|

市场调查报告书

商品编码

1637826

拉丁美洲气雾罐:市场占有率分析、产业趋势与成长预测(2025-2030)Latin America Aerosol Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

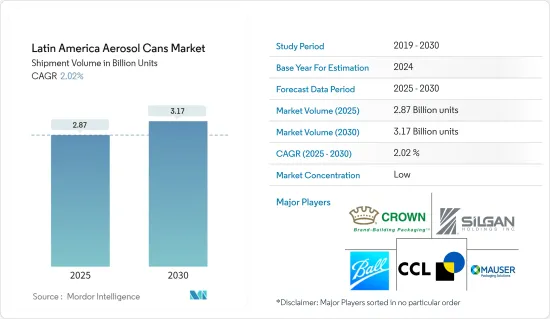

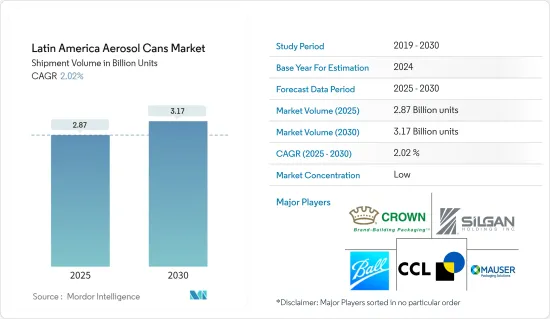

根据出货量,拉丁美洲气雾罐市场规模预计将从 2025 年的 28.7 亿个增长到 2030 年的 31.7 亿个,预测期内(2025-2030 年)复合年增长率为 2.02%。

主要亮点

- 气雾罐是市场上最受欢迎的,因为它们可回收和可重复使用。由于气雾罐大多由金属製成,因此可以无限期回收。气雾罐的製造符合环保法规,为使用者提供了经济高效的包装解决方案,同时也无浪费。这有助于供应商透过其产品实现永续性目标。

- 此外,化妆品和个人护理行业的成长是推动市场成长的主要因素。由于可支配收入的增加、消费者生活方式的改变、产品展示和差异化以及对除臭剂、髮胶喷雾等产品的需求不断增加,气雾罐市场正在见证成长。由于需求量大,铝在所研究的市场中迅速被接受。

- 随着拉丁美洲个人护理和化妆品行业的扩张,对环保包装罐的需求迅速增加。个人护理品和化妆品特别采用气溶胶金属罐包装,因为它们含有与阳光和空气反应的敏感化学成分。

- 此外,随着该地区医疗基础设施的发展,气雾罐在医疗领域的使用也越来越多。例如,吸入器和滴鼻剂依靠气雾剂技术来有效地输送药物。随着呼吸系统疾病的日益普及和人口老化,对气雾剂医疗产品的需求不断增加。这为製造商开发专门的气雾剂解决方案以满足不断变化的医疗需求提供了重要的机会。

- 此外,汽车行业快速采用喷漆进行客製化和维护,为巴西和阿根廷气雾罐市场创造了广泛的可能性。喷漆用作绘画材料和家庭绘画。此外,市场上的供应商正在提高人们对永续性努力的认识,并因此推动回收倡议以带来改变。

- 金属气雾剂包装面临其他包装解决方案的竞争。可以使用塑胶、纸张和玻璃等替代包装解决方案。塑胶包装仍然是金属包装的主要竞争对手。玻璃包装在化妆品行业也很普遍,各个供应商推出了新的永续玻璃包装来支持循环经济。

拉丁美洲气雾罐市场趋势

化妆品和个人护理产品预计将占据主要市场占有率

- 由于气雾罐的高耐热性,化妆品和个人保健产品可以保持其品质,同时又不会放弃水分流失的特性。气雾罐也已在工业中用于透过衬里控制湿度。它主要用于化妆品和个人护理行业,用于包装除臭剂和剃须泡沫等产品。气密罐用于维持产品品质并延长保质期。

