|

市场调查报告书

商品编码

1644363

北美货柜型资料中心:市场占有率分析、产业趋势和成长预测(2025-2030 年)North America Containerized Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

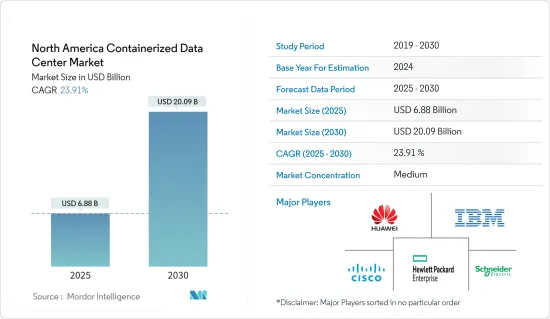

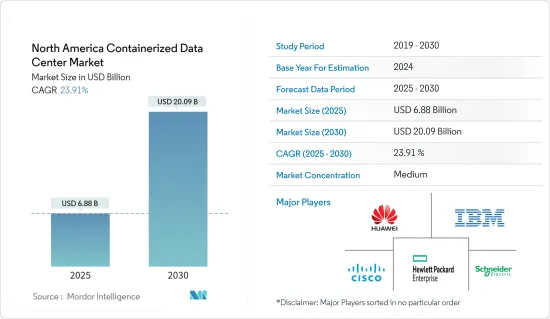

北美货柜型资料中心市场规模预计在 2025 年为 68.8 亿美元,预计到 2030 年将达到 200.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 23.91%。

关键亮点

- 近年来,由于云端运算的普及和资料生成的不断增加,该地区对货柜型资料中心的需求呈指数级增长。这些资料中心在製造工厂中製造并透过货柜运送给最终用户。在这种类型的资料中心中,大多数组件都是预先安装的,限制了更换或升级组件的灵活性。

- 货柜型资料中心解决方案单元简化了您的实体IT基础设施。模组化方法可以集中在资料中心或更精细的层面上。例如,更精细的方法可以深入到机架层级。随着基于 x86 的伺服器、储存和网路设备市场的成长,各垂直市场的最终用户都在寻找更有效的方式来部署和管理他们的资料中心设备。

- 此外,巨量资料和物联网(IoT)在该地区的渗透预计将显着改变下一代模组化资料中心的规模和范围。现有的竞争迫使企业在 IT 可扩展性和容量方面不断发展。随着资料、混合云端和外包给第三方资料中心的快速成长,货柜型资料中心因其能够在最短时间内灵活地建立中心而越来越受欢迎。

- 此外,主要工业领域数位化程度的提高、技术的稳步进步以及智慧连网型设备的不断普及正在促进北美物联网的发展。

- 组织正在转向模组化服务,透过从可用的整合产品组合中选择所需的服务来优化其基础设施。此外,我们的标准化交付部署意味着可以透过我们的线上目录获得多种服务选项。这些选项列出了可减少企业前期投资的功能。 IBM 的整合託管基础架构服务就是这种情况的一个例子。

- 然而,高昂的初始投资和低资源可用性对这个市场构成了挑战。此外,这些资料中心是容器化的,体积小,可以从一个地方移动到另一个地方。因此,计算效率受到限制。

- 在新冠疫情封锁期间,随着越来越多的人远距办公,对资料中心的需求增加。由于云端服务的使用日益增多,资料流量的增加对所研究的市场产生了影响。

北美货柜型资料中心市场趋势

政府机构预计将显着成长

- 政府机构也广泛采用货柜型资料中心来增强安全性。员工社保号、军事地址和平民资讯等敏感资料将储存在由人工智慧系统操作的模组化资料中心,提供额外的保护。

- 政府措施和公共存取平台的数位化是全球对货柜型资料中心的最大需求来源。这推动了对模组化资料中心的需求。

- 例如,2022年9月,美国能源局宣布将提供4,200万美元的资金,帮助减少用于冷却资料中心的能源,并在2050年实现净零碳排放。

- 此外,2023 年 2 月,亚马逊网路服务 (AWS) 向美国政府推出了模组化资料中心 (MDC),这将使在偏远地区部署临时的 AWS 管理的 Bitburn 变得更加容易。 AWS MDC 是美国国防部 (DoD) 机构的自足式模组化资料中心单元,可透过增加其他单元进行扩充。每个单元都安置在一个坚固的货柜内,可以透过船、铁路、卡车甚至军用货机运输。

- 考虑到加拿大的环境,加拿大政府 (GC) 透过其「云端优先」策略概述了在进行资讯技术 (IT) 投资、倡议、策略和计划时将云端服务确定和评估为主要交付选项。

美国:预计将大幅成长

- 北美企业开始将超融合视为传统资料中心的可行替代方案。超融合将储存、网路和运算结合到单一系统中,从而降低了资料中心的复杂性并提高了可扩展性。因此,超融合式基础架构平台的采用正在增加,推动了货柜型资料中心市场的发展。

