|

市场调查报告书

商品编码

1637844

防爆设备:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Explosion Proof Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

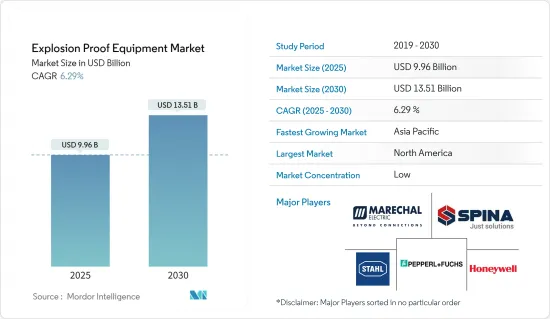

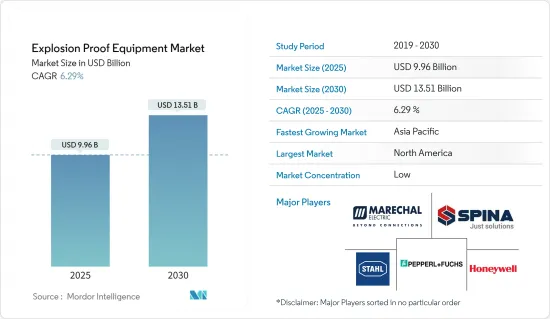

防爆设备市场规模预计到2025年为99.6亿美元,预计2030年将达到135.1亿美元,预测期内(2025-2030年)复合年增长率为6.29%。

主要亮点

- 技术进步和日益严格的安全法规正在推动防爆设备市场的成长。自动化和工业物联网 (IIoT) 的普及导致人们采用提供即时监控和控制的智慧防爆设备,从而提高安全性和营运效率。

- 此外,石油和天然气、采矿和化学製造等行业日益严格的安全标准也推动了对可靠防爆解决方案的需求。

- 技术进步和日益严格的安全法规正在推动防爆设备市场的成长。自动化和工业物联网 (IIoT) 的普及导致人们采用提供即时监控和控制的智慧防爆设备,从而提高安全性和营运效率。严格的安全标准和法规是石油和天然气、采矿和化学製造等多种行业对强大防爆解决方案需求的关键驱动力。

- 由于严格的安全标准和专门的设计,防爆设备通常非常昂贵。这种高成本也可能阻碍采用,特别是在成本敏感的地区和产业。此外,随着现有设备接近其生命週期终点或需要升级以跟上技术进步的步伐,这可能会导致防爆设备的更换和维护成本增加。

- 儘管防爆技术取得了进步,但在尺寸、重量和这些产品适合的不同环境方面仍然存在挑战。这些限制可能会限制其在某些产业或环境中的使用。

- 由于 COVID-19 大流行,防爆设备市场经历了双重影响。由于停工和经济放缓导致营运中断,石油、天然气和采矿等领域的需求下降。相反,製药和化学领域的活动增加,对防爆设备的需求也增加。此次疫情凸显了职场安全的重要性,从而提高了监管合规性并活性化了对先进安全设备的投资。此外,供应链中的挑战促使製造商进行创新和适应,重塑市场动态,以促进长期弹性和成长。

防爆设备市场趋势

石油和天然气领域占主要市场占有率

- 石油和天然气工业面临可燃性气体和蒸气的危害。安装防爆设备是法规要求,也是不可或缺的安全措施。此类设备对于降低爆炸风险以及保护人员和基础设施至关重要。

- 石油钻井平台是高风险环境,需要专门的监控系统,例如防爆摄影机,以防止发生事故。这些相机有助于避免火花造成的灾难。因此,这些先进的监控系统专为受监管的场所量身定制,尤其是定期进行钻井和精製活动的陆上石油钻井平台。

- 此外,2024 年 9 月,海上钻井承包商 Noble Corporation 表示,如果石油公司的需求持续增加,深水钻井钻机的租金可能会升至接近历史最高水准。