- 由于收入的增加、消费者生活方式的改变、产品展示和差异化以及对化妆品和个人保健产品(包括除臭剂、髮胶喷雾和其他护肤霜)的需求增加,预计气雾罐的消费量将会增加。例如,根据Beautycare Brazil (ABIHPEC & ApexBrasil)的数据,2023年巴西除臭剂、护髮产品和香水的进口额将分别为1,850万美元、5,560万美元和1.782亿美元。

- 此外,美容产品供应商可能正在寻找标准的包装解决方案。市场相关人员正专注于产品发布和开发气雾喷雾等创新产品。

- 因此,主要企业在推出铝基气雾罐,特别是用于髮胶喷雾和除臭剂等个人保健产品的气雾罐。此外,具有环保意识的消费者越来越多地采用可回收和生物分解性的包装,推动了气雾罐的销售。

巴西可望占据最大市场占有率

- 在巴西,可支配收入的增加、消费者生活方式的改变、产品展示和差异化以及对化妆品/个人护理、家居、製药/兽医、油漆/清漆和汽车等各种最终用户的需求增加等因素可能会增加消费量。

- 根据巴西专利权协会 (ABF) 2023 年 2 月发布的报告,美容连锁店连续第三年位居巴西成长最快市场排名榜首,并且在其他国家也取得了成功。在专利权经营业务中,在健康、美容和保健领域,巴西已成为拉丁美洲最大的美容和美容市场,仅次于美国、中国和日本,位居世界第四。巴西个人护理领域对气雾罐的需求反映了消费者对便利性、效率和产品有效性的广泛偏好。

- 在个人护理行业,气雾罐描述了一种方便卫生的方式来分配除臭剂、髮胶喷雾和剃须泡沫等产品。气雾剂包装提供的易用性和精确剂量符合消费者的生活方式,推动了对这些产品的持续需求。

- 此外,气雾罐市场正在经历全球机会,该地区的贸易关係也帮助製造商创新气雾罐的新形式,使其更引人注目、重量更轻。髮胶喷雾和造型慕丝是各种个人护理和化妆品市场需求的重要护髮产品。贸易在其中扮演重要角色。巴西护髮产品的出口额逐年增长,从2020年的1.249亿美元增至2023年的2.02亿美元,而包括喷雾在内的巴西护髮产品的趋势正在增加对气雾罐的需求。

- 此外,家居、室内和装饰用品支出的增加正在推动市场需求。最常见的是空气清新剂和清洁产品。许多住宅都会使用气溶胶喷漆来进行装饰、DIY 和住宅装修计划。

拉丁美洲气雾罐产业概况

拉丁美洲气雾市场占有率市场由皇冠控股永续性( Crown Holdings Inc.)主导。

2023 年 9 月,Crown Holdings Inc. 继续透过铝管理计画进行一系列检验,成为哥伦比亚第一家获得负责任采购实务 ASI 绩效标准认证的公司。这项成就预计将鼓励 ASI 扩展到拉丁美洲的新地区,并鼓励在该地区运营的其他公司展示其业务流程。

2023 年 4 月,波尔宣布其全球气雾剂包装部门已获得铝业管理倡议(ASI) 的性能和产销监管链标准认证。 Ball Aerosol 部门为个人护理、家居用品和饮料行业提供各种创新且可无限回收的铝包装解决方案。其中包括一系列一次性和多用途衝击挤压铝瓶,以及采用低碳能源来源生产的高铝含量的最先进的气雾剂容器。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 化妆品产业需求不断扩大

- 气雾罐的可回收性

- 市场限制因素

- 替代包装的竞争加剧

第六章 市场细分

- 按材质

- 铝

- 钢罐

- 按最终用户产业

- 化妆品/个人护理

- 家庭使用

- 医药/兽药

- 油漆/清漆

- 车

- 其他的

- 按国家/地区

- 巴西

- 墨西哥

- 阿根廷

第七章 竞争格局

- 公司简介

- Crown Holdings inc.

