|

市场调查报告书

商品编码

1640664

云端加密:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Cloud Encryption - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

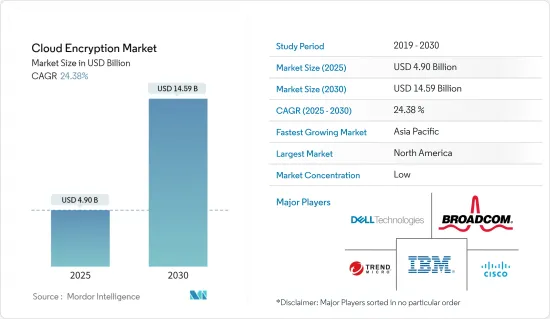

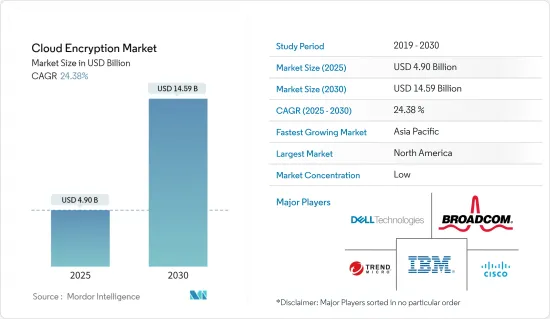

预计 2025 年云端加密市场规模为 49 亿美元,到 2030 年将达到 145.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 24.38%。

主要亮点

- 云端运算可以增强公司的运算和分析能力,使其能够整理、分离、处理和分析大量资料。

- 云端运算和虚拟的日益普及,以及为提高云端加密解决方案的采用率而出台的严格法规,正在推动全球市场的成长。

- 在过去十年中,资料外洩急剧增加,产生了对云端加密的需求。网路攻击和恶意软体等其他动态将进一步推动云端加密市场的成长。

- 有几个因素可能会阻碍云端加密的采用,包括优质云端服务的成本。然而,值得注意的是,云端加密还可以提供显着的好处,包括提高安全性和符合监管要求。

- 由于远距办公和业务数位化的增加,COVID-19 疫情导致云端服务的采用显着增加。因此,随着企业寻求确保储存在云端的敏感资料的安全,对云端加密的需求也随之增加。即使在疫情过后,随着云端运算在各个组织中的采用持续成长,市场仍在迅速成长。

云端加密市场趋势

云端运算的不断普及和物联网的成长预计将推动市场成长

- 各主要行业的技术日益融合,对云端加密市场产生了正面影响。云端服务越来越受欢迎,对物联网系统的需求也不断增加。这种成长推动了对云端加密系统的需求。

- 物联网连接设备的增加预计将推动市场成长。思科年度网际网路报告预测,连网设备和连线的数量将从2018年的184亿增加到2023年的近300亿。预计到 2023 年,物联网设备将占所有连网装置的 50%(147 亿),高于 2018 年的 33%(61 亿)。

- 随着购买、管理和维护内部储存设备的成本大幅下降,云端储存的采用率不断增长。由于我们对技术的依赖,网路攻击呈指数级增长,这就是公司开始投资加密技术的原因。

- 各行业日益广泛地采用连网型设备也对所研究的市场产生了积极影响。爱立信预计,海量物联网连线数量将增加一倍,达到近2亿。爱立信预计,到2027年终,40%的蜂巢式物联网连接将是宽频物联网,其中大部分将由4G连接。

- 此外,使用者对威胁的认知也越来越强,并要求更好、更安全的服务。所有这些因素都在推动云端加密软体市场的成长。已开发国家国防、医疗等产业对SaaS的采用越来越多,这也是推动云端加密市场成长的关键因素。

- 此外,IT 系统日益复杂,以及通讯、银行和 IT 产业对云端加密安全的认识和采用不断提高,也是推动云端加密市场成长的因素。

预计北美将占据较大的市场占有率

- 美国和加拿大是新兴经济体,可以对研发进行大量投资。工业重点领域数位化程度的提高、技术的稳定进步以及智慧连网设备的日益普及,都促进了北美云端加密市场的成长。连网设备和相关网路基础设施的使用日益增多,以及网路、硬体和软体供应商之间日益加强的协作,是推动北美物联网市场扩张的关键因素。

- 快速的5G连接将促进该国的敏捷运作。该技术可望促进网路化物流、自动化仓库、自动化组装、包装和产品处理,并实现自动推车的使用。

- 该地区的政府也发起了公共意识宣传活动,教育个人和组织了解加密的重要性以及不使用加密的风险。这可能会增加对加密解决方案的需求并推动其采用。

- 《联邦资讯安全现代化法案》(FISMA)是影响美国云端加密的一项重要立法。 FISMA 要求联邦机构实施安全控制来保护资讯和资讯系统,包括对云端的敏感资料进行加密。

