|

市场调查报告书

商品编码

1639366

中东和非洲玻璃瓶和容器市场占有率分析、行业趋势、统计数据和成长预测(2025-2030)Middle East & Africa Glass Bottles And Containers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

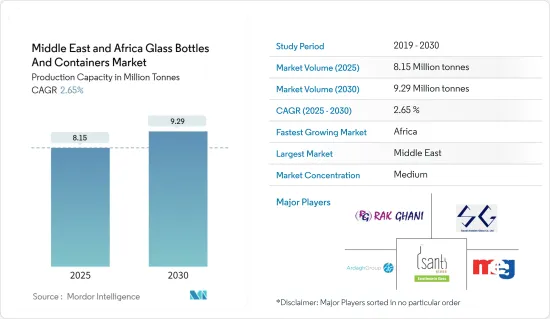

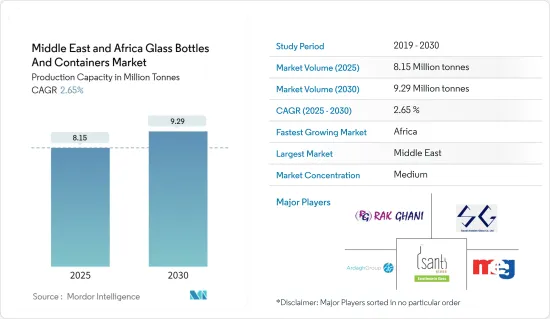

根据产能计算,中东和非洲玻璃瓶及容器市场规模预计将从2025年的815万吨扩大到2030年的929万吨,预测期间(2025-2030年)复合年增长率为2.65%。

玻璃容器是透明的,使消费者能够看到产品,同时保留其感官和营养品质。这一特性巩固了其作为该地区饮料和药品包装首选的地位。

主要亮点

- 在中东和非洲,由于沙乌地阿拉伯和南非的饮料消费量增加,对玻璃容器的需求迅速增加。饮料消费的成长归因于旅游业的蓬勃发展、可支配收入的增加以及消费者偏好的不断变化。

- 消费者越来越意识到环境问题和永续性,这促使人们更喜欢玻璃包装而不是塑胶包装。这项变化主要是由于人们认识到玻璃是一种更环保的选择,因为它是可回收的。

- 在强劲的经济成长和国内消费成长的推动下,该地区各国的食品和饮料产业正在蓬勃发展。根据美国农业部(USDA)的报告,阿联酋有2,000多家食品和饮料製造公司,年收益总计76.3亿美元。

- 随着消费者要求更安全、更健康的包装,玻璃包装在各个类别中都在经历成长。压花、成型和艺术饰面等创新技术正在增加玻璃包装对最终用户的吸引力。此外,疫情后市场的復苏归因于对环保产品的需求不断增长以及食品和饮料行业的兴趣日益浓厚。

- 玻璃产业出版商 Glass Online 的研究显示,目前非洲人口约占世界人口的 16%,预计到 2030 年将达到 20%,对于玻璃製造商而言,非洲代表着巨大的机会。非洲大陆拥有一个尚未开发的市场,消费者的选择有限。南非是非洲大陆第二大经济体,是容器玻璃的主要生产国。南非的年产能超过100万吨,是非洲领先的玻璃容器生产国之一。

- 然而,市场面临挑战。人们对塑胶包装的日益偏好是一个主要的障碍,因为塑胶包装因其成本效益和比玻璃更轻的重量而受到重视。此外,与塑胶相比,玻璃更脆弱,这增加了运输成本和运输过程中破损的风险,这可能会阻碍中东和非洲的市场成长。

中东和非洲玻璃瓶市场趋势

製药领域预计将创下最高市场占有率

- 在中东和非洲,医疗产业正在收紧有关给药产品的法规,增加了生物技术和成本敏感型药品的重要性。药用玻璃製造商越来越多地投资于包装解决方案,旨在延长其产品的保质期。

- 该地区各国政府正在促进公私合营,以加强卫生基础设施和服务。领先的製药公司正在扩大在中东的足迹,特别是在沙乌地阿拉伯 (KSA)、阿拉伯联合大公国和南非,推动市场成长。财务咨询公司 Alpen Capital 报告称,2020 年阿联酋的医疗保健支出为 197 亿美元,预计 2025 年将达到 269 亿美元。医疗保健支出的增加可能会为该领域的容器玻璃创造机会。

- 正如世界经济论坛2023年3月指出的那样,面临疫苗分配不平等和依赖进口药品等挑战的非洲国家已经认识到发展强大的国内製药业的重要性。随着非洲大陆自由贸易区(AfCFTA)协定的生效,非洲的药品贸易可能会得到显着的推动,主要是透过非洲内部贸易。

