|

市场调查报告书

商品编码

1639384

亚太地区酰胺纤维:市场占有率分析、产业趋势与成长预测(2025-2030 年)Asia-Pacific Aramid Fiber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

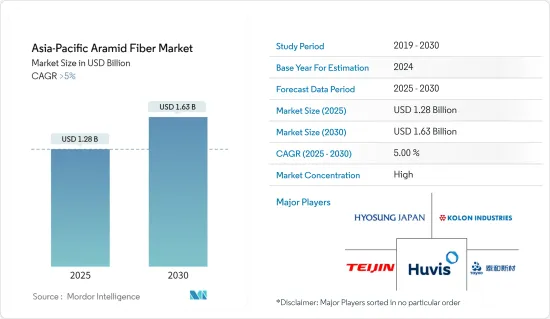

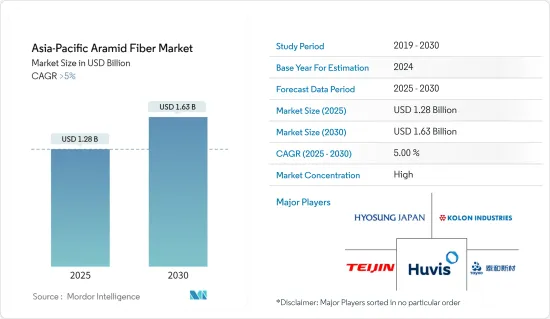

亚太地区酰胺纤维市场规模预计在 2025 年达到 12.8 亿美元,预计到 2030 年将达到 16.3 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 5%。

在亚太地区,中国、印度等国家受到新冠疫情的严重打击,对市场造成不利影响。疫情导致汽车和电子製造活动暂时停止,减少了酰胺纤维的使用。然而,限制解除后市场恢復良好。由于航太、国防和汽车工业对酰胺纤维的消费增加,市场出现了明显復苏。

主要亮点

- 预计市场将受到汽车业对轻质材料的需求不断增长、印度和中国国防支出增加以及酰胺纤维作为钢铁材料潜在替代品的使用增加的推动。

- 酰胺纤维的更好替代品的出现以及酰胺纤维非生物分解的性质阻碍了市场的成长。

- 预计预测期内航太领域的需求不断增长和芳香聚酰胺材料製造技术的进步将为市场创造机会。

- 由于航太和国防以及汽车终端用户产业对酰胺纤维的需求不断增加,预计中国将占据市场主导地位。预计在预测期内,其复合年增长率也将达到最高。

亚太芳纶酰胺纤维市场趋势

航太和国防终端用户产业占据市场主导地位

- 从热气球和滑翔机到战斗机、客机和太空梭,芳香聚酰胺被用于所有飞机和太空船的零件和结构应用中。酰胺纤维通常用于机翼组件、直升机叶轮、座椅螺旋桨以及仪器和内部组件的外壳。

- 在航太工业中,酰胺纤维越来越多地用于新一代飞机的建造,以实现民航机的全天候运作并增强视觉系统。此外,温度稳定性和耐用性等特性可能会在未来几年进一步推动航太复合材料市场的成长。

- 中国和印度是该地区航太和国防工业的最大市场。中国可望成为民航发展最快的国家。该国的乘客数量预计将年增与前一年同期比较%,需要额外 6,800 架飞机来补充其现有的民航机。预计这一增长将推动该国对酰胺纤维的需求。

- 波音和空中巴士是中国最着名的民航机製造商。为了削弱这些公司的主导地位,中国商用航空公司(COMAC)开始在国内生产民航机。 2022年9月,公司交付中国首架国产客机。此外,中国商用飞机有限责任公司(COMAC)5年内国产C919大型客机产能将达到年产150架左右。

- 此外,随着新的直升机製造厂的增加,印度的直升机产量也不断增加。例如,印度总理莫迪于 2023 年在卡纳塔克邦开设了印度斯坦航空有限公司 (HAL) 直升机製造厂。该工厂每年将生产约 30 架轻型公共事业直升机 (LUH)。也有可能逐步增加到每年60架或90架飞机。

- 同样,印度也在增加国防支出。根据斯德哥尔摩国际和平研究所(SIPRI)估计,印度2022年的国防开支将达814亿美元(去年为760亿美元)。因此,增加国防支出将推动该国酰胺纤维市场的发展。

- 因此,航太和国防工业的成长预计将推动该地区酰胺纤维市场的发展。

中国主导市场

- 中国是该地区酰胺纤维的重要市场之一。酰胺纤维用于各种终端用户产业,包括航太和国防。汽车、电器及电子设备、体育用品等。在中国,汽车和航太产业正在实现显着的市场成长,并推动中国酰胺纤维市场的发展。

