|

市场调查报告书

商品编码

1637854

中东油田服务:市场占有率分析、产业趋势与成长预测(2025-2030)Middle-East Oilfield Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

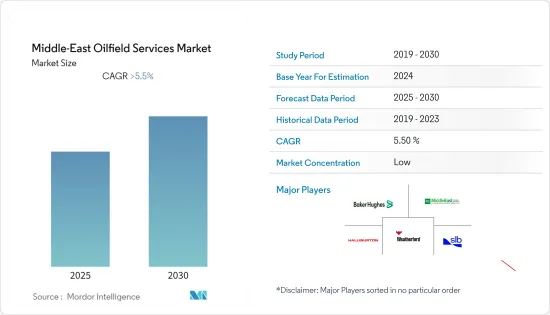

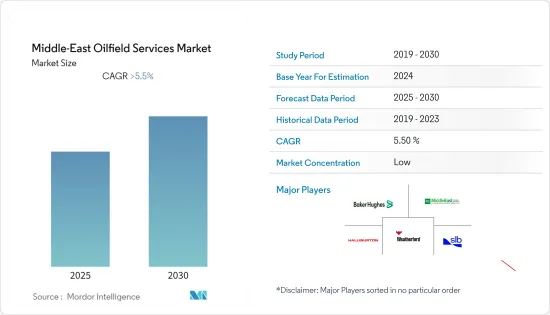

预计中东油田服务市场在预测期内将维持5.5%以上的复合年增长率。

COVID-19 对 2020 年市场产生了负面影响。目前,市场已达到疫情前水准。

从中期来看,旨在提高产能的投资增加预计将增加对中东油田服务市场的需求。

另一方面,太阳能和风力发电等再生能源来源的持续采用预计将阻碍市场成长。

增加技术投资以开发更有效率的石油生产和钻井製程预计将为中东油田服务市场创造重大机会。

由于已探明的石油和天然气蕴藏量庞大,沙乌地阿拉伯预计将在预测期内主导市场。

中东油田服务市场趋势

完井和生产服务预计将大幅成长

- 完井服务的目的在于无论油井的复杂程度如何,都能最大限度地原位开采石油 (OOIP)。在钻井、评估、下套管和固井后,完井服务包括添加设备以优化生产。一旦油井完工并开始生产,碳氢化合物就开始被带到地面。生产服务保持长期良好运作和可持续性。

- 预测期内,完井服务的需求预计将激增,这主要是由于中东探勘和生产计划的增加。例如,在中东地区,2021年我们参与了约41个油气合同,其中超过31个上游计划占合约的大部分。

- 根据贝克休斯钻机数量,2022 年中东的平均钻机数量较 2021 年显着增加。 2022年平均钻机数量为308座,较2021年成长16.3%。

- 此外,中东海上矿区的扩张预计将增加对人工举升生产服务的需求。 2022年,沙乌地阿拉伯和科威特宣布计画开发Durra海上天然气田,预计每天生产10亿立方英尺天然气和84,000桶冷凝油。

- 2022年,阿布达比国家石油公司(ADNOC)宣布在阿布达比酋长国近海发现天然气资源。这是该国海上勘探区块的首次发现,凸显了阿布达比国家石油公司区块竞标的成功。该探井已产出 1.5 至 2 兆标准立方英尺 (TSCF) 的原始天然气。

- 因此,在预测期内,由于全球碳氢化合物需求和价格上涨,上游计划激增,中东的完井和生产服务预计将扩大。

沙乌地阿拉伯正在经历显着的成长

- 2021年,沙乌地阿拉伯探明蕴藏量位居全球第二,仅次于委内瑞拉,是全球第二大原油生产国,约占全球原油产量的11%。它也是世界上最大的原油出口国。

- 沙乌地阿拉伯的页岩气蕴藏量估计位居世界第五。因此,它具有复製美国传统型蕴藏量开发成长的巨大潜力。

- 2022年2月,沙乌地阿美公司在Shadoun(中部地区)、Shehab和Shulfa(东南部)、Umm Khansal(靠近伊拉克北部边境)和Samnah(东部)四个地区发现了天然气天然气田,并取得了重大进展。该行业的发展。这项发现预计将在预测期内增加对油田服务的需求并推动市场发展。

- 根据石油输出国组织(OPEC)的数据,沙乌地阿拉伯原油产量为912.5万桶/日,比2020年下降1%。然而,由于天然气田的扩张,预计未来产量将会增加。

- 沙乌地阿拉伯正在扩大其现有的石油和天然气田。主要扩建计划包括贝里油田和马里安油田。贝里油田部分位于沙乌地阿拉伯东海岸陆上,部分位于海上,根据贝里增产计画 (BIP),到 2023 年,该油田的原油产能将扩大一倍,达到 50 万桶/日 (Bpd)。进步。该计划预计2023年完工,预计投资60亿美元。

- 因此,鑑于上述几点,预计沙乌地阿拉伯油田服务市场在预测期内将显着成长。

中东油田服务业概况

中东油田服务市场较为分散。该市场的主要企业包括(排名不分先后)贝克休斯公司、哈里伯顿公司、斯伦贝谢有限公司和威德福国际有限公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 调查先决条件

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 服务类型

- 钻井服务

- 钻井/完井流体

- 分层评估

- 竣工及生产服务

- 钻井废弃物管理服务

- 其他的

- 地点

- 陆上

- 离岸

- 地区

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 伊朗

- 其他中东地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Anton Oilfield Services(Group)Ltd.

- Baker Hughes Co.

