|

市场调查报告书

商品编码

1639398

北美软性饮料包装:市场占有率分析、行业趋势和成长预测(2025-2030 年)North America Soft Drinks Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

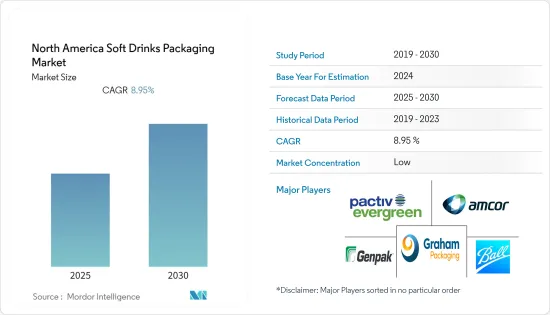

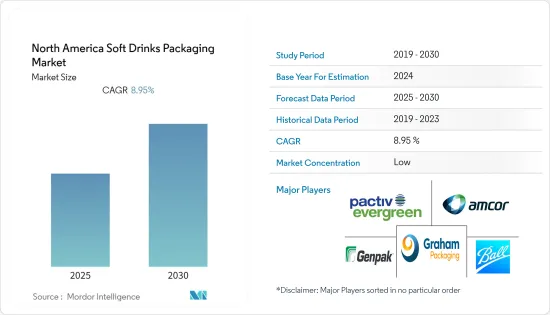

预计预测期内北美软性饮料包装市场复合年增长率为 8.95%。

包装在软性饮料市场中发挥着至关重要的作用。高效率的包装解决方案易于使用、可丢弃且能改善使用者体验。这些优势导致该地区对软性饮料包装解决方案的需求增加。推动需求的另一个趋势是新颖和创新的产品,它们可以帮助製造商区分其产品并提高品牌知名度。

由于健康意识趋势威胁到碳酸软性饮料的成长,因此,对于包装製造商和品牌所有者来说,找到透过包装刺激来吸引消费者的新颖和创新方式至关重要。然而,成本仍然是实现新包装的关键因素。

软性饮料是继水之后消费量第二大的饮料,而软性饮料最常用的包装材料是塑胶。许多饮料製造商倾向于使用塑胶包装来包装宝特瓶饮料,因为它重量轻、耐用且具有成本效益。

近年来,许多塑胶製品正在被回收和再利用。此外,用于包装的塑胶种类繁多,如 PVC、PE、PP、PS、PET 和尼龙,也为该地区该领域的市场占有率做出了贡献。

受新冠疫情影响,历史上利润最高的软性饮料在外消费由于人们对卫生维护的担忧日益加剧以及大面积封城,已几乎陷入停滞。这预计将带来客户行为和购买模式的长期变化,迫使包装行业提供创新解决方案以满足不断变化的需求。

北美软性饮料包装市场趋势

即饮饮料市场预计将占据主要市场占有率

RTD 饮料包括茶、咖啡、能量饮料、运动营养饮料、营养和调味水、软性饮料和现成的酒精鸡尾酒。该地区此类饮料的消费量大幅增加。果菜汁、能量棒混合饮料和冰沙等其他饮料的需求也在增加。

最近,由于需求增加,即饮冰茶的销售量大幅成长。市场上的供应商提供专门用于即饮茶的再生包装。例如,Graham Packaging 提供可回收塑胶包装并延长单份包装的保质期。

能量饮料在该地区的千禧世代中非常受欢迎。受欢迎的主要原因与针对年轻消费者的积极行销宣传活动有很大关係。此外,广告声称能量饮料可以让你精神焕发、头脑清醒、提高你的耐力和表现。

随着美国市场对鸡尾酒的需求不断增长,供应商正在采用灵活的饮料包装。例如,美国饮料品牌 buzzox 和 Tetra Pak 采用可回收包装提供便携式鸡尾酒。鸡尾酒采用 200 毫升可回收利乐包装,不含防腐剂,确保安全且口感新鲜。

即饮(RTD)咖啡在研究区域内不再是小众市场领域。即饮咖啡的零售额正在成长,尤其是在美国。近年来,消费者的健康意识不断增强,越来越多地选择即饮咖啡,而不是高糖碳酸饮料。由于一些冷萃即饮饮料具有额外的健康益处,这些产品的市场正在崛起,并被视为高级产品。

美国占有最大的市场占有率

- 该市场的消费者越来越注重健康和保健。从早晨果汁到能量饮料,人们在提神产品的支出正在增加,符合健康趋势。这一趋势使得果汁饮料领域对经济高效的包装解决方案的需求很高。

- 预计预测期内对果汁和饮料的需求将以可观的速度成长。这些产品的包装使用可延长其保质期。新的包装方法可以延长果汁的保存期限。

- 另外,果汁无菌包装是将容器、无菌果汁和辅助包装材料置于无菌环境的过程。这些饮料在无菌填充机中填充和密封。果汁食品通常经过高温巴氏杀菌,然后冷却至20℃至30℃,以达到无菌需求。

