|

市场调查报告书

商品编码

1639354

无线流量感测器:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Wireless Flow Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

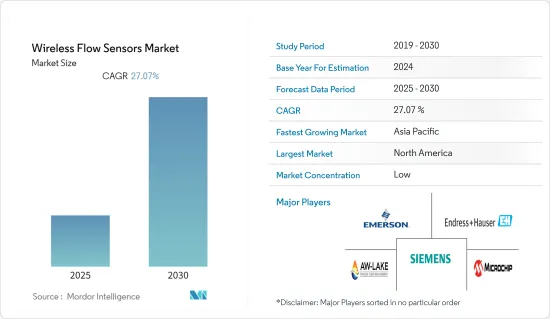

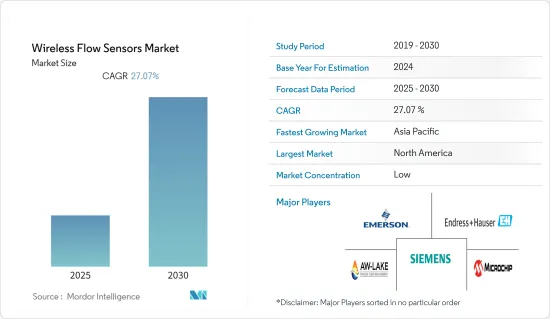

无线流量感测器市场预计在预测期内复合年增长率为 27.07%

主要亮点

- 石油和天然气产业的復苏以及用水和污水产业基础设施的扩建可能成为中长期成长的驱动力。成长机会正在扩展到中国和印度等石油、天然气和化学工业发达的新兴经济体。

- 新能源来源的不断探索、可再生能源的开发、政府法规以及快速的技术进步是推动无线流量感测器市场快速成长的关键因素。无线流量感测器的需求量很大,因为它们可以节省时间、材料和劳力。借助现代微电子技术,流量计提供了多种通讯选项。

- 流量感测器可以检测洩漏、堵塞、管道爆裂以及由于污染和污染造成的流体浓度变化。超音波流量感测器是最常见的非接触式流量感测器。超音波流量感测器将高频声音脉衝发送到流动的液体或气体中。这些感测器测量声音发射和与感测器接收器接触之间的时间,以确定气体或液体的流速。

- 不断进步,例如采用有助于连接企业网路的新通讯协定,进一步推动了市场的成长。例如,流量感测器可以将 OPC-UA(开放平台通讯统一架构)伺服器应用程式封装合併到流量计中,从而允许装置与 OPC-UA 用户端通讯并整合到工业物联网 (IIoT) 中它允许您。这是透过 LAN 或 WLAN 将流量计联网来实现的,从而允许 DCS 或 PLC 专注于控制功能。相反,这个额外的通讯通道可以专用于诊断、监视和报告目的。

- COVID-19 大流行对无线流量感测器市场产生了积极影响。世界卫生组织(WHO)表示,必须确保供水安全,因为病毒可以透过污水迅速传播。这项因素促进了生物污水处理系统的采用,并推动了疫情期间无线流量感测器市场的成长。政府机构和非营利组织在疫情期间提高了人们对水安全和保障的认识。

无线流量感测器市场趋势

无线技术的采用增加推动市场成长

- 无线感测器比有线感测器具有更广泛的功能和相容性、更快的响应速度和更低的功耗等优势。主要参与者不断增加的投资以及最终用户行业对无线技术的需求正在支撑市场。

- 随着越来越多的公司采用无线技术,製造成本正在下降,从而可以满足更广泛的市场消费。然而,新兴市场缺乏意识和资本以及传统市场有线感测器的强大支柱正在限制无线感测器的成长,许多消费者对采用新技术持怀疑态度。此外,Wi-Fi 和 WLAN 在全球范围内的日益普及正在推动无线感测器市场的发展。

- 过去,流量感测器将流量和状态资讯撷取到SCADA(监控和资料撷取)、CMMS(电脑化维护管理系统)、ERP(企业资源规划)和其他企业级网路中的步骤非常复杂,现在您可以缩短这些步骤。这些通讯功能允许软体直接从设备轻鬆存取所需的资料。

- 移动技术也被引入流量感测器。该流量计已经具备无线、蓝牙和网路伺服器功能,可从智慧型手机、平板电脑和手持装置存取、探测、配置和诊断流量计。无线流量感测器的这些优势主要推动了市场需求。

北美实现显着成长

- 美国是北美最大的无线流量感测器消费国。无线流量感测器在美国占有很大份额,用水和污水行业的需求量很大。

- 美国市场以科技为驱动,消费者更喜欢技术最新、性能可靠的产品。因此,无线流量计在该国的最终用户中变得非常受欢迎。

- 美国和加拿大等国家对无线技术的巨额投资和立法正在推动北美地区的市场成长。此外,WSN(无线感测器网路)在该地区的扩展预计将增强这些感测器的市场需求。

- 美国仍然是世界上最重要的国家之一,因为许多大公司已经进入这个市场。工业和消费市场中塑胶的使用不断增加,从而产生了工业废弃物。美国每年使用的数亿吨塑胶中,大约 80% 最终被垃圾掩埋场。根据 Pump and Systems 2022 年 9 月的数据,另外 15% 被焚烧,5% 被回收。

