|

市场调查报告书

商品编码

1639408

生物表面活性剂:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Biosurfactants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

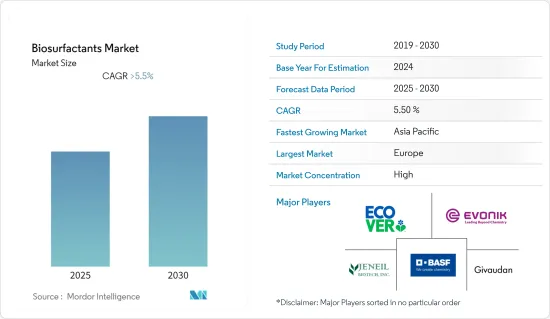

预测期内,生物界面活性剂市场预计将以超过 5.5% 的复合年增长率成长。

2020 年,新冠肺炎疫情对市场产生了负面影响。然而,目前人们对个人卫生和清洁环境的意识不断增强,刺激了对个人和家庭清洗产品的需求,从而促进了生物表面活性剂市场的成长。

主要亮点

- 短期内,亚太地区个人护理行业的成长以及消费者对生物基产品的偏好日益增加预计将推动市场成长。

- 高生产成本可能会阻碍市场成长。

- 生物表面活性剂生产方法的不断进步的技术创新有望优化产品的整体成本,为市场成长提供丰厚的成长机会。

- 预计欧洲地区将主导市场。然而,亚太地区可能在预测期内呈现最高的复合年增长率。

生物表面活性剂的市场趋势

清洁剂和工业清洁剂领域预计将占据市场主导地位

- 界面活性剂在洗衣和家用清洗配方中发挥重要作用。化学表面活性剂、织物柔软剂、氧化剂和各种酵素是现代清洁剂的一些成分。

- 此外,所有界面活性剂都是合成的,对幼小水生生物构成威胁。随着大众对环境问题和合成界面活性剂相关风险的认识不断提高,人们开始重新寻找具有环保特性的界面活性剂来取代服饰中的合成界面活性清洁剂。

- 与化学界面活性剂相比,生物界面活性剂更受青睐,因为它们毒性较小、对温度和pH值变化的抵抗力更强,而且更易生物分解性。最重要的是,它的优点在于它是由可再生资源生产的。根据所使用的微生物和碳源和氮源,可以产生醣脂、脂肽和聚合物界面活性剂等生物表面活性剂结构。与残留物的相互作用可能因生物界面活性剂的结构而异。

- 环状脂肽 (CLP) 等生物表面活性剂在很宽的 pH 值范围 (7.0–12.0) 内都很稳定,并且即使加热到高温也不会失去其表面动态性能。此外,它表现出与植物油优异的乳液形成能力,清洗与商用服饰具有优异的相似性和强度,表明在服饰策略清洗应考虑它。

- 根据个人护理和清洁剂工业协会 (IKW) 的数据,2021 年德国洗衣精和清洁产品的销售额预计将达到50.92 亿欧元(约59.89 亿美元),而2020 年这一数字为52.46 亿欧元(约59.89 亿美元)百万欧元(约 60.246 亿美元)。

