|

市场调查报告书

商品编码

1637834

印度玻璃包装:市场占有率分析、行业趋势和成长预测(2025-2030 年)India Glass Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

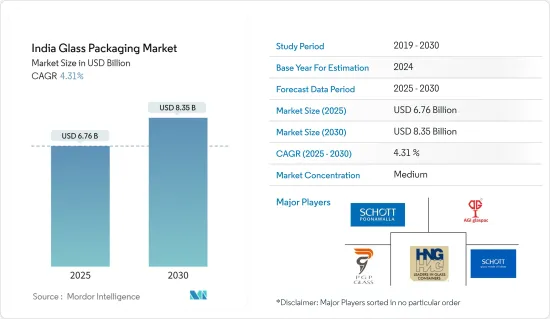

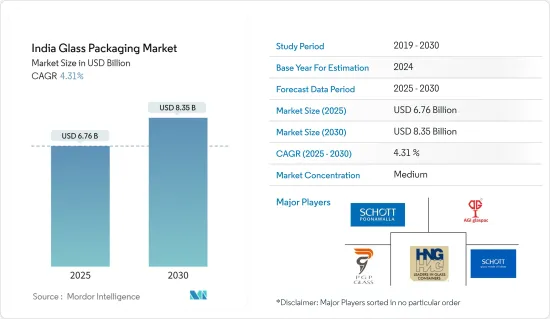

预计 2025 年印度玻璃包装市场价值为 67.6 亿美元,到 2030 年将达到 83.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.31%。

包装及相关产业的製造和生产仅在许多包装对 GDP 贡献较大的国家中发挥作用。此举标誌着公司重点从国内玻璃包装产业转向製药业。

主要亮点

- 印度拥有世界第二大製药和生技产业劳动力份额。根据《2021 年印度经济调查》,预计未来十年医药市场将成长三倍。预计2021年该国医药市场规模将达410亿美元,2024年将达650亿美元,到2030年将进一步扩大至1200至1300亿美元。

- 由于玻璃瓶具有无孔、不渗透、环保、美观等特性,在包装产业的应用越来越广泛。在印度,玻璃产业已经很成熟,并且长期以来一直是家庭工业。该行业最近已从手动流程发展为现代自动化方法。根据印度斯坦国家玻璃工业有限公司统计,印度的人均玻璃包装消费量(1.8公斤)远低于其他国家。

- 消费者环保意识的增强也推动了玻璃包装产业的发展,因为玻璃包装可回收并且是塑胶包装的环保替代品。此外,可支配收入的增加和消费者生活方式的改变也有望推动市场成长。

- 市场面临的主要挑战之一是来自铝罐和塑胶容器等替代包装形式的竞争日益激烈。铝罐和塑胶容器越来越受到製造商和消费者的欢迎,因为它们比笨重的玻璃重量轻,而且携带和运输成本较低。此外,玻璃包装行业最近一直致力于提高可追溯性,以限制国内的假冒活动。本公司对容器进行永久标记,以保护消费者免受仿冒品製造商的有害行为的侵害。

- 近期,该国对 COVID-19 疫苗的投资趋势已成为管瓶的主要驱动力。例如,根据 IBEF 的数据,印度製药业供应了全球 50% 以上的各种疫苗需求、美国非专利市场的 40% 左右以及英国所有药品的 25%。

印度玻璃包装市场的趋势

玻璃瓶/容器:预计需求旺盛

- 在印度,玻璃包装解决方案(尤其是瓶子)的使用正在增加,因为消费者重视环保和健康选择并且更喜欢玻璃包装而不是其他选择。此外,印度斯坦国家玻璃有限公司和朝日印度玻璃有限公司等许多公司为所有工业领域提供玻璃包装解决方案。

- 去年,印度容器玻璃製造商Sunrise Glass增加了一座产能为240 TPD的新熔炉。该公司目前营运两座熔炉,总合为 380 TPD。该公司表示,该炉有四条生产线,配备三台 AIS 10 Triple Gob (TG) Emhart 机器。所有生产线上都将安装EVM(检查机)。随着生产能力的扩大,该公司现在向美国和欧洲出口食品罐,主要出口到酒精饮料製造商。

- 过去三年来,跨国药用玻璃製造商和印度药用玻璃製造商一直在投资提高其设计能力。此外,全球领先的药用玻璃製造商 Gerresheimer、SGD Pharma 和 Schott 均对其印度业务进行了资本投资。近年来,其他参与者也采取了类似的倡议,预计将推动该国对玻璃瓶的需求。

- 食品饮料、食品加工、个人护理和医药终端用户行业的大量投资为印度瓶和容器玻璃行业创造了巨大的机会。从数量上看,酒精饮料是最大的子区隔,其次是食品和饮料、药用玻璃以及化妆品和香水。

饮料业需求预计较高

- 玻璃瓶和容器因其保持化学惰性、无菌性和渗透性的能力而主要用于酒精和非酒精饮料行业。啤酒等饮料占据了很大的市场占有率,因为玻璃不会与饮料中的化学物质发生反应,从而可以保留这些饮料的香气、浓度和味道,是一种很好的包装选择。由于这些原因,大多数啤酒都用玻璃瓶运输,预计这一趋势将在研究期间持续下去。啤酒被包装在深色玻璃瓶中以保存内容物,但当暴露在紫外线下时,瓶子很容易变质。

- 在国内,饮料终端用户正在推动市场需求。据印度工商联合会称,玻璃和硬质塑胶约占印度饮料包装的三分之二。但由于人们对环境问题的日益关注,玻璃包装的范围正在扩大。即饮(RTD)饮料,尤其是酒精饮料中越来越多地使用玻璃包装是印度饮料包装行业的当前趋势。玻璃包装产业的发展主要受到国内酒精饮料消费量成长的推动。

- 据印度国际经济关係研究委员会 (ICRIER) 称,未来十年,印度酒精消费成长的 70% 以上将来自中低收入和高所得人群,预计产品的优质化。

- 软性饮料是非酒精饮料业务最重要的贡献者。玻璃瓶装可乐占印度可乐销售的35%。饮料製造商可口可乐印度私人有限公司再次推广可回收玻璃瓶。这些瓶装饮料去年在部分邦推出,价格分布为 10 印度卢比(0.15 美元)(200 毫升),可口可乐、Thumbs Up 和雪碧等公司最畅销的品牌均有贩售。在某些市场,玻璃瓶现在占饮料销售额的 30%(资料来源:可口可乐)。

- 许多饮料预计都会使用玻璃瓶,特别是大厂商生产的饮料,都用玻璃瓶来装饰。对使用者来说,主要的优势是,使用玻璃瓶包装果汁和其他饮料时,包装材料中的化学物质几乎不会迁移。

印度玻璃包装产业概况

由于多家公司的竞争,印度玻璃包装市场适度整合。 Schott Kaisha Pvt Ltd.、AGI glaspac.、Piramal Glass Limited、Borosil Glass Works Limited 和 Haldyn Glass Limited 等市场参与者正在采用产品创新、伙伴关係和併购等策略来进一步扩大市场占有率。市场的主要发展包括:

- 2022 年 8 月—碱灰製造商 Nirma 已提交以 165 亿印度卢比(2.06 亿美元)收购最着名的印度斯坦国家玻璃有限公司 (HNGL) 的计划。非洲瓶子製造商 Madhvani Group 和玻璃容器製造商 AGI Greenpac 也提交了单独的解决方案。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 产业影响评估

- 贸易情景分析

第五章 市场动态

- 市场驱动因素

- 民众环保意识增强

- 国内饮料消费量增加

- 市场限制

- 铝和塑胶的替代包装选择

第六章 市场细分

- 按产品

- 瓶子/容器

- 管瓶

- 安瓿

- 注射器/药筒

- 按最终用户产业

- 食物

- 饮料(软性饮料、牛奶、酒精饮料、其他类型饮料)

- 化妆品、香水和个人护理

- 药品

第七章 竞争格局

- 公司简介

- Schott Kaisha Pvt Ltd(SCHOTT AG)

- AGI Glaspac(HSIL Ltd)

- Piramal Glass Limited

- Hindustan National Glass & Industries Limited(HNGIL)

- Schott Poonawalla Private Limited

- Gerresheimer AG

- Borosil Glass Works Limited(Klasspack Pvt. Ltd.)

- Haldyn Glass Limited(HGL)

- Sunrise Glass Industries Private Limited

- Ajanta Bottle Pvt Ltd

- GM Overseas

- Empire Industries Limited-Vitrum Glass

第八章投资分析

第九章:未来市场展望

The India Glass Packaging Market size is estimated at USD 6.76 billion in 2025, and is expected to reach USD 8.35 billion by 2030, at a CAGR of 4.31% during the forecast period (2025-2030).

The manufacturing and production of packaging and relatable industries are only functional in many countries where packaging contributes significantly to GDP. The trend witnessed a shift of focus from glass packagers in the country to the pharmaceutical industry.

Key Highlights

- India contributes the second-largest share of the pharmaceutical and biotech workforce worldwide. According to the Indian Economic Survey of 2021, the pharmaceutical market is expected to grow three times in the next decade. The country's pharmaceutical market was projected at USD 41 billion in 2021 and will reach USD 65 billion by 2024 and further expand to around USD 120-130 billion by 2030.

- Glass bottle characteristics, such as being non-porous, impermeable, eco-friendly, and aesthetically pleasing, lead to ever-increasing use in the packaging industry. In India, the glass industry is well established and has remained a cottage industry for a long time. The sector is recently evolving from hand-working processes to modern automation methods. According to the Hindusthan National Glass & Industries Ltd, Indian per capita consumption of glass packaging (1.8 kg) is much lower than other nations.

- The glass packaging industry is also driven by the growing environmental awareness among consumers, with glass packaging being reusable and an environmentally friendly alternative to plastic packaging. The increasing disposable incomes and changing consumers' lifestyles are also expected to drive the market's growth.

- One of the main challenges for the market is the increased competition from alternative forms of packaging, such as aluminum cans and plastic containers. The items are lighter in weight than the bulky glass, gaining popularity among manufacturers and customers because of the lower cost involved in their carriage and transportation. Moreover, the glass packaging industry is recently concentrating on increasing traceability to restrict counterfeit activities in the country. The companies are mentioned using permanent engravings on containers, protecting consumers from harmful practices by spurious product manufacturers.

- The recent investing trend in vaccines for COVID-19 in the country is emerging as a significant driver for the vials growth. For instance, according to IBEF, the Indian pharmaceutical sector supplies more than 50% of the global demand for various vaccines, around 40% of the generic market for the United States, and 25% of all medicines for the United Kingdom.

India Glass Packaging Market Trends

Glass Bottles/Containers Expected to Witness Significant Demand

- In India, only the usage of glass packaging solutions, especially bottles, is increasing as consumers emphasize eco-friendly and healthy options and prefer glass packaging over other options. Also, the country comprises many companies, including Hindustan National Glass and Asahi India Glass, offering glass packaging solutions across industries.

- Last year, India's container glass producer Sunrise Glass added a new furnace with an installed capacity of 240 TPD. The company currently operates two furnaces with a combined installed of 380 TPD. The company stated that the stove would have four lines with three AIS 10 triple gob (TG) Emhart Machines. All the lines will have EVM (Inspection Machines). With this capacity expansion, the company focuses on catering to significant liquor clients and exports to the USA and Europe for food-grade jars.

- Multinational pharmaceutical glass producers, along with Indian pharmaceutical glass producers, have invested in increasing designed capacity over the last three years. In addition, leading global pharmaceutical glass producers Gerresheimer, SGD Pharma, and Schott have invested capital in Indian operations. Such initiatives by other players are estimated to take place in recent years and will fuel the demand for glass bottles in the country.

- Considerable investments in the beverages, food processing, personal care, and pharmaceutical end-user industries have created enormous opportunities for the country's bottles/container glass industry. Alcoholic beverages are the largest sub-segment for bottles/container glass consumption on a volume basis, followed by food, pharmaceutical glass, and cosmetics & perfumery.