- 此外,许多公司正在寻求向中东国家扩张,增加关键药品的本地生产并增加对容器玻璃的需求。 2024年9月,阿斯特捷利康埃及公司宣布投资5,000万美元用于药品生产。阿斯特捷利康目前年产量为 9 亿片,目标是将产量增加至 12.9 亿片,从而增加该地区对玻璃容器的需求。

- 此外,沙乌地食品药物管理局(SFDA) 的资料强调,临床测试的进步和製造业中人工智慧的引入是沙乌地阿拉伯医药市场扩张的关键催化剂。由于人口成长和慢性病治疗需求的增加,该市场的市场规模将从2021年的54亿美元快速成长至2023年的85亿美元。

南非预计将出现显着成长

- 随着对酒精和非酒精饮料的需求增加,对玻璃包装的需求也增加。玻璃通常是首选,因为它具有卓越的保留风味和新鲜度的能力。人们越来越关注永续性,消费者被环保的包装解决方案所吸引。许多公司正在转向玻璃包装,因为玻璃是可回收的,并且被认为比塑胶更环保。

- 两家公司在南非容器玻璃产业占据主导地位。康索尔玻璃在国内市场占有压倒性的份额,约75-80%。另一方面,Nampak Glass保证了国内玻璃容器需求的20-25%。 (参考来源:Glass Online)。

- 2023 年 11 月,Ardagh Glass Packaging-Africa (AGP-Africa) 点燃了位于南非豪登省奈杰尔生产工厂的 N3 熔炉。这个耗资 15 亿雷亚尔(8000 万美元)的大型计划在核准后仅一年多时间就按时按预算完成,对于所有相关人员来说都是一项值得称讚的壮举。 Nigel 3 (N3) 扩建工程的揭幕仪式是在同一地点的 N2 扩建计划运作之后进行的。这个新熔炉加上 4 条生产线,使工厂的产量提高了 50%。因此,奈杰尔已成为非洲最大的玻璃包装生产基地,也是世界上最广泛、最高效的设施之一。

- 此外,南非酒精饮料消费量的增加在推动这一需求方面发挥关键作用。总部位于伦敦的资讯服务公司 IWSR 的资料显示,2023 年南非的啤酒消费量将成长 9%。这种成长与城市的快速扩张和年轻人向大城市的迁移有关,这增加了获得酒精饮料的机会。

- 此外,根据南非统计局的数据,酒精饮料和烟草的消费者物价指数 (CPI) 从 2023 年 9 月的 111.1 升至 2024 年 7 月的 115.7。饮料价格的上涨,加上全国平均需求,支持了包装玻璃需求的成长。

- 南非餐厅和咖啡馆消费者支出的增加刺激了对玻璃容器(包括瓶子和碗)的需求。根据南非统计局的数据,餐厅和咖啡店的食品销售额不断上升,从 2024 年 1 月的 1.4387 亿美元跃升至 2024 年 3 月的 1.5604 亿美元。

中东和非洲玻璃瓶和容器市场的主要企业

中东和非洲玻璃瓶及容器市场的特征是竞争激烈、整合适度。主要企业正在国内和国际舞台上争夺更大的市场占有率,例如 RAK Ghani Glass LLC、Isanti Glass、Ardagh Group SA 和 East Glass Manufacturing Company。这些公司奉行新产品开发、业务扩张和併购等策略,以改善产品功能并扩大其在中东国家的地理影响力。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 容器玻璃进出口贸易资料

- PESTLE分析

- 包装玻璃行业标准及法规

- 容器和包装的永续性趋势

- 中东和非洲货柜玻璃熔炉的产能和位置

第五章市场动态

- 市场驱动因素

- 该地区各种食品和饮料的消费量增加

- 製药业对玻璃容器的需求不断增长

- 市场限制因素

- 对塑胶容器的需求超过玻璃容器可能会阻碍市场成长

- 贸易概况:中东容器玻璃产业进出口模式的历史与现况分析

第六章 市场细分

- 按最终用户产业

- 饮料

- 酒精饮料(计划提供定性分析)

- 葡萄酒和烈酒

- 啤酒/苹果酒

- 其他酒精饮料

- 非酒精饮料(计划提供定性分析)

- 碳酸饮料

- 果汁

- 水

- 乳类饮料

- 调味饮料

- 其他非酒精饮料

- 食物

- 化妆品

- 医药产品(不包括管瓶和安瓿)

- 其他的

- 饮料

- 按国家/地区

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 埃及

- 南非

- 奈及利亚

- 科威特

第七章 竞争格局

- 公司简介

- RAK Ghani Glass LLC

- Isanti Glass

- Ardagh Group SA

- Saudi Arabian Glass Company Ltd

- Middle East Glass Manufacturing Company

- Altajir Glass Industries

- Nafis Glass

- Mahmood Saeed Glass Industry Co.

