|

市场调查报告书

商品编码

1851258

无菌包装:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Aseptic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

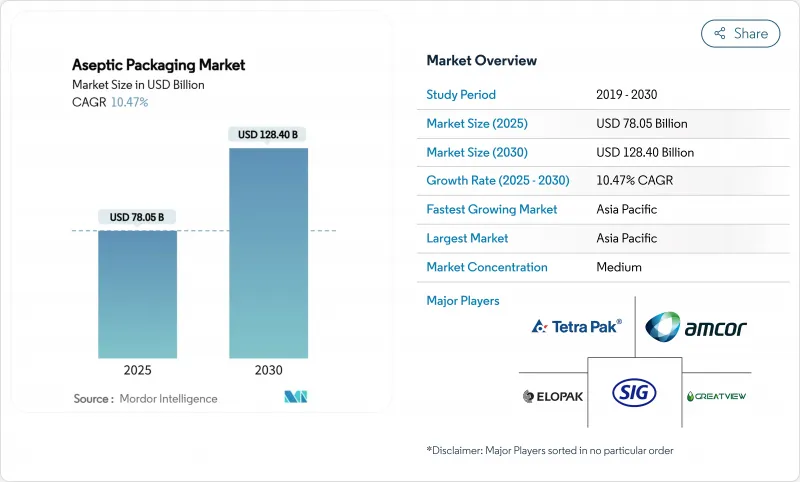

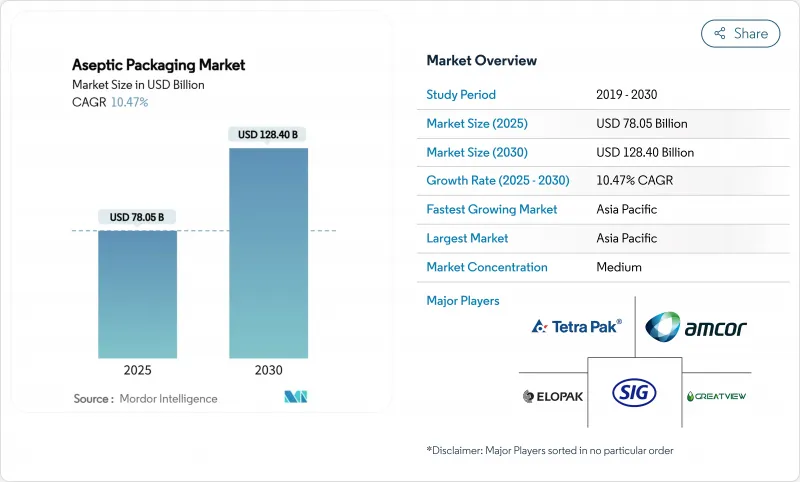

无菌包装市场预计到 2025 年将达到 780.5 亿美元,到 2030 年将达到 1,284 亿美元,年复合成长率为 10.47%。

对常温保存食品和饮料的需求不断增长、食品安全法规日益严格以及降低低温运输成本的需求,都增强了无菌常温配送的吸引力。品牌商正在扩大无菌生产线,以满足冷藏基础设施尚未完善地区对即饮机能饮料和常温保存乳製品日益增长的需求。同时,生技药品生产和个人化疗法正在扩大无菌包装市场的医药收入基础。材料科学的突破,例如无铝高阻隔纸盒和不含PFAS的被覆剂,正在帮助製造商在不牺牲无菌性的前提下,满足新的永续性要求。加工商和树脂製造商之间的整合增强了他们在波动较大的聚合物市场中的购买力,而数位印刷技术则实现了成本效益高的小批量生产,适用于库存单位的快速增长。

全球无菌包装市场趋势与洞察

即饮机能饮料市场快速成长

功能性即饮饮料如今需要采用无菌解决方案,以在常温下将敏感的微量营养素、益生菌和植物成分锁住长达 12 个月。品牌商纷纷选择高阻隔纸盒和多层瓶,以提供氧气、光线和紫外线防护,同时方便在便利商店进行最后一公里配送。美国、中国和泰国的饮料填充厂已安装了每小时产能超过 48,000 瓶的高速无菌生产线,以支持运动营养品、能量茶和植物蛋白产品的上市。食品级无菌和药品级验证之间的重迭部分正在缩小,这促使管瓶和小瓶供应商积极拓展高端定位的饮料生产商市场。原料供应商指出,无菌加工带来的更长保质期允许配方中减少防腐剂的使用,增加活性成分的用量,从而实现更简洁的标籤和更高的零售价格。

