|

市场调查报告书

商品编码

1637898

亚太无菌包装:市场占有率分析、行业趋势和成长预测(2025-2030 年)Asia Pacific Aseptic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

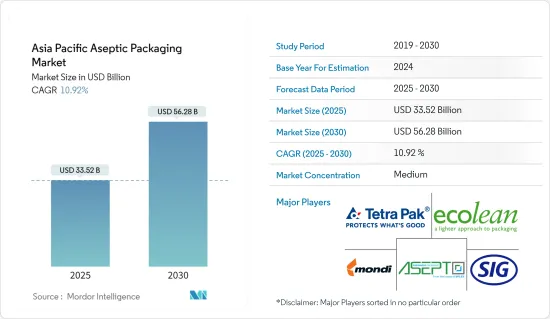

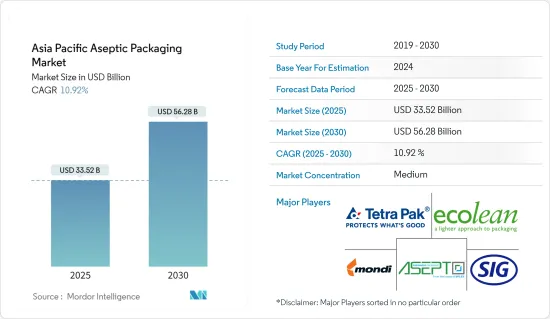

亚太地区无菌包装市场规模预计在2025年为335.2亿美元,预计到2030年将达到562.8亿美元,预测期内(2025-2030年)的复合年增长率为10.92%。

主要亮点

- 亚太地区的无菌包装市场主要由印度、中国和日本等国推动。可支配收入的增加和食品饮料行业的不断发展推动了该地区多个国家采用无菌包装解决方案。预计这一趋势将在未来几年为无菌包装市场创造机会。

- 该地区消费者饮食习惯的改变,导致对即食食品的偏好日益增加,对方便和高品质食品的需求不断增加,从而推动了市场的成长。这种转变在都市区尤其明显,因为时间限制和繁忙的生活方式推动着人们对快速简便的膳食解决方案的需求。无菌包装市场的公司正在透过开发确保食品安全并延长保质期的创新包装解决方案来回应这些不断变化的消费者需求。

- 无菌技术透过使用比传统方法更经济的材料,显着降低了包装成本。这种创新方法也最大限度地减少了对防腐剂的需求,为消费者健康和环境永续性带来了显着的益处。此外,无菌技术可以精确生产小批量饮料,有助于减少整个供应链的废弃物。这种生产灵活性使公司能够更好地匹配生产需求,从而降低整体製造成本。该技术的效率还扩展到能源消费量和储存要求,为饮料行业提供了更高的成本效益和环境优势。

- 市场先驱者也投资于研发,以在不断发展的行业中保持竞争力。新产品的推出符合市场趋势和支援需求。製药业对无菌包装的需求不断增长,促进了市场的成长。世界各国政府都在增加在医疗保健领域的支出,进一步推动无菌包装市场的发展。因此,製药、食品和饮料产业对无菌包装的需求不断增长,预计将推动市场成长。

- 例如,SIG 于 2023 年 4 月在印度帕尔加尔开设了第二家生产工厂。该工厂为 SIG 生产衬袋纸盒和带嘴袋包装,之前以 Scholle IPN 和 Bossar 品牌销售。新工厂位于孟买以北 90 公里,对 SIG 位于帕尔加尔的现有工厂进行了补充,该工厂主要生产成品零件和包装材料。 1 号工厂包括吹膜挤出机、射出成型单元、盒中袋生产机以及用于盒中袋和吸嘴袋产品的包装配件和封盖的模具製造设备。

- 永续包装和延长保质期是食品和饮料行业消费者关注的关键因素。因此,该地区的许多食品和饮料供应商都选择无菌包装,因为它具有成本效益和环境考虑,特别是在运输和现场储存方面。该地区对无菌包装的高需求是由于其使用可回收纸板和环保材料。这种包装类型很受喜欢少量购买和频繁购买的消费者的欢迎。