- 随着世界各地工业废弃物的增加,危及饮用水和大气的全球污染也增加。一些製造商认识到减少工业废弃物的重要性,正在将废弃物转化为无污染燃料。具体来说,我们正在将塑胶废弃物转化为商业性可行的产品。

- 为了在系统内准确地将塑胶转化为燃料,流量计的需求对于废弃物转化系统中两个重要且不同的过程至关重要:监测蒸馏过程中的冷却水流量以及准确计量分配的燃料。的水量显着增加。

无线流量感测器产业概况

无线流量感测器市场竞争非常激烈。该市场的主要企业包括松下公司、霍尼韦尔国际公司、德州仪器公司、ABB 有限公司、西门子公司、AW-Lake、艾默生电气公司和森萨塔技术公司。公司正在透过建立多个伙伴关係和投资新产品推出来增加市场占有率,以在预测期内赢得竞争。

2022 年 3 月,针对工业 4.0 革命的最新要求和发展,ES Systems 开发了一款创新、智慧、自主、低功耗和无线感测器,非常适合整合物联网系统和解决方案。 ES Systems 宣布透过三项新的分销协议扩展其全球分销管道:Nexcomm、Powell 和 Servoflo。透过此次伙伴关係,ES Systems 将利用其市场地位并在全球扩展其流量感测器产品组合。此外,新的伙伴关係关係的重点是扩大公司的感测器产品范围,并为客户提供卓越的品质和出色的客户服务。

2021 年 7 月,Endress+Hauser 收购了 SensAction AG,现为 Endress+Hauser Flow 德国 AG。 Endress+Hauser Flowtec AG 是完全子公司,现已完全併入集团。该公司的目标是成为超音波流量测量或流量感测器技术与品质测量相结合的市场领导者。透过结合品质和流量测量,该公司可以为客户提供流程优化的资讯。该公司还致力于利用工业 4.0 解决方案帮助客户提高效率和品质。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 扩大温度感测器在工业的应用

- 家用电子电器产品对温度感测器的需求增加

- 市场问题

- 系统高成本

第六章 市场细分

- 依技术

- Bluetooth

- ZigBee

- RFID

- Wi-Fi

- 无线区域网路

- EnOcean

- 按用途

- 用水和污水

- 化学和石化

- 发电

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Panasonic Corporation

- Honeywell International Inc.

- Texas Instruments Incorporated

- ABB Ltd

- Siemens AG

- AW-Lake

- Emerson Electric Co.

- Sensata Technologies, Inc.

- Microchip Technology Inc.

- NXP Semiconductors.

- Endress+Hauser Group Services AG

第八章投资分析

第9章 市场的未来

The Wireless Flow Sensors Market is expected to register a CAGR of 27.07% during the forecast period.

Key Highlights

- The revival of the oil and gas industry and the expanding infrastructure in the water and wastewater industry are likely to drive growth in the medium to long term. Growth opportunities are opening in developing economies, such as China and India, that have developed their oil, gas, and chemical industries.

- The increasing quest for new energy sources, renewable energy development, government regulations, and rapid technological advancements are the key drivers making the wireless flow sensors market grow with a boom. The demand for wireless flow sensors is increasing significantly as it saves time, materials, and labor. With modern microelectronics, flowmeters offer many communication options.

- Flow sensors can detect leaks, blockages, pipe bursts, and changes in liquid concentration due to contamination or pollution. Ultrasonic flow sensors are the most popular type of non-contact flow sensor. Ultrasonic flow sensors send high-frequency sound pulses across the flowing liquid or gas medium. These sensors measure the time between the emission of the sound and its contact with the sensor's receiver to determine the flow rate of the gas or liquid.

- Increasing advancements, such as incorporating new protocols to ease the connection to enterprise networks, are further boosting market growth. For instance, a flow sensor can have an Open Platform Communication - Unified Architecture (OPC-UA) server application package built into the flowmeter, allowing the device to communicate with an OPC-UA client and be integrated into Industrial Internet of Things (IIoT) applications. This is accomplished through networking the flowmeter via either LAN or WLAN, which allows the DCS or PLC to be dedicated to the control function. In contrast, this additional communication path can be devoted to diagnostic, monitoring, and reporting purposes.

- The COVID-19 pandemic positively impacted the wireless flow sensors market. According to the World Health Organization (WHO), the water supply had to be kept safe, owing to the chances of virus transmission that could quickly grow through sewage. This factor drove the adoption of biological wastewater treatment systems and propelled the growth of the wireless flow sensors market during the pandemic. Government bodies and non-profit organizations created awareness about water safety and security during the pandemic.

Wireless Flow Sensors Market Trends

Increasing Adoption of Wireless Technologies to Drive the Market Growth

- Wireless sensors are advantageous over wireline, with a broader range of features and compatibility, faster response, and lower power consumption. Growing investments by leading players and the demand for wireless technologies from end-user industries support the market.