扩大新兴亚洲地区的乳製品分销

印度、越南和印尼正迅速从管控鬆散的冷藏供应链升级为无菌常温牛奶和优格。都市区乳製品加工商正在投资超高温瞬时灭菌器和Brick包装填充机,以服务电网不稳定且冷藏成本高的农村地区。中国计划于2024年禁止在常温饮料中使用婴幼儿奶粉,这推动了对纯牛奶无菌生产线的投资,并增加了对能够承受135°C高温灭菌的低酸纸盒复合材料的需求。跨国品牌正与当地合作社成立合资企业以确保原料奶供应,并在农场附近部署模组化无菌微型工厂,从而降低运输成本并减少变质。因此,无菌包装市场正成为新兴亚洲国家政府长期粮食安全议程中不可或缺的一部分。

多层聚合物价格波动

预计2024年聚乙烯和聚丙烯价格将上涨5美分/磅,将收紧加工商利润,并导致季度额外费用。石脑油和乙烷原料市场的波动使纸箱吸嘴、瓶盖和阻隔膜的预算编制变得复杂。大型买家透过签订多年树脂合约进行避险,而小型灌装商则感受到现货价格波动带来的压力,并推迟了旨在用无菌设备替换热填充线的资本计划。全球树脂供应的结构性限制,包括裂解装置的计划外停产和运输瓶颈,显示价格波动在可预见的未来仍将持续。

细分市场分析

受乳製品、果汁和即饮咖啡市场渗透率的推动,纸盒包装市场在2024年占据了64%的收入份额。矩形包装最大限度地提高了托盘利用率和货架吸引力,而新型无吸管瓶盖则符合减少塑胶使用的目标。同时,由于注射用生技药品、疫苗和细胞疗法的广泛应用,管瓶和安瓿瓶市场预计到2030年将以13.2%的复合年增长率成长。管瓶和安瓿瓶的无菌包装市场预计到2030年将达到97亿美元,这反映了它们在人类和兽医保健领域的应用。瓶装产品对于冰沙和风味牛奶等黏稠饮料仍然很重要,因为大容量可重复密封的包装形式提高了饮用便利性。罐装产品凭藉其强大的抗穿刺性,在超高温灭菌椰子水和高酸性果泥食物泥保持着一定的市场份额,但铝价波动和年轻消费者对纸质包装的偏好限制了其增长。对于寻求紧凑运输和开封后延长保质期的食品和饮料运营商来说,袋装盒中袋系统很有吸引力,而单份吸嘴袋则为婴儿饮料和运动营养凝胶提供了便携性。

对减少碳足迹的追求正在推动产品层面的创新。 SIG计划于2025年推出一款完全可回收、不含铝的1升纸盒,常温期长达12个月,该产品迅速被欧洲各大乳製品品牌采用。同时,玻璃瓶製造商正在研发聚合物-玻璃混合容器,这种容器重量减轻30%,同时保持惰性接触面,从而在全球疫苗接种宣传活动期间减少运输排放。随着新材料的不断涌现,阻隔性能、可回收性和填充速度等方面的产品差异化将继续塑造竞争优势。

区域分析

亚太地区,以中国、印度和印尼为首,预计到2024年将占全球销售额的38.4%。印度的国家营养计画旨在2027年将包装牛奶的普及率提高到15%以上,鼓励公共和私人投资建立无菌加工能力。 SIG在古吉拉突邦新建的价值9000万欧元的工厂将每年新增40亿包本地乳製品和饮用型优格的产能。中国禁止销售超高温灭菌(UHT)盒装奶粉,促使加工商转向更全面的生产模式,以加强价格管控并扩大净利率。一家东南亚新兴企业正在推出一款采用250毫升纤薄纸盒包装的强化维生素茶,吸引消费者随时随地消费。

南美洲是成长最快的地区,预计到2030年将以14.21%的复合年增长率成长。由于通膨压力促使消费者购买大尺寸、保质期更长的产品,巴西包装食品市场预计将在2024年达到1,136亿美元。高昂的柴油和电力成本推动了对内陆配销中心的投资,以促进常温产品的销售。阿根廷乳製品出口商正在利用软包装袋线,无需冷藏即可向智利和秘鲁运送无乳糖牛奶。

