|

市场调查报告书

商品编码

1685784

全球无菌包装:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Global Aseptic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

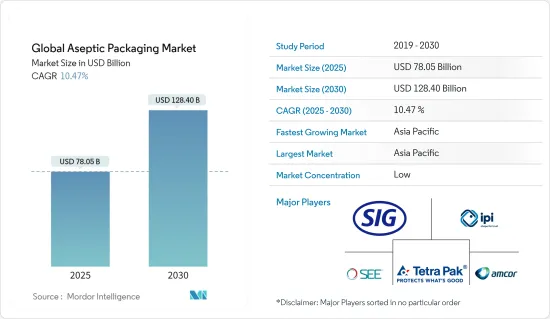

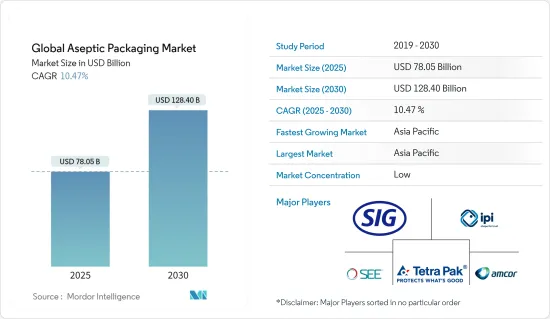

2025 年全球无菌包装市场规模预计为 780.5 亿美元,预计到 2030 年将达到 1,284 亿美元,预测期内(2025-2030 年)的复合年增长率为 10.47%。

主要亮点

- 无菌包装涉及在超高温(UHT)下包装产品,对包装进行单独灭菌或消毒,然后在无菌大气条件下焊接和密封,以避免病毒和细菌污染。此外,内容物的品质得以维持,且不需要添加防腐剂。

- 永续包装和延长保质期对于食品和饮料行业的消费者来说至关重要。因此,大多数食品和饮料供应商都转向无菌包装,因为它具有成本和环境效益。此外,无菌包装支援可回收纸盒或环保袋包装,其目标客户通常是喜欢小包装、购买频率更高的消费者,全球对此类产品的需求相当大。

- 消费者饮食习惯的改变推动了人们对即食食品的偏好,增加了对方便和高品质食品的需求,进一步为市场成长打开了大门。预计全球电子商务销售额的逐步上升和新兴市场的成长机会将在预测期内为无菌包装市场带来重大机会。

- 製药业利用无菌袋来包装液体药物、输液和其他无菌产品。无菌包装市场的成长是由生技药品和疫苗日益增长的需求所推动的。这种需求主要是由维持无菌和延长保质期的要求所驱动。

- 无菌包装市场併购活动的激增显示了市场公司整合和利用消费者对安全便捷包装解决方案不断变化的需求的策略。例如,2023年10月,中国无菌包装公司山东新捷丰科技包装有限公司(NEWJF)完成对纷美无菌包装28.22%的股份的收购。此举旨在透过加强市场占有率、简化业务和推动快速成长市场中的创新来提升 NEWJF 在液体产品包装领域的地位。

无菌包装市场趋势

饮料需求的增加预计将推动市场

- 预计,便携式饮料消费的上升趋势和销售点数量的增加将推动饮料行业的市场成长。不断变化的消费者需求为包装生产商提供了多种选择,以满足饮料行业创新包装的需求。

- 消费者经常选择方便、功能性的饮料,例如即饮咖啡、茶和能量饮料,他们可以随时随地轻鬆饮用。非酒精饮料具有功能性和实用性,相对健康、天然,可以吸引忙碌的消费者。在新产品配方中利用电解质、维生素、矿物质和其他天然成分的天然能量增强特性,使品牌能够针对特定的消费者群体。

- 预计对含有蔬菜和水果等多种健康成分的营养饮料和产品的需求不断增加,以及对牛奶饮料的全球需求不断增长,将推动全球功能性成长。预计这将成为预测期内饮料市场的主要成长动力。

- 健身爱好者对即溶能量饮料的需求不断增加,以获得精神和身体刺激,预计将在预测期内为机能饮料市场提供巨大的成长机会。

- 市场上的消费者越来越注重健康和保健。从早晨的果汁到能量饮料,消费者在提供清爽和符合健康趋势的产品上的花费越来越多。这一趋势推动了饮料包装领域对具有成本效益的包装解决方案的需求。由于无菌纸盒具有易于堆迭产品和延长保质期等优点,牛奶和其他乳类饮料领域对无菌纸盒的需求不断增加,可能会进一步刺激市场。

