|

市场调查报告书

商品编码

1637871

货柜型资料中心:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Containerized Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

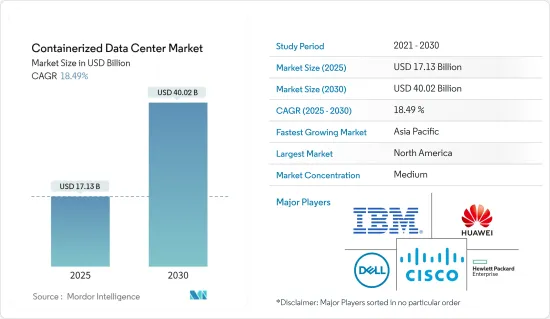

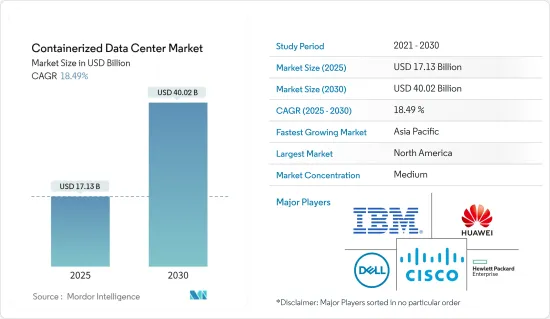

2025 年货柜型资料中心市场价值预计为 171.3 亿美元,预计到 2030 年将达到 400.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 18.49%。

主要亮点

- 巨量资料和物联网(IoT)技术将推动货柜型资料中心市场的投资。全球企业正在见证 IT 和电信、BFSI、医疗保健、政府和国防等产业的大量资料产生。云端处理的扩张导致了外国云端供应商的渗透、政府对本地资料安全的监管以及国内参与者的投资增加是推动货柜型资料中心需求的一些主要因素。

- 政府在货柜型资料中心市场的成长中发挥关键作用。各政府机构均致力于数位基础设施,以增加就业机会并推动创新。例如,今年 6 月,英国政府公布了期待已久的数位计划,以支持该国的数位经济。英国政府声称,新的英国数位策略到 2025 年将使英国科技业对经济的贡献增加 415 亿美元。

- 近年来,云端服务的普及增加了对资料中心的需求。根据《2021 年云端基础设施报告》发布的调查结果,57% 的受访者表示,他们一半以上的基础设施在云端,64% 的受访者预计未来五年将完全在公有云上。这样做。

- 在IT和通讯业,对每天处理和储存海量资料的资料中心的需求很高,这是推动该行业资料中心建设市场成长的主要因素之一。此外,科技和服务型新兴企业的出现促使这些中小企业将重点转向具有成本效益的解决方案。这推动了向云端运算的转变,并增加了 IT 解决方案供应商在扩展基础设施方面的支出。

- 新冠肺炎疫情对远距办公、线上学习、虚拟娱乐等的影响,以及巨量资料和物联网的日益增长的影响力,促使世界各地的货柜型资料中心的部署力度。能力。因此,资料中心为全球经济从 COVID-19 疫情中復苏提供了巨大的机会。此外,新南威尔斯州政府也对 COVID-19 疫情对国民经济造成的财务影响进行了评估,并暂时允许在该州边界建造资料资料. 宣布将把该产品重新归类为重大发展。

- 在由众多设备组成的大型网路中分发资料并从公司位置运行资料中心可能是一个巨大的挑战,尤其是在物联网网路中,其中每个设备都代表另一个潜在端点。和控制问题。其他使用 Edge 的装置也有类似的问题。安全漏洞使骇客可以轻鬆存取核心网络,从而进一步限制资料中心的效能。随着物联网世界变得越来越普及,随着网路节点数量的增加,安全问题也将随之增加。此外,物联网设备是最常受到攻击的设备之一。

货柜型资料中心的市场趋势

节能资料中心的需求不断增加

- 绿色资料中心的主要目标是提高能源效率和最大限度地减少对环境的影响。绿色或永续资料中心是储存、管理和传输资料的地方,其中的所有系统(包括机械和电气)都节约能源。它具有更低的碳排放、降低成本并提高效率。

- 此外,这些绿色资料中心还能帮助现代企业节省电力并减少碳排放。在全球范围内,无论是大企业还是小型企业,它的使用都在不断增长。这样的资料中心可以成功地满足大量企业资料的需要,从收集到处理、审查和分发。

- 此外,政府也宣布了该地区实现碳中和的计画。例如,今年6月,日本政府发布了《清洁能源战略》快报。政府还计划在 2050 年实现碳中和,到 2030 财年减少 46% 的温室气体排放,同时在未来保持可靠且负担得起的能源供应,以实现成长。日本正在加大脱碳力度,以实现两个雄心勃勃的目标:到2050年实现碳中和、2030财年减少46%的温室气体排放。