- 根据美国劳工统计局的数据,2021 年美国消费者在肥皂和清洁剂上的平均年度支出为 80.49 美元,而 2020 年为 75.53 美元。

- 所有这些因素都可能对研究市场的需求产生重大影响。

预计欧洲将主导市场

- 在区域性生物界面活性剂市场中,欧洲占有最大的份额。由于德国、英国、法国和义大利等一些最大的消费国的存在,该地区对生物表面活性剂的需求正在大幅增长。

- 德国人口每年都在成长,人们越来越注重个人照护和卫生。这意味着要使用更多的肥皂和清洁剂。因此,预计预测期内表面活性剂的使用量将会增加。

- 德国化学工业的产出对于各种产品至关重要,例如肥皂、清洁剂和化妆品。德国拥有60多家清洗、护理和清洁产品製造商。

- 根据VKE(德国化妆品新兴市场协会)的数据,2021年德国化妆品产业与前一年同期比较收益发展率为0.4%,而2020年为-9%。

- 英国肥皂和清洁剂製造业是一个充满活力的市场,由于製造商竞争以保持消费者的兴趣,该行业以强大的产品创新而闻名。

- 根据英国国家统计局的数据,到 2023 年,肥皂、清洁剂、清洗剂和抛光剂製造产生的收益预计将达到约 61.3181 亿美元。

- 石油和天然气工业在该国经济成长中发挥着至关重要的作用。英国是一个成熟的石油国家,面对近年来最严重的油价下滑,该国海上石油产业证明了其韧性。英国海上石油工业以浅水区为主,深水区所占比例有限。

生物表面活性剂产业概况

生物界面活性剂市场趋于整合,主要企业占了相当大的份额。生物界面活性剂市场的主要企业(不分先后顺序)包括 Evonik Industries AG、 BASF SE、Ecover、Jeneil 和 Givaudan。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 亚太地区个人护理产业的成长

- 消费者对使用生物产品的偏好日益增加

- 限制因素

- 生产成本高

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(以金额为准的市场规模)

- 依产品类型

- 醣脂(鼠李醣脂、海藻醣脂、槐醣脂)

- 磷脂

- 界面活性剂

- 地衣多醣

- 聚合物生物界面活性剂

- 其他产品类型

- 按应用

- 清洁剂和工业清洁剂

- 化妆品(个人护理)

- 食品加工

- 油田化学品

- 农业化学品

- 纺织产品

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业策略

- 公司简介

- AGAE Technologies LLC

- Biotensidon GmbH

- Cognis Care Chemicals(BASF SE)

- Ecover

- Evonik Industries AG

- Givaudan

- GlycoSurf LLC

- Jeneil

- Kaneka Corporation

- Logos Technologies(Stepan Company)

- Saraya Co. Ltd

- Synthezyme LLC

- TeeGene Biotech

- TensioGreen

- WHEATOLEO

第七章 市场机会与未来趋势

- 生物表面活性剂商业化生产的创新

The Biosurfactants Market is expected to register a CAGR of greater than 5.5% during the forecast period.

The COVID-19 pandemic negatively impacted the market in 2020. However, consciousness regarding personal hygiene and clean surroundings has increased in the current situation, stimulating the demand for personal and household cleaning products and enhancing the market growth of biosurfactants.

Key Highlights

- Over the short term, the growing personal care industry in Asia-Pacific and rising consumer inclination toward using bioproducts are expected to drive the market's growth.

- High production costs are likely to hinder the market's growth.

- Growing innovation in the production methods of the biosurfactants will optimize the overall cost of their products which is further expected to stage lucrative growth opportunities for the growth of the market studied.

- The Europe region is expected to dominate the market. However, Asia-Pacific is likely to witness the highest CAGR during the forecast period.

Biosurfactants Market Trends

Detergents and Industrial Cleaners Segment is Expected to Dominate the Market

- Surfactants serve a critical role in the formulation of laundry and household cleaning products. Chemical surfactants, softeners, oxidizing agents, and different enzymes are among the constituents of modern detergents.

- Furthermore, surfactants are all synthetically made and pose a threat to young aquatic life. The search for eco-friendly characteristic alternatives for compound surfactants in garment cleaners has been re-energized by the growing public awareness of environmental problems and risks associated with compound surfactants.

- Biosurfactants are preferable over chemical surfactants because of their low toxicity, the endurance of temperature and pH fluctuations, and high biodegradability. Above all, they have the advantage of being able to be made from renewable resources. Biosurfactant structures, such as glycolipids, lipopeptides, and polymeric surfactants, can be generated depending on the microbe and carbon and nitrogen sources employed. The interaction with the residue may differ depending on the structure of the biosurfactant.

- Biosurfactants, such as Cyclic Lipopeptide (CLP), are stable across a wide pH range (7.0-12.0) and do not lose their surface-dynamic properties when heated to high temperatures. They demonstrate excellent emulsion creation capability with vegetable oils, as well as outstanding resemblance and strength to commercial clothes cleaners, indicating that they should be considered in a clothing cleansers strategy.