北美和欧洲的成长率维持在中等个位数,这主要得益于永续性驱动的材料变革,而非销售成长。欧盟对全氟烷基和多氟烷基物质(PFAS)的禁令正在促进二氧化硅基纸箱阻隔材料的商业化,而美国的填充企业正在高风险区域采用机器人来缓解劳动力短缺。中东和非洲虽然目前市场规模较小,但其长期成长潜力与人口成长和政府的粮食安全战略密切相关。 UFlex公司投资2亿美元在埃及工业区建造了层压板综合体,旨在为区域市场提供供应。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 即饮机能饮料市场快速成长

- 扩大新兴亚洲地区的常温乳製品分销

- 严格的食品安全法规推动了无菌包装的普及。

- 受通膨影响,物流方式正从低温运输转向常温物流。

- 转向永续、轻量化包装已成为强制性要求

- D2C品牌中数位和印刷品短SKU的兴起

- 市场限制

- 多层聚合物价格波动

- 无菌灌装生产线的初始资本支出较高。

- 铝箔层压板的回收基础设施有限。

- PFAS阻隔涂层监管方面的不确定性

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 定价分析

- 无菌饮料包装—需求洞察

第五章 市场规模与成长预测

- 副产品

- 纸盒

- 瓶子

- 能

- 袋子和小袋

- 管瓶和安瓿

- 按材料组成

- 纸和纸板

- 塑胶(PP、PE、PET)

- 玻璃

- 金属(铝、钢)

- 复合层压板

- 透过使用

- 饮料

- 即饮饮料

- 乳类饮料

- 食物

- 加工食品

- 水果和蔬菜

- 乳製品

- 製药

- 个人护理和化妆品

- 饮料

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Tetra Pak International SA

- SIG Combibloc Group

- Amcor PLC

- Elopak ASA

- IPI SRL(Coesia Group)

- DS Smith PLC

- Smurfit Kappa Group

- Mondi PLC

- Uflex Limited

- Schott AG

- Gerresheimer AG

- Toyo Seikan Group

- CDF Corporation

- BIBP Sp. z oo

- Nampak Ltd

- Greatview Aseptic Packaging

- Liqui-Box(Graphic Packaging)

- OPLATEK Group

- Sealed Air Corporation

- ProAmpac

第七章 市场机会与未来展望

The aseptic packaging market size is valued at USD 78.05 billion in 2025 and is projected to reach USD 128.40 billion by 2030, expanding at a 10.47% CAGR.

Growing demand for shelf-stable foods and beverages, stricter food-safety rules, and the need to trim cold-chain costs are reinforcing the appeal of sterile, ambient-distribution formats. Brand owners are scaling aseptic lines to meet rising demand for ready-to-drink (RTD) functional beverages and for shelf-stable dairy in regions where refrigeration infrastructures remain patchy. At the same time, biologics manufacturing and personalized therapies are widening the pharmaceutical revenue base for the aseptic packaging market. Material science breakthroughs-such as aluminum-free high-barrier cartons and PFAS-free coatings-help manufacturers comply with new sustainability mandates without sacrificing sterility. Consolidation among converters and resin producers is bolstering purchasing leverage in a volatile polymer market, while digital printing is enabling cost-effective short runs that suit proliferating stock-keeping units.

Global Aseptic Packaging Market Trends and Insights

Rapid Growth of RTD Functional Beverages

Functional RTD drinks now demand aseptic solutions that lock in sensitive micronutrients, probiotics, and botanicals for up to 12 months at ambient temperatures. Brands are selecting high-barrier cartons and multilayer bottles that offer oxygen, light, and UV protection while easing last-mile distribution in convenience stores. Beverage fillers in the United States, China, and Thailand have installed new high-speed aseptic lines rated above 48,000 bottles per hour to serve sports-nutrition, energy-tea, and plant-based protein launches. The overlap between food-grade sterility and pharmaceutical-grade validation is narrowing, encouraging suppliers of vials & ampoules to court beverage customers seeking premium positioning. Ingredient suppliers note that the longer shelf life afforded by aseptic processing allows them to blend less preservative and more active compounds, supporting cleaner labels and higher retail prices.

