|

市场调查报告书

商品编码

1637916

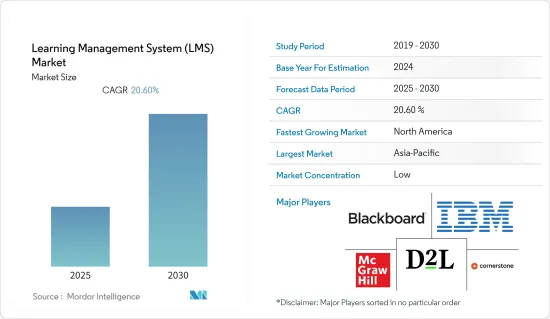

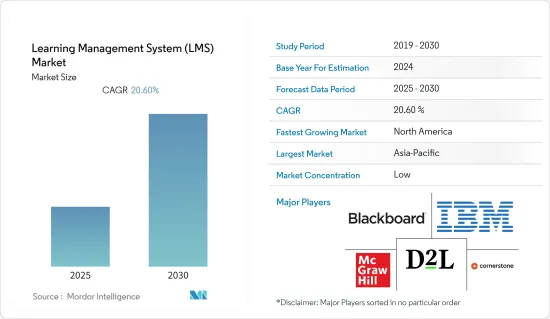

学习管理系统 (LMS):市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Learning Management System (LMS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计预测期内学习管理系统 (LMS) 市场复合年增长率将达到 20.6%。

主要亮点

- 在研究期间,数位学习已发展成为公司的收益来源。学习技术的新发展正在帮助组织支持学习者不断变化的需求。在这些发展的推动下,它透过增加和改进资料收集活动实现了随时随地的学习技术,从而彻底改变了数位学习。 IBM 发现,在其组织内实施数位学习计画后,参与者在不增加培训时间的情况下学习了约五倍的材料。

- 公司和教育机构预计将能够监控其员工和学生的学习过程。然而,追踪学习者进度的传统方法——人工调查或使用调查工具——效率低且不准确。人工调查有几个缺点,包括耗时、回应率低、缺乏参考资料和基准以及可能出现错误回应。由于时间限製或缺乏有效的测量工具,组织无法准确地追踪其计划的有效性。

- 智慧型手机和其他设备的日益普及可能会促进采用线上教育进行学习和进度评估。无论在已开发国家或新兴国家,智慧型手机的普及率都很高,全球许多教育机构都采用了BYOD(自备设备)。这些智慧学习设备支持教育机构有效的教学和学习过程。此外,教育机构正在鼓励教师和学习者使用平板电脑等智慧型设备。

- 5G技术的出现彻底改变了云端处理世界。 5G 连接提供低延迟连接,实现更流畅的对话和更快的资料传输。 5G 速度还将增加视讯分析和人工智慧的访问,使城市变得更加安全。这使城市管理者、业主和设施管理者能够做出更明智的决策并提供更明智的公共服务。 5G的演进继续发挥其彻底变革的潜力。这也为学习管理系统 (LMS) 市场带来了巨大的成长机会。

- 在新冠肺炎疫情期间,世界各地的学校都暂时关闭,以保护学生、教师和工作人员免受潜在的感染。根据联合国教科文组织的研究,此次疫情已影响143个国家的约12亿名学生。在新冠肺炎疫情期间,线上学习应运而生,让学生能够继续接受教育。学校、大学和学院已经脱离了教室的束缚,进入了数位空间。疫情过后,由于客製化学习平台的出现,市场蓬勃发展。

学习管理系统 (LMS) 市场趋势

虚拟和线上电子学习内容的兴起推动了市场

- 新冠肺炎疫情迫使教育机构关闭,影响了学校教育和学习,包括教学和评估方法。然而,这一空白很快就被数位学习所填补,学校、大学、办公室和教育机构迅速转向线上教学和学习。疫情期间,人们待在家里的时间比以往任何时候都多,数位学习成为重要的教育资源。疫情将传统的粉笔教学法转变为技术主导的替代方法。市场上参加虚拟课程的人数呈指数级增长。