- According to the Industry Association for Personal Care and Detergents e. V (IKW), revenues from laundry detergents and cleaning products in Germany accounted for EUR 5,092 million (~USD 6,024.60 million) in 2021, compared to EUR 5,246 million (~USD 5,989.49 million) in the previous year.

- According to the Bureau of Labor Statistics, average annual expenditure on soaps and detergents per consumer unit in the United States accounted for USD 80.49 in 2021, compared to USD 75.53 in 2020.

- All such factors are likley to significantly impact the demand for the studied market.

Europe is Expected to Dominate the Market

- The European region accounted for the largest share of the regional market for biosurfactants. Owing to the presence of the largest consuming countries, such as Germany, the United Kingdom, France, and Italy, the demand for biosurfactants in the region is growing at a significant rate.

- Germany's population has increased over the years, and awareness regarding personal care and hygiene is high. Hence, the usage of soaps and detergents is high. This, in turn, is expected to increase the usage of surfactants over the forecast period.

- The output from the German chemical industry is essential in various products, which include soaps, detergents, cosmetics, etc. More than 60 manufacturers of washing, care, and cleaning agents are present in the country.

- According to the VKE - Association of Marketing Companies for Cosmetic Products e. V, year-on-year revenue development in the cosmetics industry in Germany accounted for 0.4% in 2021, compared to -9% in 2020.

- The market for the soap and detergent manufacturing industry in the United Kingdom is dynamic, and the industry is known for strong product innovation, as the manufacturers compete to retain consumer interest.

- According to the Office for National Statistics in the United Kingdom, the revenue generated through the manufacturing of soap and detergents and cleaning and polishing preparations is likely to reach about USD 6,131.81 million by 2023.

- The oil and gas industry plays a vital role in the growth of the country's economy. Although the United Kingdom is a mature petroleum province, the offshore oil industry in the country proved its resilience in the face of one of the most severe oil price downturns in recent years. The offshore oil industry in the United Kingdom is shallow-water-based, and deep-water accounts for a limited share.

Biosurfactants Industry Overview

The biosurfactants market is consolidated, with the top five players holding a significant of market share. Some key players in the biosurfactants market (in no particular order) include Evonik Industries AG, BASF SE, Ecover, Jeneil, and Givaudan, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Personal Care Industry in Asia-Pacific

- 4.1.2 Rising Consumer Inclination Toward the Use of Bioproducts

- 4.2 Restraints

- 4.2.1 High Production Cost

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Glycolipid (Rhamnolipids, Trehalolipids, and Sophorolipids)

- 5.1.2 Phospholipids

- 5.1.3 Surfactin

- 5.1.4 Lichenysin

- 5.1.5 Polymeric Biosurfactants

- 5.1.6 Other Product Types

- 5.2 Application

- 5.2.1 Detergents and Industrial Cleaners

- 5.2.2 Cosmetics (Personal Care)

- 5.2.3 Food Processing

- 5.2.4 Oilfield Chemicals

- 5.2.5 Agricultural Chemicals

- 5.2.6 Textiles

- 5.2.7 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AGAE Technologies LLC

- 6.4.2 Biotensidon GmbH

- 6.4.3 Cognis Care Chemicals (BASF SE)

- 6.4.4 Ecover

- 6.4.5 Evonik Industries AG

- 6.4.6 Givaudan

- 6.4.7 GlycoSurf LLC

- 6.4.8 Jeneil

- 6.4.9 Kaneka Corporation

- 6.4.10 Logos Technologies (Stepan Company)

- 6.4.11 Saraya Co. Ltd

- 6.4.12 Synthezyme LLC

- 6.4.13 TeeGene Biotech

- 6.4.14 TensioGreen

- 6.4.15 WHEATOLEO

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation in Feasible Commercial Production of Bio-surfactants

![鼠李醣脂的全球市场评估,类别[单鼠李醣脂,双鼠李醣脂],各用途[界面活性剂,润滑剂,农业,食品产业,其他],各地区,机会,预测,2018年~2032年](/sample/img/cover/42/default_cover_2.png)