- Denholm Oilfield Services

- Halliburton Company

- Middle East Oilfield Services

- Welltec A/S

- OiLServ Limited

- Schlumberger Limited

- Swire Oilfield Services Ltd.

- Weatherford International PLC

第七章 市场机会及未来趋势

The Middle-East Oilfield Services Market is expected to register a CAGR of greater than 5.5% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently, the market has reached pre-pandemic levels.

Over the medium term, the rising investments aimed at increasing production capacity are expected to increase the demand for the Middle East oilfield services market.

On the other hand, the increasing adaptation of renewable energy sources such as solar and wind energy is expected to hinder market growth.

Nevertheless, the increasing technological investments in the market to develop more efficient oil production and drilling processes are expected to create huge opportunities for the Middle-East oilfield services market.

Saudi Arabia is expected to dominate the market during the forecasted period due to the country's significant amount of proven oil and gas reserves.

Middle East Oilfield Services Market Trends

Completion and Production Services Expected to Witness Significant Growth

- Well-completion services aim to extract the maximum amount of original oil in place economically (OOIP), regardless of the complexity of the well. Once a well has been drilled, evaluated, cased, and cemented, completion services involve adding equipment to optimize production. Once the well is completed and production begins, bringing hydrocarbons to the surface will start. The production services keep the well running and sustaining for a long time.

- During the forecast period, the demand for completion services is anticipated to surge, primarily due to the increasing number of exploration and production projects in the Middle East. For example, in 2021, the Middle East region worked on approximately 41 oil and gas contracts, with upstream projects accounting for most of the contracts at over 31.

- According to Baker Hughes rig count, the average rig count in the Middle East increased significantly in 2022 compared to 2021. In 2022, the average number of rigs was 308, an increase of 16.3% compared to 2021.

- Moreover, expanding offshore fields in the Middle East is anticipated to bolster demand for artificial lift production services. In 2022, Saudi Arabia and Kuwait announced plans to develop the Durra offshore gas field, which was projected to yield 1 billion cubic feet of gas and 84,000 barrels of condensate per day.

- In 2022, the Abu Dhabi National Oil Company (ADNOC) announced the discovery of natural gas resources offshore the Emirates of Abu Dhabi. This is the first discovery from the country's offshore exploration concessions, highlighting the success of ADNOC's block bid rounds. This exploration well has indicated between 1.5 and 2 trillion standard cubic feet (TSCF) of raw gas in place.

- Therefore, in the forecast period, completion and production services in the Middle East are expected to expand, fueled by a surge in upstream projects as a result of the global increase in demand and price of hydrocarbons.

Saudi Arabia to Witness Significant Growth

- In 2021, Saudi Arabia, which is home to the second-largest proven oil reserves globally after Venezuela, was the world's second-largest crude oil producer, responsible for approximately 11% of global crude oil output. Additionally, the country holds the top spot as the largest crude oil exporter globally.

- Saudi Arabia is estimated to have the world's fifth-largest estimated shale gas reserve. Thus, it has great potential to replicate the United States' unconventional reserves' development growth.

- In February 2022, Saudi Aramco made significant strides in the development of its natural gas sector by discovering natural gas fields in four regions of the Kingdom, namely in Shadoon (the central region), Shehab and Shurfa (the southeast region), Umm Khansar (near the northern border with Iraq), and Samna (the eastern region). This discovery is expected to boost demand for oilfield services, driving the market in the forecast period.

- According to the Organization of the Petroleum Exporting Countries (OPEC), crude oil production in Saudi Arabia was 9,125 thousand barrels per day, which was a 1% drop compared to 2020. But production is expected to increase in the future due to oil and gas field expansion.

- Saudi Arabia is in the process of expanding its existing oil and gas fields. A few major expansion projects include the Berri field and the Marjan oil field. The Berri field is located partly onshore and partly offshore on the east coast of Saudi Arabia and is being expanded under the Berri Increment Program (BIP) to double its crude production capacity to 500,000 barrels per day (bpd) by 2023. The project is scheduled to be completed in 2023, with an estimated investment of USD 6 billion.

- Therefore, due to the above-mentioned points, Saudi Arabia is expected to witness significant growth in the oilfield services market during the forecasted period.

Middle East Oilfield Services Industry Overview

The Middle-East oilfield services market is fragmented in nature. Some of the major players in the market (in no particular order) include Baker Hughes Co., Halliburton Company, Schlumberger Limited, Middle-East Oilfield Services, and Weatherford International PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Service Type

- 5.1.1 Drilling Services

- 5.1.2 Drilling and Completion Fluids

- 5.1.3 Formation Evaluation

- 5.1.4 Completion and Production Services

- 5.1.5 Drilling Waste Management Services

- 5.1.6 Other Services

- 5.2 Location

- 5.2.1 Onshore

- 5.2.2 Offshore

- 5.3 Geography

- 5.3.1 Saudi Arabia

- 5.3.2 Qatar

- 5.3.3 United Arab Emirates

- 5.3.4 Iran

- 5.3.5 Rest of the Middle-East

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Anton Oilfield Services (Group) Ltd.

- 6.3.2 Baker Hughes Co.

- 6.3.3 Denholm Oilfield Services

- 6.3.4 Halliburton Company

- 6.3.5 Middle East Oilfield Services

- 6.3.6 Welltec A/S

- 6.3.7 OiLServ Limited

- 6.3.8 Schlumberger Limited

- 6.3.9 Swire Oilfield Services Ltd.

- 6.3.10 Weatherford International PLC