第八章补充资料:区域内主要容器玻璃厂主要加热炉供应商分析

第九章 市场未来展望

The Middle East & Africa Glass Bottles And Containers Market size in terms of production capacity is expected to grow from 8.15 million tonnes in 2025 to 9.29 million tonnes by 2030, at a CAGR of 2.65% during the forecast period (2025-2030).

Glass containers offer transparency, enabling consumers to see the product while safeguarding its sensory and nutritional qualities. This attribute has solidified their status as the region's preferred choice for packaging beverages and pharmaceuticals.

Key Highlights

- The demand for glass containers surges in the Middle East and Africa, driven by increasing beverage consumption in Saudi Arabia and South Africa. This uptick in beverage consumption is witnessed owing to a booming tourism industry, rising disposable incomes, and evolving consumer preferences.

- Heightened awareness of environmental issues and sustainability among consumers has spurred a preference for glass packaging over plastic. This shift is mainly because glass is perceived as a more environmentally friendly option, thanks to its recyclability.

- Countries in the region are witnessing a thriving food and beverage industry fueled by strong economic growth and heightened domestic consumption. Highlighting this growth, the US Department of Agriculture (USDA) reports that the United Arab Emirates is home to more than 2,000 food and beverage manufacturing companies, collectively raking in an impressive USD 7.63 billion in annual revenue.

- As consumers increasingly demand safer and healthier packaging, glass packaging is witnessing growth across various categories. Innovative technologies, such as embossing, shaping, and artistic finishes, enhance the appeal of glass packaging among end-users. Additionally, the post-pandemic resurgence of the market can be attributed to the rising demand for eco-friendly products and heightened interest from the food and beverage sector.

- Accordiung to a study by Glass Online, a publisher for the glass industry, Africa, currently home to about 16% of the global population and projected to reach 20% by 2030, presents a significant opportunity for glass producers. The continent boasts untapped markets where consumers face limited choices. South Africa, the continent's second-largest economy, is a leading nation in container glass production. With a production capacity surpassing 1 million tons annually, South Africa has become one of Africa's advanced container glass producers.

- However, the market faces challenges. The rising preference for plastic packaging, lauded for its cost-effectiveness and lighter weight than glass, poses a significant hurdle. Furthermore, glass' fragility, in contrast to plastic, results in higher freight costs and risks of breakage during transit, potentially hindering market growth in the Middle East and Africa.

Middle East and Africa Glass Bottles Market Trends

Pharmaceuticals Segment is Expected to Register the Highest Market Share

- In the MENA region, the healthcare industry has tightened regulations on drug delivery products, highlighting the growing importance of biotech and cost-sensitive medications. Pharmaceutical glass manufacturers are increasingly investing in packaging solutions aimed at extending product shelf life.

- Governments in the region are promoting public-private partnerships to enhance healthcare infrastructure and services. Key pharmaceutical companies are expanding their footprint in the Middle East, particularly in Saudi Arabia (KSA), the United Arab Emirates (UAE), and South Africa, driving market growth. Alpen Capital, a financial advisory firm, reported that healthcare spending in the UAE was USD 19.7 billion in 2020 and is projected to hit USD 26.9 billion by 2025. This uptick in healthcare spending could present opportunities for container glass in the sector.

- As noted by the World Economic Forum in March 2023, African countries, which have faced challenges like unequal vaccine distribution and a dependence on imported medicines, recognize the importance of developing a strong domestic pharmaceutical industry. With the African Continental Free Trade Area (AfCFTA) agreement now active, there's potential for a significant boost in Africa's pharmaceutical trade, largely driven by intra-African commerce.

- Additionally, many companies are looking to expand in Middle Eastern countries to increase local production of vital medications, thereby heightening the demand for container glass. In September 2024, AstraZeneca Egypt announced a USD 50 million investment in pharmaceutical production. Currently producing 900 million tablets yearly, AstraZeneca has set its sights on increasing output to 1.29 billion, subsequently driving up the demand for glass containers in the area.

- Moreover, data from the Saudi Food & Drug Authority (SFDA) highlights that advancements in clinical trials and the adoption of artificial intelligence in manufacturing are key catalysts for Saudi Arabia's expanding pharmaceutical market. The market's value jumped from USD 5.4 billion in 2021 to USD 8.5 billion in 2023, driven by a growing population and rising demand for chronic disease treatments.