- Ball Corporation

- CCL Industries Inc.

- Can-Pack SA

- Ardagh Group

- Mauser Packaging Solutions

- Silgan Holdings Inc.

- Tecnocap Group

- LINDAL Group

- Trivium Packaging

第八章投资分析

第9章 市场的未来

The Latin America Aerosol Cans Market size in terms of shipment volume is expected to grow from 2.87 billion units in 2025 to 3.17 billion units by 2030, at a CAGR of 2.02% during the forecast period (2025-2030).

Key Highlights

- Aerosol cans are among the most popular in the market due to their recyclability and reusability. As aerosol cans are mostly made from metal, they can be recycled indefinitely. Manufactured by environmental regulations, aerosol cans provide users with cost-effective packaging solutions while eliminating disposal worries. This helps vendors to meet their sustainability objectives with their products.

- Furthermore, the increasing cosmetics and personal care industries are significant factors behind the market growth. The aerosol cans market is experiencing growth due to rising disposable incomes, changing consumer lifestyles, product presentation and differentiation, and increased demand for products such as deodorants, hairsprays, and more. Due to the high demand, aluminum is rapidly gaining acceptance in the markets studied.

- With the expansion of the personal care and cosmetics industry in Latin America, the demand for eco-friendly packaging cans has surged. As personal care and cosmetic products have sensitive chemical ingredients that are reactive to sun exposure and air, they are packed in aerosol metal cans specifically.

- Moreover, with the growing healthcare infrastructure in the region, aerosol cans are increasingly finding applications in the healthcare sector. Inhalers and nasal sprays, for instance, rely on aerosol technology to deliver medication effectively. With the rising prevalence of respiratory diseases and the growing aging population, the demand for aerosol-based medical products is rising. This presents significant opportunities for manufacturers to cater to the evolving healthcare needs and develop specialized aerosol solutions.

- Additionally, the quick adoption of spray paints for customization and maintenance in the automotive industry has opened a wide range of potential for the aerosol cans market in Brazil and Argentina. Spray paints are utilized as art supplies and for in-home painting. Furthermore, vendors in the market are driven by sustainability efforts to raise awareness and thus promote recycling initiatives to make a difference.

- Metal aerosol packaging faces competition from other packaging solutions. Alternatives such as plastic, paper, or glass packaging solutions are available. Plastic packaging continues to be the main competitor of metal packaging. Glass packaging is also widely popular in the cosmetics industry, and various vendors are launching new sustainable glass packaging to support the circular economy.

Latin America Aerosol Cans Market Trends

Cosmetic and Personal Care is Expected to Account for Significant Market Share

- Aerosol cans have a high-temperature resistance, allowing cosmetics and personal care products to maintain quality without relinquishing the characteristic moisture loss. Aerosol cans have also been used in the industry to control the moisture due to linings. They are mainly used in the cosmetics and personal care industry for packing deodorant, shaving foam, etc. Airtight aerosol cans are used to maintain product quality and extend shelf life.

- Consumption of aerosol cans is projected to increase due to rising incomes, changes in consumer lifestyles, product presentation and differentiation, and increased demand for cosmetic and personal care products, including deodorants, hair sprays, and other skin creams. For instance, according to Beautycare Brazil (ABIHPEC & ApexBrasil), the import of deodorants, hair care products, and fragrances in Brazil accounted for USD 18.5 million, USD 55.6 million, and USD 178.2 million, respectively, in 2023.

- Furthermore, beauty product vendors are probably looking for a standard packaging solution. The market players are focusing on product launches and creating innovative products such as aerosol sprays.

- Consequently, key players are introducing aluminum-based aerosol cans, especially for personal care products such as hair sprays and deodorants. In addition, environmentally-conscious consumers are increasingly adopting packaging materials that can be recycled and are biodegradable, facilitating the sales of aerosol cans.

Brazil is Expected to Account for the Largest Market Share

- In Brazil, factors such as rising disposable income, changes in consumer lifestyles, product presentation and differentiation, and rising demand for various end users, such as cosmetic and personal care, household, pharmaceutical/veterinary, paints and varnishes, and automotive, will increase the consumption of aerosol cans.

- According to the ABF (Brazilian Franchise Association) report published in February 2023, beauty chains lead the ranking of the fastest-growing market in Brazil for the third consecutive year and have been successful in other countries. In the franchising business, in the health, beauty, and wellness segment, Brazil emerged as the largest market for aesthetics and beauty in Latin America and the fourth in the world, behind only the United States, China, and Japan. Brazil's demand for aerosol cans across personal care reflects a broader consumer preference for convenience, efficiency, and product efficacy.

- In the personal care industry, aerosol cans offer a convenient and hygienic way to dispense products such as deodorants, hair sprays, and shaving foams. The ease of application and precise dosage provided by aerosol packaging align well with consumers' lifestyles, driving continued demand for these products.

- Moreover, the market of aerosol cans is experiencing global opportunities where trade relations of the region also help manufacturers innovate new formats of aerosol cans that are more eye-catching and less weighted. Hair spray and hair mousse are essential hair care products that are in demand in different personal care and cosmetic markets. In this context, trade plays an important role. The export value of hair care products from Brazil grew yearly from USD 124.90 million in 2020 to USD 200.20 million in 2023, showing that the growing trend of hair care products, including sprays from Brazil, created a landscape for the aerosol can demand.

- Furthermore, increasing home, interior, and decor spending drives market demand. The most common are air fresheners and cleaning products. Many homeowners have aerosol spray paints for decorating, DIY, and home improvement projects.

Latin America Aerosol Cans Industry OVerview

The Latin American aerosol cans market is fragmented with significant players like Crown Holdings Inc., Ball Corporation, CCL Industries Inc., Can-Pack SA, and Ardagh Group. Furthermore, vendors in the market are driven by sustainability and product enhancements to capture market share and profitability.

In September 2023, Crown Holdings Inc. became the first company in Colombia to receive the ASI Performance Standard certification for responsible sourcing practices, continuing its series of verifications with the Aluminium Stewardship Initiative. This achievement is expected to encourage ASI to expand its operations to new regions in Latin America and create momentum for other undertakings operating in this area to demonstrate their business processes.

In April 2023, Ball Corporation announced that its Global Aerosol Packaging division earned the Aluminium Stewardship Initiative (ASI) certification for the Performance and Chain of Custody Standards. The Ball Aerosol division provides various inventive, infinitely recyclable aluminum packaging solutions for the personal care, home, and beverage industries. These include a variety of impact-extruded aluminum bottles for single- and multiple-use applications and cutting-edge aerosol containers with a high aluminum content produced from low-carbon energy sources.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industrial Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand from the Cosmetic Industry

- 5.1.2 Recyclability of Aerosol Cans

- 5.2 Market Restraints

- 5.2.1 Increasing Competition from Substitute Packaging

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Aluminum

- 6.1.2 Steel-tinplate

- 6.2 By End-user Industry

- 6.2.1 Cosmetic and Personal Care

- 6.2.2 Household

- 6.2.3 Pharmaceutical/Veterinary

- 6.2.4 Paints and Varnishes

- 6.2.5 Automotive

- 6.2.6 Other End-user Industries

- 6.3 By Country

- 6.3.1 Brazil

- 6.3.2 Mexico

- 6.3.3 Argentina

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Crown Holdings inc.

- 7.1.2 Ball Corporation

- 7.1.3 CCL Industries Inc.

- 7.1.4 Can-Pack SA

- 7.1.5 Ardagh Group

- 7.1.6 Mauser Packaging Solutions

- 7.1.7 Silgan Holdings Inc.

- 7.1.8 Tecnocap Group

- 7.1.9 LINDAL Group

- 7.1.10 Trivium Packaging