|

市场调查报告书

商品编码

1637851

企业资源规划:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Enterprise Resource Planning - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

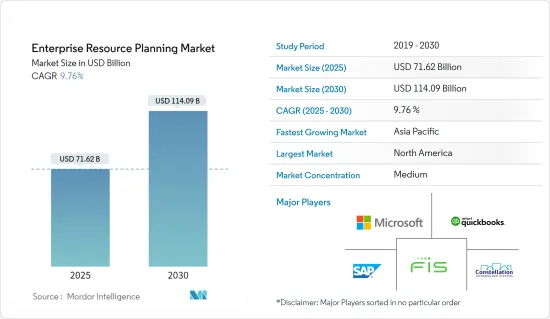

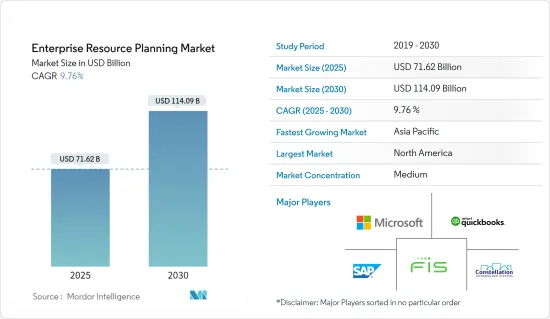

企业资源规划市场规模预计到 2025 年为 716.2 亿美元,预计到 2030 年将达到 1,140.9 亿美元,预测期内(2025-2030 年)复合年增长率为 9.76%。

主要亮点

- ERP 软体可协助组织进行财务规划、预算、预测和财务报告。全球公司数量的快速增加以及对云端基础的ERP 平台的需求增加了对供应商关係管理和客户关係管理的需求,推动了市场的成长。

- 创新和先进技术的不断采用扩大了现有 ERP 系统的价值,最大限度地减少对第三方的依赖并提供高度保护的资源,财务系统的进步等是推动云端基础的ERP 软体需求的重要因素。

- 对以客户为中心的策略的日益增长的需求也推动了 ERP 市场的发展。企业越来越认识到将客户置于业务中心对于提高客户满意度、忠诚度和整体业务成功的重要性。 ERP 系统对于实现这一目标至关重要,因为它们提供全方位的整合应用程序,使公司能够提高生产力、优化工作流程并提供更好的客户服务。

- 行动装置的普及增加了对行动友善 ERP 解决方案的需求。行动 ERP 应用程式可让您核准工作流程、存取关键公司资料并随时随地做出决策,从而提高营运敏捷性。例如,智慧型手机和平板电脑使用者可以使用 SAP ERP 行动应用程式存取基本 ERP 功能。这有助于即时决策、改善团队合作并提高对不断变化的企业需求的适应性。

- 不灵活的 ERP 系统可能会难以随着您的业务变化和发展而发展和适应。这种限制可能会使公司难以推出新产品线、进入新市场或适应组织结构的变化。例如,快速扩张的企业可能会发现很难扩展其 ERP 系统来处理更大的交易量,这可能会导致效能问题并造成业务瓶颈。

- 后COVID-19时代「线上商务」概念的兴起,增加了非接触式交易的需求,使得製造业中小型企业在竞争中举步维艰。这就产生了对製造 ERP 的需求,该 ERP 允许即时执行所有活动。

企业资源规划市场趋势

中小企业市场预计将经历最高的市场成长

- 中小企业是指从业人员250人以下的企业。 ERP 的实施使中小型企业能够更轻鬆、更经济地实现业务流程的自动化和整合。可扩展且灵活的 ERP 软体使小型企业能够存取高度整合的应用程式。适用于中小型企业的 ERP 系统对降低成本和改善业务有直接影响,有助于您实现预期的业务成果。

- 小型企业正在迅速转向 ERP 自动化,包括数位调度和分析。过去十年 ERP 软体和服务的出现让业务变得更加轻鬆。中小型企业已采用 ERP 软体来简化和自动化流程,消除了手动输入的需要。

- 简化的工作流程、更快的交付时间和更高的生产能力等优势带来了透明度,使管理人员能够更好地洞察并做出有效的决策。为中小企业提供即时财务资料,以获得竞争优势并降低成本。

