|

市场调查报告书

商品编码

1637866

云端加密软体:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Cloud Encryption Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

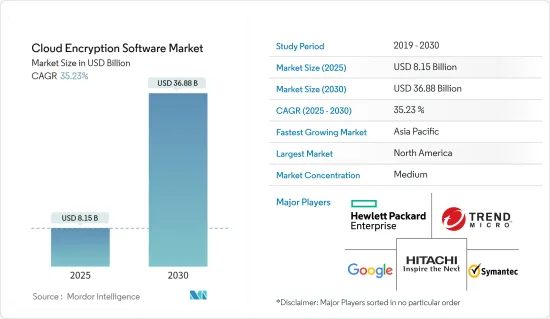

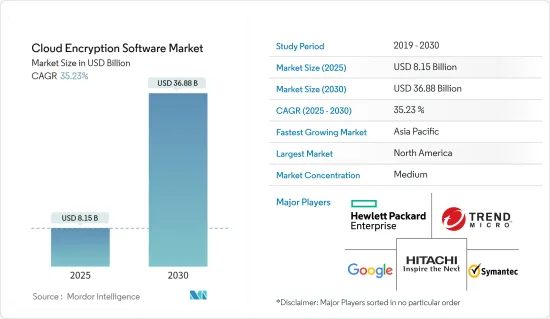

预计 2025 年云端加密软体市场价值为 81.5 亿美元,预计到 2030 年将达到 368.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 35.23%。

云端运算采用和虚拟的快速成长,以及推动云端加密解决方案采用的严格法规是推动全球市场成长的一些因素。

主要亮点

- 传统上,保护资料非常容易。市场上有可用的安全功能来保护和确保资料的安全。资料是从 IT 部门核准的、公司控制的设备和应用程式收集的,并储存在伺服器上。透过阻止外部人员并信任内部人员来保护资料。

- 但今天,情况发生了巨大变化。如今,从更多应用程式、用户、设备和连接硬体收集的资料比以往任何时候都多。新的经营模式需要便捷的外部存取。此外,随着云端运算的出现,公司的资料可能不再驻留在内部。

- 现在,相关人员还包括甚至不属于该组织的第三方云端供应商,他们是采用加密解决方案的主要因素,并正在推动市场的发展。

- 云端加密是云端储存提供者提供的服务,其中资料使用各种加密演算法进行转换并放置在储存云中。过去几年中,加密的使用呈指数级增长。加密的部署方式有很多种,从加密资料库和檔案系统内的资料到透过公共和内部网路传输资料。

云端加密软体市场趋势

资讯科技和通讯产业高速成长

- IT和通讯业是云端加密软体市场的主要消费者之一。资料安全是通讯和IT产业关注的主要议题之一,也是推动市场发展的重要因素。

- 云端技术已经深入IT和通讯业的核心层面。通讯业正在使用云端服务来减少流程的时间和成本。由于云端的功能,该行业正专注于以更快的速度成长,从而推动云端加密软体市场的发展。

- IT 产业也正在大规模采用云端运算。随着流程和运算在云端进行,公司发现削减成本和提高效率变得更加容易。此外,这些产业中的云端系统也解决资料管理问题。按需服务和低营运成本正在推动通讯和 IT 产业从核心层面采用云端技术。

- 2023 年 2 月,Gmail 用户端加密 (CSE) 将推广至 Google Workspace Enterprise Plus、Education Standard 用户和 Education Plus。该功能于去年在 Google Docs、Google Drive、幻灯片、表格、Google Meet 和 Google 日历(测试版)中推出,并于去年作为 Beta 测试版首次在网页版 Gmail 中推出。当您启用 Gmail CSE 时,作为电子邮件附件(包括内嵌图像)或电子邮件正文的一部分发送的任何敏感资料都会在到达 Google 伺服器之前加密且不可读。