- 此外,果汁饮料的无菌包装还包括带有塑胶层的塑胶包装。铝层保护饮料免受光线和氧气的侵害。因此,无需冷藏即可保持保质期。为了保护塑胶包装免受产品内部和外部湿气的影响,其内外都涂有一层聚乙烯 (PE)。

- 此外,碳酸饮料通常装在铝罐中。新冠疫情在疫情初期就影响了这些罐头的供应,凸显了它们的限制。这种罐装短缺促使汽水公司寻找新的包装,尤其是任何可以延长保质期的无菌包装。

北美软性饮料包装产业概况

北美软性饮料包装市场集中度适中,很快就会进入分散阶段。市场主要企业采用的主要策略是产品创新、併购和伙伴关係。市场的一些主要参与者包括 Pactive LLC、Amcor Ltd、Genpak LLC 和 Graham Packaging Company。市场的最新趋势包括:

- 2021 年 7 月 - Liquibox 和 WestRock 为亚马逊推出了自有货柜运输 (SIOC)衬袋纸盒解决方案,该解决方案让消费者满意、减少废弃物并确保货物完好无损地到达。经过严格的性能测试,这种新包装通过了亚马逊 APASS 认证实验室的 ISTA 6-Amazon.com-SIOC 测试,无需额外的保护盒。

- 2021 年 1 月—Ball Corporation 宣布计划在肯塔基州鲍灵格林建立一个新的铝废料製造工厂。该工厂预计将于 2022 年初投入生产,并进行多年的扩建,创造约 200 个製造业职缺。位于肯塔基州鲍灵格林的新工厂将向 Ball 公司遍布北美的不断增长的饮料罐製造厂网络供应铝边角料。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 疫情对市场的影响评估

第五章 市场动态

- 市场驱动因素

- 软性饮料消费量增加

- 消费者对方便包装的需求不断增加

- 市场限制

- 与塑胶使用相关的环境问题

- 严格的政府法规

第六章 市场细分

- 依包装材料类型

- 塑胶

- 纸和纸板

- 玻璃

- 金属

- 其他材料

- 依产品类型

- 瓶装水

- 碳酸饮料

- 汁

- 即饮饮料

- 运动饮料

- 其他产品类型

- 按地区

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Pactive LLC

- Amcor Ltd

- Genpak LLC

- Graham Packaging Company

- Ball Corporation

- SIG Combibloc Company Ltd

- Tetra Pak International

- Placon Corporation

- Toyo Seikan Group Holdings Ltd

- WestRock Company

- Owens-Illinois Inc.

- The Scoular Company

- Ardagh Group SA

- Crown Holdings Inc.

- CAN-PACK SA

- Alcoa Corporation

第八章投资分析

第九章:市场的未来

The North America Soft Drinks Packaging Market is expected to register a CAGR of 8.95% during the forecast period.

Packaging plays an essential role in the soft drinks market. Efficient packaging solutions offer ease of use, disposability, and enhanced user experience. These benefits have led to the demand for packaging solutions for the soft drinks segment in the region. Another trend augmenting demand is new and innovative products that help manufacturers enhance their brand visibility while offering product differentiation.

With the trend toward healthier beverages threatening the growth of carbonated soft drinks, finding new and innovative ways to get consumers through packaging stimuli is crucial for packaging manufacturers and brand owners. However, the cost will still be the key ingredient to any new packaging feasibility.

Soft drinks are the second most-consumed drink after water, with plastic being the most used material for soft drinks packaging. Many beverage companies favor plastic packaging material for bottled beverages due to its lightweight, durability, and cost-efficiency.

Many plastic products are being recycled and reused in recent years. Also, the variety of plastics available for packaging, such as PVC, PE, PP, PS, PET, and nylon, is one of the reasons contributing to the market share of this segment in the region.

As a result of the COVID-19 pandemic, out-of-home consumption of soft drinks, which historically generates the highest margin, has come to nearly a standstill due to growing concerns about maintaining hygiene and widespread lockdown. This is expected to bring long-term changes in customers' behavior and purchasing patterns, pushing the packaging industry to bring innovative solutions to meet the changing requirements.

North America Soft Drinks Packaging Market Trends

The RTD Beverages Segment is Expected to Hold a Significant Market Share

Ready-to-drink beverages include tea, coffee, energy drinks, sports nutrition drinks, highly nutrient and flavored water, alcopops, and ready-made alcohol cocktails. These beverages are witnessing a significant rise in consumption in the region. Also, other beverages, like vegetable juices, bar mixes, and smoothies, are experiencing increased demand.

Lately, ready-to-drink iced tea has grown considerably due to the increasing demand. Market vendors are offering specialized recycle packaging for ready-to-drink tea. For instance, Graham Packaging offers recyclable plastic packaging to provide longer shelf life for single-serve packaging.