- 根据欧盟统计局的一项调查,2019年至2021年间,参加线上课程或使用线上学习资源进行学习的匈牙利人比例增加了14%。因此,截至 2021 年,大约四分之一的匈牙利人使用网路进行教育目的,其中大多数年龄在 16 至 25 岁之间。

- 提供客製化服务的线上学习工具和平台透过解决访问、品质和有限预算的问题,推动了数位学习市场的发展。市场主要企业为都市区数百万学生和员工提供便利、实惠、可靠的学习选择。

- 根据 2022 年 7 月发布的 Stack Overflow 调查,全球约有 70% 的软体开发人员透过存取影片和部落格等线上资源来学习程式设计。

- 两家公司还伙伴关係为市场上的各种终端用户应用程式提供客製化的数位学习平台。例如,2022 年 9 月,海事软体开发平台 Helm Operations 和海事培训计画开发商 Moxie Media 宣布建立新的整合伙伴关係,以实现船员培训。新的伙伴关係正式确立了 Moxie Media 的船上学习管理系统 (LMS) 与 Helm CONNECT 的整合,为两家公司的客户提供了访问 Helm CONNECT 平台和 Moxie Media 的海事专用数位学习课程库的权限。

北美有望创下最快成长

- 随着领先的供应商每年推出智慧学习解决方案和服务,北美地区对学习管理系统 (LMS) 的需求正在上升。例如,2021 年 6 月,Blackboard Inc. 宣布与 K16 Solutions 合作,以简化 LMS 迁移。这将使该公司的客户能够从其他 LMS 平台迁移到 Blackboard Learn Ultra,并利用强大的教学和学习体验。

- 根据教育世界消息,2021年11月,Square Panda India 将为教师和年轻学习者提供由人工智慧驱动的个人化学习。该公司已经推出了自己的应用程式“SquareHub”和“Square Activity”。 SquareHub 也可透过专用入口网站存取。

- 伙伴关係也有望塑造市场格局。例如,2021 年 11 月,爱尔兰 LMS 公司 LearnUpon 与 15Five 合作,让客户在两个平台之间无缝移动。这使得客户能够从 15Five 登入 LearnUpon 并接受培训,从而提高业务生产力和绩效。

- 专注于现代学习的政府支持的组织正在看到市场扩张。加拿大21世纪学习与创新组织(C21 Canada)是全国性的非营利组织,致力于推动21世纪教育学习模式。倡议致力于创造激励加拿大人的 21 世纪学习愿景和框架。

- 此外,该供应商还与各种协会合作,以实现体育教育的现代化。例如,2021 年 5 月,职业高尔夫球协会 [CPG] 宣布将使用学习管理系统 (LMS) 更新高尔夫 PGA 专业人员的高等教育。因此,该协会与加拿大公司 D2L 合作设计了一个平台,CPG 成员可以共用相关资讯和教育内容。这有望使高尔夫教育现代化。

学习管理系统 (LMS) 产业概览

学习管理系统 (LMS) 市场竞争激烈,有许多全球和区域参与者。 Blackboard Inc.、Cornerstone Ondemand Inc.、D2L Corporation、IBM Corporation 和 McGraw-Hill Companies 等市场主要企业已参与策略联盟、合併、收购和投资,以保持其在市场中的地位。

2022 年 9 月,自适应人力资源解决方案的全球领导者 Cornerstone OnDemand 宣布与着名银行机构 BBVA 建立合作伙伴关係。 BBVA 将利用 Cornerstone 的能力来制定和完善其员工成长策略,并管理招募、评估、学习和流动等多个人才领域。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 虚拟和线上电子学习内容增加

- 客製化学习需求激增

- 市场限制

- 低度开发国家缺乏IT基础设施

第六章 市场细分

- 依使用者类型

- 教育 LMS 用户

- 企业 LMS 用户

- 依部署方式

- 云端基础的LMS 实施

- 现场或安装的 LMS 实施

- 按出货方式

- 远端教育

- 讲师指导的培训

- 按应用

- 行政

- 内容管理

- 学习者管理

- 绩效管理

- 其他用途(沟通和协作)

- 按最终用户产业

- BFSI

- 医疗保健和製药

- 製造业

- 零售

- 教育机构

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 世界其他地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Blackboard Inc.

- Cornerstone Ondemand Inc.