- 随着资料外洩和网路窃盗的增加,云端加密软体市场预计将进一步成长。

北美占有最大市场占有率

- 北美地区是世界上最大的经济体之一,占据全球云端加密软体市场的大部分份额。由于资料隐私和安全是企业主要关注的问题之一,预计该地区的云端加密软体市场将快速成长。

- 过去几年,该地区发生了多起备受瞩目的资料外洩事件,引发了提供云端服务的公司对涉嫌侵犯用户资料隐私的愤怒。这迫使公司加强云端安全并采用更好的加密解决方案。此外,类似的资料外洩迫使许多公司投入大量资金来开发更好的加密软体。预计此类资料遗失担忧将推动加密解决方案市场的发展。

- 一次大规模网路攻击袭击了美国联邦政府,危及了路易斯安那州和奥勒冈州数百万人的资料。这次洩密事件影响了 350 万持有驾驶执照或州ID卡的奥勒冈州。洩漏的记录超过 600 万条,但由于有些人有驾驶执照或许可证,因此数字是重复的。联邦当局指责俄罗斯勒索软体组织利用相同漏洞发起了大规模骇客宣传活动。

- 该地区的政府也在加强安全规范,对公司实施严格的监管,以便为用户资料提供更好的云端安全。

云端加密软体产业概况

云端加密软体市场竞争适中,国内外都有许多大大小小的参与者。市场似乎正在适度整合,产品创新和併购是主要企业采取的主要策略。该市场的主要参与者包括 Google LLC、赛门铁克公司、惠普企业和趋势科技公司。

2022 年 12 月,苹果宣布推出端对端加密系统-iCloud 高阶资料保护。这确保即使 Apple 遭到骇客攻击,您的 iCloud 帐户中的大部分资料仍将保持安全,并且还能防止 Apple 根据执法请求存取您的 iCloud 手机备份。

2022 年 10 月,Valuetree 宣布发布针对 Google AlloyDB 的资料使用中加密。该产品将 Vaultree 的全球首个全功能加密解决方案与 Google 的 AlloyDB for PostgreSQL 结合。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素与限制因素简介

- 市场驱动因素

- 资料传输及其安全的监管标准

- 网路攻击和手机窃盗不断增加

- 市场限制

- 组织的管理费用增加

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 按组织规模

- 中小型企业

- 大型企业

- 按服务

- 专业服务

- 託管服务

- 按行业

- 资讯科技/通讯

- BFSI

- 卫生保健

- 娱乐与媒体

- 零售

- 教育

- 其他行业

- 地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 公司简介

- Trend Micro

- Ciphercloud

- Symantec Corporation

- Hewlett Packard Enterprise

- Google LLC

- Sophos

- Voltage Security Inc.

- CyberArk

- Safenet

- Hitachi Vantara

- Boxcryptor

第七章投资分析

第八章 市场机会与未来趋势

The Cloud Encryption Software Market size is estimated at USD 8.15 billion in 2025, and is expected to reach USD 36.88 billion by 2030, at a CAGR of 35.23% during the forecast period (2025-2030).

The rapid increase of cloud adoption and virtualization and the stringent regulations helping to increase the adoption of cloud encryption solutions are some factors boosting the global market growth.

Key Highlights

- Traditionally, it was a lot easier to protect the data. There were security features available in the market for protecting and securing the data. The data came from IT-approved, enterprise-controlled devices and applications and was stored in the servers. It was protected by walling off the outsiders and trusting the insiders.

- But in today's times, there is a drastic change in how things happen. Now, more data than ever is collected from more applications, users, devices, and connected hardware. New business models demand easy access from the outside. Moreover, with the emergence of the cloud, a firm's data may not even be on the inside anymore.

- Also, the insiders now include third-party cloud providers who are not even part of your organization, which is the primary factor for the adoption of encryption solutions, thus driving the market.

- Cloud encryption is a service offered by cloud storage providers whereby data is transformed using different encryption algorithms and is then placed in a storage cloud. Encryption use has risen sharply in the past few years. It is deployed in a multitude of ways, from encrypting data in databases and file systems to data being transferred over public and internal networks.

Cloud Encryption Software Market Trends

IT & Telecommunication Segment to Witness High Growth

- The IT & telecommunication industry is one of the major consumers of the cloud encryption software market. Data security is one of the primary concerns of the telecom and IT industry, which is driving the market.

- Cloud technologies are integrated into the core levels of the IT and telecom industry. The telecom industry is using cloud services to reduce the time and cost of the processes. With cloud capabilities, the industry is focused on growing at a faster pace, driving the market for cloud encryption software.