- 根据 Coldwell Banker Richard Ellis (CBRE) 的报告,2022 年上半年美国主要资料中心市场的总容量成长了 10.5%,达到 352.9 兆瓦 (MW)。该国目前还有 1,600 兆瓦的额外发电容量正在建设中。因此,美国主要批发资料中心市场在 2022 年上半年的总合净吸收量达到 453.4MW,是 2021 年上半年的三倍多。

- 边缘资料中心的发展完全由货柜型资料中心推动。此外,它还具有便携性、安装快速、可扩展、无论身在何处都可以随时配备伺服器功能等特点,因此被广泛采用。因此,市场相关人员正在致力于製造用于货柜型资料中心的伺服器。

- 2022年9月,提案在深海建立商业资料中心的公司Subsea Cloud宣布计画在华盛顿州安吉利斯港附近安装一个吊舱。这些伺服器舱将安置在长 6 公尺(20 英尺)的货柜内,深度约为 9 米,最初将容纳 800 台伺服器,并计划最终扩展到 100 个这样的伺服器舱。

- 此外,该地区拥有强大的模组化资料中心提供者基础,从而推动了成长。 IBM 公司、HPE、Vertiv 公司、思科系统、戴尔 EMC 等

- 例如,Google已宣布计划在2022年终前在美国投资95亿美元设立新办公室和资料中心。此外,Google还在 26 个美国的办公室和资料中心投资超过 370 亿美元。该地区主要企业的重大投资预计将推动货柜型资料中心的发展。

北美货柜型资料中心产业概况

北美货柜型资料中心市场包括 IBM 公司、惠普企业、戴尔公司、思科系统、Rittal GmbH & Co. KG 和华为技术等主要参与者。这些参与企业正在进行併购和产品推出,以开发并向市场推出新技术和新产品。因此,预计市场集中度将处于中等水平。

2022 年 10 月,IBM 宣布将把 Red Hat 的储存产品蓝图和 Red Hat 关联团队加入其 IBM 储存业务部门,以在本地基础设施和云端提供一致的应用程式和资料储存。透过此举,IBM 将整合 Red Hat OpenShift Data Foundation (ODF) 的储存技术作为 IBM Spectrum Fusion 的基础。此举将 IBM 和 Red Hat 的资讯服务容器储存技术整合在一起,并加速 IBM 在快速成长的 Kubernetes 平台市场中的能力。

此外,2022 年 10 月,Oracle 宣布推出新服务以简化云端中的管理、安全性和开发,其中包括一项託管无伺服器 Kubernetes 服务,适用于希望建立容器化应用程式而无需管理 Kubernetes 基础架构的客户。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链/供应链分析

- COVID-19 工业影响评估

第五章 市场动态

- 市场概况

- 市场驱动因素

- 对便携性的需求以及对可扩展资料中心解决方案日益增长的需求

- 节能资料中心的需求不断增加

- 市场限制

- 运算能力有限

第六章 市场细分

- 按最终用户产业

- 资讯科技/通讯

- BFSI

- 政府

- 其他的

- 按国家

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Hewlett Packard Enterprise Company

- IBM Corporation

- Dell Inc.

- Cisco Systems Inc.

- Huawei Technologies Co. Ltd.

- Emerson Network Power(Emerson Electric Co.)

- Schneider Electric SE(acquired AST Modular)

- Rittal Gmbh & Co. KG

第八章投资分析

第九章:市场的未来

The North America Containerized Data Center Market size is estimated at USD 6.88 billion in 2025, and is expected to reach USD 20.09 billion by 2030, at a CAGR of 23.91% during the forecast period (2025-2030).

Key Highlights

- With the growing adoption of the cloud and increasing data generation, the demand for containerized data centers in the region has spiked drastically over the past few years. These data centers are fabricated in a manufacturing facility and shipped to the end user in the container. Most of the components in this type of data center are preinstalled and offer limited flexibility in replacing and upgrading components.

- Containerized data center solution units facilitate the physical IT infrastructure. The modular approach can focus on the data center or a more granular level. For instance, more granular approaches can go down to the rack level. As the market for x86-based servers, storage, and network equipment has grown, end users across a broad spectrum of vertical markets have been exploring ways to find more effective methods of installing and managing data center equipment.

- Moreover, big data and Internet of Things (IoT) penetration in the region is expected to significantly transform the size and scope of the next-generation modular data centers. With the existing competition, organizations are under pressure to evolve IT scalability and capacity. With the exponential growth of data, hybrid cloud, and outsourcing third-party data centers, containerized data centers are gaining traction, owing to their flexibility in installing a center within the least possible time.

- Further, rising digitization throughout the industrial emphasis areas, steady technological advancements, and rising penetration of smart connected devices have all contributed to the growth of IoT in the North American region.

- Organizations are looking at modular services to optimize their infrastructure by selecting the desired services from the available integrated portfolio. In addition, with the standardized delivery deployment, several service options are made available from online catalogs. These options offer the ability to lower the upfront investment for companies. IBM integrated managed infrastructure service is an example of this situation.

- However, higher initial investments and low resource availability are some factors presenting challenges to this market. Further, these data centers are containerized; they are in small sizes and can be moved from one place to another. As a result of this, they have limited computing efficiency.