- D2L Corporation

- IBM Corporation

- McGraw-Hill Companies

- Oracle Corporation

- Pearson PLC

- SABA Software Inc.

- SAP SE

- Docebo SpA

第八章投资分析

第九章:市场的未来

The Learning Management System Market is expected to register a CAGR of 20.6% during the forecast period.

Key Highlights

- Over the study period, e-learning has evolved into an enterprise revenue generator. New developments in learning technology help organizations support evolving learner needs. Supported by such developments, it has revolutionized e-learning by allowing increased and improved data collection activities that enable on-the-move learning methodology. After implementing an e-learning program in its organization, IBM found that participants learned nearly five times more material without increasing training time.

- Enterprises and educational institutions are expected to be able to monitor their employees' or students' learning processes. However, the traditional method of tracking learner progress, taking surveys manually or using a survey tool, is inefficient and inaccurate. Manual surveys have several drawbacks, including time consumption, low response rates, a lack of references or benchmarks, and the possibility of incorrect responses. Organizations cannot accurately track their programs' effectiveness due to time constraints and a lack of efficient measuring tools.

- The increasing accessibility of smartphones and other devices might drive the adoption of online education for learning and progress evaluation. Both developed and developing countries are witnessing high penetration of smartphones, with many educational institutions adopting BYOD (Bring Your Own Device) worldwide. These smart learning devices support institutions in effective teaching and learning processes. Also, institutions facilitate the teachers and learners to use smart devices, like tablets.

- The emergence of 5G technology has significantly changed the world of cloud computing. 5G connection provides low-latency connectivity, allowing for smoother conversations and quicker data transfers. 5G speeds increase access to video analytics and artificial intelligence, making the city a safer place. This enables city administrators, property owners, and facility managers to make educated decisions and deliver smart public services. The evolution of 5G continues to fulfill its complete transformational potential. It also offers significant growth opportunities for the learning management system market.

- Schools around the world were temporarily closed to protect students, teachers, and staff from potential contamination during the COVID-19 pandemic. According to a UNESCO study, the pandemic affected nearly 1.2 billion students in 143 countries. The rise of online learning during the COVID-19 pandemic allowed students to continue their education. Schools, colleges, and universities moved away from the four walls of the classroom, taking advantage of the digital space. After the pandemic, the market is growing rapidly due to the availability of customized learning platforms.

Learning Management System Market Trends

Rise in Virtual and Online E-learning Content Driving the Market

- Due to COVID-19, educational institutes had to shut down, affecting schools and learning, including teaching and assessment methodologies. However, this gap was rapidly filled by e-learning as schools, colleges, offices, and educational institutions quickly shifted to teaching and learning online. With people having spent more time at home than ever during the pandemic, digital learning became an essential educational resource. The pandemic converted the traditional chalk-talk teaching approach into a technology-driven alternative. The number of people taking virtual classes witnessed an exponential rise in the market.

- According to a survey conducted by Eurostat, the percentage of Hungarians taking online courses or utilizing online learning resources for their studies increased by 14 % between 2019 and 2021. As a result, approximately every fourth Hungarian utilized the internet for educational purposes as of 2021, with a significant portion being between the ages of 16 and 25.

- With customized offerings, online learning tools and platforms address the problems of access, quality, and limited budgets, driving e-learning in the market. The key players in the market offer millions of students and employees in urban and rural regions a convenient, economical, and reliable way to learn.

- According to a survey conducted by Stack Overflow published in July 2022, around seven out of ten software developers across the globe learned coding by accessing online resources such as videos and blogs.

- The companies are also making partnerships to offer customized e-learning platforms to various end-user applications in the market. For instance, in September 2022, Helm Operations, a maritime software development platform, and Moxie Media, a maritime training program developing company, announced a new integration partnership to enable crew training. The new partnership formalizes the integration of Moxie Media's onboard Learning Management System (LMS) with Helm CONNECT, providing customers from both companies access to the Helm CONNECT platform and Moxie Media's library of maritime-specific eLearning programs.

North America is Expected to Register the Fastest Growth

- In the North American Region, the demand for learning management systems is bolstered by major vendors rolling out smart learning solutions and offerings every year. For instance, in June 2021, Blackboard Inc. announced a partnership with K16 solutions to streamline LMS migrations. It enables the company's clients to move from other LMS platforms to Blackboard Learn Ultra and take advantage of a powerful teaching and learning experience.