- 石油和天然气行业对防爆设备的需求,以及对自动化系统、远端监控和节能防爆产品的需求正在推动市场创新。例如,2024年10月,全球马达、驱动器和自动化技术製造商WEG在阿布达比国际石油展览及会议(ADIPEC)上推出了防爆马达W51Xdb。 W51Xdb 适用于危险和潜在爆炸性环境,是石油和天然气产业应用的理想选择。

- 此外,2024 年 3 月,危险区域电脑硬体供应商 HMI Elements 与荷兰防爆设备专家 Cobic-Ex 合作。此次合作旨在扩大HMi用于海上和陆上石油钻井平台的先进客製化PC工作站的分销网络。 Cobic-Ex 作为荷兰线上市场运营,提供各种 ATEX 设备和防爆解决方案,从摄影机、空调到特殊照明。此次合作将增强防爆产品的供应,有利于市场供应方。

- 因此,石油和天然气行业的防爆设备对于确保安全和遵守法规至关重要。从灯到开关和感测器,这些设备旨在在危险条件下安全运行,从而防止潜在的爆炸。由此可见市场对防爆设备的需求。

- 近年来,全球对石油和天然气的需求激增,推动了新生产工厂和探勘活动的投资。石油和天然气产业的繁荣推动了对防爆设备的需求。

- 例如,日益增长的环境问题正在加速全球向可再生能源的过渡,但这种过渡的实际影响预计只能在长期内感受到。目前的可再生能源技术在效率和可扩展性方面存在很大障碍,而石油和天然气仍然是初级能源。石油输出国组织(OPEC)的资料预测,全球原油需求将从2023年的1.0221亿桶/日增加到2024年的1.0446亿桶/日。

北美占最大市场占有率

- 北美是防爆解决方案的主要且成熟的市场。受强劲经济(特别是能源、电力和製造业)的推动,北美製造业正经历快速成长。这种繁荣将增加全国对防爆解决方案的需求。

- 推动这项需求的关键产业包括石油和天然气、采矿、电力和製造业,在各个工业州的业务不断成长。据美国环保署称,截至2023年4月,美国最危险的地区包括新泽西州、加州、宾州和纽约州。

- 根据美国能源资讯署(EIA)的数据,2024年9月美国汽油消费量达到898万桶/日。值得注意的是,汽油消费量于 2024 年 7 月达到顶峰,创下四周平均最高。石油和天然气行业不断增长的需求预计将在未来几年推动防爆工具市场的成长。

- 此外,EIA 强调美国是世界领先的石油和天然气生产国,在石化燃料供应方面投资超过 2,000 亿美元。此外,美国准备在本十年后半叶将液化天然气 (LNG) 出口能力的约 40% 推向市场。

- 采矿业是加拿大经济的支柱。它是各种贵重矿物和金属的顶级生产商之一,包括石棉、硫、钛、铂、铝、锌、铜、铅、银、金和其他贵金属。根据美国地质调查局的资料,2023年加拿大金矿产量约200吨。 2021年,在研究期间,加拿大黄金产量达到最高223吨。

防爆设备产业概况

在防爆设备市场,业界由ABB Ltd.、Intertek Group plc、Eaton Corporation plc、Pepperl+Fuchs GmbH、Honeywell RAE Systems、R. STAHL AG等业界领先供应商主导,最终服务多样化顾客。随着工业组织越来越拥抱数位转型,策略计画的执行显着增加。虽然业务效率是数位化的关键驱动因素,但人们也越来越关注提高工业设施和设备的安全性。

此外,公司越来越多地与行业同行调整其成长策略,并越来越受到先进工业解决方案提供商的关注。这一趋势将加剧现有企业之间的竞争,并吸引新参与企业进入市场。主要竞争因素包括价格、产品供应、市场占有率和市场进入强度。主要企业正在利用其研发能力和整合策略发挥重要影响力。然而,市场不仅高度渗透,而且高度细分。

