|

市场调查报告书

商品编码

1686663

亚太防爆设备:市场占有率分析、产业趋势与成长预测(2025-2030 年)Asia-Pacific Explosion Proof Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

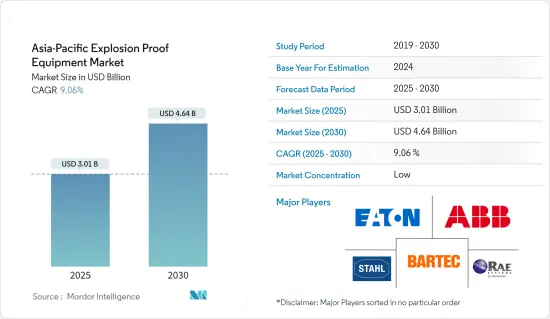

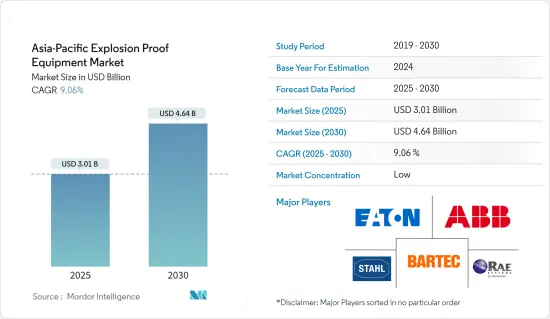

亚太防爆设备市场规模预计在 2025 年为 30.1 亿美元,预计到 2030 年将达到 46.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 9.06%。

防爆设备可用于各种领域,包括航空和飞机维修场所、建筑工地、暖气、通风和空调系统、製造机械和加工设备、采矿以及石油和天然气开采。工业应用中最常见的一些设备包括照明、监控和信号系统。

主要亮点

- 预计防爆设备市场将受到亚洲国家(尤其是中国和印度)日益增长的工业化的推动。亚太地区工业环境中危险油漆、化学品和其他可燃粉尘的增加导致爆炸事故的增加。

- 石油天然气和化学工业容易发生爆炸,因此预计在预测期内将推动市场成长。在石油和天然气行业,防爆有两个要求:设备必须按照正确的标准製造,然后按照这些标准进行安装和维护。日益增长的能源需求以及新矿山和石油天然气蕴藏量的探勘推动了对防爆设备的需求。

- 此外,对整合系统的需求不断增长、自动化领域的进步、工业领域的成长以及政府对处理危险区域的严格规定预计将推动市场成长。各个组织都制定了具体的设施标准,以确保劳动力和基础设施的安全。 OSHA 积极主动地为员工提供安全和支持性的工作环境,并制定职场标准。

- 儘管危险区域设备产业正在成长,但仍有几个因素阻碍其进一步发展。设备费用高昂以及需要合格的专业人员来操作设备是影响市场扩张的主要障碍。

亚太地区防爆设备趋势

石油和天然气产业成长强劲

- 石油和天然气行业的工人经常需要在危险的条件下工作。在存在大量易燃液体、气体、蒸气或可燃粉尘的情况下,安全至关重要。

- 石油和天然气设施面临巨大的火灾风险,因为电气设备和机械靠近易燃材料。石油和气体纯化和加工设施含有危险的化学化合物、石油和天然气,并且有电火花可能点燃这些化合物的风险。因此,该行业在此类危险区域的监管需求中占有很大的份额。此外,该行业对工人安全进行严格监管,这进一步促进了需求。

- 防护罩低压IP摄影机的出现是防爆摄影机技术最重要的发展之一。与需要额外安装基础设施和人力的传统 110V AC 高压安装相比,固定 PoE+ 摄影机提供了大幅节省成本的新机会。 PoE+摄影机的进步也与传统的24伏特系统形成了鲜明对比。

- 此外,印度和中国等国家分别在阿拉伯海和朱加尔盆地发现石油蕴藏量,也有望推动该领域的成长。据石油规划和分析小组称,到 2024 财年末,由于即将对探勘过程进行的投资,印度的原油产量可能会恢復。预计此类发展将增加对防爆设备的需求。

中国占最大市场占有率

- 中国是世界主要生产设备和工具机生产国和出口国之一。过去十年来,该国製造业活动不断成长,设备和工具产量也随之增加。因此,防爆设备的采用率正受到这种成长的影响。

- 预计生产过程自动化程度的提高将推动对防爆解决方案的需求。此外,许多工业和製造工厂的工作人员会定期进行现场检查,以确保设施和设备的安全和良好的工作状态,沿着既定路线行驶并在沿途的特定地点检查测试设备。

- 对提高生产力的需求不断增长,正在改变製造业的基础设施、流程和技术。由于这些行业趋势,防爆设备的采用预计会增加。

- 国际能源总署预计,2040年,中国天然气需求量将占全球天然气需求量的2,800亿立方公尺,预计2040年中国石油净进口量将达到1,300万桶/日,届时中国可望超过美国成为全球最大石油消费国。中国已经制定了2030年的二氧化碳排放目标,并计划在2060年实现碳中和。这迫切需要增加清洁能源的使用,减少对中国石化燃料依赖有害的排放。这表明,未来几年我们将看到越来越多的计划正在进行中。

