|

市场调查报告书

商品编码

1637877

丁酮-市场占有率分析、产业趋势/统计、成长预测(2025-2030)Methyl Ethyl Ketone - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

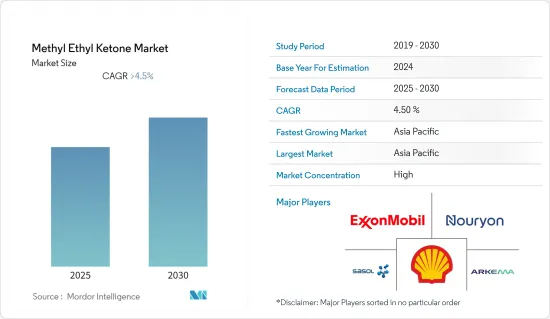

预计丁酮市场在预测期内将维持4.5%以上的复合年增长率。

COVID-19 损害了 2020 年的市场。考虑到大流行的情况,在封锁期间,汽车和製造活动暂时停止,丁酮作为成分的使用量减少,从而对市场产生影响。然而,随着监管的放鬆,市场开始恢復步伐。

主要亮点

- 短期内,市场扩张可能是由于建筑业的树脂、油漆和被覆剂等应用对 MEK 的需求增加,以及製药业中 MEK 作为溶剂的使用增加而推动的。

- 另一方面,人们对 MEK 毒性的认识不断提高可能会阻碍市场成长。

- 政府增加对基础设施发展的投资预计很快就会为市场成长提供各种机会。

- 亚太地区在市场上占据主导地位,并且在预测期内可能保持最高的复合年增长率。

丁酮市场走势

油漆和涂料领域主导市场需求

- 油漆和涂料领域是丁酮的最大消费者。 MEK 是一种用于油漆和涂料领域的优异溶剂。油漆和涂料的主要消费者是建筑业。

- 亚太和北美地区的住宅呈现强劲成长,住宅应用的 MEK 需求在预测期内可能会进一步增加。

- 在美国和加拿大大量投资的推动下,北美建筑业健康成长。根据美国人口普查局的数据,2022 年 12 月该国建筑支出经季节已调整的的年增长率估计为 18,099 亿美元,比 11 月修正后的数字 18,173 亿美元低 0.4%。然而,2022 年 12 月的数字比先前 12 月估计的 16,810 亿美元高出约 8%。

- 此外,2022年的建筑支出将达到1.79兆美元,比2021年的1.6兆美元高出约10%,增加了建筑应用油漆和涂料的消耗。

- 汽车工业也是油漆和涂料的主要最终用途。根据 OICA(国际汽车製造商组织)的数据,全球汽车产量增加了 3%。 2020年产量为7,771万台,2021年将增加至8,014万台。因此,后疫情时代对汽车装置的需求增加可能会扩大油漆和被覆剂的市场,从而扩大 MEK 的市场。

- 欧洲拥有许多大型涂料工业,并且是德国、法国、义大利和西班牙四大经济体的所在地。德国是最大的油漆和被覆剂市场,约有300家公司生产油漆、被覆剂和印刷油墨,是欧洲最大的油漆出口国。

- 因此,预计上述因素将在未来几年对市场产生重大影响。

亚太地区主导市场

- 由于印度、中国、菲律宾、越南和印尼等国家对住宅和商业建筑投资的增加,预计未来几年丁酮(MEK)市场将扩大。

- 目前,中国有许多机场建设计划正在开发或规划中。中国民用航空局 (CAAC) 的目标是到 2035 年建造 216 个新机场,以满足不断增长的航空需求,到 2035 年这一数字可能达到 450 个。此外,政府还推出了一项大规模建设计画,将在未来 10 年内将 2.5 亿人迁移到新的特大城市。

- 中国是最大的汽车生产国和消费国。中国工业协会的报告显示,2022年中国汽车销量与前一年同期比较成长约2.1%。 2022年,汽车销量约2686万辆,而2021年汽车销量为2627万辆。

- 预计到2030年,印度房地产产业的市场规模将达到1兆美元,到2025年,对该国GDP的贡献预计将达到13%左右。

- 截至2022年,印度是世界第四大橡胶消费国。印度人均橡胶消费量目前为 1.2 公斤,而全球整体橡胶消费量为 3.2 公斤。印度橡胶工业产值约 1,200 亿印度卢比(14.49 亿美元)。轮胎产业消耗了印度橡胶产量的大部分,占全国总产量的一半以上。