- 据荷兰资料中心协会称,80%的荷兰资料中心使用绿色电力。这意味着至少 20% 的荷兰资料中心仍然严重依赖石化燃料。所使用的绿色能源通常是「浅绿色」电力(「认证电力」),并非来自荷兰的永续能源。在资料中心的电源供应器中,只有一小部分是荷兰永续产生的「深绿色」电源。还有很多工作要做,特别是考虑到《气候协议》和《荷兰气候法》的目标,到 2050 年几乎消除温室气体并实现二氧化碳中性电力生产。

- 此外,据Cloud Scene称,截至今年资料,美国共有2,701个资料中心,德国共有487个资料中心。英国拥有456个资料中心,仅次于中国(443个),位居第三。

预计北美将占很大份额

- 预计未来几年北美货柜型资料中心市场将快速成长。推动这种扩张的因素有几个,包括巨量资料和云端运算的兴起,以及对主机託管服务的需求不断增加。在这篇部落格中,我们探讨北美货柜型资料中心市场及其扩张的关键因素。

- 据 Temenos AG 称,美国BFSI 产业对云端运算的采用正在增加。在美国,针对云端技术的监管已连续数年收紧,81% 的相关人员认为多重云端战略将成为监管要求,77% 的相关人员认为 AI(人工智慧)将成为一项要求我们相信,从这些资产中提取价值将成为成功银行与败者银行之间的差异。这是因为云端、人工智慧和物联网的广泛应用将产生大量资料,增加对资料中心的需求,从而刺激研究市场的成长。

- 今年 4 月,美国合众银行表示正在扩大云端基础技术的使用,但暂时仍将继续使用查斯卡资料中心。这家总部位于明尼阿波利斯的银行表示,将关闭位于亚特兰大和诺克斯维尔的两个小型资料中心,并使用微软的 Azure 提供云端服务。该银行于 2017 年在查斯卡开设了一个占地 56,000 平方英尺的新资料中心。该资料中心由位于德克萨斯州的Stream Data Centers 建造,将获得该市为期20 年的税收减免(价值约548,000 美元)、明尼苏达州就业和经济发展部提供的287,000 美元补贴以及基础设施资金。公共津贴和补贴总计已收到超过 100 万美元的资金,其中包括 DEED 的 25 万美元升级支援津贴。

- 此外,增加资料中心建设可能会为所研究的市场创造成长机会。例如,Facebook母公司Meta今年4月在密苏里州和德克萨斯州启用了两个新的资料中心计划,使其在美国建造和营运资料中心的总投资达到约160亿美元。位于德州坦普尔德克萨斯州价值 8 亿美元的工厂面积约为 90 万平方英尺,而位于密苏里州堪萨斯城价值 8 亿美元的工厂面积约为 100 万平方英尺。

- 此外,物联网和互联技术的兴起迫使许多企业转型为数位企业,这必然要求企业转向提供可扩展性、快速部署、安全性、灵活性和可用性的先进资料中心生态系统。这些不断变化的商业趋势正在推动尖端、灵活且经济高效的软体定义解决方案的发展和创造。预计上述因素将推动市场的成长。

货柜型资料中心产业概况

主要参与者包括 IBM 公司、惠普企业、思科系统、戴尔公司、Rittal GmbH &Co.KG 和华为技术有限公司。这些公司越来越多地参与併购和产品发布,以开发和推出新技术和新产品。这导致市场集中度处于中等水平。

2022年5月,华为发布全新电源系统PowerPOD 3.0,定义新一代资料中心设备。这是华为资料中心设施团队与业界专家智慧与共同努力的成果,也是华为致力于发展低碳智慧资料中心的倡议。下一代资料中心建筑将完全绿色、节能,所有资料中心材料将尽可能回收。从而使整个资料中心生态系统变得更加绿色和永续。

2022 年 2 月,Vantage 位于德国法兰克福的资料中心综合体第二期工程正式动工。该公司宣布将在位于奥芬巴赫的 55MW 欧盟园区 (FRA1) 建造三栋建筑中的第二栋。全部建成后,该电厂的容量将达到 16 兆瓦,占地 13,000平方公尺(140,000 平方英尺)。预计 2024 年上半年开始向客户交付。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 市场驱动因素

- 对便携性的需求以及对可扩展资料中心解决方案日益增长的需求

- 节能资料中心的需求不断增加

- 市场限制

- 运算能力有限

第五章 市场区隔

- 依所有权类型

- 购买

- 租

- 按最终用户

- BFSI

- 资讯科技/通讯

- 政府

- 教育机构

- 卫生保健

- 防御

- 娱乐和媒体

- 其他最终用户(工业、能源)

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 公司简介

- Hewlett Packard Enterprise Company

- IBM Corporation

- Dell Inc.