- 2024 年 5 月,欧洲中小企业 ERP 软体供应商 Forterro 宣布在英国推出入门级云端基础的ERP 解决方案 Fortee。 Fortee 被设计为即用型 SaaS 解决方案,针对刚接触 ERP 实施的企业。 Fortee 建立在 Forterro 云端 ERP Sylob 的基础上,专为采购、生产、CRM 和供应链管理等关键功能而建置。

- 世界各地的中小型企业正在意识到数位转型的好处,并正在转向云端基础的ERP 解决方案,以满足他们的预算和业务需求。对简化复杂流程和快速回应客户需求的需求不断增长,正在推动所研究领域的市场采用。

预计北美将占据最大市场份额

- 美国一些最受欢迎的 ERP 解决方案包括 Oracle NetSuite、Oracle ERP Cloud 和 Microsoft Dynamics 365。美国越来越多地采用 ERP 软体的原因是 Oracle 和 Microsoft 等大公司需要透过整合其部门来增加市场竞争。

- 此外,这些公司还提供专为大中型企业建置的 ERP 软体解决方案,以支援财务和营运等复杂功能。许多供应商凭藉数十年的专业知识和行业知识提供成熟的 ERP 解决方案,推动了美国对此类解决方案的需求。

- Oracle Netsuite、Oracle ERP Cloud、Microsoft D365 和 Acumatica 等 ERP 解决方案面向希望升级基本会计系统并透过数位转型发展的中小型企业。还有一些公司在市场上占据了显着的地位,专注于製造分销组织,并提供具有极高投资收益(ROI) 的经济高效的解决方案。

- 此外,2023 年 7 月,总部位于旧金山的 Evergreen Services Group(由私募股权支持的託管 IT 解决方案公司组成的家族)宣布,它是微软金牌云端合作伙伴,也是微软 ERP 系统 Western I 的经销商。此次收购是 Evergreen Services Group 收购美国B2B 服务公司策略的一部分。

- ERP 软体透过整合业务流程减少重复资料输入,使加拿大组织受益。客户对节省时间和提高部门准确性的需求不断增加,推动了加拿大对 ERP 解决方案的需求。多伦多和蒙特娄正在成为加拿大商业和技术进步的中心枢纽。这些地区的 ERP 市场已有许多现有的和新兴的参与企业。

企业资源规划产业概述

企业资源规划 (ERP) 市场处于半固体,有许多区域和全球参与企业。市场供应商正致力于扩大基本客群,并利用策略合作措施来提高市场占有率和盈利。参与企业包括 SAP SE、Intuit、微软公司和 Constellation Software。

- 2024 年 5 月 Amazon Web Services (AWS) 和 SAP 扩大了现有合作伙伴关係,引入了可整合到跨业务组合的功能中的生成式 AI 功能。此次扩展将使使用 Zappos 等 SAP 软体的公司能够利用其云端基础的企业资源规划 (ERP) 平台中的生成式 AI 工具集。

- 2024 年 4 月,Nuvei 推出了一项服务,让商家可以直接透过其企业资源规划 (ERP) 系统存取发票融资解决方案。透过这种集成,系统会自动在总分类帐中反映贷款和还款项目,并将其与每张融资发票保持一致。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- COVID-19大流行和其他宏观经济因素对市场的影响

第五章市场动态

- 市场驱动因素

- 以客户为中心的需求不断增长

- 云端和行动应用程式的激增

- 更多采用资料密集型方法和决策

- 市场问题

- 缺乏灵活性和整合挑战

- 维护成本

- 生态系分析

- 定价及定价模式分析

第六章 市场细分

- 按服务

- 解决方案

- 按服务

- 按功能分类

- 人力资源

- 供应链

- 金融

- 行销

- 其他的

- 按发展

- 本地

- 杂交种

- 按组织规模

- 小型企业

- 大公司

- 按行业分类

- BFSI

- 使用案例

- 资讯科技和电讯

- 使用案例

- 政府机构

- 使用案例

- 零售与电子商务

- 使用案例

- 製造业

- 使用案例

- 石油和天然气能源

- 使用案例

- 其他行业案例

- 使用案例

- BFSI

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- SAP SE

- Intuit

- Microsoft Corporation

- Constellation Software

- FIS

- Oracle Corporation

- IBM Corporation

- Infor Inc.