- 由于勘探和生产设施的增加以及新安全法规的实施,它正在成为成长引擎。去年,中国东北的山东省发生爆炸,多名矿工被困近两天,爆炸还损坏了通讯系统,切断了所有联繫。中国矿难频繁,企业防护记录不佳,法规执行不力,导致该地区对防爆设备的需求增加。

亚太防爆设备产业概况

亚太防爆设备市场较为分散,由多家参与者组成。从市场占有率来看,目前市场主要被几家大公司占据。然而,透过技术创新和开拓进取,许多公司正在透过赢得和开发新契约来扩大其市场影响力。例如

- 2023 年 12 月,R. Stahl 推出了其 Ex e 开关和配电盘。新的 8530 和 8550 系列设计的工作电流高达 125A,两个版本均从 40A 扩展到 63A。

- 2023 年 10 月,Pepperl+Fuchs 推出新款 SmartEx 03 高效能 5G 智慧型手机,将危险区域的数位化流程提升到一个新的水平。它具有广泛的功能,可满足所有行业要求,包括 IP 语音、可编程按钮、仅 Wi-Fi 模式、远端诊断和远端支持,以实现工业 4.0 最多样化的应用。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 行业法规

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 加强危险区域及危险物质处理规定

- 不断增长的能源需求推动了新矿山和石油天然气资源的探勘

- 市场限制

- 安装成本高,投资高

第六章市场区隔

- 按类型

- 防爆

- 防爆

- 防爆隔离

- 按区域

- 0区

- 20区

- 1区

- 21区

- 2区

- 22区

- 按最终用户

- 製药

- 化工和石化

- 能源与电力

- 矿业

- 食品加工

- 石油和天然气

- 其他最终用户

- 按系统

- 供电系统

- 物料输送

- 马达

- 自动化系统

- 监控系统

- 其他系统

- 按国家

- 中国

- 印度

- 日本

第七章竞争格局

- 公司简介

- R. Stahl Group

- Marechal Electric Group

- Adalet

- Bartec GmbH

- Rae Systems(Acquired By Honeywell)

- Pepperl+Fuchs

- Alloy Industry Co. Ltd

- Cordex Instruments

- ABB Limited

- GM International SRL

- Eaton Corporation PLC

- Warom Technology Inc.

- Phoenix Mecano

- MAM Explosion-proof Technology(Shanghai)Co. Ltd

- CZ Electric Co. Ltd

第八章投资分析

第九章:市场的未来

The Asia-Pacific Explosion Proof Equipment Market size is estimated at USD 3.01 billion in 2025, and is expected to reach USD 4.64 billion by 2030, at a CAGR of 9.06% during the forecast period (2025-2030).

In a variety of sectors, such as aeronautics and aircraft maintenance sites, construction sites, heating, ventilation, and air conditioning systems, manufacturing machines and processing units, mining, and oil and gas extraction, explosion-proof equipment is available. Some of the most common types of equipment in the industrial sector are lighting, surveillance, and signal systems.

Key Highlights

- The market for explosion-proof equipment is expected to be driven by the growth of industrialization in Asian countries, particularly China and India. In view of the growing presence of dangerous paints, chemicals, and other combustible dust in industrial environments throughout Asia-Pacific, there has been a rise in explosions.

- The oil and gas and chemical industries are expected to drive the growth of the market during the forecast period, as these industries are more prone to explosions. Explosion proofing has two requirements in the oil & gas industry: equipment must be built to the right standards and then installed and maintained in line with the further standards. The need for explosion-proof equipment is driven by increasing energy demands and demand for exploration of new mines and oil and gas reserves.

- Moreover, increasing demand for integrated systems, progress in the automation sector, growth in industrial sectors, and stringent government regulations in handling hazardous areas are projected to foster the market's growth. Various organizations are setting specific equipment standards to ensure the safety of the workforce and infrastructure. OSHA has been proactively working toward providing safe and conducive working conditions for employees by stipulating standards for workplaces.

- Although the hazardous area equipment industry has experienced growth, there are several factors that impede its further development. The significant expenses associated with the equipment and the necessity for qualified professionals to operate them are the primary obstacles affecting the expansion of the market.

Asia-Pacific Explosion Proof Equipment Market Trends

The Oil and Gas Industry to Show Significant Growth

- Workers in the oil and gas industry frequently have to work in dangerous conditions. In situations where significant quantities of flammable liquids, gases, vapors, or combustible dust are present, safety is of paramount importance.

- The probability of ignition from electric devices and machines that are close to flammable substances increases significantly in oil & gas facilities. The presence of dangerous chemical compounds, oil, and gas in oil & gas refining and processing facilities poses a risk of electrical sparks igniting such compounds. Hence, the industry commands a large share of the demand for regulations in such hazardous areas. In addition, the industry is highly regulated for worker safety, which further contributes to the demand.

- The advent of low-voltage IP cameras for housings is one of the most significant developments in explosion-proof camera technology. Compared to traditional high-power 110 V AC installations, which require additional infrastructure and personnel to install them, there are new opportunities for fixed PoE+ cameras that can significantly reduce costs. The advancement of PoE+ cameras is also in contrast to the conventional 24-volt system.