- 根据德国联邦统计局(Statistisches Bundesamt;BMEL)的资料,2023年德国人均牛奶消费量将高达44.38公斤,显示乳製品需求强劲,推动无菌包装解决方案来维持产品新鲜度并延长保质期。

亚太地区将实现最快成长

- 中国是亚太地区无菌包装的主要消费国之一。预计食品和饮料行业的成长将在预测期内支持市场的成长。盒装午餐的流行趋势、餐厅和超级市场数量的增加以及瓶装水和饮料消费量的增加是推动该国市场发展的关键因素。

- 2023年10月,中国食品公司海南春光食品有限公司选用西得乐Aseptic Combi Predis生产线生产椰奶,进军饮料市场。最新的设备采用西得乐针对 350 毫升瓶型设计的 PET 瓶,每小时可生产 28,000 瓶。该工厂是对中国境内现有的 100 多条无菌生产线的补充。海南春光采用西得乐的技术,为无菌包装市场的成长做出了贡献。

- 在日本,消费者越来越多地使用无菌袋,尤其是用于酱汁和咖哩。无菌袋由塑胶和铝层压板製成,可以承受灭菌所需的热处理,使其成为传统罐头的替代品。袋装包装比罐装包装更便宜,特别是在进口金属罐的国家,这是推动其在日本被接受的一个主要因素。软性饮料消费量的增加也促使饮料製造商扩大其无菌生产线。例如,2023年2月,日本可口可乐公司在其海老名工厂建造了一条咖啡产品无菌生产线。

- 澳洲是亚太地区成长最快的包装市场之一。全国各地的肉类、生鲜食品和加工食品产业正在成长。消费者道德意识的增强以及健康和福祉趋势的提高,推动了对新鲜本地食品的需求。此外,随着该国零食消费趋势的兴起,多年来,一次性包装和可重复使用包装(如小袋)的使用也在增加。对乳製品和新鲜果汁的稳定增长的需求也推动了对 RTD 袋的需求。

- 印度市场受到人口成长、收入增加和生活方式改变的推动。终端用户领域的成长前景正在推动硬质塑胶包装产业的需求。此外,越来越多地使用替代包装来替代袋装包装,限制了市场扩张产品。随着包装食品需求的快速成长和可支配收入的增加,印度预计将占据亚太无菌包装市场的大部分份额。

- 根据美国农业部对外农业服务局的数据,2023年印度的消费量将达2.075亿吨,年平均成长率稳定在2.5%。印度牛奶消费量大幅成长,导致无菌包装的采用量激增,以满足对方便、保质期长的乳製品日益增长的需求,同时解决分销和储存方面的物流挑战,从而推动印度无菌包装市场的市场成长和创新。

无菌包装产业概况

无菌包装市场竞争激烈,有多家大公司参与。这些占据了绝对市场份额的大公司正致力于扩大海外基本客群。这些公司正在利用策略合作计划,透过收购和产品发布来增加市场占有率并增强其产品能力。市场的主要参与者包括 Amcor Ltd、IPI SRL(Coesia Group)、Tetra Pak International SA、Sealed Air Corporation、SIG Combibloc Group 和 Schott AG。

- 2023 年 9 月:SIG 开始建造印度第一家无菌纸盒工厂。该厂预计将于2025年全面运作,建成后每年将支援生产多达40亿个无菌纸盒包装。随着未来追加投资,产能可扩大至每年100亿包。

- 2023 年 9 月:SIG 和 AnaBio Technologies 合作在全球推出长寿益生菌优格。这项合作促成了新的产品类型的推出,例如无菌纸盒包装和发芽袋包装的益生菌饮料,这些饮料无需冷藏即可长期保存。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 饮料无菌包装-需求洞察

第五章市场动态

- 市场驱动因素

- 饮料需求不断成长

- 提高可回收玻璃的商业价值

- 市场挑战

- 原物料价格波动

第六章市场区隔

- 按产品

- 纸盒

- 袋子和小袋

- 能

- 瓶子

- 按应用

- 饮料

- 即饮饮料

- 乳类饮料

- 食物

- 加工食品

- 水果和蔬菜

- 乳製品

- 製药

- 饮料

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 亚洲

- 中国

- 印度

- 日本

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 阿根廷

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 北美洲

第七章竞争格局

- 公司简介

- Amcor Ltd

- IPI SRL(Coesia Group)

- Tetra Pak International SA

- SIG Combibloc Group

- DS Smith PLC

- Uflex Limited

- Elopak AS

- BIBP SP ZOO

- CDF Corporation

- Smurfit Kappa

- Mondi PLC

第八章:市场的未来

The Global Aseptic Packaging Market size is estimated at USD 78.05 billion in 2025, and is expected to reach USD 128.40 billion by 2030, at a CAGR of 10.47% during the forecast period (2025-2030).