- 由于聚合物价格上涨,市场面临巨大的成本压力,导致整体生产成本上升。自疫情爆发以来,原材料成本大幅上涨。俄乌战争加剧了价格上涨。同时,塑胶和塑胶製品的需求量每年都在持续成长。供应未能满足需求的成长,导致聚合物价格呈现上涨趋势。

亚太无菌包装市场趋势

饮料市场预计将占很大份额

- 亚太国家快速的都市化正在推动对饮料和天然产品(包括果汁和调味奶)的需求。该地区消费者购买力的上升是推动无菌纸盒需求的关键因素。健康的生活方式趋势和不断增强的卫生意识,尤其是在疫情之后,正在极大地推动整个亚太地区的无菌纸盒市场的发展。

- 包装对于增加非酒精饮料的价值和差异化发挥重要作用。随着消费者对这些产品的兴趣日益增加,对有效包装解决方案的需求也预计会成长。非酒精饮料的包装必须保护液体在处理和储存过程中免受污染和洩漏。对于果汁和能量饮料等产品,无菌包装可以保护内容物免受外部因素的影响。这种包装通常结合热塑性塑胶、纸板和铝箔以确保产品的完整性。

- 无菌技术比传统方法使用更经济的材料,大大降低了包装成本。这种成本效益来自于使用更轻、更薄的包装材料,同时仍能保持产品的完整性。该技术还最大限度地减少了对防腐剂的需求,减少了饮料中的化学添加剂,有利于消费者的健康和环境。无菌处理可以延长保质期,无需冷藏,从而节省储存和运输过程中的能源。

- 此外,该技术还可以生产更小批量的饮料,并实现更精确的生产,从而减少废弃物。这种产量弹性减少了过度生产和库存持有成本,从而降低了整体生产成本。这些因素结合在一起,使无菌技术成为希望优化生产流程和降低营运成本的饮料製造商的一个有吸引力的选择。

- 预测期内,饮料包装的需求预计会增加。无菌包装具有多种尺寸,广泛用于饮料的储存和分销,适合运输和储存。随着消费者越来越喜欢安全和新鲜的产品,该地区对无菌包装的需求预计将会成长。

- 便利性已成为即饮饮料和健康照护类别的主要趋势。消费者更喜欢即饮鸡尾酒,因为从头开始製作饮料是一个耗时的过程。近年来,即饮饮料的兴起已成为所有饮料类别的显着发展。这些饮料的独特风味和外出饮用的便利性吸引了消费者。

- 雀巢印度公司宣布推出其知名咖啡品牌雀巢的一系列即饮咖啡。该公司已开始透过零售店和电子商务管道以每包 180 毫升 30 印度卢比的价格销售即饮咖啡。本产品采用无菌包装,有助于增加销售量。营收从 2017 年的 12.1 亿美元增加到 2023 年的 22.6 亿美元。即饮产品需求的不断增长也有望推动该地区无菌包装市场的发展。

- 雀巢印度有限公司推出即饮咖啡标誌着其饮料领域的重大倡议。无菌包装在无需冷藏的情况下,对于维持这些产品的品质和延长其保质期起着关键作用。这种包装技术可以确保咖啡即使在室温下长期保存也能保持新鲜和安全。

预计印度在预测期内将实现高成长

- 印度对乳製品产业贡献巨大。对一次性塑胶的严格规定为市场相关人员提供了开发生物分解性和可重复使用的无菌包装的巨大机会。永续包装选择包括可重复使用的材料,例如由生质乙醇製成的聚乙烯、聚乳酸、微纤维化纤维素和其他生物分解性的材料。

- 人口的成长、收入的提高和生活方式的改变正在推动无菌包装产业的发展。终端用户领域不断增长的成长前景正在推动对无菌包装的需求。然而,替代包装选择(尤其是袋装包装)的日益使用限制了市场扩张。受包装食品需求快速成长和可支配收入增加的推动,印度预计将占据亚太地区无菌包装市场的大部分份额。

- 印度是世界上最大的牛奶消费国,拥有庞大且多元的乳製品产业。过去十年来,印度的牛奶产量显着增长,其中北方邦和拉贾斯坦邦的贡献尤其显着。原乳产量的增加导致对无菌包装的需求增加,这对于维持原乳和乳製品的无菌性和品质至关重要。

- 根据印度农业和农民福利部的报告,印度23财年的原乳产量预计将达到2.26亿吨,较前一年的2.216亿吨大幅增加。不过,原乳产量增幅略有放缓,从2023财年的约5.8%下降至隔年的3.83%。

- 儘管成长略有放缓,但牛奶产量整体上升的趋势仍将继续对市场产生重大影响。随着牛奶产量的增加,对可靠的无菌包装解决方案的需求也随之增加。随着製造商努力满足印度蓬勃发展的乳製品产业不断变化的需求,这种不断增长的需求正在推动市场创新和扩张。

- 印度消费者在选择饮料时越来越重视健康和保健,从早晨的果汁到能量饮料,消费者在符合其健康目标的饮料上花费更多,我希望如此。因此,饮料业对经济高效的包装解决方案的需求日益增加。特别是牛奶和乳类饮料行业越来越多地采用无菌纸盒,其优点包括易于堆放产品和延长保质期。

亚太无菌包装产业概况

亚太地区无菌包装市场竞争激烈,供应商众多。市场已呈现半固体,参与者采用各种策略,包括产品创新、併购,主要是为了扩大市场并维持竞争优势。市场的主要参与者包括 Tetra Pak International SA、Asepto (UFlex Ltd) 和 SIG Combibloc Group。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 买家的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 亚太无菌包装市场的机会

- 技术简介

第五章 市场动态

- 市场驱动因素

- 低温运输物流成本降低需求日益增加

- 对长期产品储存的需求不断增加

- 市场挑战

- 环境和回收问题

- 製造复杂性增加(例如原材料成本上升)和投资回报率降低

第六章 市场细分

- 按产品

- 纸盒

- 袋子和小袋

- 能

- 瓶子

- 按应用

- 饮料

- 即饮饮料

- 乳类饮料

- 食物

- 加工食品

- 水果和蔬菜

- 乳製品

- 製药和医疗

- 其他用途

- 饮料

- 按国家

- 中国

- 印度

- 日本

- 东南亚

第七章 竞争格局

- 公司简介

- Tetra Pak International SA

- Ecolean Packaging

- SIG Combibloc Group

- Mondi PLC

- Asepto(UFlex Ltd)

- Greatview Aseptic Packaging

- Hangzhou Hansin New Packing Material Co. Ltd

第八章投资分析

第九章:市场的未来

The Asia Pacific Aseptic Packaging Market size is estimated at USD 33.52 billion in 2025, and is expected to reach USD 56.28 billion by 2030, at a CAGR of 10.92% during the forecast period (2025-2030).

Key Highlights

- The Asia-Pacific aseptic packaging market is primarily driven by countries such as India, China, and Japan. Increased disposable income and growth in the food and beverage industry have prompted several countries in the region to adopt aseptic packaging solutions. This trend will create opportunities for the aseptic packaging market in the coming years.

- Evolving consumer eating habits in the region have led to an increased preference for ready-to-eat meals and a higher demand for convenient, high-quality food products, fostering market growth. This shift is particularly evident in urban areas where time constraints and busy lifestyles are driving the need for quick and easy meal solutions. Players in the aseptic packaging market have responded by developing innovative packaging solutions that ensure food safety and extend shelf life, catering to these changing consumer needs.

- Aseptic technology significantly reduces packaging costs using more economical materials than traditional methods. This innovative approach also minimizes the need for preservatives, offering substantial consumer health and environmental sustainability benefits. Furthermore, aseptic technology enables the precision production of smaller beverage quantities, which helps decrease waste throughout the supply chain. This flexibility in production volume lowers overall manufacturing costs, as companies can better match production to demand. The technology's efficiency extends to energy consumption and storage requirements, enhancing its cost-effectiveness and environmental advantages in the beverage industry.

- Market players also invest in research and development to stay competitive in evolving industries. New product launches align with market trends and support demand. The pharmaceutical industry's increasing need for aseptic packaging contributes to market growth. Governments across various countries are raising healthcare sector spending, further boosting the aseptic packaging market. Thus, the growing demand for aseptic packaging from the pharmaceutical and food and beverage industries is expected to drive the market's growth.

- For instance, SIG inaugurated its second production facility in Palghar, India, in April 2023. This plant manufactures SIG's bag-in-box and spouted pouch packaging, previously marketed under the Scholle IPN and Bossar brands. Located 90 km north of Mumbai, the new facility complements SIG's existing plant in Palghar, which produces components and finished packaging. The first plant has blown film extruders, injection molding cells, bag-in-box manufacturing machines, and a mold-making facility for packaging fitments and closures that are used in bag-in-box and spouted pouch products.

- Sustainable packaging and extended shelf life are crucial factors for consumers in the food and beverage industry. Consequently, many food and beverage vendors in the region opt for aseptic packaging, driven by cost efficiency and environmental considerations, particularly regarding transportation and storage in local conditions. The region's high demand for aseptic packaging is attributed to its use of recyclable cardboard and environmentally friendly materials. This packaging type is prevalent among consumers who prefer smaller quantities and make frequent purchases.

- The market is experiencing significant cost pressures due to rising polymer prices, which have increased the overall production expenses. Raw material costs have risen substantially since the onset of the pandemic. The Russia-Ukraine War further exacerbated this price escalation. Concurrently, the demand for plastics and plastic products continues to grow annually. The supply has not kept pace with this increasing demand, contributing to the upward trend in polymer prices.

Asia Pacific Aseptic Packaging Market Trends

The Beverages Segment is Expected to Hold a Significant Share

- Rapid urbanization in Asia-Pacific countries fuels the rising demand for beverages and natural products, including juices and flavored milk. The growing purchasing power of consumers in the region is a crucial factor contributing to the demand for aseptic cartons. The rising trend of healthier lifestyles and heightened awareness of hygiene, particularly in the aftermath of the pandemic, has significantly boosted the market for aseptic cartons across Asia-Pacific.

- Packaging plays a vital role in adding value and differentiating non-alcoholic beverages. As consumer interest in these products grows, the demand for effective packaging solutions is expected to increase. Packaging for non-alcoholic beverages must protect liquids from contamination and leakage during handling and storage. Aseptic packaging shields the contents from external elements for products such as juices and energy drinks. This packaging typically combines thermoplastics, paperboard, and aluminum foil to ensure product integrity.

- Aseptic technology significantly reduces packaging costs using more economical materials than traditional methods. This cost-effectiveness stems from the ability to use lighter, thinner packaging materials that still maintain product integrity. The technology also minimizes the need for preservatives, benefiting consumer health and the environment by reducing beverage chemical additives. Aseptic processing allows extended shelf life without refrigeration, which can lead to energy savings in storage and transportation.

- Additionally, this technology enables the production of smaller beverage quantities, which helps decrease waste by allowing for more precise production runs. This flexibility in production volume lowers overall production costs by reducing overproduction and inventory-holding expenses. Combining these factors makes aseptic technology an attractive option for beverage manufacturers looking to optimize their production processes and reduce operational costs.

- The demand for beverage packaging is expected to increase during the forecast period. Aseptic packaging, available in various sizes, is widely used for storing and distributing beverages, making it suitable for shipping and storage. The demand for aseptic packaging in this region will likely grow as consumers increasingly prefer safe and fresh products.

- Convenience has emerged as a significant trend in ready-to-drink beverages and health and well-being categories. Consumers prefer ready-to-drink cocktails due to the time-consuming nature of preparing beverages from scratch. The rise of ready-to-drink options has been a notable development across all beverage categories in recent years. Consumers are attracted to these drinks for their unique flavors and convenience outside the home.

- Nestle India Ltd announced the launch of a range of ready-to-drink variants of its renowned coffee brand, Nescafe. The company commenced the sale of ready-to-drink coffee for INR 30 per pack of 180 ml at retail outlets and through its e-commerce channel. This product uses aseptic packaging, which helps the company increase sales. Sales increased to USD 2.26 billion in 2023 from USD 1.21 billion in 2017. The rise in the demand for ready-to-drink products will also boost the aseptic packaging market in the region.

