|

市场调查报告书

商品编码

1637853

製造业云端安全:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Cloud Security in Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

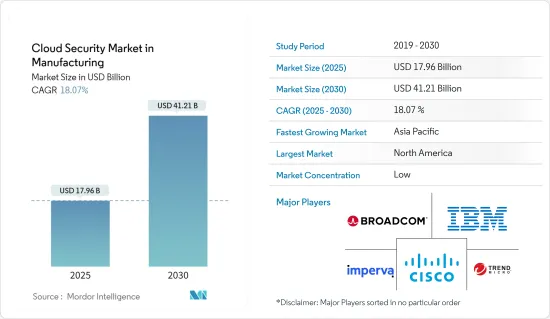

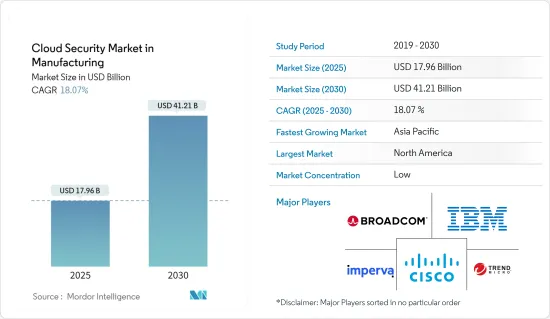

製造业云端安全市场预计将从 2025 年的 179.6 亿美元成长到 2030 年的 412.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 18.07%。

製造业正在快速发展,推动对敏捷系统创新和流程支援的需求。这种需求推动了云端安全解决方案的采用,为製造商提供了更高的可视性和灵活性。

主要亮点

- 製造业是网路攻击最严重的行业之一,大约一半的製造商都经历过网路安全事件。这导致了重大的财务损失和业务运营的中断。因此,企业预算的很大一部分都花在了安全解决方案上。

- 然而,目前大多数生产流程都由内部部署解决方案支持,因此将生产流程从内部部署迁移到云端是一项艰鉅的挑战。製造公司应该专注于可以迁移到云端的新事件,同时开发更智慧的 ERP 系统来处理旧事件,从而使製造能力可以根据需要扩展。

- 世界各国政府正透过官民合作关係关係投资云端基础运算的交付方式,为创新大都会企业和智慧交通网路提供支援。云端基础的技术提供了可靠、经济且可扩展的成果,将大都市转变为数位连接的智慧结构。在整个中东地区,各国政府都在支持发展智慧城市和创新交通服务的倡议,例如杜拜网路城 (DIC) 和沙乌地阿拉伯王国 (KSA) 的「2030 愿景」。

- 此外,2023 年 7 月,Sight Machine Inc. 宣布其製造资料平台现已成为 Microsoft Cloud for Manufacturing 的认证解决方案,进一步扩大了其在 Microsoft Azure 市场中的影响力。 SiteMachine 多年来一直参与微软的製造合作伙伴生态系统,这将使该公司能够利用云端、资料和人工智慧等先进技术,帮助世界各地的製造商转变业务并达到新的生产力永续性。

- 然而,由于对云端服务供应商 (CSP) 缺乏信任,大大小小的企业可能不愿意将业务迁移到云端。由于 CSP 掌握关键资料,因此它们很容易受到复杂的网路攻击,这可能会使企业不愿意将其非公开资料委託给这些提供者。

- 由于网路钓鱼犯罪的增加,COVID-19 疫情导致了对云端解决方案(包括云端安全解决方案)的需求增加。诈骗利用新冠肺炎疫情作为诱饵来赚钱,而远距工作模式的转变使得临时工诈骗计画更容易实施,因为通讯在很大程度上依赖于临时工作。

- 总而言之,受网路威胁、对更高灵活性的需求以及系统创新和流程支援的可见性的推动,製造业对云端安全解决方案的采用预计将快速成长。此外,儘管对 CSP 的信任问题仍然是一个挑战,但政府对云端基础的技术的投资也可能促进市场成长。 COVID-19 疫情凸显了云端安全解决方案的重要性。