- During the COVID-19 lockdown, the demand for data centers grew as more people started working remotely. Increased data traffic impacted the market studied due to the expanding use of cloud services.

North America Containerized Data Center Market Trends

Government Sector Expected to Witness Significant Growth

- Government agencies are also broadly adopting containerized data centers to bolster security. The sensitive data, such as employees' social security numbers, addresses of service members, and citizens' information, are stored in modular data centers operated by AI systems for an additional layer of protection.

- Government initiatives and the digitalization of public accessibility platforms are the greatest sources of demand for containerized data centers worldwide. This is increasing the demand for modular data centers.

- For instance, in September 2022, the US Department of Energy announced that it is providing USD 42 million in funding for initiatives to lower the energy consumed for cooling in data centers and reach net zero carbon dioxide emissions by 2050.

- Moreover, in February 2023, Amazon Web Services (AWS) pitched a modular data center (MDC) to the US government to make it easier to deploy makeshift bit barns managed by AWS in remote locations. AWS MDC is a self-contained modular data center unit for US Department of Defense (DoD) agencies, which can scale by deploying additional units. Each is housed inside a ruggedized shipping container for freight transportation via ship, rail, truck, or even air transport using military cargo aircraft.

- Considering the Canadian environment, the Government of Canada (GC), by its "cloud-first" strategy, outlined that cloud services are identified and evaluated as the principal delivery option when initiating information technology (IT) investments, initiatives, strategies, and projects.

United States Expected to Witness Significant Growth

- Enterprises in the North American region have started to view hyper-convergence as a viable alternative to the traditional data center. It combines storage, networking, and computing into a single system, reducing data center complexity and increasing scalability. As a result, an increase in adopting a hyper-converged infrastructure platform is driving the containerized data center market.

- According to a report by Coldwell Banker Richard Ellis (CBRE), the total capacity of the US primary data center markets grew by 352.9 megawatts (MW) or 10.5% in H1 2022. The country is expanding its capacity by more than 1600 MW, currently under construction. As a result, the primary US wholesale data center market recorded a combined 453.4 MW of net absorption in H1 2022, more than triple H1 2021's level and almost 60% of it in Northern Virginia.

- The development of edge data centers attributes solely to containerized data centers, as it tends to meet an organization's new-age demands. Moreover, it is highly adopted due to its portable format, quick to install, scalable, and equipped with server functionality at a given point in time, regardless of location. Therefore, market players are observed to manufacture servers compatible with containerized data centers.

- In September 2022, Subsea Cloud, the company proposing to put commercial data centers in deep ocean waters, announced its plan to install a pod near Port Angeles, Washington State. The pod will start with a 6m (20ft) shipping container around nine meters underwater, holding 800 servers, eventually scaling to 100 such pods.

- Moreover, the region has a strong foothold of modular data center providers, which adds to its growth. Some include IBM Corporation, HPE, Vertiv Co., Cisco Systems, and Dell EMC.

- For instance, Google announced its plan to invest USD 9.5 billion in new offices and data centers in the US by the end of 2022. Moreover, Google has spent over USD 37 billion on its offices and data centers across 26 US states. Such significant investments by the key players in the region are expected to boost the development of containerized data centers.

North America Containerized Data Center Industry Overview

The North America containerized data center market includes major players such as IBM Corporation, Hewlett Packard Enterprise, Dell Inc., Cisco Systems Inc., Rittal GmbH & Co. KG, and Huawei Technologies Co. Ltd, among others. These players are undertaking mergers and acquisitions and product launches to develop and introduce new technologies and products to the market. As a result of this, market concentration will be medium.

In October 2022, IBM announced it would add Red Hat storage product roadmaps and Red Hat associate teams to the IBM Storage business unit, bringing consistent application and data storage across on-premises infrastructure and cloud. With the move, IBM will integrate the Red Hat OpenShift Data Foundation (ODF) storage technologies as the foundation for IBM Spectrum Fusion. This combines IBM and Red Hat's container storage technologies for data services and helps accelerate IBM's capabilities in the burgeoning Kubernetes platform market.

Moreover, in October 2022, Oracle announced the launch of new services to simplify management, security, and development in the cloud, including a managed serverless Kubernetes service for customers who want to build containerized applications without having to manage the Kubernetes infrastructure.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain / Supply Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Need for Portability and Increasing Demand for Scalable Data Center Solutions

- 5.2.2 Rising Demand for Energy Efficient Data Centers

- 5.3 Market Restraints

- 5.3.1 Limited Computing Performance

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 IT & Telecommunications

- 6.1.2 BFSI

- 6.1.3 Government

- 6.1.4 Other End-users

- 6.2 Country

- 6.2.1 The United States

- 6.2.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Hewlett Packard Enterprise Company

- 7.1.2 IBM Corporation

- 7.1.3 Dell Inc.

- 7.1.4 Cisco Systems Inc.

- 7.1.5 Huawei Technologies Co. Ltd.

- 7.1.6 Emerson Network Power(Emerson Electric Co.)

- 7.1.7 Schneider Electric SE (acquired AST Modular)

- 7.1.8 Rittal Gmbh & Co. KG