|

市场调查报告书

商品编码

1851947

生物表面活性剂:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Biosurfactants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

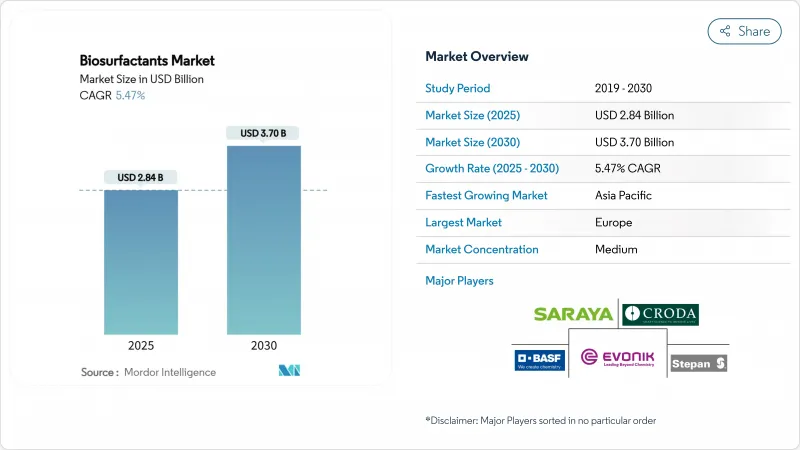

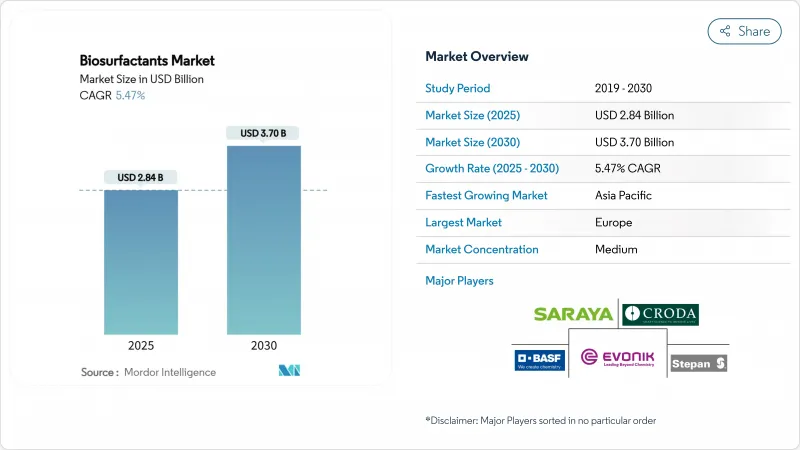

预计到 2025 年,生物界面活性剂市值将达到 28.4 亿美元,到 2030 年将达到 37 亿美元,预测期(2025-2030 年)的复合年增长率为 5.47%。

对可生物降解成分的强有力政策要求、大规模发酵技术的稳步突破以及个人护理和油田化学品应用领域日益增长的需求,共同推动了这一发展趋势。随着生产商整合成本更低的废弃物基材,以及亚太地区蓬勃发展的供应链重塑全球贸易格局,生产经济效益开始向微生物合成倾斜。掌控上游原料和下游精炼环节对于竞争策略至关重要,这种转变有利于拥有垂直整合营运模式的公司。

全球生物表面活性剂市场趋势与洞察

亚太地区对个人护理和化妆品的需求不断增长

该地区收入的增长以及消费者对「洁净标示」成分的偏好,正在推动对天然来源的温和表面活性剂的需求。醣脂分子凭藉其优异的皮肤相容性,满足了这项需求,为配方师提供了合成乙氧基化物的理想替代方案。BASF顺应市场趋势,推出了Dehyton PK45 GA/RA,这是一款获得雨林联盟认证的棕榈油表面活性剂,专为温和护肤产品而设计。当地製造商正利用其靠近棕榈仁和椰子供应链的优势,进一步降低成本并缩短交货週期。不断提高的消费者期望,加上结构性的供应优势,正在加速生物表面活性剂市场在个人护理领域的普及。随着时间的推移,这种转变有望透过降低亚太地区对欧洲特种界面活性剂的进口依赖,重新平衡全球贸易格局。

欧盟和美国正在收紧对可生物降解表面活性剂的监管

欧盟更新的清洁剂法规引入了数位产品护照、严格的生物降解性指标和磷含量上限,降低了化石基界面活性剂的再製造成本。同时,美国环保署扩大了《有毒物质管制法》的註册范围,将所有Locus Ingents Amphi生物界面活性剂产品纳入其中。这些政策倡议建构了一条跨大西洋的合规通道,使生物表面活性剂在该领域拥有天然优势。符合新标准的公司可以更快地获得产品认证,并在主要零售商处占据货架空间,这些零售商越来越重视永续性评分,而不仅仅是价格和性能。因此,监管的确定性直接转化为生物表面活性剂市场渗透率的提高。

食品级和医药级材料均有严格的纯度标准。

食品和製药终端用户对内毒素含量和批次间一致性要求极高,因此需要多道下游精製工序。每道工序都会产生资本支出和产量比率损失,进而推高产品成本。监管机构要求在核准新的生物界面活性剂活性剂辅料之前提供安全性文件和致敏性研究,这延缓了商业性进程。小型公司往往缺乏资金进行此类研究,因此只有资金雄厚的成熟公司才能涉足这个高端市场。由此导致市场分化:大宗商品需求稳定成长,而超高纯度细分市场则受到进入障碍的保护。