- Adobe Inc.

- Sage Group PLC

第八章厂商市场占有率分析

第九章 厂商地域排名

第十章投资分析

第十一章投资分析市场的未来

The Enterprise Resource Planning Market size is estimated at USD 71.62 billion in 2025, and is expected to reach USD 114.09 billion by 2030, at a CAGR of 9.76% during the forecast period (2025-2030).

Key Highlights

- ERP software aids in planning, budgeting, forecasting, and reporting an organization's financial results. Due to a steep surge in the number of businesses worldwide and the requirement for cloud-based ERP platforms, the growing need for supplier-relationship management and customer-relationship management is augmenting the market's growth.

- The increasing adoption of innovative and advancing technologies is broadening the value of existing ERP systems, minimizing third-party dependencies, advancing highly secured resources, and advancing financial systems, among other notable factors driving the demand for ERP software, especially cloud-based.

- The growing need for a customer-centric strategy partly drives the enterprise resource planning (ERP) market. Businesses increasingly realize how crucial it is to put the customer at the heart of their operations to increase customer satisfaction, loyalty, and overall business success. ERP systems are essential to reaching this objective because they offer a full range of integrated applications that let businesses increase productivity, optimize workflows, and provide better customer service.

- Demand for mobile-friendly ERP solutions has increased due to the widespread use of mobile devices. By enabling people to approve workflows, access vital company data, and make decisions while on the move, mobile ERP apps help improve operational agility. For instance, users of smartphones or tablets can access essential ERP capabilities with SAP ERP mobile apps. This facilitates real-time decision-making, improves teamwork, and increases adaptability to shifting company needs.

- ERP systems that aren't flexible may find it difficult to evolve and adapt as businesses alter or expand. This restriction may make it more difficult for companies to introduce new product lines, enter new markets, or adapt to organizational structure changes. For instance, a business that is expanding quickly could find it difficult to scale its ERP system to handle higher transaction volumes, which could cause problems with performance and create bottlenecks in the business.

- The rise of the" business online" concept in the post-COVID-19 era increases the demand for contactless transactions, making manufacturing SMEs struggle to compete. This has created the need for ERP for manufacturing companies to enable them to run all activities in real time.

Enterprise Resource Planning Market Trends

The Small and Medium-sized Enterprises Segment is Expected to Witness Highest Growth in the Market

- SMEs are enterprises that have an employee size of fewer than 250 employees. ERP implementations have made it easier and less expensive for small and medium-sized businesses to use business process automation and integration. Scalable and flexible ERP software gives small and medium enterprises access to highly integrated applications. The ERP system for SMEs directly impacts cost savings and operational improvements, helping them achieve desired business outcomes.

- Small businesses rapidly shift to ERP automation, including digital scheduling and analysis. The emergence of ERP software and services over the last decade has made business operations easier. SMEs have been embracing ERP software to streamline and automate processes, eliminating the need for manual input.

- Benefits like ease of workflow, less turnaround time, and high production capability provide transparency, allowing managers to gain better insights and make effective decisions. It provides SMEs with real-time financial data that offers a competitive advantage and helps ensure cost savings.

- In May 2024, Forterro, a European ERP software provider for the industrial mid-market, announced the UK launch of Fortee, its entry-level cloud-based ERP solution. Designed as an out-of-the-box SaaS solution, Fortee targets organizations new to ERP adoption. Drawing from the foundation of Forterro's cloud ERP, Sylob, Fortee is tailored to focus on key functionalities for its intended audience, including procurement, production, CRM, and supply chain management.

- Small and medium enterprises across the world acknowledge the benefits of digital transformation, which drives the transition to cloud-based ERP solutions to meet their budget and business needs. The increasing demand to streamline complex processes and respond to customer demands more quickly would likely boost market adoption in the segment studied.

North America is Expected to Hold the Largest Share in the Market

- The most popular ERP solutions in the United States include Oracle NetSuite, Oracle ERP Cloud, and Microsoft Dynamics 365. The increasing adoption of ERP software in the United States is attributed to large enterprises such as Oracle and Microsoft and the need for businesses to gain a competitive edge in the market by integrating business functions.