- 总体而言,云端加密是美国云端安全的关键组成部分,受各种法律、法规和行业标准的约束。在云端中储存敏感资料的组织正在推动市场成长。

云端加密产业概况

云端加密市场高度分散,主要参与者包括 IBM 公司、趋势科技公司、戴尔科技公司、博通公司(赛门铁克公司)和谷歌有限责任公司。市场参与者正在采用联盟、创新、併购等策略来增强其产品供应并获得永续的竞争优势。

2022 年 10 月,Vaultree 宣布推出 Google 针对 AlloyDB 的资料使用中加密预览试用版。作为 Google AlloyDB 的发布合作伙伴,该服务将 Vaultree 的全球加密使用解决方案与 Google 的 AlloyDB for PostgreSQL 结合。用户现在可以在云端搜寻搜寻加密技术,推进加密标准,实现下一代加密和资料安全。

2022年6月,思科推出了新的Talos Intel On-Demand服务。它针对每个组织特定的威胁情势提供客製化研究。思科对思科安全云端分析进行了更改,包括立即向 SecureX 发出警报并将这些警报映射到 MITRE ATT&CK 以协助事件侦测和回应。这是继 SecureX 设备洞察普遍可用之后的又一成果,它可以收集、关联和规范化您环境中的设备资料,并将 Kenna 与 Secure Endpoint 整合以改善漏洞优先排序。思科也发布了专为混合使用而设计的安全防火墙 3100 系列。该系列采用了新的加密视觉化引擎,利用人工智慧和机器学习来侦测隐藏的威胁。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 购买者/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 云端运算的采用和物联网的成长

- 云端环境面临的威胁日益增加

- 法规推动云端加密解决方案的采用

- 市场限制

- 采用优质云端服务需要巨额投资

第六章 市场细分

- 按最终用户产业

- 零售

- 政府

- 能源和电力

- 按服务模式

- Infrastructure-as-a-Service

- Platform-as-a-Service

- Software-as-a-Service

- 按公司规模

- 大型企业

- 中小企业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 澳洲

- 新加坡

- 其他亚太地区

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲国家

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东和非洲地区

- 北美洲

第七章 竞争格局

- 公司简介

- IBM Corporation

- Trend Micro Inc.

- Dell Technologies Inc.

- Broadcom Inc.(Symantec Corporation)

- Google LLC

- Cisco Systems Inc.

- Sophos Group PLC

- Hewlett Packard Enterprise Company

- Skyhigh Networks Inc.(McAfee Inc.)

- CipherCloud

第八章投资分析

第九章 市场机会与未来趋势

The Cloud Encryption Market size is estimated at USD 4.90 billion in 2025, and is expected to reach USD 14.59 billion by 2030, at a CAGR of 24.38% during the forecast period (2025-2030).

Key Highlights

- Cloud computing can improve an enterprise's computing and analytics capabilities by enabling it to collate, segregate, process, and analyze significant volumes of data.

- The proliferation of cloud adoption and virtualization and the introduction of stringent regulations to increase the adoption rate of cloud encryption solutions fuel global market growth.

- In the last decade, data breaches increased dramatically, resulting in the need for cloud encryption. Other dynamics, like cyberattacks and malicious software, further drive the growth of the cloud encryption market.

- Several factors can restrain the adoption of cloud encryption, including the cost of premium cloud services. However, it is important to note that cloud encryption can also provide significant benefits, such as increased security and compliance with regulatory requirements.

- The COVID-19 pandemic led to a significant increase in the adoption of cloud services due to remote work and increased digitization of businesses. As a result, the demand for cloud encryption also increased as companies looked to secure their sensitive data stored in the cloud. Post-pandemic also, the market is growing rapidly with the increased cloud adoption in various organizations.

Cloud Encryption Market Trends

Increase in Cloud Adoption and Growth of IoT is Expected to Drive the Market Growth

- The increased integration of technology across all major industries has positively impacted the cloud encryption market. Cloud services are experiencing high adoption, and the demand for IoT systems is rising. This rise is driving the demand for cloud encryption systems.

- The increase in IoT-connected devices is expected to drive market growth. By 2023, there will be approximately 30 billion network-connected devices and connections, up from 18.4 billion in 2018, as Cisco's Annual Internet Report predicted. By 2023, IoT devices are projected to make up 50% (14.7 billion) of all networked devices, up from 33% (6.1 billion) in 2018.

- The usage of cloud storage has grown as the cost of purchasing, administering, and maintaining in-house storage equipment has decreased significantly. Because of the reliance on technology, cyber-attacks have increased exponentially, and businesses have begun to invest in encryption technologies.