- 据日本国土交通省称,2022年整个建筑业投资预计约为66.99兆日圆(5,081.6亿美元),与前一年同期比较增长0.6%。

- 菲律宾统计局在2022年年度报告中也指出,汽摩维修对该国GDP成长做出了巨大贡献,与前一年同期比较%。该行业是主要贡献者,约占总扩张的8.7%。

- 由于可支配收入的增加、生活水准的提高和都市化,中国、印度和日本等主要已开发国家和新兴国家的建设活动和汽车生产正在迅速扩大,导致对丁酮市场的需求不断增加。

丁酮产业概况

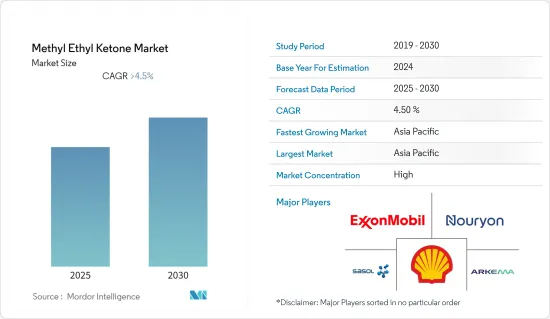

丁酮市场是一个综合市场,少数主要企业占据了市场需求的很大份额。市场上的主要企业包括(排名不分先后)壳牌公司、阿科玛、埃克森美孚公司、诺力昂和沙索。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 对油漆和涂料的需求不断增长

- 製药业对树脂作为溶剂的需求不断增长

- 抑制因素

- 人们对 MEK 毒性的认知不断增强

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 技术简介

- 贸易分析

第五章市场区隔(以金额为准的市场规模)

- 目的

- 溶剂

- 树脂

- 印刷油墨

- 胶水

- 其他的

- 最终用户产业

- 画

- 橡皮

- 建筑学

- 包装/出版

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Arkema

- Cetex Petrochemicals

- China National Petroleum Corporation

- Exxon Mobil Corporation

- Idemitsu Kosan Co., Ltd

- INEOS

- Maruzen Petrochemical

- Nouryon

- Shell Plc

- Sasol

- Tasco Chemicals

- Zibo Qixiang chemical Co., Ltd

第七章 市场机会及未来趋势

- 政府加大基础建设投入

The Methyl Ethyl Ketone Market is expected to register a CAGR of greater than 4.5% during the forecast period.

COVID-19 harmed the market in 2020. Given the pandemic scenario, automotive and manufacturing activities were temporarily halted during the lockdown, reducing the usage of methyl ethyl ketone as a component and thereby impacting the market. But with the easing of the restrictions, the market started to gather pace over time.

Key Highlights

- In the short term, rising demand for MEK in the construction industry for applications such as resins, paints, and coatings, as well as increased use of MEK as a solvent in the pharmaceutical industry, are likely to fuel market expansion.

- On the flip side, the increasing awareness regarding the toxic effects of MEK is likely to hamper the growth of the market studied.

- Increasing government investments in infrastructural developments are expected to offer various opportunities for market growth shortly.

- The Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Methyl Ethyl Ketone Market Trends

Paints and Coatings Segment to Dominate the Market Demand

- The paints and coatings segment stands to be the largest consumer of methyl ethyl ketone. MEK is an excellent solvent for use in the paints and coatings sector. The paints and coatings major consumption is in the construction industry.

- Asia-Pacific and North America regions have been witnessing strong growth in residential construction, which is further likely to increase the demand for MEK for residential applications during the forecast period.

- North America witnessed healthy growth in the construction sector due to significant investments in the United States and Canada. According to the US Census Bureau, in December 2022, construction spending in the country was estimated at a seasonally adjusted annual rate of USD 1,809.9 billion, 0.4% below the revised November estimate of USD 1,817.3 billion. However, the December 2022 figure is about 8% above the previous year's December estimate of USD 1,681.0 billion.