Key Highlights

- Aseptic packaging involves packaging a product at ultra-high temperature (UHT), sterilizing or sanitizing the packaging separately, and fusing and sealing under sterile atmospheric conditions to avoid viral and bacterial contamination. In addition, it maintains the quality of the package contents and does not require preservatives.

- Sustainable packaging and longer shelf life are essential to consumers in the food and beverage industry. As a result, most food and beverage vendors are inclining toward aseptic packaging due to its cost and environmental benefits. Also, as aseptic packaging supports packaging through recyclable cartons and eco-friendly pouches and bags, which often target consumers that prefer small-quantity packaging and make purchases more frequently, the demand for such products is considerably high worldwide.

- Changing consumer eating habits is increasing the preference for ready-to-eat meals and demand for convenient, high-quality food products, opening more doors for market growth. A gradual increase in global e-commerce sales and growth opportunities in emerging markets is anticipated to present significant opportunities for the sterile packaging market during the forecast period.

- The pharmaceutical industry utilizes aseptic pouches for packaging liquid medications, IV drugs, and other sterile products. Factors driving the growth of the aseptic packaging market include a rising need for biologics and vaccines. The demand is primarily due to the requirement for maintaining sterility and extending shelf life.

- The surge in mergers and acquisitions within the aseptic packaging market signals the strategies of market players to consolidate and capitalize on evolving consumer demands for safe and convenient packaging solutions. For instance, in October 2023, Shandong NewJF Technology Packaging Co. Ltd (NEWJF), a Chinese aseptic packaging enterprise, completed the acquisition of a 28.22% stake in Greatview Aseptic Packaging. This was intended to elevate NEWJF's position in liquid product packaging by enhancing market presence, streamlining operations, and fostering innovations in the rapidly growing market.

Aseptic Packaging Market Trends

The Growing Demand for Beverages is Expected to Drive the Market

- The rising consumption of on-the-go beverages and the increasing number of outlets are expected to boost the market's growth in the beverage industry. The change in consumer needs provides packaging producers with several options for meeting innovative packaging needs in the beverage industry.

- Consumers frequently grab convenient and functional drinks, such as RTD coffee and tea, energy drinks, and other beverages that can be consumed whenever and wherever they need a boost. Non-alcoholic drinks that offer functional and practical benefits that are relatively healthy and natural can appeal to busy consumers. Leveraging the natural, energy-boosting characteristics of electrolytes, vitamins, minerals, and other natural ingredients in new product formulations can help brands target a specific consumer base.

- The increasing demand for nutraceutical beverages and products due to several healthy ingredients, such as vegetables and fruits, and the rising global demand for milk-based drinks are expected to boost global functional growth. This is expected to be a significant growth driver for the beverage market during the forecast period.

- The increasing demand for instant energy drinks that provide mental and physical stimulation among fitness enthusiasts is projected to create significant growth opportunities for the functional beverage market during the forecast period.

- Consumers in the market are becoming increasingly conscious of health and wellness. From juice in the morning to energy drinks, they are spending more on products that provide refreshments and are well within the wellness trend. This trend has created a high demand for cost-effective packaging solutions in the beverage packaging segment. The increasing demand for aseptic cartons from the milk and other dairy beverages sectors may trigger additional activity in the market due to the ability of cartons to offer benefits like easy stacking of products and longer shelf life.

- As per data from Statistisches Bundesamt; BMEL, Germany's high per capita milk consumption in 2023 at 44.38 kg indicated a strong demand for dairy products, driving the adoption of aseptic packaging solutions to maintain product freshness and extend shelf life, which aligned with consumer preferences for convenience and food safety.

Asia-Pacific to Witness the Fastest Growth

- China is one of the major consumers of aseptic packaging in Asia-Pacific. The growing food and beverage sector is anticipated to support the market's growth during the forecast period. The growing trend of packed meals, the increasing number of restaurants and supermarkets, and the increasing consumption of bottled water and beverages are significant factors driving the market in the country.