South Africa is Expected to Experience Significant Growth

- As the demand for both alcoholic and non-alcoholic beverages rises, so does the need for glass packaging. Glass is often preferred for its superior ability to preserve flavor and freshness. With a growing emphasis on sustainability, consumers are gravitating towards eco-friendly packaging solutions. Given that glass is recyclable and considered more environmentally friendly than plastics, many companies are making the switch to glass packaging.

- In South Africa's container glass industry, two dominant players hold sway. Consol Glass, the more prominent of the duo, boasts a commanding share of approximately 75-80% of the domestic market. In contrast, Nampak Glass secures 20-25% of the nation's container glass demand. (Source: Glass Online).

- In November 2023, Ardagh Glass Packaging-Africa (AGP-Africa) ignited the N3 furnace at its production facility located in Nigel, Gauteng, South Africa. Completing a significant R 1.5 billion (USD 0.08 billion) mega-project on schedule and within budget, just over a year post-approval, is a commendable feat for all stakeholders. The unveiling of the Nigel 3 (N3) expansion followed the operational commencement of the N2 expansion project at the same site. This new furnace, coupled with four production lines, amplifies the facility's output by 50%. As a result, Nigel now stands as Africa's largest glass container production site and ranks among the world's most extensive and efficient facilities.

- Additionally, the rising consumption of alcoholic beverages in South Africa plays a crucial role in driving this demand. Data from IWSR, a London-based information services firm, highlighted a 9% surge in beer consumption in South Africa for 2023. This increase is linked to rapid urban expansion and younger populations migrating to major cities, enhancing accessibility to alcoholic beverages.

- Moreover, Statistics South Africa indicates that the Consumer Price Index (CPI) for alcoholic beverages and tobacco rose from 111.1 in September 2023 to 115.7 in July 2024. This uptick in beverage prices, coupled with average demand across the nation, underscores the growing appetite for container glass.

- Increased consumer spending in South African restaurants and cafes has spurred demand for container glass products, including bottles and bowls. Statistics South Africa notes a rise in food sales from restaurants and coffee shops, jumping from USD 143.87 million in January 2024 to USD 156.04 million in March 2024.

Middle East and Africa Glass Bottles Market Leaders

The container glass market is characterized by intense competition and moderate consolidation in the Middle East and Africa. Key players compete in domestic and international arenas to capture a larger market share, including RAK Ghani Glass LLC, Isanti Glass, Ardagh Group SA, and East Glass Manufacturing Company. These companies are pursuing strategies such as new product development, expansion, and mergers and acquisitions to enhance product functionality and broaden their geographic presence in Middle Eastern nations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Import Export Trade Data of Container Glass

- 4.3 PESTLE Analysis

- 4.4 Industry Standards and Regulations for Container Glass Use for Packaging

- 4.5 Sustainability Trends for Packaging

- 4.6 Container Glass Furnace Capacity and Location In Middle East & Africa

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Consumption of Variety of Food and Beverages in the Region

- 5.1.2 Growing Demand of Glass Containers in the Pharmaceutical Industry

- 5.2 Market Restraint

- 5.2.1 Demand of Plastic Packaging Over Glass Can Hamper Market Growth

- 5.3 Trade Scenerio: Analysis of the Historical and Current Export Import Paradigm for Container Glass Industry in Middle East

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Beverages

- 6.1.1.1 Alcoholic Beverages (Qualitative Analysis to be Provided)

- 6.1.1.1.1 Wins and Spirits

- 6.1.1.1.2 Beer and Cider

- 6.1.1.1.3 Other Alcoholic-Beverages

- 6.1.1.2 Non-alcoholic Beverages (Qualitative Analysis to be Provided)

- 6.1.1.2.1 Carbonated Drinks

- 6.1.1.2.2 Juices

- 6.1.1.2.3 Water

- 6.1.1.2.4 Dairy-Based

- 6.1.1.2.5 Flavored Drinks

- 6.1.1.2.6 Other Non-Alcoholic Drinks

- 6.1.2 Food

- 6.1.3 Cosmetics

- 6.1.4 Pharmaceutical (Excluding Vials and Ampoules)

- 6.1.5 Other End-user Industries

- 6.1.1 Beverages

- 6.2 By Country

- 6.2.1 United Arab Emirates

- 6.2.2 Saudi Arabia

- 6.2.3 Egypt

- 6.2.4 South Africa

- 6.2.5 Nigeria

- 6.2.6 Kuwait

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 RAK Ghani Glass LLC

- 7.1.2 Isanti Glass

- 7.1.3 Ardagh Group SA

- 7.1.4 Saudi Arabian Glass Company Ltd

- 7.1.5 Middle East Glass Manufacturing Company

- 7.1.6 Altajir Glass Industries

- 7.1.7 Nafis Glass

- 7.1.8 Mahmood Saeed Glass Industry Co.