Energy drinks are getting immense popularity among the region's millennial population. The principal reason for this popularity is significantly related to the aggressive marketing campaigns primarily directed toward young consumers. Moreover, advertisements promote that energy drinks refresh the body, ignite the mind, and enhance stamina and performance.

Owing to the increasing demand for cocktails in the US market, vendors adopt flexible beverage packages. For instance, buzzox, an American beverage brand, and Tetra Pak provide cocktails on the go using recyclable packages. The cocktails come in 200 ml recyclable Tetra Pak's packages, allowing the beverages to stay safe and taste fresh without using preservatives.

Ready-to-drink (RTD) coffee is no longer a niche market segment in the studied region. Retail sales of RTD coffee have been growing, especially in the United States. Consumers are also more health-conscious nowadays; therefore, they opt for RTD coffee instead of high-sugar and carbonated beverages more often. Due to the additional health benefits that some cold-brew RTD beverages offer, the market is on the rise for these products, and they are seen as premium products.

The United States Accounts for the Largest Market Share

- Consumers in the market are becoming increasingly conscious of health and wellness. From juice in the morning to energy drinks, they are spending more on the products that provide refreshments are well within the wellness trend. This trend has created a high demand for cost-effective packaging solutions in the fruit-based beverage segment.

- This demand for fruit juices and beverages is expected to grow decently over the forecast period. The use of packaging for these products improves the shelf-life. The recent new packaging method provides shelf-stable fruit juices.

- Moreover, Fruit-based beverages aseptic packaging is a process in which containers, aseptic juices, and auxiliary packaging materials are placed in an aseptic environment. These beverages are filled and sealed with an aseptic filling machine. Fruit juice foods are usually sterilized at high temperatures and then reduced to 20°C to 30°C to attain aseptic requirements.

- Additionally, aseptic packaging for fruit-based beverages includes plastic packaging with plastic layers. The aluminum layer protects the beverage from light and oxygen. As a result, the product can retain shelf life without cooling. To protect the plastic package against the moisture of the product and the moisture from the outside, a layer of polyethylene (PE) is applied on the inside and outside.

- Further, Carbonated soft drinks are usually packaged in aluminum cans. The COVID-19 pandemic impacted the supply of these cans in the early months of the pandemic, which highlighted the limitations of these cans. The can shortage made carbonated beverage producers look for new packages, specifically all forms of aseptic, enabling a long ambient shelf life.

North America Soft Drinks Packaging Industry Overview

The North America soft drinks packaging market is moderately concentrated, shortly moving toward the fragmented stage. The key strategies adopted by the major players in the market are product innovations, mergers, acquisitions, and partnerships. Some of the major players in the market are Pactive LLC, Amcor Ltd, Genpak LLC, and Graham Packaging Company. Some of the recent developments in the market are:

- July 2021 - Liquibox and WestRock launched a Ships In Own Container (SIOC) bag-in-box solution for Amazon that delights consumers, reduces waste, and ensures that products arrive undamaged. Following rigorous performance tests, the new packaging passed the ISTA 6-Amazon.com-SIOC test in an Amazon APASS-certified lab and did not require additional protective boxes.

- January 2021 - Ball Corporation announced plans to build a new aluminum end manufacturing facility in Bowling Green, Kentucky. The facility is scheduled to begin production in early 2022 and expand over multiple years to create approximately 200 manufacturing jobs. The new Bowling Green, Kentucky, facility will provide aluminum end supply to Ball's expanding North American network of beverage can manufacturing plants.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of the COVID-19 Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Soft Drink Consumption

- 5.1.2 Increased Demand for Convenience Packaging from Consumers

- 5.2 Market Restraints

- 5.2.1 Environmental Concerns Regarding Usage of Plastic

- 5.2.2 Stringent Government Regulations

6 MARKET SEGMENTATION

- 6.1 Packaging Material Type

- 6.1.1 Plastic

- 6.1.2 Paper and Paperboard

- 6.1.3 Glass

- 6.1.4 Metal

- 6.1.5 Other Materials

- 6.2 Product Type

- 6.2.1 Bottled Water

- 6.2.2 Carbonated Drinks

- 6.2.3 Juices

- 6.2.4 RTD Beverages

- 6.2.5 Sports Drinks

- 6.2.6 Other Product Types

- 6.3 Geography

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Pactive LLC

- 7.1.2 Amcor Ltd

- 7.1.3 Genpak LLC

- 7.1.4 Graham Packaging Company

- 7.1.5 Ball Corporation

- 7.1.6 SIG Combibloc Company Ltd

- 7.1.7 Tetra Pak International

- 7.1.8 Placon Corporation

- 7.1.9 Toyo Seikan Group Holdings Ltd

- 7.1.10 WestRock Company

- 7.1.11 Owens-Illinois Inc.

- 7.1.12 The Scoular Company

- 7.1.13 Ardagh Group SA

- 7.1.14 Crown Holdings Inc.

- 7.1.15 CAN-PACK SA

- 7.1.16 Alcoa Corporation