- In October 2023, Chinese food company Hainan Chunguang Foodstuff Co. selected Sidel's Aseptic Combi Predis line to expand into the beverage market by producing coconut milk. Utilizing Sidel's PET design for 350 ml bottles, the latest facility produces 28,000 bottles per hour. This installation supplements the existing more than 100 aseptic line setups across China. The adoption of Sidel's technology by Hainan Chunguang contributed to the growth of the aseptic packaging market.

- Consumers increasingly use aseptic pouches in Japan, particularly for sauces and curries. Aseptic pouches can replace conventional cans since they are made from laminated plastic and aluminum, which can withstand the thermal processing used for sterilizing. Pouch packaging is more affordable than cans, especially in nations that import metal for canning, which is the key driver promoting acceptance in Japan. The rising consumption of soft drinks is also leading to the expansion of aseptic production lines among beverage manufacturers. For instance, in February 2023, Coca-Cola Japan built an aseptic production line for its coffee products at its Ebina plant.

- Australia is one of the Asia-Pacific region's fastest-growing packaging markets. The meat, fresh produce, and processed food industries are growing nationwide. Rising consumer ethical concerns and trends in health and well-being have sustained the demand for locally produced, fresh food. In addition, the use of single-serve and reusable packaging options such as pouches has increased along with the country's tendency to snack over the years. The demand for RTD pouches is also fueled by the steadily rising demand for dairy products and fresh fruit juices.

- India's market is driven by a growing population, increased income, and changing lifestyles. Growth prospects of end-user segments are leading to a rise in the demand for the rigid plastic packaging industry. In addition, the market's expansion products are being constrained by the increasing use of alternative packaging options for pouch packaging. Due to the rapidly growing demand for packaged food goods and increased disposable income, India is expected to hold a significant share of the Asia-Pacific aseptic packing market.

- As per the USDA Foreign Agricultural Service, in 2023, the consumption in India was 207.5 million metric tons, indicating a steady annual growth of 2.5%. India's substantial milk consumption rates prompt a surge in aseptic packaging adoption, catering to the growing demand for convenient, longer-lasting dairy products while addressing logistical challenges in distribution and storage, fostering market growth and innovation within India's aseptic packaging market.

Aseptic Packaging Industry Overview

The aseptic packaging market is highly competitive and consists of several major players. With a prominent share in the market, these major players are focusing on expanding their customer bases across foreign countries. These companies leverage strategic collaborative initiatives to increase their market shares and strengthen their product capabilities through acquisitions, product launches, etc. Some of the major players in the market are Amcor Ltd, IPI SRL (Coesia Group), Tetra Pak International SA, Sealed Air Corporation, SIG Combibloc Group, and Schott AG.

- September 2023: SIG started the construction of its first aseptic carton facility in India. The plant is expected to be fully operational by 2025, and once constructed, the facility is set to support the production of up to four billion aseptic carton packs every year. With additional investments in the future, the capacity could be expanded to ten billion packs annually.

- September 2023: SIG and AnaBio Technologies joined forces to release a long-life probiotic yogurt worldwide. This collaboration introduced a novel product category, including probiotic beverages packaged in aseptic carton packs and sprouted pouches, designed to remain shelf-stable for extended storage periods without refrigeration.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products and Services

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Aseptic Packaging for Beverages - Demand Insights

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Beverages

- 5.1.2 Commodity Value of Glass Increased With Recyclability

- 5.2 Market Challenges

- 5.2.1 Volatility in the Raw Material Prices

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Cartons

- 6.1.2 Bags and Pouches

- 6.1.3 Cans

- 6.1.4 Bottles

- 6.2 By Application

- 6.2.1 Beverage

- 6.2.1.1 Ready-to-drink Beverages

- 6.2.1.2 Dairy-based Beverages

- 6.2.2 Food

- 6.2.2.1 Processed Food

- 6.2.2.2 Fruits and Vegetables

- 6.2.2.3 Dairy Food

- 6.2.3 Pharmaceuticals

- 6.2.1 Beverage

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.5.1 Brazil

- 6.3.5.2 Argentina

- 6.3.6 Middle East and Africa

- 6.3.6.1 United Arab Emirates

- 6.3.6.2 Saudi Arabia

- 6.3.6.3 South Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Ltd

- 7.1.2 IPI SRL (Coesia Group)

- 7.1.3 Tetra Pak International SA

- 7.1.4 SIG Combibloc Group

- 7.1.5 DS Smith PLC

- 7.1.6 Uflex Limited

- 7.1.7 Elopak AS

- 7.1.8 BIBP SP ZOO

- 7.1.9 CDF Corporation

- 7.1.10 Smurfit Kappa

- 7.1.11 Mondi PLC