在这种环境下,创新是永续竞争优势的核心。现有参与企业寻求透过差异化产品和扩大市场范围来维持自己的地位。市场供应商显着地展示了收购、与产业参与企业结盟以及采用新产品/服务等策略。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 市场驱动因素

- 加强危险区域和物质处理法规

- 能源需求的增加增加了对新矿山和油气资源探勘的需求

- 市场限制因素

- 经济活动停滞直接影响市场

- 安全法规因地区而异

第六章 市场细分

- 按保护方式分

- 防爆

- 防爆

- 爆炸隔离

- 按区域

- 0区

- 20区

- 1区

- 21区

- 2区

- 22区

- 按最终用户

- 製药

- 化学/石化

- 能源/电力

- 矿业

- 食品加工

- 石油和天然气

- 其他的

- 按系统

- 供电系统

- 物料输送

- 马达

- 自动化系统

- 监控系统

- 其他系统

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 亚洲

- 中国

- 日本

- 印度

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争格局

- 公司简介

- R. STAHL AG

- Marechal Electric Group

- RAE Systems(Honeywell)

- Pepperl+Fuchs GmbH

- Intertek Group PLC

- Adalet Inc.

- Bartec GmbH

- Alloy Industry Co. Ltd

- Rockwell Automation Inc.

- GM International SRL

- Siemens AG

- ABB Ltd

- Eaton Corporation PLC

- MAM Explosion-proof Technology(Shanghai)Co. Ltd

- CZ Electric Co. Ltd

第八章投资分析

第九章 市场机会及未来趋势

The Explosion Proof Equipment Market size is estimated at USD 9.96 billion in 2025, and is expected to reach USD 13.51 billion by 2030, at a CAGR of 6.29% during the forecast period (2025-2030).

Key Highlights

- Technological advancements and heightened safety regulations are propelling the growth of the explosion-proof equipment market. The surge in automation and the Industrial Internet of Things (IIoT) is leading to the adoption of smart explosion-proof devices, which provide real-time monitoring and control, thereby boosting safety and operational efficiency.

- Moreover, stringent safety standards across industries such as oil and gas, mining, and chemical manufacturing also drive the demand for reliable explosion-proof solutions.

- Technological advancements and heightened safety regulations are propelling the growth of the explosion-proof equipment market. The surge in automation and the Industrial Internet of Things (IIoT) is leading to the adoption of smart explosion-proof devices, which provide real-time monitoring and control, thereby boosting safety and operational efficiency. Various industries, notably oil and gas, mining, and chemical manufacturing, are witnessing a heightened demand for robust explosion-proof solutions, largely due to stringent safety standards and regulations.

- Due to stringent safety standards and specialized designs, explosion-proof equipment often carries a premium price. This high cost can hinder its adoption, especially in regions or industries sensitive to expenses. Additionally, as existing equipment nears the end of its lifecycle or requires upgrades to keep pace with technological advancements, it can lead to increased replacement and maintenance costs for explosion-proof equipment.

- Despite advancements in explosion-proof technology, challenges remain regarding size, weight, and the variety of environments suitable for these products. Such limitations can confine their use in specific industries or settings.

- The explosion-proof equipment market experienced a dual impact from the COVID-19 pandemic. Lockdowns and economic slowdowns led to operational disruptions and diminished demand in sectors like oil and gas and mining. Conversely, heightened activity in the pharmaceuticals and chemicals sectors spurred demand for explosion-proof equipment. The pandemic underscored the importance of workplace safety, resulting in stricter regulatory compliance and bolstered investments in advanced safety equipment. Furthermore, challenges in the supply chain pushed manufacturers to innovate and adapt, reshaping market dynamics and promoting long-term resilience and growth.

Explosion Proof Equipment Market Trends

Oil and Gas Segment Holds Major Market Share

- The oil and gas industry faces hazards from flammable gases and vapors. Installing explosion-proof equipment has become a regulatory requirement and an essential safety measure. Such devices are crucial in mitigating explosion risks and safeguarding personnel and infrastructure.