云端安全市场趋势

入侵侦测和预防是成长最快的领域

- 入侵侦测和预防软体 (IDPS) 是一种监控网路流量以发现潜在攻击征兆的安全系统。其主要目的是识别潜在的危险活动并立即采取行动防止攻击。这可能包括丢弃恶意资料包、阻止网路流量或重置连线。此外,IDPS 通常会向安全管理员发送警报,告知他们潜在的威胁。

- 数位孪生是使用物联网 (IoT)资料创建的实体物件、环境和流程的虚拟表示。数位双胞胎使製造商能够透过在虚拟环境中模拟和分析资料来优化产品、流程和决策。在整个资料生命週期中连接和管理资料的方法称为数位执行绪。

- 随着IT效能的提高,製造商可以利用基于IT的模拟、建模和资料分析来优化其对各种应用情境的反应。高效能运算 (HPC) 功能(包括复杂运算、提高的营运灵活性和更好地利用 IT 资源)是此最佳化过程中使用的标准工具。 HPC 系统用途极为广泛,广泛应用于製药、离散製造和製程製造等许多不同领域。

- 数位工程利用云端基础的製造资料工具和相容的合作伙伴解决方案生态系统,帮助製造商加速其产品开发流程。

- IDS 或 IPS 系统的成功部署和运作取决于两个主要因素:部署的特征码和通过它的网路流量。全面且定期更新的签章资料库可确保系统能准确侦测潜在威胁。流经系统的网路流量是一级资讯来源,系统必须能够即时处理和分析它。

亚太地区将经历最高成长

- 亚太地区目前是全球成长最快的地区。根据《东协邮政》报道,製造业是东南亚国家联盟(东协)经济成长的主要动力。

- 推动这一成长的关键倡议之一是东协经济共同体 (AEC),旨在将东协建立为单一市场和生产中心。此外,区域全面经济伙伴关係(RCEP)等大型贸易协定可能是建立更广泛的亚太自由贸易区(FTAAP)的重要一步,为促进自由贸易提供宝贵工具。

- 为了帮助亚太地区 (APAC) 的企业防范和应对日益严重的网路攻击威胁,IBM 宣布对网路安全资源进行大量投资。这项投资将以 IBM 安全指挥中心为特色,该中心将运行高度逼真的网路攻击模拟,并为从技术执行长到高阶主管层的每个人提供应对技术的培训。

- 作为这项投资的一部分,IBM 还将收购一个全新的安全营运中心 (SOC),该中心将整合到公司广泛的全球 SOC 网路中,为全球客户提供全天候安全回应服务。

- 许多领先的公司正在扩大在亚太地区的业务。例如,Google最近将其亚太地区的 Google Cloud Platform 区域从三个扩展到六个。

云端安全产业概览

由于对网路攻击的担忧日益加剧,製造业云端安全市场高度分散。许多公司正在扩展其服务以适应各种规模的组织。该市场的一些主要企业包括思科系统公司、IBM 公司、博通和 Imperva。

- 2023 年 4 月 – AWS 推出製造业和工业能力。 AWS 已宣布推出 AWS 製造和工业能力。 AWS 製造和工业能力扩展了类别,以进一步区分合作伙伴并协助客户找到适合其共同业务需求的解决方案。

- 2022 年 5 月-云端运算产业最大公司Google宣布推出针对智慧工厂和智慧员工的全新Google云端製造 (Google Cloud Manufacturing)。 Google Cloud 的新製造解决方案使製造工程师和工厂经理能够存取来自所有不同资产和流程的统一、情境化的资料。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素与限制因素简介

- 市场驱动因素

- 网路威胁日益加剧推动市场扩张

- 市场限制

- 将製造流程从本地迁移到云端是一项重大挑战

- 价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 按解决方案

- 身分和存取管理

- 预防资料外泄

- IDS/IPS

- 安全资讯和事件管理

- 加密

- 安全

- 应用程式安全

- 资料库安全

- 端点安全

- 网路安全

- Web 和电子邮件安全

- 依部署方式

- 民众

- 私人的

- 杂交种

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第六章 竞争格局

- 公司简介

- Trend Micro Inc.

