|

市场调查报告书

商品编码

1690174

鼠李醣脂:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Rhamnolipids - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

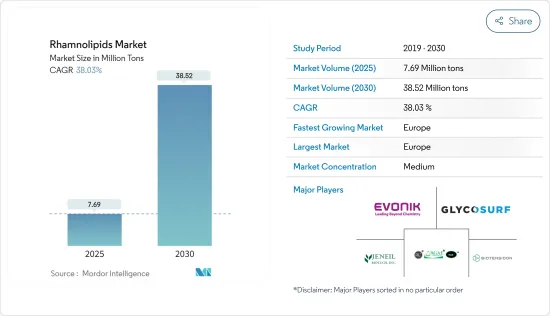

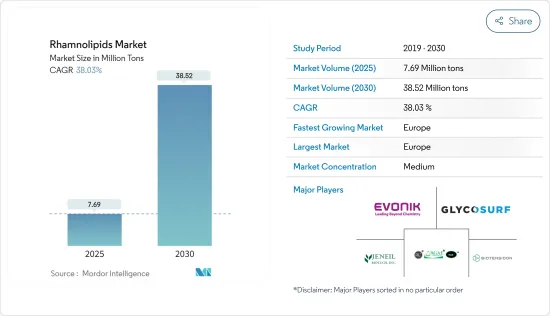

鼠李醣脂市场规模预计在 2025 年达到 769 万吨,预计在 2030 年达到 3,852 万吨,预测期内(2025-2030 年)的复合年增长率为 38.03%。

主要亮点

- 新冠疫情导致全球封锁、供应链和製造活动中断以及生产停顿,所有这些都对 2020 年的市场产生了不利影响。不过,情况在 2021 年开始好转,市场在预测期的剩余时间内恢復了上升趋势。

- 推动市场发展的主要因素是由于环保界面活性剂导致对鼠李醣脂的需求不断增长。此外,个人保健产品的需求增加预计也将推动市场需求。

- 然而,工业规模生产鼠李醣脂有其局限性,阻碍了市场的成长。

- 预计未来对鼠李醣脂应用的研究将在预测期内为市场成长提供各种机会。

- 欧洲地区是最大的市场,由于德国、英国和法国等国家的消费量不断增加,预计将在预测期内成为成长最快的市场。

鼠李醣脂的市场趋势

界面活性剂对鼠李醣脂的需求不断增加

- 鼠李醣脂生物界面活性剂在自然界中比合成界面活性剂更容易被破坏。它被认为是合成表面活性剂的优良替代品,因为它对皮肤温和,易于冲洗,而且对环境友好。

- 界面活性剂是众所周知的清洁剂和家用清洗的主要成分。清洁剂和其他清洗产品行业对环保表面活性剂的需求一直存在。

- 鼠李醣脂生物界面活性剂用于洗衣精、地板清洁剂、清洁剂和其他清洗产品。许多公司正在向市场推出生物表面活性剂清洗和清洁剂产品。

- 鼠李醣脂界面活性剂含有一个或两个鼠李糖分子作为亲水部分和一个或两个B-羟基化脂肪酸链分子作为疏水区。

- 鼠李醣脂可在有氧或无氧条件下自然分解,是100%天然物质。这些醣脂是多功能生物表面活性剂,具有广泛的应用,包括作为清洗。

- 此外,比利时生态清洗产品製造商 Ecover 也提供含有鼠李醣脂的玻璃和表面清洗。该公司提供的产品属于生物分解性,对水生生物的影响极小。

- 根据加拿大统计局 Statcan 的数据,2023 年 1 月至 3 月加拿大肥皂和清洗产品的月度製造商销售额为 3.9558 亿加元(约 3.04 亿美元),比去年同期增长约 20%。

- 因此,由于上述因素,界面活性剂中的鼠李醣脂的应用很可能在预测期内占据主导地位。

欧洲主导市场

- 目前,受工业和终端用途需求的推动,欧洲在全球表面活性剂、化妆品和药品市场上占有最高份额。

- 在欧洲,德国是鼠李醣脂的重要市场。 Fraunhofer IGB、Cognis Care Chemicals、Evonik Industries AG 和 Biotensidon GmbH 生产鼠李醣脂和生物界面活性剂。