- Cisco Systems Inc.

- Huawei Technologies

- Emerson Network Power(Emerson Electric Co.)

- Schneider Electric SE(acquired AST Modular)

- Rittal Gmbh & Co. KG

- Baselayer Technology, LLC.

第七章投资分析

第 8 章:市场的未来

The Containerized Data Center Market size is estimated at USD 17.13 billion in 2025, and is expected to reach USD 40.02 billion by 2030, at a CAGR of 18.49% during the forecast period (2025-2030).

Key Highlights

- Big data and Internet-of-Things (IoT) technology will expand investments in the containerized data center market. Enterprises worldwide are witnessing high data generation across industries, such as IT and telecom, BFSI, healthcare, and government and defense. The growing cloud computing increasing penetration of foreign cloud vendors, government regulations for local data security, and increasing investment by domestic players are some of the major factors driving the demand for containerized data centers.

- The government plays a crucial role in the containerized data center market growth. Various government bodies focus on digital infrastructure to fuel job opportunities and drive innovation. For instance, in June this year, the UK government revealed its eagerly expected digital plan to support the nation's digital economy. By 2025, the government claimed that the new UK Digital Strategy could boost the economy's contribution from the UK tech sector by USD 41.5 billion.

- The need for data centers has increased in recent years due to the high adoption of cloud services. According to the survey results published in the Cloud Infrastructure Report 2021, 57% of the respondents reported that more than half of their infrastructure is in the cloud, while 64% expect that they will be fully in the public cloud in the next five years.

- The significant demand in the IT and telecommunication industries for data processing and storage of vast amounts of data daily has been one of the primary reasons for the growth of the data center construction market in this segment. Moreover, with the advent of more technology and service-based startups, these SMEs have shifted focus to cost-effective solutions. This has led to increased migration to the cloud, which, in turn, has increased spending on scaling up infrastructure by IT solution providers.

- Due to the COVID-19 pandemic's impact on the advent of remote work, online learning, and virtual entertainment, as well as the expanding influence of big data and the internet of things, global containerized data center operators are seeing a sharp rise in demand for their processing and storage capacity. As a result, data centers offer a great chance for the global economy to recover from the COVID-19 pandemic. Further, the New South Wales (NSW) state government announced the interim reclassification of data centers as State Significant Developments in reaction to the financial effects of the COVID-19 epidemic on the domestic economy and in appreciation of the economic benefits of data centers (SSDs).

- Distributing data across a large network containing numerous devices and data centers operating from enterprise locations can create problems with network visibility and control, with each device representing another potential endpoint, especially in the IoT network framework. Other devices that use edge have similar problems. Security loopholes can give hackers easy access to the core network, further creating performance constraints for data centers. With the global adoption of IoT, any increase in network node points increases security concerns further. Moreover, IoT devices are some of the frequently targeted devices.

Containerized Data Center Market Trends

Rising Demand for Energy Efficient Data Centers

- An environmentally friendly data center's primary goals are energy efficiency and minimal environmental effect. A green or sustainable data center is a location for storing, managing and transmitting data where all systems, including mechanical and electrical ones, conserve energy. It produces fewer carbon footprints, which reduces costs and improves efficiency.

- Further, these green data centers enable contemporary firms to conserve electricity and cut carbon emissions. Their use is expanding globally among both large corporations and SMBs. Such data centers can successfully serve the aims of a vast array of company data, from collection to processing and review to distribution.

- Moreover, the government has released plans to achieve carbon neutrality in the region. For example, in June this year, the Japanese government released a preliminary report on its "Clean Energy Strategy." Further, growth will be attained through maintaining a reliable and inexpensive energy supply for the future while striving to achieve carbon neutrality by 2050 and a 46% decrease in greenhouse gas emissions in fiscal 2030. To reach two ambitious goals-carbon neutrality by 2050 and a 46% decrease in greenhouse emissions (GHG) in fiscal 2030 Japan has intensified its decarbonization efforts.

- According to the Dutch Data Center Association, 80% of data centers in the Netherlands use green electricity. This means that at least 20% of Dutch data centers are still largely reliant on fossil fuels. The green energy used is often 'light green' electricity ('certified power') and does not come from sustainable electricity generation in the Netherlands. Only a small part of the power supply for data centers is 'dark green,' meaning that it is generated sustainably in the Netherlands. There is still a lot of work to be done, particularly considering the Climate Accord and the objectives of the Dutch Climate Act, namely the almost eradication of greenhouse gases and CO2- neutral electricity generation in this country by 2050.