- 中国是该地区最大的汽车製造商。根据国际汽车製造商协会(OICA)预测,2022年中国汽车产量将达2,702万辆,较去年同期成长3%。

- 此外,该国的汽车产业正在经历趋势的转变,消费者越来越倾向于电池驱动的汽车。此外,中国政府预测2025年电动车产量将达20%。这反映在该国的电动车销售趋势上,2022 年创下了历史新高。根据中国乘用车协会的数据,政府将在 2022 年销售 567 万辆电动车和插电式汽车,几乎是 2021 年销量的两倍。

- 中国是该地区最大的飞机OEM商市场。波音和空中巴士是中国最着名的民航机製造商。为了削弱这些公司的主导地位,中国商用航空公司(COMAC)开始在国内生产民航机。

- 此外,为了削弱这些公司的主导地位,中国商用航空公司(COMAC)开始在国内生产民航机。 2022年9月,公司交付中国首架国产客机。此外,中国商用飞机有限责任公司(COMAC)5年内已形成年产约150架国产C919飞机的生产能力。

- 总体而言,预计预测期内汽车和航太等行业的成长将推动该国酰胺纤维市场的发展。

亚太地区酰胺纤维产业概况

亚太地区的酰胺纤维市场本质上是整合的。该市场的主要企业(不分先后顺序)包括 Huvis Corp、HYOSUNG JAPAN、Kolon Industries Inc.、Teijin Aramid 和 Yantai Tayho Advanced Materials。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 汽车产业对轻量材料的需求不断增加

- 印度和中国的国防费用增加

- 增加酰胺纤维作为钢材潜在替代品的使用

- 限制因素

- 酰胺纤维的更好替代品的可用性

- 酰胺纤维非生物分解

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章 市场区隔(以金额为准的市场规模)

- 依产品类型

- 对芳香聚酰胺

- 间芳香聚酰胺

- 按最终用户产业

- 航太和国防

- 车

- 电气和电子

- 体育用品

- 其他终端用户产业(石油及天然气、通讯等)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- China National Bluestar(Group)Co. Ltd

- Dupont

- Hebei Silicon Valley Chemical Co. Ltd.

- Huvis Corp

- HYOSUNG JAPAN

- KERMEL

- Kolon Industries Inc.

- Shanghai J&S New Materials Co.,ltd

- Teijin Aramid

- TORAY INDUSTRIES, INC.

- X-FIPER New Material Co. Ltd.

- Yantai Tayho Advanced Materials Co.,Ltd.

第七章 市场机会与未来趋势

- 航太领域的需求不断增长

- 芳香聚酰胺製造技术的进步

The Asia-Pacific Aramid Fiber Market size is estimated at USD 1.28 billion in 2025, and is expected to reach USD 1.63 billion by 2030, at a CAGR of greater than 5% during the forecast period (2025-2030).

In Asia-Pacific, countries like China and India were worst hit by the COVID pandemic, negatively affecting the market. Automotive and electronic manufacturing activities were temporarily halted due to the pandemic, which had decreased the usage of aramid fibers. However, the market recovered well after the restrictions were lifted. The market recovered significantly, owing to the rise in consumption of aramid fibers in the Aerospace and, defense, and automotive industries.

Key Highlights

- The increase in demand for lightweight materials in the automotive industry, the rising defense expenditure of India and China, and the increase in the usage of aramid fibers as a potential substitute for steel materials are expected to drive the market.

- The availability of better alternatives for aramid fibers and the non-biodegradable nature of aramid fibers are hindering market growth.

- The growing demand from the aerospace sector and advancements in aramid materials manufacturing technology are expected to create opportunities for the market during the forecast period.

- China is expected to dominate the market due to the rising demand for aramid fibers in the aerospace and defense, automotive end-user industries. It is also expected to register the highest CAGR during the forecast period.

Asia-Pacific Aramid Fibers Market Trends

Aerospace and Defense End-User Industry to Dominated the Market

- Aramids are used for components and structural applications in all aircraft and spacecraft, ranging from hot air balloons and gliders to fighter planes, passenger airliners, and space shuttles. The aramid fibers are generally used in wing assemblies, helicopter rotor blades, seat propellers, and enclosures for instruments and internal parts.

- Every year, the aerospace industry uses a higher proportion of aramid fibers in constructing each new generation of aircraft due to the provision of an all-weather operation of commercial aviation and enhanced vision systems. Moreover, characteristics such as temperature stability and durability will further fuel the growth of the aerospace composites market over the coming years.

- China and India are the region's largest markets for aerospace and defense industries. China is expected to be the fastest-growing country in the civil aviation sector. The government is expected to witness a 9.5% y-o-y passenger growth rate, which will require an additional 6,800 aircraft to add to the existing commercial fleet. This increase is expected to drive the demand for aramid fibers in the country.