- Biotensidon GmbH 已开发出以低成本大规模生产鼠李醣脂的能力,从而帮助改善多个工业领域许多产品的健康和环境特性。为了提高鼠李醣脂的生产能力,Biotensidon GmbH 正在建造一种新的鼠李醣脂-超分子复合物,将鼠李醣脂的生产能力提高到每年 5,000 吨。

- 在英国,有公司投资开发鼠李醣脂和生物界面活性剂的高效生产技术。

- 泰基生物科技是国内专业从事生物表面活性剂生产和研发的生物技术公司。该公司开发了尖端的、环保的生物技术工艺,利用微生物、植物和海洋生物等天然来源生产生物表面活性剂。

- 在义大利,鼠李醣脂和生物界面活性剂市场仍处于研发阶段。预计未来几年国内鼠李醣脂市场将会扩大。

- 法国是世界上最大的化妆品市场。因此,大多数公司都在开发用于个人护理应用的特定生物界面活性剂。例如,化妆品和个人护理公司奇华顿开发了生物界面活性剂。这种生物界面活性剂用于除臭剂、洗面乳、沐浴凝胶和卸妆。

- 因此,由于上述因素,欧洲很可能在预测期内主导鼠李醣脂市场。

鼠李醣脂产业概况

全球鼠李醣脂市场处于部分整合状态,只有少数几家大公司占据市场主导地位。主要公司包括(不分先后顺序):Evonik Industries AG、Jeneil Biotech、Stepan Company、AGAE Technologies LLC 和 Biotensiodn GmbH。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 环保界面活性剂的出现

- 个人保健产品需求不断增加

- 限制因素

- 鼠李醣脂工业规模生产的局限性

- 价值链分析

- 波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 类型

- 单鼠李醣脂

- 双鼠李醣脂

- 应用

- 界面活性剂

- 化妆品

- 农业

- 食物

- 药品

- 其他用途

- 地区

- 亚太地区

- 北美洲

- 欧洲

- 南美洲

- 中东和非洲

第六章 竞争格局

- 併购、合资、合作、协议

- 市场排名分析

- 主要企业策略

- 公司简介

- AGAE Technologies, LLC

- Stepan Company

- Biotensidon GmbH

- Evonik Industries AG

- GlycoSurf

- Jeneil Biotech

- DEGUAN Biosurfactant Supplier

- TensioGreen

第七章 市场机会与未来趋势

- 鼠李醣脂的应用未来研究

简介目录

Product Code: 70585

The Rhamnolipids Market size is estimated at 7.69 million tons in 2025, and is expected to reach 38.52 million tons by 2030, at a CAGR of 38.03% during the forecast period (2025-2030).

Key Highlights

- The COVID-19 outbreak resulted in a global lockdown, a breakdown in supply chains and manufacturing activities, and production halts, all of which had a detrimental effect on the market in 2020. However, things started to get better in 2021, which allowed the market to resume its upward trend for the remainder of the projected period.

- The major factor driving the market studied is the growing demand for rhamnolipids from eco-friendly surfactants. Moreover, the increasing demand for personal care products is also expected to fuel the market demand.

- On the flip side, limitations in the production of rhamnolipids on an industrial scale have hindered the growth of the market.

- The upcoming research in the applications of rhamnolipids is forecasted to offer various opportunities for the growth of the market over the forecast period.

- Europe region represents the largest market and is also expected to be the fastest-growing market over the forecast period owing to the increasing consumption from countries such as Germany, the United Kingdom, and France.

Rhamnolipids Market Trends

Growing Demand of Rhamnolipids from Surfactants

- Rhamnolipid bio-surfactants have the property of getting dreaded easily in nature as compared to synthetic surfactants. They are believed to be a better alternative to synthetic surfactants due to their being skin-friendly, rinse-active, and very environmentally friendly.

- Surfactants are known to be the major ingredients of detergents and household cleaning agents. There is a constant need for environmentally sound surfactants to be used in the industry for detergents and other cleaning products.

- Rhamnolipid bio-surfactants are used in laundry detergents, floor cleaners, dishwashing liquids, and other cleaning products. Many companies have been introducing bio-surfactant cleaning and detergent products in the market.