Expansion of Ambient Dairy Distribution in Emerging Asia

India, Vietnam, and Indonesia are rapidly upgrading from loosely supervised chilled supply chains to aseptic shelf-stable milk and yogurt. Urban dairy processors are investing in UHT sterilizers and brick-pack fillers to reach rural districts where grid instability inflates refrigeration costs. In China, the 2024 decision to prohibit reconstituted milk powder in shelf-stable beverages elicited a wave of capex for pure-milk aseptic lines, driving demand for low-acid carton laminates that can withstand 135 °C sterilization. Multinational brands are forming joint ventures with local cooperatives to secure raw milk and deploy modular aseptic micro-plants close to farms, slashing road-haul costs and mitigating spoilage. As a result, the aseptic packaging market is becoming integral to the long-term food-security agendas of emerging Asian governments.

Volatility in Multilayer Polymer Prices

Polyethylene and polypropylene prices rose by 5 cents per pound in 2024, tightening converter margins and prompting quarterly surcharges. Fluctuating naphtha and ethane feedstock markets complicate budgeting for carton spouts, caps, and barrier films. While large purchasers hedge through multi-year resin contracts, small fillers experience spot-price pain that slows capital projects aimed at replacing hot-fill lines with aseptic equipment. Structural constraints in global resin supply, including unplanned outages at cracker complexes and shipping bottlenecks, signal that price volatility will persist for the near term.

Other drivers and restraints analyzed in the detailed report include:

- Stringent Food-Safety Regulations Pushing Sterile Packaging Adoption

- Inflation-Linked Shift From Cold-Chain to Shelf-Stable Logistics

- High Initial CAPEX for Aseptic Filling Lines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cartons secured 64% of 2024 revenue within the aseptic packaging market thanks to deep penetration in dairy, juice, and RTD coffee. Their rectangular footprint maximizes pallet efficiency and shelf facings, and new straw-less closures appeal to plastic-reduction goals. Meanwhile, vials & ampoules are expanding at a 13.2% CAGR through 2030 as injectable biologics, vaccines, and cell therapies proliferate. The aseptic packaging market size for vials & ampoules is projected to reach USD 9.7 billion by 2030, reflecting adoption in both human and veterinary medicine. Bottles remain important for high-viscosity drinks such as smoothies and for flavored milk where larger resealable formats enhance consumption convenience. Cans hold niche positions in UHT coconut water and high-acid fruit purees due to their robust puncture resistance, though growth is tempered by aluminum price swings and by younger consumers' preference for paper-based packs. Pouch-based bag-in-box systems attract food-service operators seeking compact shipping and extended post-opening shelf life; single-serve spouted pouches offer portability for early-childhood beverages and sports nutrition gels.

The pursuit of carbon-footprint cuts is stimulating product-level innovation. SIG's 2025 launch of a fully recyclable, aluminum-free 1 L carton that maintains a 12-month ambient shelf life won early adoption from leading European dairy brands. Separately, glass vial manufacturers have developed polymer-over-glass hybrid containers that reduce weight by 30% while retaining inert contact surfaces, easing freight emissions in global vaccine campaigns. As new materials emerge, product-level differentiation in barrier performance, recyclability, and filling speed will continue to shape competitive advantage within the aseptic packaging market.

Aseptic Packaging Market Report is Segmented by Product (Cartons, Bottles, Cans, Bags and Pouches, and More), Material Composition (Paper and Paperboard, Plastics, Glass, Metal, Composite Laminates), Application (Beverage, Food, Pharmaceuticals, Personal Care and Cosmetics), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 38.4% of revenues in 2024, driven by China, India, and Indonesia. National nutrition programs in India aim to increase packaged milk penetration above 15% by 2027, catalyzing public-private investment in aseptic capacity. SIG's EUR 90 million green-field plant in Gujarat adds 4 billion pack annual output devoted to local dairy and drinkable yogurt. China's policy forbidding reconstituted milk powder in UHT cartons is pushing processors toward higher-integrity manufacturers, reinforcing price discipline and lifting margins. Southeast Asian start-ups are launching vitamin-fortified teas in 250 mL slim cartons to capture on-the-go consumption.

South America is the fastest growing region, projected to rise at 14.21% CAGR through 2030. Brazil's packaged-food market reached USD 113.6 billion in 2024 as inflationary pressures encouraged consumers to favor large-format, shelf-stable purchases. Investments in inland distribution centers favor ambient products due to high diesel and electricity costs. Argentina's dairy exporters are leveraging flexible pouch lines to ship lactose-free milk to Chile and Peru without refrigeration.