- Imperva Inc.

- Broadcom Inc.

- IBM Corporation

- Cisco Systems Inc.

- Fortinet Inc.

- Sophos PLC

- Mcafee LLC

- Qualys Inc.

- Check Point Software Technologies Ltd

- Computer Science Corporation(CSC)

第七章投资分析

第八章 市场机会与未来趋势

The Cloud Security Market in Manufacturing Industry is expected to grow from USD 17.96 billion in 2025 to USD 41.21 billion by 2030, at a CAGR of 18.07% during the forecast period (2025-2030).

The manufacturing industry is rapidly evolving, and with it comes an increasing demand for agile system innovation and process support. This demand has led to the adoption of cloud security solutions, which offer greater visibility and flexibility to manufacturers.

Key Highlights

- Manufacturing is one of the most highly targeted industries for cyberattacks, with almost half of all manufacturers have experienced a cybersecurity incident. This has resulted in significant financial losses and disruptions to business operations. As a result, a major portion of a company's budget is being spent on security solutions.

- However, migrating production processes from on-premise to the cloud can be challenging, as most production processes are currently supported by on-premise solutions. Manufacturers should focus on new events that can be transferred to the cloud while developing a more intelligent ERP system to handle older events, enabling manufacturing functions to scale as needed.

- Governments worldwide are investing in cloud-based computing delivery methods through public-private partnerships to advance innovative megacity enterprises and intelligent transportation networks. Cloud-based technology provides reliable, affordable, and scalable outcomes that can transform metropolises into digitally connected and intelligent structures. In the Middle East, governments are endorsing initiatives like the Dubai Internet City (DIC) and the Kingdom of Saudi Arabia (KSA) Vision 2030 to develop smart municipalities and innovative transportation services.

- Furthermore, in July 2023, Sight Machine Inc. announced that its Manufacturing Data Platform is now a certified solution for Microsoft Cloud for Manufacturing, further expanding its reach within the Microsoft Azure Marketplace. Sight Machine's multi-year participation in Microsoft's partner ecosystem for manufacturing enables organizations to assist manufacturers around the globe in transforming their businesses and unlock new levels of productivity and sustainability with leading cloud, data and AI-powered technology.

- However, large and small organizations may be hesitant to shift their operations to the cloud due to a lack of trust in cloud service providers (CSPs). CSPs hold critical data, making them highly vulnerable to complex cyberattacks that can discourage businesses from entrusting their nonpublic data to these providers.

- The COVID-19 pandemic increased the demand for cloud solutions, including cloud security solutions, due to an increase in phishing offenses. Scammers were using COVID-19 as a lure to generate income, and the shift to remote working made dispatch fraud schemes easier to execute as communication relies heavily on dispatch.

- In conclusion, the manufacturing industry's adoption of cloud security solutions is expected to grow rapidly, driven by cyber threats, demand for greater agility, and visibility in system innovation and process support. The government's investments in cloud-based technology will also contribute to market growth, though the issue of trust in CSPs remains a challenge. The COVID-19 pandemic highlighted the importance of cloud security solutions, which will continue to be in high demand in the foreseeable future.

Cloud Security Market Trends

Intrusion Detection and Prevention is the Fastest Growing Segment

- An intrusion detection and prevention software (IDPS) is a security system that monitors network traffic for any signs of potential attacks. Its primary purpose is to identify any potentially dangerous activity and take immediate action to prevent the attack. This may involve dropping malicious packets, blocking network traffic, or resetting connections. Additionally, the IDPS typically sends an alert to security administrators to inform them of the potential threat.

- Digital twins are virtual representations of physical objects, environments, and processes, created using data from the Internet of Things (IoT). Manufacturers can use digital twins to optimize their products, processes, and decisions by simulating and analyzing data in a virtual environment. The means of connecting and managing data throughout its lifecycle are known as digital threads.

- Manufacturers with improved IT performance can optimize their support for different application scenarios by leveraging IT-based simulations, modeling, and data analysis. High-performance computing (HPC) capabilities, such as complex calculations, greater operational agility, and better IT resource utilization, are standard tools used in this optimization process. HPC systems are incredibly versatile and widely used in various sectors, including pharmaceutical, discrete, and process manufacturing.