- Moreover, the discovery of oil reserves in countries such as India and China, in the Arabian Sea and Juggar Basin, respectively, is also projected to drive the segment's growth. According to the Petroleum Planning and Analysis Cell, by the end of FY2024, India's crude oil production is poised to recover as a result of upcoming investments in the exploration processes. Such developments are expected to drive the demand for explosion-proof equipment.

China to Hold the Highest Market Share

- China is one of the major producers and exporters of production equipment and machine tools globally. Equipment and tools production in the country has grown in the past decade as a result of an increase in manufacturing activities. Consequently, the rate of adoption of explosion-resistant equipment is influenced by this growth.

- The demand for explosion-proof solutions is anticipated to be driven by the growing use of automation in production processes. In addition, staff regularly carry out field inspections on a regular basis to keep facilities and equipment safe and in good working order at many industrial and manufacturing plants by patrolling the defined routes and checking inspection devices at selected points along the way.

- Allied pressures have led to changes in the underlying infrastructure, processes, and technologies of the manufacturing sector as a result of growing productivity requirements. The adoption of explosion-proof equipment is expected to increase as a result of these industry trends.

- According to the IEA, by 2040, China is expected to account for 280 billion cubic meters of global natural gas demand. With a projected net import of 13 million barrels per day by 2040, China is likely to overtake the United States as the world's largest oil consumer. The country has already set a 2030 carbon emission reduction target. By 2060, China wants to be carbon neutral. To that end, there is an urgent need to increase the use of clean energy and reduce emissions that are detrimental to China's reliance on fossil fuels. This shows that in the coming years, there will be a growing number of projects underway.

- The country is emerging as a growth engine due to the increasing exploration and production facilities and the introduction of new safety regulations. In the previous year, various miners in China's northeastern Shandong province had been trapped for almost two days following an explosion, where the blast damaged their communication systems, cutting off all contact. Mining accidents are pretty common in China, where enterprises have a poor protection record and regulations are not adequately enforced, which is driving the need for explosion-proof equipment in the region.

Asia-Pacific Explosion Proof Equipment Industry Overview

The Asia-Pacific explosion-proof equipment market is fragmented and consists of several players. In terms of market share, few major players currently dominate the market. However, with innovation and technological development, many companies are increasing their market presence by securing new contracts and by tapping new markets. For instance,

- In December 2023, R. STAHL introduced the Ex e switching and power distribution boards, which shall be protected by new 8530 and 8550 explosion-resistant components. The design of the new 8530 and 8550 series, which has been extended to 63 A from 40 A with an operating current of up to 125 A in both versions, is a major feature.

- In October 2023, Pepperl+Fuchs took digitization processes in hazardous areas to a new level with the launch of the new SmartEx 03 high-performance 5G smartphone. It is equipped with a wide range of features that meet all industry requirements, including voice over IP, programmable buttons, Wi-Fi only mode, remote diagnostics, and remote support for the implementation of the most diverse applications of Industry 4.0.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Regulation

- 4.5 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Stricter Regulations for Handling Hazardous Areas and Substances

- 5.1.2 Increasing Energy Requirements Driving the Demand for Exploration of New Mines and Oil and Gas Resources

- 5.2 Market Restraints

- 5.2.1 Pricey Investments Due to High Costs of Installation of the Equipment

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Explosion Proof

- 6.1.2 Explosion Prevention

- 6.1.3 Explosion Segregation

- 6.2 By Zone

- 6.2.1 Zone 0

- 6.2.2 Zone 20

- 6.2.3 Zone 1

- 6.2.4 Zone 21

- 6.2.5 Zone 2

- 6.2.6 Zone 22

- 6.3 By End User

- 6.3.1 Pharmaceutical

- 6.3.2 Chemical and Petrochemical

- 6.3.3 Energy and Power

- 6.3.4 Mining

- 6.3.5 Food Processing

- 6.3.6 Oil & Gas

- 6.3.7 Other End Users

- 6.4 By System

- 6.4.1 Power Supply System

- 6.4.2 Material Handling

- 6.4.3 Motor

- 6.4.4 Automation System

- 6.4.5 Surveillance System

- 6.4.6 Other Systems

- 6.5 By Country

- 6.5.1 China

- 6.5.2 India

- 6.5.3 Japan

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 R. Stahl Group

- 7.1.2 Marechal Electric Group

- 7.1.3 Adalet

- 7.1.4 Bartec GmbH

- 7.1.5 Rae Systems (Acquired By Honeywell)

- 7.1.6 Pepperl+Fuchs

- 7.1.7 Alloy Industry Co. Ltd

- 7.1.8 Cordex Instruments

- 7.1.9 ABB Limited

- 7.1.10 G. M. International SRL

- 7.1.11 Eaton Corporation PLC

- 7.1.12 Warom Technology Inc.

- 7.1.13 Phoenix Mecano

- 7.1.14 MAM Explosion-proof Technology (Shanghai) Co. Ltd

- 7.1.15 CZ Electric Co. Ltd