- Oil rigs, being high-risk environments, necessitate specialized surveillance systems, including explosion-proof cameras, to prevent accidents. These cameras are instrumental in averting catastrophic incidents triggered by sparks. Consequently, these advanced surveillance systems are tailored for regulated sites, particularly onshore oil rigs, where drilling and refining activities occur regularly.

- Additionally, in September 2024, Noble Corporation, an offshore drilling contractor, reported that the price to rent a deepwater drilling rig might climb to near-record levels if demand from oil companies continues to increase in the future, driving the production activities in the oil and gas sector, and will create a growth opportunity for the studied market.

- The demand for explosion-proof equipment in the oil and gas industries, along with the demand for automation systems, remote monitoring, and energy-efficient explosion-proof products, is driving innovations in the market. For instance, in October 2024, WEG, a global manufacturer of electric motors, drives, and automation technologies, launched its explosion-proof W51Xdb motor at the Abu Dhabi International Petroleum Exhibition and Conference (ADIPEC). The W51Xdb is suitable for hazardous or potentially explosive environments, making it ideal for applications in oil and gas industries.

- Additionally, in March 2024, HMi Elements, a provider of computer hardware for hazardous areas, partnered with Cobic-Ex, a Dutch expert in explosion-proof equipment. This collaboration aims to broaden the distribution network for HMi's advanced PC workstations, tailored for offshore and land-based oil rigs. Cobic-Ex operates as an online marketplace in the Netherlands, offering a diverse range of ATEX equipment and explosion-proof solutions, from cameras and air conditioners to specialized lighting. Through this partnership, the market's supply side will benefit, bolstering the availability of explosion-proof products.

- Therefore, explosion-proof equipment in the oil and gas industry is vital for ensuring safety and adhering to regulations. These devices, ranging from lighting to switches and sensors, are engineered to function safely under hazardous conditions, thereby preventing potential explosive incidents. This shows the need for explosion-proof equipment in the market.

- In recent years, global demand for oil and gas has surged, prompting investments in new production plants and exploration activities. This uptick in the oil and gas sector subsequently fuels the demand for explosion-proof equipment.

- For instance, even with a worldwide shift towards renewable energy spurred by escalating environmental concerns, the tangible effects of this transition are expected to materialize only in the long run. Current renewable technologies face hurdles in efficiency and scalability, allowing oil and gas to retain their status as primary energy sources. Supporting this, the Organization of the Petroleum Exporting Countries (OPEC) data forecasts an increase in global crude oil demand from 102.21 million barrels per day in 2023 to 104.46 million barrels per day in 2024.

North America Holds Largest Market Share

- North America stands as a leading and sophisticated market for explosion-proof solutions. Bolstered by a robust economy, particularly in the energy, power, and manufacturing sectors, North America is witnessing a surge in manufacturing growth. This upswing is set to bolster the demand for explosion-proof solutions nationwide.

- Key sectors driving this demand include oil and gas, mining, power, and manufacturing, surging their presence in various industrial states. According to EPA, as of April 2023, some of the most hazardous areas in the US include New Jersey, California, Pennsylvania, New York, and many others.

- According to the US Energy Information Administration (EIA), US gasoline consumption hit 8.98 million barrels daily in September 2024. Notably, July 2024 saw gasoline consumption peak with its highest four-week average. This rising demand from the oil and gas sector is anticipated to fuel the growth of the explosion-proof tools market in the coming years.

- Furthermore, the EIA highlights the US as the globe's leading oil and gas producer, investing over USD 200 billion in fossil fuel supply-roughly 19% of the worldwide total. Additionally, the US is poised to introduce about 40% of the new liquefied natural gas (LNG) export capacity, set to hit the market in the latter half of the decade.