- The IT industry is also implementing the cloud on a very large scale. With processes and computing now sourced on clouds, companies are finding it easier to reduce costs and improve efficiency. Additionally, the cloud system in these industries is also addressing the concern of data management. On-demand services and the low cost of operations are driving the telecom and IT industry to utilize cloud technology at the core level.

- February 2023, Gmail client-side encryption (CSE) is public for Google Workspace Enterprise Plus, Education Standard customers, and Education Plus. Last year, the part was first introduced in Gmail on the web as a beta test after being available in Google Docs, Google Drive, Slides, Sheets, Google Meet, and Google Calendar (in beta). Once enabled, Gmail CSE provides that any sensitive data sent as part of the email's attachments (including inline images) and body will be encrypted and unreadable before reaching Google's servers.

- With the increasing number of data breaches and cyber thefts, the cloud encryption software market is expected to grow further.

North America Occupies the Largest Market Share

- North American region is one of the largest economies of the world and holds a major share of the global cloud encryption software market. The cloud encryption software market is expected to witness rapid growth in this region as data privacy and security are becoming one of the major concerns for companies in this region, thus driving the market.

- This region has witnessed some high-profile data breaches in the past few years, which have resulted in outrage among companies providing cloud services as the privacy of user data was compromised. This compelled various firms to tighten their cloud security and implement better encryption solutions. Moreover, similar breaches have forced many companies to invest highly in better encryption software. This data loss concern is expected to drive the market for these encryption solutions.

- Millions of people in Louisiana and Oregon have compromised their data in the sprawling cyberattack that has hit the US federal government. The breach has affected 3.5 million Oregonians with driver's licenses or state ID cards. More than 6 million records were compromised, noting that number is duplicative because some people have driver registrations and permits. Federal officials have attributed a broader hacking campaign using the same vulnerability to a Russian ransomware gang.

- The governments in this region have also tightened the security norms by passing strict regulations for firms to provide better cloud security for user's data. data.

Cloud Encryption Software Industry Overview

The cloud encryption software market is moderately competitive due to many small and large players in the domestic and international markets. The market appears to be mildly Consolidated, and the key strategies adopted by the major players are product innovation and mergers and acquisitions. Some of the major players in the market are Google LLC, Symantec Corporation, Hewlett Packard Enterprise, and Trend Micro Inc., among others.

In December 2022, Apple launched Advanced Data Protection, an end-to-end encryption system, iCloud. This would keep most of the iCloud account's data secure even when Apple is hacked and would prevent Apple from accessing iCloud phone backups in response to law enforcement requests.

In October 2022, Valuetree announced the release of its data-in-use encryption for Google's AlloyDB. The offering pairs the world's first fully functional encryption-in-use solution powered by Vaultree with Google's AlloyDB for PostgreSQL.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Regulatory Standards Related to Data Transfer and its Security

- 4.3.2 Growing Volume of Strength of Cyber Attacks and Mobile Theft

- 4.4 Market Restraints

- 4.4.1 Rise in Organizational Overhead Expenses

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Organization Size

- 5.1.1 SMEs

- 5.1.2 Large Enterprises

- 5.2 By Service

- 5.2.1 Professional Services

- 5.2.2 Managed Services

- 5.3 By Industry Vertical

- 5.3.1 IT & Telecommunication

- 5.3.2 BFSI

- 5.3.3 Healthcare

- 5.3.4 Entertainment and Media

- 5.3.5 Retail

- 5.3.6 Education

- 5.3.7 Other Industry Verticals

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia

- 5.4.4 Australia and New Zealand

- 5.4.5 Latin America

- 5.4.6 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Trend Micro

- 6.1.2 Ciphercloud

- 6.1.3 Symantec Corporation

- 6.1.4 Hewlett Packard Enterprise

- 6.1.5 Google LLC

- 6.1.6 Sophos

- 6.1.7 Voltage Security Inc.

- 6.1.8 CyberArk

- 6.1.9 Safenet

- 6.1.10 Hitachi Vantara

- 6.1.11 Boxcryptor