- Moreover, these companies provide ERP software solutions built for mid and large-sized companies to assist them in complex functions such as finance and operations. Many providers offer mature ERP solutions owing to their decades of expertise and industry knowledge, promoting demands for such solutions in the United States.

- ERP solutions such as Oracle Netsuite, Oracle ERP Cloud, Microsoft D365, and Acumatica target small and mid-market companies looking to upgrade their basic accounting system and evolve through digital transformation. Others have defined a prominent niche in the marketplace, focusing on manufacturing distribution organizations and offering cost-effective solutions with a very high return on investment (ROI).

- Moreover, in July 2023, San Francisco-based Evergreen Services Group, a private equity-backed family of managed IT solutions companies, acquired Western Computer, a Microsoft Gold Cloud partner and reseller of Microsoft's ERP systems. The acquisition was part of Evergreen Services Group's strategy to acquire B2B services companies across the United States.

- ERP software benefits Canadian organizations by reducing duplicated data entry by integrating business processes. Increasing customer demand to reduce time and increase the accuracy of business functionalities is driving the need for ERP solutions in Canada. Toronto and Montreal are rising as central hubs for business and tech advancements in Canada. These areas are witnessing many established and emerging players in the regional ERP market.

Enterprise Resource Planning Industry Overview

The enterprise resource planning (ERP) market is semi-consolidated, with many regional and global players. Market vendors focus on expanding their customer base across foreign countries and leveraging strategic collaborative initiatives to increase the market's share and profitability. Some players include SAP SE, Intuit, Microsoft Corporation, and Constellation Software.

- May 2024: Amazon Web Services (AWS) and SAP expanded their existing partnership to introduce generative AI capabilities that can integrate into functions across entire business portfolios. The expansion will allow companies using SAP software like Zappos to access generative AI toolsets within the cloud-based enterprise resource planning (ERP) platform.

- April 2024: Nuvei introduced a service allowing merchants to directly access its invoice financing solutions via enterprise resource planning (ERP) systems. This integration ensures that the system automatically mirrors loan and repayment entries in the general ledger, aligning them with the respective financed invoice.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 The Impact of Aftereffects of the COVID-19 Pandemic and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Customer Centric Approach

- 5.1.2 Rapid Increase in Cloud and Mobile Application

- 5.1.3 Increase in Adoption of Data-intensive Approach and Decisions

- 5.2 Market Challenges

- 5.2.1 Lack of Flexibility and Integration Challenges

- 5.2.2 Maintenance Costs

- 5.3 Ecosystem Analysis

- 5.4 Analysis of Pricing and Pricing Model

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Solutions

- 6.1.2 Services

- 6.2 By Function

- 6.2.1 HR

- 6.2.2 Supply Chain

- 6.2.3 Finance

- 6.2.4 Marketing

- 6.2.5 Other Functions

- 6.3 By Deployment

- 6.3.1 On-premise

- 6.3.2 Hybrid

- 6.4 By Organization Size

- 6.4.1 Small and Medium Enterprises

- 6.4.2 Large Enterprises

- 6.5 By Industry Verticals

- 6.5.1 BFSI

- 6.5.1.1 Use Cases

- 6.5.2 IT and Telecom

- 6.5.2.1 Use Cases

- 6.5.3 Government

- 6.5.3.1 Use Cases

- 6.5.4 Retail and E-commerce

- 6.5.4.1 Use Cases

- 6.5.5 Manufacturing

- 6.5.5.1 Use Cases

- 6.5.6 Oil, Gas, and Energy

- 6.5.6.1 Use Cases

- 6.5.7 Other Industry Verticals

- 6.5.7.1 Use Cases

- 6.5.1 BFSI

- 6.6 By Geography

- 6.6.1 North America

- 6.6.2 Europe

- 6.6.3 Asia-Pacific

- 6.6.4 Latin America

- 6.6.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SAP SE

- 7.1.2 Intuit

- 7.1.3 Microsoft Corporation

- 7.1.4 Constellation Software

- 7.1.5 FIS

- 7.1.6 Oracle Corporation

- 7.1.7 IBM Corporation

- 7.1.8 Infor Inc.

- 7.1.9 Adobe Inc.

- 7.1.10 Sage Group PLC