|

市场调查报告书

商品编码

1637849

中东和非洲的无菌包装:市场占有率分析、行业趋势、统计数据和成长预测(2025-2030 年)Middle East And Africa Aseptic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

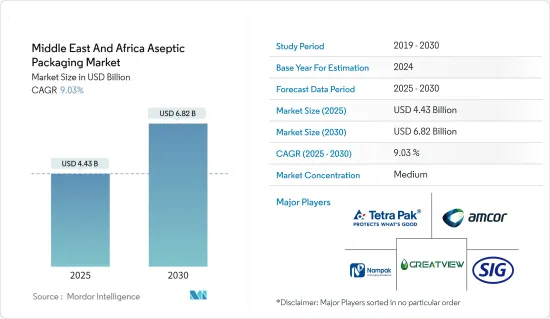

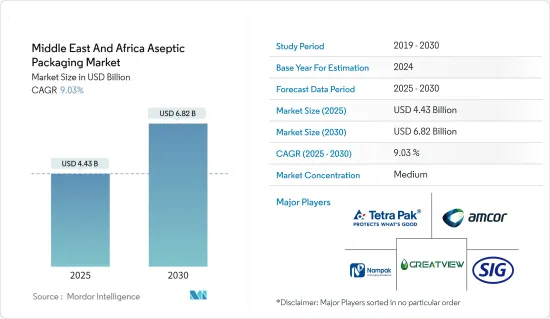

中东和非洲无菌包装市场规模预计在 2025 年为 44.3 亿美元,预计到 2030 年将达到 68.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 9.03%。

主要亮点

- 无菌包装市场的主要成长动力是包装材料满足持续高产品品质和营养保留的需求的能力。它还可以避免其他包装类型(如罐头内衬)中经常出现的双酚 A (BPA) 争议。无菌包装满足了所有这些要求,并且可以在不冷藏的情况下将某些产品的保质期延长约 6 至 12 个月。

- 快速都市化和消费品多样化是推动无菌包装发展的主要因素。对加工食品和一次性医疗用品的需求不断增长也推动了该地区采用无菌包装。

- 人们生活方式的改变导致了从家庭烹饪到已烹调产品的转变。这些生活方式的改变以及由此导致的消费者对加工、包装和已调理食品的依赖正在推动对无菌纸盒包装解决方案的需求。超级市场文化的出现也改变了购物格局,增加了包装的需求,特别是食品和饮料的包装。

- 无菌包装减少了产品中添加防腐剂的需要,在那些转向天然、无防腐剂产品的消费者中越来越受欢迎。无菌包装也有助于降低运输和配送成本,因为在运输和配送过程中它不需要冷藏,环境也更为宽鬆。

- 区域无菌包装市场正处于起步阶段。然而,对健康和产品保质期的日益关注是影响该地区成长的主要因素之一。

中东和非洲无菌包装市场的趋势

越来越多地采用无菌纸盒包装来延长产品保质期

- 消费者正在寻找保质期更长、使用效率更高的产品。这迫使企业想出替代传统包装的包装解决方案。对于希望在不依赖复杂冷藏链的情况下扩大产品供应的公司来说,生产保质期更长的包装变得至关重要。

- 透过保护产品免受氧气、湿气和微生物等潜在劣化因素的影响,可以延长保质期。公司需要具有成本效益的包装解决方案来实现相同的目标。减少整个食品供应链中的浪费对于减少农业对环境的影响和满足日益增长的粮食需求至关重要。投资高效、低成本和永续的加工和包装解决方案来延长产品保质期是一个可行的解决方案,从而推动了对无菌纸盒包装的需求。

- 食品包装不再只是起到保护食品和销售食品的被动作用。减少防腐剂的重视也是无菌包装的驱动因素之一。无菌食品储藏可使加工食品在打开纸箱之前无需添加防腐剂就能保存更长时间。

- 随着非洲财富的不断增长导致饮食习惯的改变,乳製品产业有望蓬勃发展。 IFCN酪农研究网估计,到2030年,乳品消费量将增加三分之一以上,而为满足需求,起司和奶油的进口量预计将增加一倍以上。此外,联合利华、雀巢和帝亚吉欧等全球巨头都在非洲扩大业务,以利用人口激增、中产阶级不断壮大以及拉各斯、开罗和约翰内斯堡等城市日益都市化。