- Further, according to Cloud scene, 2,701 data centers were located in the United States as of January this year, and 487 more were found in Germany. With 456, the United Kingdom came in third place among nations regarding the number of data centers behind China (443).

North America is Expected to Hold Major Share

- The North American containerized data center market is predicted to grow rapidly in the next few years. Several factors fuel this expansion, including the rise of big data and cloud computing and increased demand for colocation services. This blog post will examine the North American containerized data center market and some key drivers driving its expansion.

- According to Temenos AG, the adoption of cloud is increasing in the US BFSI industry as 81% of bankers believe that a multi-cloud strategy would become a regulatory prerequisite after several years of regulatory focus on cloud technologies in the United States, and 77% of bankers believed that unlocking value from artifiical intelligence (AI) will be the differentiator between winning and losing banks. This is because the proliferation of the cloud, AI, and the IoT has generated voluminous data that increases the need for data centers, thereby stimulating the growth of the market studied.

- In April this year, US Bancorp is expanding its use of cloud-based technologies, but for the time being, it will continue to use its Chaska data center. In addition to closing two minor data centers in the Atlanta and Knoxville regions, the Minneapolis-based bank said it would use Microsoft's Azure to offer cloud services. The bank occupied a new 56,000-square-foot data center in Chaska in 2017. The site, built by Texas-based Stream Data Centers, received more than USD 1 million in total public grants and subsidies, including a 20-year tax abatement from the city valued at approximately USD 548,000, a budget of USD 287,000 from the Minnesota Department of Employment and Economic Development, and a grant of USD 250,000 from DEED to support infrastructure upgrades.

- Further, the rise in data center construction would create an opportunity for the studied market to grow. For instance, in April this year, Meta, the parent company of Facebook, started two new data center projects in Missouri and Texas, bringing its total investment in US data center construction and operations to almost USD 16 billion. A USD 800 million facility in Temple, Texas, will total approximately 900,000 square feet, while another USD 800 million facility in Kansas City, Missouri, will total nearly 1 million square feet.

- Further, With the rise of IoT and connected technologies, many firms have been forced to change into digital enterprises, which has increased the need for an advanced data center ecosystem that provides scalability, rapid deployment, security, flexibility, and availability. This change in business trends enables the evolution and creation of cutting-edge, highly agile, cost-efficient, and software-defined solutions. The factors mentioned above are anticipated to propel market growth.

Containerized Data Center Industry Overview

The major players include - IBM Corporation, Hewlett Packard Enterprise, Cisco Systems Inc., Dell Inc., Rittal GmbH & Co. KG, and Huawei Technologies Co. Ltd, among others. These players increasingly undertake mergers, acquisitions, and product launches to develop and introduce new technologies and products. As a result of this, the market concentration will be Moderately consolidated.

In May 2022, Huawei unveiled PowerPOD 3.0, a brand-new power supply system, as well as the definition of the Next-Generation Data Center Facility. Based on the collective wisdom and joint efforts of the Huawei Data Center Facility Team and industry experts, the latest rollouts confirm Huawei's commitment to developing low-carbon smart data centers. Next-generation data center buildings will be completely green and energy-efficient, with all data center materials recycled to the greatest extent possible. As a result, the total data center ecosystem will be ecologically benign and sustainable.

In February 2022, the second stage of construction of one of Vantage's data center complexes in Frankfurt, Germany, was revealed. On its 55 MW EU campus (FRA1) in Offenbach, the business announced that it would erect the second of three buildings there. When fully constructed, the plant will have a 16 MW capacity and be 13,000 square meters (140,000 square feet) in size. It will begin serving customers in the first half of 2024.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Market Drivers

- 4.4.1 Need for Portability and Increasing Demand for Scalable Data Center Solutions

- 4.4.2 Rising Demand for Energy Efficient Data Centers

- 4.5 Market Restraints

- 4.5.1 Limited Computing Performance

5 MARKET SEGMENTATION

- 5.1 By Ownership Type

- 5.1.1 Purchase

- 5.1.2 Lease

- 5.2 By End User

- 5.2.1 BFSI

- 5.2.2 IT and Telecommunications

- 5.2.3 Government

- 5.2.4 Education

- 5.2.5 Healthcare

- 5.2.6 Defense

- 5.2.7 Entertainment and Media

- 5.2.8 Other End Users (Industrial, Energy)

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Hewlett Packard Enterprise Company

- 6.1.2 IBM Corporation

- 6.1.3 Dell Inc.

- 6.1.4 Cisco Systems Inc.

- 6.1.5 Huawei Technologies

- 6.1.6 Emerson Network Power(Emerson Electric Co.)

- 6.1.7 Schneider Electric SE (acquired AST Modular)

- 6.1.8 Rittal Gmbh & Co. KG

- 6.1.9 Baselayer Technology, LLC.