North America and Europe show mid-single-digit growth, propelled by sustainability-driven material swaps rather than volume expansion. The EU PFAS ban stimulates the commercialization of silicon-oxide-based carton barriers, while US fillers adopt robotics in high-care zones to offset labor shortages. The Middle East and Africa, although smaller in value, present long-term upside tied to demographic growth and government food-security strategies. Egypt's industrial zones host UFlex's USD 200 million laminated-board complex aimed at regional supply

- Tetra Pak International SA

- SIG Combibloc Group

- Amcor PLC

- Elopak ASA

- IPI SRL (Coesia Group)

- DS Smith PLC

- Smurfit Kappa Group

- Mondi PLC

- Uflex Limited

- Schott AG

- Gerresheimer AG

- Toyo Seikan Group

- CDF Corporation

- BIBP Sp. z o.o.

- Nampak Ltd

- Greatview Aseptic Packaging

- Liqui-Box (Graphic Packaging)

- OPLATEK Group

- Sealed Air Corporation

- ProAmpac

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid growth of RTD functional beverages

- 4.2.2 Expansion of ambient dairy distribution in emerging Asia

- 4.2.3 Stringent food-safety regulations pushing sterile packaging adoption

- 4.2.4 Inflation-linked shift from cold-chain to shelf-stable logistics (under-reported)

- 4.2.5 Shift toward sustainable, lightweight packaging mandates

- 4.2.6 Rise of digital?print-enabled short SKUs for D2C brands (under-reported)

- 4.3 Market Restraints

- 4.3.1 Volatility in multilayer polymer prices

- 4.3.2 High initial CAPEX for aseptic filling lines

- 4.3.3 Limited recycling infrastructure for aluminum-foil laminates (under-reported)

- 4.3.4 Regulatory uncertainty around PFAS barrier coatings (under-reported)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Pricing Analysis

- 4.9 Aseptic Packaging for Beverages - Demand Insights

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product

- 5.1.1 Cartons

- 5.1.2 Bottles

- 5.1.3 Cans

- 5.1.4 Bags and Pouches

- 5.1.5 Vials and Ampoules

- 5.2 By Material Composition

- 5.2.1 Paper and Paperboard

- 5.2.2 Plastics (PP, PE, PET)

- 5.2.3 Glass

- 5.2.4 Metal (Aluminum, Steel)

- 5.2.5 Composite Laminates

- 5.3 By Application

- 5.3.1 Beverage

- 5.3.1.1 Ready-to-drink (RTD) Beverages

- 5.3.1.2 Dairy-based Beverages

- 5.3.2 Food

- 5.3.2.1 Processed Food

- 5.3.2.2 Fruits and Vegetables

- 5.3.2.3 Dairy Food

- 5.3.3 Pharmaceuticals

- 5.3.4 Personal Care and Cosmetics

- 5.3.1 Beverage

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Middle East

- 5.4.4.1 Israel

- 5.4.4.2 Saudi Arabia

- 5.4.4.3 United Arab Emirates

- 5.4.4.4 Turkey

- 5.4.4.5 Rest of Middle East

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Egypt

- 5.4.5.3 Rest of Africa

- 5.4.6 South America

- 5.4.6.1 Brazil

- 5.4.6.2 Argentina

- 5.4.6.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Tetra Pak International SA

- 6.4.2 SIG Combibloc Group

- 6.4.3 Amcor PLC

- 6.4.4 Elopak ASA

- 6.4.5 IPI SRL (Coesia Group)

- 6.4.6 DS Smith PLC

- 6.4.7 Smurfit Kappa Group

- 6.4.8 Mondi PLC

- 6.4.9 Uflex Limited

- 6.4.10 Schott AG

- 6.4.11 Gerresheimer AG

- 6.4.12 Toyo Seikan Group

- 6.4.13 CDF Corporation

- 6.4.14 BIBP Sp. z o.o.

- 6.4.15 Nampak Ltd

- 6.4.16 Greatview Aseptic Packaging

- 6.4.17 Liqui-Box (Graphic Packaging)

- 6.4.18 OPLATEK Group

- 6.4.19 Sealed Air Corporation

- 6.4.20 ProAmpac

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment