|

市场调查报告书

商品编码

1640324

欧洲无菌包装:市场占有率分析、行业趋势、统计数据和成长预测(2025-2030 年)Europe Aseptic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

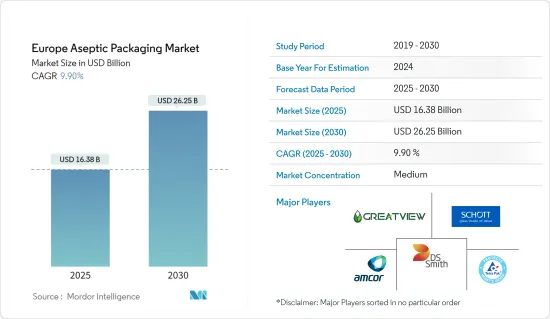

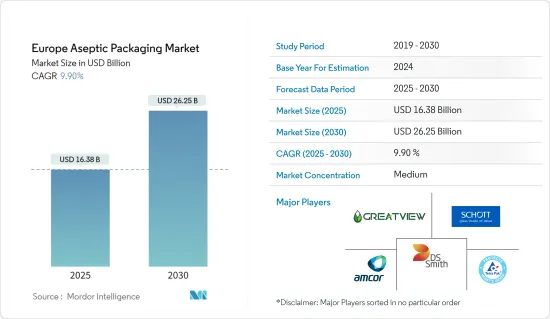

预计2025年欧洲无菌包装市场规模为163.8亿美元,预计2030年将达262.5亿美元,预测期内(2025-2030年)的复合年增长率为9.9%。

由于当地企业在无菌包装产业占据主导地位,欧洲是无菌包装产品和设备的主要市场之一。虽然该地区大部分地区的市场规模将保持平稳,但技术创新的进步预计将推动工业应用的扩大。

主要亮点

- 高压处理在该地区的批量处理系统中也取得了长足的进步。这些散装系统可与无菌填充系统结合使用,以确保延长保质期,从而有望为该地区的无菌包装提供发展空间。

- 此外,一项针对 7,000 名消费者的欧洲消费者包装态度调查发现,四分之三的消费者表示产品包装对环境的影响对他们的购买决策有重大影响,其中90% 的人希望包装易于回收。因此,永续性在市场新产品的开发中也扮演着重要角色。

- 雀巢等公司也正在与 SIG 合作,探索永续的包装材料。这符合雀巢应对塑胶污染的策略。 2020年5月,雀巢、Logitec和其他产业伙伴承诺在10年内提供500万瑞士法郎,支持永续包装材料的研究。

- 此外,由于 COVID-19 的蔓延,预计市场将经历显着成长。疫情导致消费者转向网路零售并出现恐慌性购买,导致对牛奶、婴儿食品和蔬菜等必需品杂货的需求增加。

- 此外,由于 COVID-19 引发的食品卫生问题也增加了对无菌包装的需求。在未来几年,预计客户将青睐更好的包装来保护自己免受此类疾病的侵害,迫使供应商考虑永续无菌包装的想法。

欧洲无菌包装市场趋势

对长期产品储存的需求不断增加

- 消费者希望产品保质期长且易于使用。这迫使公司开发替代的包装解决方案。保质期是产品的一个重要方面。对于希望扩大产品供应而不依赖复杂冷藏链的公司来说,生产保质期更长的包装已经成为必要。

- 透过保护产品免受氧气、湿气和微生物等潜在劣化因素的影响,可以延长保质期。为了保护他们的产品,公司需要能够达到相同效果并且具有成本效益的包装解决方案。减少整个食品供应链中的浪费将是减少农业对环境的影响和满足日益增长的粮食需求的重要措施。因此,投资高效、低成本和永续的加工和包装解决方案来延长产品(尤其是乳製品、婴儿食品和膳食补充剂)的保质期是一种可行的解决方案,而无菌包装则会增加要求。

- 生活方式的改变以及由此导致的消费者对加工、包装和已调理食品的依赖增加了对无菌包装解决方案的需求。超级市场文化的出现也改变了购物格局,增加了包装的需求,特别是食品和饮料的包装。人们生活方式的改变导致了从家庭烹饪到已烹调产品的转变。除了易于使用之外,这些产品还需要以确保新鲜和未受污染的方式进行包装。

- 食品包装不再只是起到保护食品和销售食品的被动作用。强调减少防腐剂的使用也是使用无菌包装的一个驱动力。无菌食品储藏允许加工食品在包装未开封的情况下长期保存,无需添加防腐剂。

- 此外,随着人口的增长和牛奶成为日常饮食的一部分,该地区的牛奶产量也在增加。例如,根据食品和农业政策研究所的数据,2020年欧盟牛奶产量将达到1.575亿吨,而2019年为1.552亿吨。因此,无菌包装被广泛使用,因为它需要长达六个月的保质期,并且在用超高温 (UHT) 处理的牛奶煎炸之前对包装进行消毒。

预测期内,製药业预计将经历高成长

- 预灌封注射器克服了非肠道给药方式的不便性、成本、准确性、无菌性和安全性等缺点。这些注射器可以更容易管理糖尿病和类风湿性关节炎等慢性疾病,并有望在预测期内促进自动注射器和笔式註射器的使用。受此影响,欧洲地区糖尿病和其他慢性病的盛行率正在上升,预计这将在预测期内推动市场需求。

- 随着製药业寻求新的、更便捷的药物输送方法,预填充式注射器已成为单位剂量药物成长最快的选择之一。它还使製药公司能够最大限度地减少药物浪费并延长产品寿命,同时患者可以在家中而不是在医院自行注射药物。

- 根据英国公共卫生部的数据,2020 年英格兰登记患有 2 型糖尿病的人的年龄分布为 4.1%(40 岁以下)、43.1%(40-64 岁)、37.8%(65-79 岁),该数字为15.1%(超过80%)。因此,胰岛素市场的成长可望推动预灌封注射器市场的发展,进一步促进无菌包装市场的成长。

- 大约80%的管瓶和安瓿瓶都是由玻璃製成的,因此它们适用于多种药物组合,但它们面临分层和破损等挑战。环状烯烃聚合物(COP)和环状烯烃共聚物(COC)等替代塑胶管瓶很可能在未来五年内获得显着的市场占有率。 Schott 和 Gerresheimer 等大型公司在 COC 的製药应用方面拥有丰富的经验。这些发展推动了该地区对无菌包装的需求。

- 此外,安瓿瓶中使用创新技术,例如透过包装外部密封部署的无线射频识别标籤(RFID),可在整个供应链中提供单独的安全性,从而扩大我们的业务。所有这些都有望推动该地区管瓶和安瓿瓶无菌包装市场的发展。

欧洲无菌包装产业概况

欧洲无菌包装市场竞争激烈,国内和国际市场都有多家供应商。市场集中度似乎较高,参与者采用产品创新、併购等各种策略,主要是为了扩大市场渗透率并保持竞争力。市场的主要参与者包括 Schott AG、DS Smith Plc 和 Tetra Pak International。

- 2020 年 6 月 - Greatview Aseptic Packaging 是利乐无菌灌装机最大的捲筒包装材料供应商之一,现已成为空白供应製造商,供应与 SIG Combibloc 灌装机相容的套管。

- 2020 年 6 月-Ecolean 的轻量化包装解决方案成为 HelloFresh 餐点套件的一部分,为客户提供更永续且便利的包装选择。两家公司都致力于加强永续性。自 2020 年 4 月起,德国和奥地利分发的餐食套件中就包含爱克林包装,丹麦和瑞典也将紧随其后。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 中东和非洲无菌包装市场的机会

- COVID-19 产业影响评估

- 技术简介

第五章 市场动态

- 市场驱动因素

- 低温运输物流成本降低需求日益增加

- 对长期产品储存的需求不断增加

- 市场挑战

- 环境和回收问题

- 製造复杂性增加(例如原材料成本上升)和投资回报率降低

第六章 市场细分

- 按包装材质

- 金属

- 玻璃

- 纸

- 塑胶

- 其他的

- 按包装类型

- 纸箱

- 袋子和小袋

- 杯子和托盘

- 瓶子和罐子

- 金属罐

- 塑胶罐

- 复合材料罐

- 其他的

- 按国家

- 德国

- 英国

- 法国

- 俄罗斯

- 义大利

- 其他欧洲国家

- 最终用户产业

- 食物

- 饮料

- 製药和医疗

- 其他的

第七章 竞争格局

- 公司简介

- Tetra Pal International SA

- Amcor PLC

- Schott AG

- Ecolean Packaging

- Reynolds Group Holdings

- SIG Combibloc Group

- WESTROCK COMPANY

- DS SMITH PLC

- Mondi PLC

- Krones, Inc.

- Reynolds Group Holdings

- Greatview Aseptic Packaging

- Sealed Air Corporation

- Coesia SPA

- CFT SPA

第八章投资分析

第九章 欧洲无菌包装市场的未来前景

The Europe Aseptic Packaging Market size is estimated at USD 16.38 billion in 2025, and is expected to reach USD 26.25 billion by 2030, at a CAGR of 9.9% during the forecast period (2025-2030).

The European region has been one of the leading markets for aseptic packaging products and equipment, owing to the dominance of local companies in the aseptic packaging industry. Although the market volumes have been static in most of the areas in the region, however, growing innovations are expected to expand the industrial applications.

Key Highlights

- High-pressure processing is also taking a significant step forward in the region with the bulk processing systems in the region that unpackages the technology in order to allow a range of packaging formats. These bulk systems can be used in conjunction with an aseptic filling system to guarantee the shelf-life extension, which in turn, is expected to develop space for aseptic packaging in the region.

- Moreover, according to an earlier European Consumer Packaging Perceptions Survey of 7,000 shoppers, three-quarters of the consumers said that the environmental impact of a product's packaging significantly affects the purchasing decisions, and 90% want the packaging to be made that is easily recyclable. Thus sustainability is also playing a major role in new product developments in the market.

- Companies such as Nestle are also collaborating with SIG to research more sustainable materials regarding packaging. This goes in line with Nestle's strategy to tackle plastic pollution. In May 2020, the companies, Logitech, and other industry partners committed to providing CHF 5 million over ten years to support sustainable packaging materials research.

- Further, Owing to the spread of COVID-19, the market is expected to witness significant growth. Due to the pandemic, customers have shifted towards online retail as well as panic stocking, which led to an increased demand for essential food items such as milk, baby food, and vegetables.

- Moreover, the concerns regarding food hygiene due to Covid-19 have been increasing the demand for aseptic packaging. In the coming years, the customers are expected to prefer better packaging to prevent themselves from such diseases, which would compel the vendors to think on the lines of sustainable aseptic packaging.

Europe Aseptic Packaging Market Trends

Increasing Demand for Longer Shelf Life of Products

- Consumers have been demanding products with extended shelf life and easier usage. This has necessitated the companies to develop alternate packaging solutions. Shelf life has been an important aspect of the product. With companies looking to expand their product offerings with less dependency on sophisticated cold storage chains, producing packages that provide longer shelf life has become imperative.

- The shelf life can be increased by protecting the products from potential deteriorating agents, such as oxygen, moisture, and microbes. In order to protect their products, companies need a packaging solution that can achieve the same and is also cost-effective. Reducing wastage throughout the food supply chain is likely to become a crucial activity in order to reduce the environmental impact of agriculture and to serve the increasing food demand. Therefore, investing in efficient, low-cost, and sustainable processing and packaging solutions to increase the shelf life of products (especially dairy, baby food, and nutraceuticals) is a viable solution, thus augmenting the requirement of aseptic packaging.

- Changing lifestyles and the consequent dependence of consumers on processed, packaged, and precooked food is increasing the demand for aseptic packaging solutions. The advent of the supermarket culture has also altered the landscape of shopping and has increased the need for packaging, especially in food and beverage products. The altering lifestyle of people has resulted in the shift from home-cooked to ready-to-eat products. In addition to this ease of use, these products should also be packaged in such a way to ensure they are fresh and uncontaminated.

- Food packaging has no longer just a passive role in protecting and marketing a food product. The emphasis on the decrease of the use of preservatives is also a driving factor for the use of aseptic packaging as aseptic food preservation methods enable processed food to be kept for a longer period of time without preservatives as long as they are not opened.

- Moreover, with the growing population in the region, the production of milk is increasing as cow milk is a part of the daily diet. For instance, according to Food and Agriculture Policy Research Institute, the production of cow milk in the European Union in 2020 accounted for 157,500 thousand metric tons compared to 155,200 thousand metric tons in 2019. This demands a longer shelf life of up to 6 months, and aseptic packaging is of high use as the packaging is sterilized prior to the fillion with UHT-treated milk.

Pharmaceutical sector is expected to higher witness growth during the forecast

- Prefillable syringes overcome disadvantages of parenteral drug delivery, such as lack of convenience, affordability, accuracy, sterility, and safety. These syringes enable easy management of chronic diseases, such as Diabetes and Rheumatoid Arthritis, which is expected to boost the use of auto-injectors and pen injectors over the forecast period. Thus, the growing prevalence of Diabetes and other chronic diseases in the European region is expected to fuel the market demand over the forecast period.

