轴流式

- 按发展

- 工业的

- 发电

- 石油和天然气

- 建造

- 钢

- 化学

- 矿业

- 其他行业

- 商业的

- 工业的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 南美洲

- 中东/非洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Acme Engineering & Manufacturing Corp.

- Airmaster Fan Company Inc.

- Continental Blower LLC

- CG Power and Industrial Solutions Limited

- DongKun Industrial Co. Ltd.

- Flakt Woods Group SA

- Gardner Denver Inc.

- Greenheck Fan Corp.

- Howden Group Ltd

- Loren Cook Company

- Pollrich GmbH

第七章 市场机会及未来趋势

The Fans And Blowers Market is expected to register a CAGR of greater than 2.5% during the forecast period.

The COVID-19 pandemic affected the market studied, as lockdown measures temporarily shut down various manufacturing industries, and there were no new manufacturing or construction projects in 2020. Currently, the market has rebounded to pre-pandemic levels.

Key Highlights

- The growing multitude of commercial places, like data centers, corporate offices, etc., and the increasing industrialization in many developing countries are expected to drive the fans and blowers market's growth during the forecast period.

- Renewable power plants require minimal infrastructure for fans and blowers. With many major countries shifting toward renewable energy sources, the share of renewable power plants in the power generation mix is expected to increase over the coming years, which, in turn, is expected to restrain the demand for fans and blowers.

- The increasing urbanization and growing population present an opportunity for the market. The average height of buildings and congestion have been increasing. Since this trend is expected to continue during the forecast period, the demand for ventilating equipment to make up for the unavailability of proper ventilation is expected to increase, providing an opportunity for the market's growth.

Fans and Blowers Market Trends

Industrial Segment Expected to Dominate the Market

- Fans and blowers are used in various industries, like chemicals, oil and gas, steel plants, food manufacturing, etc., to maintain indoor air quality and a dust-free environment for people to work in. The growing trend of industrialization in many countries, with new factories, power plants, and other manufacturing sectors, is expected to drive the market's growth

- The most air-equipment-consuming industries are iron and steel plants, chemical plants, fuel-based power plants, etc., which have seen a proliferation in recent years. For example, in August 2022, the government of India planned to build six steel plants in Odisha. The investors for the project include Tata Steel, ArcelorMittal, Nippon Steel, and the Adani Group. The chemical industry is advancing in the current scenario, particularly in developing countries.

- For example, in April 2022, INEOS Nitriles planned to establish a chemical plant in Koln, Germany, to produce acetonitrile. The French chemical companies tabled new plans for setting up new chemical parks and clusters in the country.

- Major player in the market is also investing in the expansion of operations to cater the needs of industrial fans and blowers. For instance, in April 2023, Howden announced that they plas to set up a branch in Brazil to expand its Latin American presence. Customers have 24-hour access to the service center, which provides hardware procurement, aftermarket service support, and hardware specialized assistance for product range of industrial fans and blowers.

- Due to such developments, the industrial sector is anticipated to overshadow other deployment segments during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to have the largest market share in the near future due to the high demand for such products from countries like China, India, Japan, etc. The growing rate of urbanization with the proliferation of industrial and commercial units is the key factor responsible for the high demand.

- In countries like China and India, oil and gas and petrochemical projects, iron and steel plant projects, and power generation projects have witnessed growth in recent years. The trend is expected to continue in the unfolding scene due to the upcoming industrial projects.

- For example, countries like China are still developing the fuel-based power generation sector. In the first quarter of 2022, the provincial governments of many states in China approved new plans to add around 8.3 GW of coal-based power generation plants. The states include Hunan, Shaanxi, Gansu, Anhui, Zhejiang, and Fujian.

- Several refinery projects have been planned in India. For example, in July 2022, the Rajasthan government entered into an agreement with HPCL to set up a refinery and petrochemical complex in the Barmer district of Rajasthan. The project includes 13 mechanical units with a combined capacity of 9 million metric tons per year. It is expected to be operational by 2024.

- Such projects are expected to bolster the demand for fans and blowers in Asia-Pacific during the forecast period.

Fans and Blowers Industry Overview

The fans and blowers market is fragmented. Some of the major players in the market (in no particular order) include Acme Engineering & Manufacturing Corp., Airmaster Fan Company Inc., and Continental Blower LLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Market Dynamics

- 4.4.1 Drivers

- 4.4.2 Restraints

- 4.5 Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products and Services

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Technology

- 5.1.1 Centrifugal

- 5.1.2 Axial

- 5.2 By Deployment

- 5.2.1 Industrial

- 5.2.1.1 Power Generation

- 5.2.1.2 Oil and Gas

- 5.2.1.3 Construction

- 5.2.1.4 Iron and Steel

- 5.2.1.5 Chemicals

- 5.2.1.6 Mining

- 5.2.1.7 Other Industries

- 5.2.2 Commercial

- 5.2.1 Industrial

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 South America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Acme Engineering & Manufacturing Corp.

- 6.3.2 Airmaster Fan Company Inc.

- 6.3.3 Continental Blower LLC

- 6.3.4 CG Power and Industrial Solutions Limited

- 6.3.5 DongKun Industrial Co. Ltd.

- 6.3.6 Flakt Woods Group SA

- 6.3.7 Gardner Denver Inc.

- 6.3.8 Greenheck Fan Corp.

- 6.3.9 Howden Group Ltd

- 6.3.10 Loren Cook Company

- 6.3.11 Pollrich GmbH