- With many companies moving toward wireless, production costs are declining, enabling broader market consumption. However, a lack of awareness and capital in developing markets and a strong foothold of wireline sensors in traditional markets are restraining the growth of wireless sensors, with many consumers being skeptical about adopting new technologies. Moreover, the increasing adoption of Wi-Fi and WLAN across the globe is driving the wireless sensor market.

- Flow sensors can now shortcut the once-complex procedure of getting flow and status information to SCADA (Supervisory Control and Data Acquisition), CMMS (Computerized Maintenance Management System), ERP (Enterprise Resource Planning), and other enterprise-level networks. With these communication capabilities, the software can easily access the data it needs directly from the device.

- Mobile technology is also working its way into flow sensors. Flowmeters already have wireless, Bluetooth, and web server capabilities, which means flowmeters can be accessed, probed, configured, and diagnosed over smartphones, tablets, and handheld devices. Such benefits of wireless flow sensors are mainly fueling the market demand.

North America to Witness Significant Growth

- The United States is North America's largest consumer of wireless flow sensors. Wireless flow sensors occupy a major share in the United States, with significant demand from the water and wastewater industry.

- The market in the United States is driven by technology, with consumers preferring products offering the latest technology with reliable performance. Thus, wireless flow meters are becoming extremely popular among the end-users in this country.

- Huge investments and legislative initiatives on wireless technology in countries such as the United States and Canada have fuelled market growth in the North American region. Moreover, the region's augmentation of WSN (wireless sensor network) is expected to bolster the market demand for these sensors.

- With many large companies being established players in the market, the US remains one of the prominent countries globally. Growing applications of plastic in industrial and consumer markets result in industrial waste. Approximately 80% of the hundreds of millions of tons of plastics used in the US annually end up in landfills. Another 15% was incinerated, and 5% was recycled, according to pumps and systems, in September 2022.

- As industrial waste increases worldwide, it also increases global pollution that endangers drinking water and air. Understanding the importance of reducing industrial waste, some manufacturers are turning waste into clean fuels. More specifically, they are turning plastic waste materials into commercially viable byproducts.

- To ensure the accurate conversion of plastics to fuel in the system, the demand for flow meters is significantly increasing in two critical and distinct processes in the waste conversion system: monitoring the flow of coolant during distillation and accurately metering the fuels being dispensed from the facility holding tanks into users' tanks.

Wireless Flow Sensors Industry Overview

The wireless flow sensors market is very competitive. Some of the significant players in the market are Panasonic Corporation, Honeywell International Inc., Texas Instruments Incorporated, ABB Ltd, Siemens AG, AW-Lake, Emerson Electric Co., Sensata Technologies Inc., and many more. Companies are increasing their market share by forming multiple partnerships and investing in introducing new products to earn a competitive edge during the forecast period.

In March 2022, toward the latest requirements and developments of the Industry 4.0 revolution, ES Systems developed innovative, smart, autonomous, low-power, and wireless sensors ideal for integrating IoT systems and solutions. ES Systems announced the extent of its worldwide distribution channel through three new distribution agreements with the following companies: Nexcomm, Powell, and Servoflo. Through the partnership, ES system will leverage its position in the market and promote its product range of flow sensors worldwide. Moreover, the new partnerships focus on expanding the company's sensors product presence and providing customers with outstanding quality and exceptional customer service.

In July 2021, Endress+Hauser acquired SensAction AG and is now Endress+Hauser Flow Germany AG. The wholly owned subsidiary of Endress+Hauser Flowtec AG, based in Reinach, Switzerland, is now fully integrated into the group. The company aims to be the market leader in ultrasonic flow measurement or flow sensor technology in combination with quality measurements. By combining quality and flow measurement, the company can provide customers with information for process optimization. The company also focuses on using Industry 4.0 solutions to help customers improve efficiency and quality.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Application of Temperature Sensors in Industries

- 5.1.2 Increasing Demand for Temperature Sensors in Consumer Electronics

- 5.2 Market Challenges

- 5.2.1 High Cost of the System

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Bluetooth

- 6.1.2 ZigBee

- 6.1.3 RFID

- 6.1.4 Wi-Fi

- 6.1.5 WLAN

- 6.1.6 EnOcean

- 6.2 By Application

- 6.2.1 Water and Wastewater

- 6.2.2 Chemicals and Petrochemicals

- 6.2.3 Power Generation

- 6.2.4 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Panasonic Corporation

- 7.1.2 Honeywell International Inc.

- 7.1.3 Texas Instruments Incorporated

- 7.1.4 ABB Ltd

- 7.1.5 Siemens AG

- 7.1.6 AW-Lake

- 7.1.7 Emerson Electric Co.

- 7.1.8 Sensata Technologies, Inc.

- 7.1.9 Microchip Technology Inc.

- 7.1.10 NXP Semiconductors.

- 7.1.11 Endress+Hauser Group Services AG