- 根据沙乌地阿拉伯统计总局的数据,2020 年沙乌地阿拉伯食品和饮料服务市场创造了约 144.6 亿美元的销售额。预计到 2025 年这一金额将达到约 1,603 万美元。这种增长表明包装食品和饮料的消费量可能会激增,这可能对无菌纸盒包装产生积极影响。

预测期内,医药和医疗保健领域预计将大幅成长

- 预灌封注射器克服了非肠道给药方式缺乏便利性、价格、准确性、无菌性和安全性等缺点。这些注射器可以更容易管理糖尿病和类风湿性关节炎等慢性疾病,从而在预测期内增加自动注射器和笔式註射器的使用量。预计预测期内中东和非洲糖尿病和其他慢性病盛行率的不断上升将导致市场需求增加。

- 随着製药业寻求新的、更便捷的药物输送方法,预填充式注射器成为快速成长的单位剂量分配选择。它还使製药公司能够最大限度地减少药物浪费,延长产品寿命,并允许患者在家中而不是在医院自行注射药物。

- 大约80%的管瓶和安瓿瓶都是由玻璃製成的,因为它们适用于多种药物组合,但它们面临剥落和破损等挑战。环状烯烃聚合物(COP)和环状烯烃共聚物(COC)等替代塑胶管瓶预计将在未来五年内获得显着的市场占有率。 Schott AG 和 Amcor Group GmbH 等领先公司在製药应用的 COC 方面拥有专业知识。这些发展推动了该地区对无菌包装的需求。

- 此外,根据国际糖尿病联盟中东和北非地区预测,2021年约有7,300万人(20-79岁)将罹患糖尿病,到2045年将有1.36亿成年人罹患糖尿病。 2021年至2045年间,非洲20至79岁糖尿病患者数量预计将增加134%。同时,中东和非洲预计将出现87%的激增。因此,胰岛素产业的成长有望推动预灌封注射器市场的发展,并进一步促进无菌包装市场的发展。

中东和非洲无菌包装产业概况

中东和非洲的无菌包装市场已呈现半固体,已有多家本地和国际供应商进入该市场。市场的主要参与者包括 Tetra Pak International SA、Amcor Group GmbH、SIG Group AG、Mondi PLC、Nampak Ltd、Greatview Aseptic Packaging Company 和 International Aseptic Paperboard Mfg LLC。参与者采用产品创新、併购等各种策略,主要是为了扩大影响力并保持竞争优势。

- 2023年11月,领先的无菌包装系统和解决方案供应商SIG Group AG宣布为阿联酋的餐饮业领导者和新兴企业推出一款灌装机。 SIG SmileSmall 24 无菌填充机和 SIG CleanPouch 25 无菌填充机可在位于杜拜硅谷的 SIG 技术中心购买。这些灌装机为食品和饮料创新者提供了一系列好处和可能性,包括产品测试和创新、性能、容量灵活性和 SIG 的 Drinksplus 功能。

- 2023 年 11 月,利乐国际公司 (Tetra Pak International SA) 与食品製造商 Lactogal 合作推出了“Tetra Brik 200 Slim Leaf”,这是一款带有纸质屏障的无菌纸盒。为了将包装中可再生材料的使用率提高到90%,纸箱由大约80%的纸板製成。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 技术简介

- 评估地缘政治情势对产业的影响

第五章 市场动态

- 市场驱动因素

- 低温运输物流成本降低需求日益增加

- 长期产品储存需求快速成长

- 市场挑战

- 环境和回收问题

- 製造复杂性增加(例如原材料成本上升)和投资回报率降低

第六章 市场细分

- 按包装材质

- 金属

- 玻璃

- 纸和纸板

- 塑胶

- 其他包装材料

- 按包装类型

- 纸盒

- 袋子和小袋

- 杯子和托盘

- 瓶子和罐子

- 能

- 其他包装类型

- 按最终用户产业

- 食物

- 饮料

- 製药和医疗

- 其他最终用户产业

- 按国家

- 沙乌地阿拉伯

- 南非

- 阿拉伯聯合大公国

第七章 竞争格局

- 公司简介

- Tetra Pak International SA

- Amcor Group GmbH

- Nampak Ltd

- DS Smith PLC

- SIG Group AG

- Uflex Limited

- Mondi PLC

- Greatview Aseptic Packaging Company

- International Aseptic Paperboard Mfg. LLC

- Smurfit Kappa Group PLC

第八章投资分析

第九章:市场的未来

The Middle East And Africa Aseptic Packaging Market size is estimated at USD 4.43 billion in 2025, and is expected to reach USD 6.82 billion by 2030, at a CAGR of 9.03% during the forecast period (2025-2030).