- Nestle India Ltd's introduction of ready-to-drink coffee variants represented a significant move in the beverages segment. Aseptic packaging plays a crucial role in preserving the quality and extending the shelf life of such products without the need for refrigeration. This packaging technology ensures that the coffee remains fresh and safe for consumption, even when stored at room temperature for extended periods.

India is Expected to Record High Growth During the Forecast Period

- India has made significant contributions to the dairy industry. Due to strict regulations on single-use plastics, market players have substantial opportunities to develop biodegradable and reusable aseptic packages. Sustainable packaging options include reusable materials such as polyethylene made from bioethanol, polylactic acid, micro-fibrillated cellulose, and other biodegradable materials.

- Population growth, rising incomes, and lifestyle changes drive the aseptic packaging industry. Increasing growth prospects in end-user segments are fueling the demand for aseptic packaging. However, the market's expansion is constrained by the increased use of alternative packaging options, particularly pouch packaging. India is expected to hold a significant share of the Asia-Pacific aseptic packaging market, propelled by the rapidly growing demand for packaged food products and increasing disposable incomes.

- India is the world's largest milk consumer, boasting a diverse and expansive dairy industry. Milk production in the country has shown significant growth over the past decade, with Uttar Pradesh and Rajasthan emerging as substantial contributors. This increase in milk production led to a corresponding rise in the demand for aseptic packaging, essential for maintaining the sterility and quality of milk and milk-based products.

- The Ministry of Agriculture and Farmers Welfare (India) reported that milk production reached an impressive 226 million metric tons in fiscal year 2023, a notable increase from the previous year's 221.6 million tons. However, the growth rate in milk production experienced a slight deceleration, decreasing from approximately 5.8% in the fiscal year 2023 to 3.83% in the following year.

- Despite this minor slowdown in growth rate, the overall upward trend in milk production continues to impact the market substantially. As milk production volumes increase, so does the need for reliable, sterile packaging solutions. This growing demand drives innovation and expansion in the market as manufacturers strive to meet the evolving needs of India's thriving dairy industry.

- Indian consumers are increasingly prioritizing health and wellness in their beverage choices, from morning juices to energy drinks, with consumers willing to spend more on refreshments that align with wellness goals. Consequently, there is a growing demand for cost-effective packaging solutions in the beverages segment. The milk and dairy beverage industries are particularly driving increased adoption of aseptic cartons, which offer advantages such as easy product stacking and extended shelf life.

Asia Pacific Aseptic Packaging Industry Overview

The Asia-Pacific aseptic packaging market is highly competitive due to multiple vendors operating in it. The market is semi-consolidated, with the players adopting various strategies, such as product innovations, mergers, and acquisitions, primarily to expand their reach and stay competitive. Some of the major players in the market include Tetra Pak International SA, Asepto (UFlex Ltd), and SIG Combibloc Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Opportunities in the Asia Pacific Aseptic Packaging Market

- 4.5 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand to Reduce Cost of Cold Chain Logistics

- 5.1.2 Increasing Demand for Longer Shelf Life of Products

- 5.2 Market Challenges

- 5.2.1 Concerns over Environment and Recycling

- 5.2.2 Manufacturing Complications( for example increasing cost of raw materials) & Lower ROI

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Cartons

- 6.1.2 Bags and Pouches

- 6.1.3 Cans

- 6.1.4 Bottles

- 6.2 By Applications

- 6.2.1 Beverage

- 6.2.1.1 Ready-to-drink Beverages

- 6.2.1.2 Dairy-based Beverages

- 6.2.2 Food

- 6.2.2.1 Processed Foods

- 6.2.2.2 Fruits and Vegetables

- 6.2.2.3 Dairy Products

- 6.2.3 Pharmaceutical & Medical

- 6.2.4 Other Applications

- 6.2.1 Beverage

- 6.3 By Country

- 6.3.1 China

- 6.3.2 India

- 6.3.3 Japan

- 6.3.4 South East Asia

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Tetra Pak International SA

- 7.1.2 Ecolean Packaging

- 7.1.3 SIG Combibloc Group

- 7.1.4 Mondi PLC

- 7.1.5 Asepto (UFlex Ltd)

- 7.1.6 Greatview Aseptic Packaging

- 7.1.7 Hangzhou Hansin New Packing Material Co. Ltd