Beverage Sector Expected to Witness Significant Demand

- Glass bottles and containers are majorly used in the alcoholic and non-alcoholic beverage industries due to their ability to maintain chemical inertness, sterility, and non-permeability. Drinks such as beer account for a significant market share, as glass does not react with the chemicals present in drinks and, therefore, preserves the aroma, strength, and flavor of these beverages, making them a good packaging option. Due to this reason, most beer volume is transported in glass bottles, and this trend is expected to continue over the study period. Beer is packaged in dark-colored glass bottles to preserve the contents, which are prone to spoilage when exposed to UV light.

- The beverage end-user vertical is driving the market demand in the country. According to ASSOCHAM, glass and rigid plastics constitute about two-thirds of packaging in India's beverage sector. However, the industry's glass packaging scope is expanding due to growing environmental concerns. Increasing glass packaging usage for Beverages, especially for the alcoholic Ready to Drink (RTD) segment, is a current trend in the Beverage packaging industry of India. The glass packaging industry is primarily boosted by increasing alcoholic beverage consumption in the country.

- Moreover, ICRIER (Indian Council for Research on International Economic Relations) said over 70% of the growth in alcoholic beverage consumption in India in the next decade would be driven by the lower middle and upper middle-income groups, and there is a growing trend toward product premiumization.

- Soft drinks are the most significant contributor on which the business of non-alcoholic drinks rests. Glass bottles retain a 35% share of sales for Coke in India. Beverage maker Coca-Cola India Pvt. Ltd. is again promoting returnable glass bottles. The bottles rolled out last year at INR 10 (USD 0.15) price point (200 ml) in select states are available across the company's top-selling brands, such as Coca-Cola, Thums Up, and Sprite. In some markets, glass bottles now make up 30% of beverage sales (source: Coca-Cola).

- Many beverages are expected to use glass bottles, particularly those from large manufacturers that have been decorated with glass bottles. The main advantage for the user is that there is almost no dissolution from container materials when glass bottles are used as packaging containers for juice or other drinks.

India Glass Packaging Industry Overview

The India Glass Packaging Market is competitive owing to multiple players, which led the market to be moderately consolidated. Players in the market, such as Schott Kaisha Pvt Ltd., AGI glaspac., Piramal Glass Limited, Borosil Glass Works Limited, and Haldyn Glass Limited are adopting strategies like product innovation, partnerships, and mergers and acquisitions to increase their market share further. Some of the critical advancements in the market are:

- August 2022 - Soda ash producer Nirma submitted an INR 16,500 million (USD 206 million) plan to acquire one of the most prominent Hindustan National Glass Limited (HNGL). Africa-based bottle maker Madhvani Group and container glass producer AGI Greenpac have also submitted separate resolution plans for the company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

- 4.5 Trade Scenario Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Environmental Awareness Among the Population

- 5.1.2 Increasing Beverage Consumption in the Country

- 5.2 Market Restraints

- 5.2.1 Alternative Packaging Options such as Aluminum and Plastic

6 MARKET SEGMENTATION

- 6.1 By Product ( Revenue in USD Billion and Volume in Million Metric Tones)

- 6.1.1 Bottles/Containers

- 6.1.2 Vials

- 6.1.3 Ampoules

- 6.1.4 Syringe/Cartridges

- 6.2 By End-user Vertical ( Revenue in USD Billion and Volume in Million Metric Tones)

- 6.2.1 Food

- 6.2.2 Beverage (Soft Drinks, Milk, Alcoholic Beverages, Other Beverage Types)

- 6.2.3 Cosmetics, Perfumery and Personal Care

- 6.2.4 Pharmaceuticals

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schott Kaisha Pvt Ltd (SCHOTT AG)

- 7.1.2 AGI Glaspac (HSIL Ltd)

- 7.1.3 Piramal Glass Limited

- 7.1.4 Hindustan National Glass & Industries Limited (HNGIL)

- 7.1.5 Schott Poonawalla Private Limited

- 7.1.6 Gerresheimer AG

- 7.1.7 Borosil Glass Works Limited (Klasspack Pvt. Ltd.)

- 7.1.8 Haldyn Glass Limited (HGL)

- 7.1.9 Sunrise Glass Industries Private Limited

- 7.1.10 Ajanta Bottle Pvt Ltd

- 7.1.11 G.M Overseas

- 7.1.12 Empire Industries Limited- Vitrum Glass