- The growing trend of adopting connected devices in various sectors positively influences the market studied. According to Ericsson, the number of massive IoT connections is expected to have doubled, reaching nearly 200 million. According to Ericsson, by the end of 2027, 40% of cellular IoT connections will likely be broadband IoT, with 4G connecting most of them.

- Additionally, users are becoming aware of the threats and looking for better, more secure services. All these factors are driving the cloud encryption software market growth. The increasing adoption of SaaS in developed countries by industries such as defense and healthcare is a crucial factor driving the growth of the cloud encryption market.

- Moreover, the increasing complexity of IT systems and the rising awareness and use of cloud encryption security by the telecom, banking, and IT industries, are other factors expected to boost the growth of the cloud encryption market.

North America is Expected to Hold Significant Market Share

- The United States and Canada have developed economies that enable them to invest heavily in R&D. Rising digitization throughout the industrial emphasis areas, steady technological advancements, and rising penetration of smart connected devices have all contributed to the growth of the North American cloud encryption market. The increased usage of connected devices and associated network infrastructure, as well as the increased collaboration of network, hardware, and software providers, are the primary drivers that assist in expanding the IoT market in the North American region.

- Rapid 5G connectivity facilitates the country's agile operations. The technology is anticipated to render networked logistics, automated warehouses, automated assembly, packing, and product handling easier and make the usage of autonomous carts possible.

- The government in this region is also launching public awareness campaigns to educate individuals and organizations about the importance of encryption and the risks associated with not using encryption. This can increase demand for encryption solutions and encourage their adoption.

- The Federal Information Security Modernization Act (FISMA) is an important law affecting cloud encryption in the United States. FISMA requires federal agencies to implement security controls to protect their information and information systems, including encrypting sensitive data in the cloud.

- Overall, cloud encryption is an important component of cloud security in the United States and is subjected to various laws, regulations, and industrial standards. Organizations that store sensitive data in the cloud drive market growth.

Cloud Encryption Industry Overview

The Cloud Encryption Market is highly fragmented, with the presence of major players like IBM Corporation, Trend Micro Inc., Dell Technologies Inc., Broadcom Inc. (Symantec Corporation), and Google LLC. Players in the market are adopting strategies such as partnerships, innovations, mergers, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In October 2022, Vaultree announced the availability of its Data-in-Use Encryption for Google's AlloyDB, which is available for a preview trial. The service, a launch partner for Google's AlloyDB, combines the global functioning Encryption-in-Use solution powered by Vaultree with Google's AlloyDB for PostgreSQL. Users may now test Vaultree's homomorphic and searchable cloud encryption technology homomorphic and searchable encryption technology on the cloud, indicating an advancement in encryption standards that will allow next-generation encryption and data security.

In June 2022, Cisco launched a new Talos Intel On-Demand service, which provides tailored research on the threat landscape specific to each organization. Cisco introduced Cisco Secure Cloud Analytics changes to assist incident detection and response, including instantly elevating alarms into SecureX and mapping those warnings to MITRE ATT&CK. This came on the heels of the public release of SecureX device insights to collect, correlate, and normalize data about the devices in their environment and the Kenna and Secure Endpoint integrations to prioritize vulnerabilities better. Cisco also announced the Secure Firewall 3100 Series, intended for hybrid usage, and features a new encrypted visibility engine that detects hidden threats using artificial intelligence and machine learning.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Cloud Adoption and Growth of IoT

- 5.1.2 Increasing Threats to Cloud Environments

- 5.1.3 Regulations to Increase the Adoption of Cloud Encryption Solutions

- 5.2 Market Restraints

- 5.2.1 Huge Investment Required for the Adoption of the Premium Cloud Service

6 MARKET SEGMENTATION

- 6.1 By End User Industry

- 6.1.1 Retail

- 6.1.2 Government

- 6.1.3 Energy and Power

- 6.2 By Service Model

- 6.2.1 Infrastructure-as-a-Service

- 6.2.2 Platform-as-a-Service

- 6.2.3 Software-as-a-Service

- 6.3 By Size of Enterprise

- 6.3.1 Large Enterprise

- 6.3.2 Small and Medium Size Enterprises

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Australia

- 6.4.3.3 Singapore

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Mexico

- 6.4.4.2 Brazil

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Trend Micro Inc.

- 7.1.3 Dell Technologies Inc.

- 7.1.4 Broadcom Inc. (Symantec Corporation)

- 7.1.5 Google LLC

- 7.1.6 Cisco Systems Inc.

- 7.1.7 Sophos Group PLC

- 7.1.8 Hewlett Packard Enterprise Company

- 7.1.9 Skyhigh Networks Inc. (McAfee Inc.)

- 7.1.10 CipherCloud