- Moreover, in 2022, construction spending amounted to a value of about USD 1,790 billion, around 10% above USD 1,600 billion in 2021, thereby increasing the consumption of paints and coatings in construction applications.

- The automotive industry is also a major end-use for paints and coatings. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), the global production of motor vehicles saw a 3% growth. The production in 2020, which was 77.71 million units, increased to 80.14 million units in 2021. Thus, the increasing demand for automobile units after the COVID era will likely increase the market of paints and coatings and, eventually, of MEK.

- Europe is home to many large paint industries, with the four largest mainland economies of Germany, France, Italy, and Spain. Germany is the largest market of paints and coatings and is home to approximately 300 coatings, paint, and printing ink-producing companies, and Germany is Europe's largest exporter of coatings.

- Therefore, the above factors are expected to significantly impact the market in the coming years.

Asia-Pacific Region to Dominate the Market

- With growing residential and commercial construction investments in countries such as India, China, the Philippines, Vietnam, and Indonesia, the methyl ethyl ketone (MEK) market is expected to increase in the coming years.

- Currently, China includes numerous airport construction projects in the development or planning stage. The Civil Aviation Administration of China (CAAC) aims to construct 216 new airports by 2035 to meet the growing demands for air travel, and this number is likely to hit 450 by 2035. Additionally, the government rolled out massive construction plans to move 250 million people to its new megacities over the next ten years.

- China is the largest producer and consumer of automotive vehicles. The China Association of Automobile Manufacturers reports that, compared to the prior year, China's automobile sales increased by about 2.1% in 2022. Compared to the 26.27 million automobiles sold in 2021, around 26.86 million were sold in 2022.

- Indian Real Estate sector is expected to reach a market size of USD 1 trillion by 2030, and its contribution to the country's GDP is expected to be approximately 13% by 2025.

- India is the fourth-largest consumer of rubber in the world as of 2022. Rubber usage per capita in India is currently 1.2 kg, compared to 3.2 kg globally. India's rubber industry generates approximately INR 12000 crores (USD 1,449 million). The tire sector consumes most of India's rubber production, accounting for over half of the country's total output.

- According to Japan's Ministry of Land, Infrastructure, Transport, and Tourism (MLIT), overall investment in the construction sector in 2022 is estimated to be around JPY 66,990 billion (USD 508.16 billion), a 0.6% increase over the previous year.

- The Philippine Statistics Authority also mentioned in its annual report for 2022 that motor vehicles and motorcycle maintenance played a significant part in the country's GDP growth of 7.6% over the previous year. The segment was the main contributor, accounting for around 8.7% of overall expansion.

- Because of the rising disposable income, greater living standards, and urbanization, major developed and developing countries such as China, India, and Japan are witnessing faster expansion in construction activities and automotive production, resulting in increased demand for the methyl ethyl ketone market.

Methyl Ethyl Ketone Industry Overview

The methyl ethyl ketone market is a consolidated market, where a few major players hold a significant share of the market demand. Some of the major players in the market include (not in a particular order) Shell Plc, Arkema, Exxon Mobil Corporation, Nouryon, and Sasol, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Paints and Coatings

- 4.1.2 Growing Demand for Resins as Solvent in the Pharmaceutical Industry

- 4.2 Restraints

- 4.2.1 Increasing Awareness About Toxic Effects of MEK

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Technological Snapshot

- 4.6 Trade Analysis

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Solvent

- 5.1.2 Resin

- 5.1.3 Printing Ink

- 5.1.4 Adhesive

- 5.1.5 Other Applications

- 5.2 End-user Industry

- 5.2.1 Paints and Coatings

- 5.2.2 Rubber

- 5.2.3 Construction

- 5.2.4 Packaging and Publishing

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema

- 6.4.2 Cetex Petrochemicals

- 6.4.3 China National Petroleum Corporation

- 6.4.4 Exxon Mobil Corporation

- 6.4.5 Idemitsu Kosan Co., Ltd

- 6.4.6 INEOS

- 6.4.7 Maruzen Petrochemical

- 6.4.8 Nouryon

- 6.4.9 Shell Plc

- 6.4.10 Sasol

- 6.4.11 Tasco Chemicals

- 6.4.12 Zibo Qixiang chemical Co., Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Government Investments for Infrastructural Developments