- Canada's mining sector stands as a pillar of its economy. The nation ranks among the top producers of diverse valuable minerals and metals, such as asbestos, sulfur, titanium, platinum, aluminum, zinc, copper, lead, silver, gold, and other precious metals. Data from the US Geological Survey indicates that in 2023, Canada's gold mine production was approximately 200 metric tons. Canadian gold production peaked at 223 metric tons in 2021 during the study period.

Explosion Proof Equipment Industry Overview

In the explosion-proof equipment market, a select group of suppliers, including industry leaders such as ABB Ltd., Intertek Group plc, Eaton Corporation plc, Pepperl+Fuchs GmbH, Honeywell RAE Systems, and R. STAHL AG, dominate the landscape, serving a diverse array of end customers worldwide. As industrial organizations increasingly embrace digital transformation, there's a marked uptick in executing strategic plans. While the primary driver for this digitization is operational efficiency, there's a growing emphasis on enhancing the safety and security of industrial facilities and equipment.

Moreover, companies are closely aligning their growth strategies with industry peers, drawing increased attention from advanced industrial solution providers. This trend is poised to heighten competition among existing players and lure new entrants into the market. Key competitive factors include pricing, product offerings, market share, and the intensity of market engagement. Leading companies leverage their research and development (R&D) capabilities and consolidation strategies to exert significant influence. Yet, the market not only witnesses high penetration but is also increasingly fragmented.

In this landscape, innovation is the cornerstone of a sustainable competitive advantage. Established players are homing in on product differentiation and broadening their market reach to uphold their standing. Market vendors have prominently showcased strategies like acquisitions, partnerships with industry players, and the introduction of new products/services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Stricter Regulations for Handling Hazardous Areas and Substances

- 5.1.2 Increasing Energy Requirements Drives the Demand for Exploration of New Mines and Oil and Gas Resources

- 5.2 Market Restraints

- 5.2.1 Slow Economic Activity Directly Affects the Market

- 5.2.2 Safety Regulations Vary Across Different Geographies

6 MARKET SEGMENTATION

- 6.1 By Method of Protection

- 6.1.1 Explosion Proof

- 6.1.2 Explosion Prevention

- 6.1.3 Explosion Segregation

- 6.2 By Zone

- 6.2.1 Zone 0

- 6.2.2 Zone 20

- 6.2.3 Zone 1

- 6.2.4 Zone 21

- 6.2.5 Zone 2

- 6.2.6 Zone 22

- 6.3 By End-user

- 6.3.1 Pharmaceutical

- 6.3.2 Chemical and Petrochemical

- 6.3.3 Energy and Power

- 6.3.4 Mining

- 6.3.5 Food Processing

- 6.3.6 Oil and Gas

- 6.3.7 Other End Users

- 6.4 By System

- 6.4.1 Power Supply System

- 6.4.2 Material Handling

- 6.4.3 Motor

- 6.4.4 Automation System

- 6.4.5 Surveillance System

- 6.4.6 Other Systems

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 Germany

- 6.5.2.3 France

- 6.5.3 Asia

- 6.5.3.1 China

- 6.5.3.2 Japan

- 6.5.3.3 India

- 6.5.4 Australia and New Zealand

- 6.5.5 Latin America

- 6.5.6 Middle East and Africa

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 R. STAHL AG

- 7.1.2 Marechal Electric Group

- 7.1.3 RAE Systems (Honeywell)

- 7.1.4 Pepperl+Fuchs GmbH

- 7.1.5 Intertek Group PLC

- 7.1.6 Adalet Inc.

- 7.1.7 Bartec GmbH

- 7.1.8 Alloy Industry Co. Ltd

- 7.1.9 Rockwell Automation Inc.

- 7.1.10 G.M. International SRL

- 7.1.11 Siemens AG

- 7.1.12 ABB Ltd

- 7.1.13 Eaton Corporation PLC

- 7.1.14 MAM Explosion-proof Technology (Shanghai) Co. Ltd

- 7.1.15 CZ Electric Co. Ltd