- According to news from the World of Education, in November 2021, Square Panda India will provide AI-powered personalized learning for teachers and young learners. The company launched its own apps, SquareHub and Square Activity. Both are available on the Google and Android stores; SquareHub is also available through a dedicated portal.

- Partnerships are also expected to shape the market landscape. For instance, in November 2021, LearnUpon, an LMS-based company from Ireland, partnered with 15Five's, allowing customers to move between two platforms seamlessly. It empowered them to log in and train in LearnUpon from 15Five, driving the productivity and performance of the business.

- Organizations that are focusing on modern learning, supported by the government, are leading to market expansion. Canadians for 21st Century Learning and Innovation (C21 Canada) is a national, non-profit organization that aims to 21st-century models of learning in education. It handles initiatives dedicated to creating a 21st-century learning vision and framework that inspires Canadians.

- Moreover, vendors have also partnered with various associations to modernize sports education. For instance, in May 2021, the Confederation of Professional Golf [CPG] announced to update in the advanced education of the PGA Professionals workforce for golf with a learning management system. Therefore, the association partnered with Canadian-based D2L to design a platform for CPG members to share relevant information and educational content. This is expected to modernize golf education.

Learning Management System Industry Overview

The learning management system (LMS) market is highly competitive, with many global and regional players. The key players in the market, such as Blackboard Inc., Cornerstone Ondemand Inc., D2L Corporation, IBM Corporation, and McGraw-Hill Companies, are making strategic partnerships, mergers, acquisitions, and investments to retain their market position.

In September 2022, Cornerstone OnDemand Inc., one of the global leaders in adaptive HR solutions, announced a partnership with BBVA, a prominent banking institution. BBVA would use Cornerstone's capabilities to build and improve employee growth strategies and manage multiple talent areas of recruitment, assessment, learning, and mobility.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in Virtual and Online E-learning Content

- 5.1.2 Surge in Demand for Customized Learning

- 5.2 Market Restraints

- 5.2.1 Lack of IT Infrastructure in the Underdeveloped Nations

6 MARKET SEGMENTATION

- 6.1 By User Type

- 6.1.1 Academic LMS Users

- 6.1.2 Corporate LMS Users

- 6.2 By Deployment Mode

- 6.2.1 Cloud-based LMS Deployment

- 6.2.2 On-premise or Installed LMS Deployment

- 6.3 By Delivery Mode

- 6.3.1 Distance Learning

- 6.3.2 Instructor-led Training

- 6.4 By Application

- 6.4.1 Administration

- 6.4.2 Content Management

- 6.4.3 Learner Management

- 6.4.4 Performance Management

- 6.4.5 Other Applications (Communication and Collaboration)

- 6.5 By End-user Vertical

- 6.5.1 BFSI

- 6.5.2 Healthcare and Pharmaceuticals

- 6.5.3 Manufacturing

- 6.5.4 Retail

- 6.5.5 Educational Institutions

- 6.5.6 Other End-user Verticals

- 6.6 By Geography

- 6.6.1 North America

- 6.6.1.1 United States

- 6.6.1.2 Canada

- 6.6.2 Europe

- 6.6.2.1 United Kingdom

- 6.6.2.2 Germany

- 6.6.2.3 France

- 6.6.2.4 Rest of Europe

- 6.6.3 Asia-Pacific

- 6.6.3.1 China

- 6.6.3.2 Japan

- 6.6.3.3 India

- 6.6.3.4 Rest of Asia-Pacific

- 6.6.4 Rest of the World

- 6.6.4.1 Latin America

- 6.6.4.2 Middle East and Africa

- 6.6.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Blackboard Inc.

- 7.1.2 Cornerstone Ondemand Inc.

- 7.1.3 D2L Corporation

- 7.1.4 IBM Corporation

- 7.1.5 McGraw-Hill Companies

- 7.1.6 Oracle Corporation

- 7.1.7 Pearson PLC

- 7.1.8 SABA Software Inc.

- 7.1.9 SAP SE

- 7.1.10 Docebo SpA