Key Highlights

- The main growth drivers in the aseptic packaging market are the packaging material's ability to meet the demands for high, consistent product quality and nutrient retention. Also, the capacity to avoid the bisphenol A (BPA) controversy is frequently found in other packaging types, such as can liners. Aseptic packaging has met all these requirements and extends the shelf life of some products by an estimated six to twelve months without refrigeration.

- Rapid urbanization and the variety of consumer goods are key factors promoting the development of aseptic packaging. The rising demand for processed foods and disposable medical supplies also drives the adoption of aseptic packaging in the region.

- The altering lifestyles of people have resulted in the shift from home-cooked to ready-to-eat products. These lifestyle changes and consumers' consequent dependence on processed, packaged, and pre-cooked food are increasing the demand for aseptic carton packaging solutions. The advent of supermarket culture has also altered the shopping landscape and increased the need for packaging, especially in food and beverage products.

- Aseptic packaging reduces the need to add preservatives to the product, which is gaining attention among consumers who are focusing on natural and no-preservative products. Also, aseptic packaging helps reduce shipping and distribution costs by eliminating the need for refrigerated, more relaxed environments during shipping and distribution.

- The regional aseptic packaging market is in its early stages. However, increasing concerns regarding health and product shelf life are some of the major factors affecting its growth in the region.

Middle East And Africa Aseptic Packaging Market Trends

Increasing Adoption of Aseptic Carton Packaging to Increase the Shelf-life of Products

- Consumers have been demanding products with a longer shelf life and more efficient usage. This has necessitated the companies to devise alternative packaging solutions to traditional packaging. With companies seeking to expand their product offerings with less dependence on sophisticated cold storage chains, producing packages that provide longer shelf life has become crucial.

- Protecting products from potential deteriorating agents, such as oxygen, moisture, and microbes, can increase shelf life. Companies need a cost-effective packaging solution to achieve the same. Reducing wastage throughout the food supply chain is likely a crucial activity to reduce the environmental impact of agriculture and serve the increasing food demand. Investing in efficient, low-cost, and sustainable processing and packaging solutions to increase product shelf life is a viable solution, thus increasing the demand for aseptic carton packaging.

- Food packaging is no longer just a passive role in protecting and marketing a food product. The emphasis on decreasing preservatives is also a driving factor for aseptic packaging, as aseptic food preservation methods enable processed food to be kept longer without preservatives until the carton is opened.

- The dairy industry is expected to prosper as Africa's growing wealth translates to evolving diets. The IFCN Dairy Research Network estimates intake will increase by more than a third by 2030, in which time imports of cheese and butter are expected to more than double to meet that demand. Furthermore, global giants like Unilever, Nestle, and Diageo are all running massive operations across Africa as they seek to capitalize on surging population growth, a rising middle class, and increasing urbanization in cities such as Lagos, Cairo, and Johannesburg.

- According to the General Authority for Statistics, the revenue of the food and beverage service activities market in Saudi Arabia was worth about USD 14.46 billion in 2020. This amount is anticipated to reach around USD 16.03 million in 2025. This growth indicates a potential surge in the consumption of packaged foods and beverages, which can positively impact aseptic carton packaging.

The Pharmaceutical and Medical Segment is Expected to Witness Significant Growth During the Forecast Period

- Prefillable syringes overcome the disadvantages of parenteral drug delivery, such as lack of convenience, affordability, accuracy, sterility, and safety. These syringes enable easy management of chronic diseases, such as diabetes and rheumatoid arthritis, thereby increasing the use of auto-injectors and pen injectors over the forecast period. The growing prevalence of diabetes and other chronic diseases in the Middle East and Africa is expected to lead to market demand over the forecast period.