- Boeing and Airbus are the most prominent civil aircraft manufacturers in China. To decrease the dominance of these companies Commercial Aviation Corp of China (COMAC) started to manufacture civil aircraft in the country. In September 2022, the company delivered its first homemade passenger jet in China. Furthermore, the reach of the annual production capacity of Commercial Aviation Corp of China (COMAC) is around 150 domestically produced C919 planes in five years.

- Furthermore, the production volume of helicopters is increasing in India with the addition of new helicopter manufacturing plants. For instance, in 2023, Prime Minister Narendra Modi inaugurated the helicopter manufacturing factory of Hindustan Aeronautics Limited (HAL) in Karnataka. The facility will produce around 30 Light Utility Helicopters (LUHs) annually. It can be enhanced to 60 and then 90 per year in a phased manner.

- Similarly, the defense expenditure is increasing in India. According to the Stockholm International Peace Research Institute (SIPRI), in 2022, the defense expenditure in India is registered at USD 81.4 billion, as compared to USD 76 billion expenditure in the previous year. Thus the increase in defense expenditure will drive the market for aramid fibers in the country.

- Thus, the growth in the aerospace and defense industries is expected to drive the market for aramid fibers in the region.

China to Dominate the Market

- China is one of the significant markets for Aramid Fibers in the region. Aramid fibers are used in various end-user industries, such as aerospace and defense. Automotive, electric and electronics, and sporting goods. In China, the automotive and aerospace sectors registered significant market growth, thereby driving the market for aramid fibers in the country.

- China is the largest automotive vehicle manufacturer in the region. According to OICA (The Organisation Internationale des Constructeurs d'Automobiles), automotive vehicle production in China reached a total of 27.02 million units in 2022, an increase of 3% over the previous year for the same period.

- Moreover, the automobile industry in the country is witnessing switching trends as the consumer inclination toward battery-operated vehicles is on the higher side. Furthermore, the government of China estimates a 20% penetration rate of electric vehicle production by 2025. This is reflected in the electric vehicle sales trend in the country, which went to a record-breaking high in 2022. As per the China Passenger Car Association, the government sold 5.67 million EVs and plug-ins in 2022, touching almost double the sales figures achieved in 2021.

- China is the largest market for airplane OEMs in the region. Boeing and Airbus are the most prominent civil aircraft manufacturers in China. To decrease the dominance of these companies, the Commercial Aviation Corp of China (COMAC) started to manufacture civil aircraft in the country.

- Furthermore, to decrease the dominance of these companies, the Commercial Aviation Corp of China (COMAC) started to manufacture civil aircraft in the country. In September 2022, the company delivered its first homemade passenger jet in China. Furthermore, the annual production capacity of Commercial Aviation Corp of China (COMAC) is around 150 domestically produced C919 planes in five years.

- Overall, the growth of industries such as automotive and aerospace are likely to drive the market for aramid fibers in the country during the forecast period.

Asia-Pacific Aramid Fibers Industry Overview

The Asia-Pacific aramid fiber market is consolidated in nature. Some of the key players in the market (not in any particular order) include Huvis Corp, HYOSUNG JAPAN, Kolon Industries Inc., Teijin Aramid, and Yantai Tayho Advanced Materials Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 The Increase in Demand for Light Weight Materials in Automotive Industry

- 4.1.2 The Rising Defense Expenditure of India and China

- 4.1.3 The Increase in Usage of Aramid Fibers as a Potential Substitute for Steel Materials

- 4.2 Restraints

- 4.2.1 The Availability of Better Alternatives For Aramid Fibers

- 4.2.2 Non-Biodegradable Nature of Aramid Fibers

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Para-aramid

- 5.1.2 Meta-aramid

- 5.2 End-user Industry

- 5.2.1 Aerospace and Defense

- 5.2.2 Automotive

- 5.2.3 Electrical and Electronics

- 5.2.4 Sporting Goods

- 5.2.5 Other End-user Industries (Oil & Gas, Telecommunication, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 China National Bluestar (Group) Co. Ltd

- 6.4.2 Dupont

- 6.4.3 Hebei Silicon Valley Chemical Co. Ltd.

- 6.4.4 Huvis Corp

- 6.4.5 HYOSUNG JAPAN

- 6.4.6 KERMEL

- 6.4.7 Kolon Industries Inc.

- 6.4.8 Shanghai J&S New Materials Co.,ltd

- 6.4.9 Teijin Aramid

- 6.4.10 TORAY INDUSTRIES, INC.

- 6.4.11 X-FIPER New Material Co. Ltd.

- 6.4.12 Yantai Tayho Advanced Materials Co.,Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand from the Aerospace Sector

- 7.2 Advancements in Aramid Materials Manufacturing Technology