- Prefilled syringes are emerging as one of the fastest-growing choices for unit dose medication as the pharmaceutical industry seeks new and more convenient drug delivery methods. Also, Pharmaceutical companies are minimizing drug waste and increasing product life span, while patients are able to self-administer injectable drugs at their homes instead of the hospital.

- According to Public Health England, the distribution of people registered with type 2 diabetes in England (in 2020) by age accounted for 4.1% (40 and under), 43.1%(age 40-64), 37.8% (for age 65-79) and 15.1% (for age over 80%). Thus, increasing growth of the insulin market is expected to drive the prefillable syringes market that would further aid the growth of the Aseptic Packaging Market.

- Around 80% of the vials and ampoules are made from glass, owing to their suitability with varied drug combinations, but they face challenges like delamination, breakage, etc. Alternative plastic vials, like Cycle Olefin Polymer (COP) and Cycle Olefin Co-Polymer (COC) formats, are likely to gain significant market share over the next five years. Major players, such as Schott and Gerresheimer, possess experience in COC for pharmaceutical applications. Such developments are driving the need for aseptic packaging in the region.

- Furthermore, the use of innovative technologies in ampoules, such as radio frequency identification tags (RFID), deployed with a seal applied outside the packaging, is growing owing to the potential to provide individual security throughout supply chains. All these are expected to drive the aseptic packaging market in the vials and ampoules segment in the region.

Europe Aseptic Packaging Industry Overview

The Europe Aseptic Packaging Market is highly competitive as there are multiple vendors operating in the domestic and international markets. The market appears to be moderately concentrated, with the players adopting various strategies such as product innovation, mergers, and acquisitions, among others, primarily to expand their reach and stay competitive in the market. Some of the major players in the market are Schott AG, DS Smith Plc, Tetra Pak International, among others.

- Jun 2020 - Greatview Aseptic Packaging, one of the largest suppliers of roll-fed packaging material for Tetra Pak aseptic filling machines, was established as a blank-fed producer, supplying sleeves compatible with SIG Combibloc filling machines.

- Jun 2020 - Ecolean's lightweight packaging solutions became part of HelloFresh's meal kits, offering customers a more sustainable and convenient packaging option. The companies aim to strengthen their commitment to sustainability. The Ecolean packages have been included in meal kits that have been distributed in Germany and Austria since April 2020, with Denmark and Sweden to follow.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Opportunities in the MEA Aseptic packaging market

- 4.5 Assessment of COVID-19 impact on the industry

- 4.6 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand to Reduce Cost of Cold Chain Logistics

- 5.1.2 Increasing Demand for Longer Shelf Life of Products

- 5.2 Market Challenges

- 5.2.1 Concerns over Environment and Recycling

- 5.2.2 Manufacturing Complications( for example increasing cost of raw materials) & Lower ROI

6 MARKET SEGMENTATION

- 6.1 Packaging Material

- 6.1.1 Metal

- 6.1.2 Glass

- 6.1.3 Paper

- 6.1.4 Plastics

- 6.1.5 Others

- 6.2 Packaging Type

- 6.2.1 Carton Boxes

- 6.2.2 Bags and Pouches

- 6.2.3 Cups and Trays

- 6.2.4 Bottles and Jars

- 6.2.5 Metal Cans

- 6.2.6 Plastic Cans

- 6.2.7 Composite Cans

- 6.2.8 Others

- 6.3 Country

- 6.3.1 Germany

- 6.3.2 United Kingdom

- 6.3.3 France

- 6.3.4 Russia

- 6.3.5 Italy

- 6.3.6 Rest of Europe

- 6.4 End-User Industry

- 6.4.1 Food

- 6.4.2 Beverage

- 6.4.3 Pharmaceutical & Medical

- 6.4.4 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Tetra Pal International SA

- 7.1.2 Amcor PLC

- 7.1.3 Schott AG

- 7.1.4 Ecolean Packaging

- 7.1.5 Reynolds Group Holdings

- 7.1.6 SIG Combibloc Group

- 7.1.7 WESTROCK COMPANY

- 7.1.8 DS SMITH PLC

- 7.1.9 Mondi PLC

- 7.1.10 Krones, Inc.

- 7.1.11 Reynolds Group Holdings

- 7.1.12 Greatview Aseptic Packaging

- 7.1.13 Sealed Air Corporation

- 7.1.14 Coesia S.P.A.

- 7.1.15 CFT S.P.A.