- Prefilled syringes are emerging as one of the fastest-growing choices for unit-dose medication as the pharmaceutical industry seeks new and more convenient drug delivery methods. Also, pharmaceutical companies minimize drug waste and increase product life span, while patients can self-administer injectable drugs in their homes instead of the hospital.

- Around 80% of the vials and ampoules are made from glass, owing to their suitability with varied drug combinations, but they face challenges like delamination, breakage, etc. Alternative plastic vials, like cycle olefin polymer (COP) and cycle olefin copolymer (COC) formats, are expected to gain significant market share over the next five years. Major players such as Schott AG and Amcor Group GmbH possess expertise in COC for pharmaceutical applications. Such developments are driving the need for aseptic packaging in the region.

- Furthermore, according to the International Diabetes Federation in the Middle East and North Africa, in 2021, around 73 million people (20-79) had diabetes, and it is projected that 136 million adults will have diabetes by 2045. People with diabetes are expected to grow by 134% in Africa among those aged 20 to 79 between 2021 and 2045. At the same time, there is projected to be an 87% surge across the Middle East and Africa. Thus, the growing insulin industry is expected to drive the prefillable syringes market, which would further aid the development of the aseptic packaging market.

Middle East And Africa Aseptic Packaging Industry Overview

The Middle East and Africa aseptic packaging market is semi-consolidated, as a few domestic and international vendors operate in the market. Some of the major players in the market include Tetra Pak International SA, Amcor Group GmbH, SIG Group AG, Mondi PLC, Nampak Ltd, Greatview Aseptic Packaging Company, and International Aseptic Paperboard Mfg LLC. Players are adopting various strategies, such as product innovation, mergers, and acquisitions, primarily to expand their reach and stay competitive.

- In November 2023, SIG Group AG, a leading systems and solutions provider for aseptic packaging, announced the launch of filling machines for F&B leaders and startups in the United Arab Emirates. The SIG SmileSmall 24 Aseptic and SIG CleanPouch 25 Aseptic filling machines are available in SIG's Technology Center at Dubai Silicon Oasis. They offer F&B innovators various benefits and possibilities for product testing and innovation, performance, volume flexibility, and SIG's Drinksplus capability.

- In November 2023, Tetra Pak International SA launched the Tetra Brik 200 Slim Leaf aseptic carton, which contains paper-based barriers, in collaboration with food products producer Lactogal. To increase the use of renewable content in the packaging to 90%, the carton is made from approximately 80% paperboard.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

- 4.5 Assessment of the Geopolitical Scenario's Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand to Reduce Cost of Cold Chain Logistics

- 5.1.2 Surge in Need for Longer Shelf Life of Products

- 5.2 Market Challenges

- 5.2.1 Concerns over Environment Problems and Recycling

- 5.2.2 Manufacturing Complications (For Example Increasing Cost of Raw Materials) and Lower ROI

6 MARKET SEGMENTATION

- 6.1 By Packaging Material

- 6.1.1 Metal

- 6.1.2 Glass

- 6.1.3 Paper & Paperboard

- 6.1.4 Plastics

- 6.1.5 Other Packaging Material

- 6.2 By Packaging Type

- 6.2.1 Cartons

- 6.2.2 Bags and Pouches

- 6.2.3 Cups and Trays

- 6.2.4 Bottles and Jars

- 6.2.5 Cans

- 6.2.6 Other Packaging Type

- 6.3 By End-User Industry

- 6.3.1 Food

- 6.3.2 Beverage

- 6.3.3 Pharmaceutical and Medical

- 6.3.4 Other End-User Industries

- 6.4 By Country

- 6.4.1 Saudi Arabia

- 6.4.2 South Africa

- 6.4.3 United Arab Emirates

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Tetra Pak International SA

- 7.1.2 Amcor Group GmbH

- 7.1.3 Nampak Ltd

- 7.1.4 DS Smith PLC

- 7.1.5 SIG Group AG

- 7.1.6 Uflex Limited

- 7.1.7 Mondi PLC

- 7.1.8 Greatview Aseptic Packaging Company

- 7.1.9 International Aseptic Paperboard Mfg. LLC

- 7.1.10 Smurfit Kappa Group PLC