- Rhamnolipids surfactants contain either one or two molecules of rhamnose as the hydrophilic moisture, linked to one or two B-hydroxylated fatty acid chains as the hydrophobic region.

- Rhamnolipids decompose naturally, whether aerobically or anaerobically, to 100% natural substances. These glycolipids are versatile biosurfactants with a wide range of possible applications ranging from cleansing agents.

- Moreover, Ecover, a Belgium-based manufacturer of ecologically sound cleaning products, offers a glass and surface cleaner containing rhamnolipid. The product provided by the company is classified as biodegradable and shows minimal impact on aquatic life.

- According to Statcan, the Canadian Statistics Agency, the monthly manufacturer sales of soap and cleaning compounds in Canada in the first three months of 2023 accounted for CAD 395.58 million (~USD 304 million), approximately 20% more than the previous year's sales for the same period.

- Hence, owing to the factors mentioned above, the application of rhamnolipids from surfactant is likely to dominate during the forecast period.

Europe Region to Dominate the Market

- Currently, Europe accounts for the highest share of surfactants, cosmetics, and pharmaceuticals in the global market, owing to the demand from the industries and end-use applications.

- In Europe, Germany has a significant market for rhamnolipids. Fraunhofer IGB, Cognis Care Chemicals, Evonik Industries AG, and Biotensidon GmbH manufacture rhamnolipids and biosurfactants.

- Biotensidon GmbH has developed the capability for cost-effective mass-production of rhamnolipids, which will be instrumental in improving the health and eco characteristics of many products in several industry sectors. In order to increase the production capacity of rhamnolipids, Biotensidon GmbH has built a new rhamnolipid-supra molecular complex to increase the production capacity of rhamnolipids up to 5,000 tons per year.

- In the United Kingdom, companies are investing in the development of efficient production technologies for rhamnolipids and biosurfactants.

- TeeGene Biotech Limited is a biotechnology company that specializes in the production and development of biosurfactants in the country. The company developed environmentally friendly cutting-edge biotechnological processes to manufacture biosurfactants from natural sources such as microorganisms, plants, and marine organisms.

- In Italy, the market for rhamnolipids and biosurfactants is still in the research and development phase. In the coming years, the market for rhamnolipids is expected to grow in the country.

- France has the largest market for cosmetics in the world. Thus, most of the companies are developing specific biosurfactants which are used in personal care applications. For instance, Givaudan, a cosmetics and personal care company, developed a biosurfactant belonging to the sophorolipids family. The biosurfactant is used in deodorants, face cleansers, shower gels, and make-up removers.

- Hence, owing to the factors mentioned above, Europe is likely to dominate the rhamnolipids market during the forecast period.

Rhamnolipids Industry Overview

The global rhamnolipids market is partially consolidated in nature with only a few major players dominating the market. Some of the major companies are (not in any particular order) Evonik Industries AG, Jeneil Biotech, Stepan Company, AGAE Technologies LLC, and Biotensiodn GmbH, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Emergence of Eco-friendly Surfactant

- 4.1.2 Increasing Demand For Personal Care Products

- 4.2 Restraints

- 4.2.1 Limitation in the Production of Rhamnolipids on an Industrial Scale

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Mono-Rhamnolipids

- 5.1.2 Di-Rhamnolipids

- 5.2 Application

- 5.2.1 Surfactants

- 5.2.2 Cosmetics

- 5.2.3 Agriculture

- 5.2.4 Food

- 5.2.5 Pharmaceutical

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.2 North America

- 5.3.3 Europe

- 5.3.4 South America

- 5.3.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AGAE Technologies, LLC

- 6.4.2 Stepan Company

- 6.4.3 Biotensidon GmbH

- 6.4.4 Evonik Industries AG

- 6.4.5 GlycoSurf

- 6.4.6 Jeneil Biotech

- 6.4.7 DEGUAN Biosurfactant Supplier

- 6.4.8 TensioGreen

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Upcoming Research in the Applications of Rhamnolipids

02-2729-4219

+886-2-2729-4219

![鼠李醣脂的全球市场评估,类别[单鼠李醣脂,双鼠李醣脂],各用途[界面活性剂,润滑剂,农业,食品产业,其他],各地区,机会,预测,2018年~2032年](/sample/img/cover/42/default_cover_mx.png)