- Digital engineering, which involves utilizing cloud-based manufacturing data tools and an ecosystem of compatible partner solutions, can help manufacturers accelerate their product development process.

- The successful deployment and operation of an IDS or IPS system rely on two main factors - the deployed signatures and the network traffic that flows through it. A comprehensive and regularly updated database of signatures ensures that the system can accurately detect potential threats. The network traffic that flows through the system is the primary source of information, and the system must be capable of processing and analyzing it in real time.

Asia-Pacific to Witness the Highest Growth

- The Asia-Pacific region is currently experiencing the fastest growth in the world, thanks in large part to the expansion of its manufacturing sector. According to a report from the ASEAN Post, the manufacturing industry has been a crucial driver of economic growth for the Association of Southeast Asian Nations (ASEAN).

- One of the key initiatives driving this growth is the ASEAN Economic Community (AEC), which aims to establish ASEAN as a single market and production base. Additionally, mega trade agreements such as the Regional Comprehensive Economic Partnership (RCEP) could be a significant step towards the creation of a broader Free Trade Area of the Asia-Pacific (FTAAP), which would serve as a valuable intergovernmental forum for promoting free trade.

- To help businesses in the Asia Pacific (APAC) region prepare for and manage the growing threat of cyberattacks, IBM has announced a significant investment in its cybersecurity resources. The centerpiece of this investment is the IBM Security Command Center, which uses highly realistic simulated cyberattacks to teach response techniques to everyone from technical staff to the C-suite.

- As part of this investment, IBM has also acquired a brand-new Security Operation Center (SOC), which will be integrated into the company's extensive global network of SOCs to provide round-the-clock security response services to clients worldwide.

- Many major companies are expanding their presence in the APAC region. For example, Google has recently increased the number of Google Cloud Platform regions in APAC from three to six.

Cloud Security Industry Overview

The market for cloud security in the manufacturing industry has experienced fragmentation due to increasing concerns about cyberattacks. To cater to organizations of all sizes, many companies are expanding their services. Some of the significant players in this market include Cisco Systems Inc, IBM Corporation, Broadcom, and Imperva, among others.

- April 2023 - AWS announced the Manufacturing and Industrial Competency. AWS announced the launch of the AWS Manufacturing and Industrial Competency. The AWS Manufacturing and Industrial Competency has expanded to include the categories to further differentiate partners and assist customers in finding the right solution for their identical business needs.

- May 2022 - Google, the most prominent player in the cloud industry, introduced the new Google Cloud Manufacturing for smart factories and intelligent employees. Google Cloud's new manufacturing solutions allow manufacturing engineers and plant managers to access united and contextualized data from all their diverse assets and procedures.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Growing Threats of Cyber Attacks is Expanding the Market

- 4.4 Market Restraints

- 4.4.1 Migration of Manufacturing Processes from On-premise to Cloud is a Major Challenge

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Solution

- 5.1.1 Identity and Access Management

- 5.1.2 Data Loss Prevention

- 5.1.3 IDS/IPS

- 5.1.4 Security Information and Event Management

- 5.1.5 Encryption

- 5.2 By Security

- 5.2.1 Application Security

- 5.2.2 Database Security

- 5.2.3 Endpoint Security

- 5.2.4 Network Security

- 5.2.5 Web and Email Security

- 5.3 By Deployment Mode

- 5.3.1 Public

- 5.3.2 Private

- 5.3.3 Hybrid

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia Pacific

- 5.4.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Trend Micro Inc.

- 6.1.2 Imperva Inc.

- 6.1.3 Broadcom Inc.

- 6.1.4 IBM Corporation

- 6.1.5 Cisco Systems Inc.

- 6.1.6 Fortinet Inc.

- 6.1.7 Sophos PLC

- 6.1.8 Mcafee LLC

- 6.1.9 Qualys Inc.

- 6.1.10 Check Point Software Technologies Ltd

- 6.1.11 Computer Science Corporation (CSC)