细分市场分析

到2024年,醣脂将占据生物界面活性剂市场69.28%的份额,巩固了其在销售和以收益为准方面的结构性优势。到2030年,醣脂的复合年增长率也将达到5.90%,成为成长最快的类别,这显示规模经济效应正持续围绕单一分子类别发展。在赢创位于斯洛伐克的工厂实现商业化的鼠李醣脂表明,优化的假单胞菌发酵过程能够维持产品产量并降低转化成本。槐醣脂是前沿的醣脂,吸引了Holiferm等新参与企业,该公司计划于2025年投产一条中试运作线。如今,竞争差异化正转向涵盖菌株工程和整合纯化等广泛的智慧财产权。

脂肽类化合物,例如界面活性素,在农业生物防治领域正日益占有一席之地,其抗菌活性使其兼具界面活性剂和活性成分的双重功能。磷脂类化合物虽然分子较小,但在创伤治疗膏和输液製剂中却能带来高净利率,并且由于其与人体细胞的相容性,价格也相对较高。聚合物生物界面活性剂和地衣素在工业脱脂和高温油脂萃取领域占据独特的技术优势,这些领域对耐热性要求较高。随着生物界面活性剂市场规模的不断扩大,产品组合的不断丰富表明,产品多样性能够支撑多种价格体系,使供应商能够平衡大宗商品和特种产品的利润。

生物界面活性剂报告按产品类型(醣脂、磷脂质、界面活性剂、地衣素、其他)、原料(植物油、工业废甘油、农业残渣、其他)、应用(清洁剂和工业清洁剂、化妆品、食品加工、油田化学品、其他)和地区(亚太地区、北美、欧洲、南美、中东和非洲)进行细分。

区域分析

2024年,欧洲将占全球销售额的52.15%,这得益于其完善的生物技术基础设施和鼓励使用植物来源原料的严格环保政策。更新后的清洁剂指令透过强制提高生物降解性标准,进一步刺激了市场需求,从而扩大了欧洲生产商的产能。例如,赢创的工业鼠李醣脂工厂和BASF获得RSPO认证的界面活性剂生产线等设施,体现了欧洲各国为维持其行业领先地位而投入的巨额资金。

预计亚太地区将成为主要需求中心,到2030年将以6.14%的复合年增长率成长。中国正大力投资精准发酵和工业园区基础设施,以提升国内生物界面活性剂的大规模生产能力。在印度,不断壮大的中产阶级推动了个人护理支出,而毗邻植物油人工林则确保了原材料物流的高效性。日本配方师正在寻求化妆品的高纯度醣脂,并利用日本先进的监管体系来获取溢价。

北美拥有庞大的用户群体,受益于有利的政策讯号,例如美国环保署的核准和联邦政府的生物经济津贴。由于该地区製造业和能源产业规模庞大,工业清洁产品和油田化学品仍是最强劲的推动要素。南美洲拥有丰富的原料和具竞争力的生产成本,但由于发酵基础设施有限,产量较低。中东和非洲正在开发利基市场。海湾地区的石油公司正在进行使用鼠李醣脂进行油藏增产的初步试验,而非洲的消费品公司正在测试面向城市市场的植物性清洁剂。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 亚太地区对个人护理和化妆品的需求不断增长

- 欧盟和美国正在收紧对可生物降解表面活性剂的监管

- 快速消费品巨头的品牌层面永续性承诺

- 透过扩大发酵规模来降低成本曲线

- 生物界面活性剂活性剂产品碳抵消额度

- 市场限制

- 石油基界面活性剂生产成本高昂

- 食品级和医药级材料均有严格的纯度标准。

- 生产菌株专利的复杂性

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依产品类型

- 醣脂

- 磷脂

- 表面活性素

- 地衣

- 聚合物生物界面活性剂

- 其他产品类型

- 按原料

- 植物油(大豆油、棕榈油、芥花油)

- 工业废弃物甘油

- 农业残渣(糖蜜、乳清)

- 其他(动物脂肪和油脂、合成糖)

- 透过使用

- 清洁剂和工业清洁剂

- 化妆品(个人护理)

- 食品加工

- 油田化学品

- 农业化学品

- 纺织品

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲国家

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- AGAE Technologies, LLC

- AmphiStar Biosurfactants

- BASF

- Biotensidon GmbH

- Croda International Plc

- Dispersa Inc.

- Ecover

- Evonik Industries AG

- Givaudan

- GlycoSurf

- Jeneil Biotech

- Kaneka Corporation

- Saraya.Co.Ltd

- Stepan Company

- Syensqo

- TeeGene Biotech

- TensioGreen

- WHEATOLEO

第七章 市场机会与未来展望

The Biosurfactants Market size is estimated at USD 2.84 billion in 2025, and is expected to reach USD 3.70 billion by 2030, at a CAGR of 5.47% during the forecast period (2025-2030).

Robust policy mandates for biodegradable ingredients, steady breakthroughs in large-scale fermentation, and rising demand from personal care and oilfield chemicals applications collectively anchor this trajectory. Production economics have begun tilting toward microbial synthesis as producers integrate low-cost waste substrates, while fast-growing Asia-Pacific supply hubs reshape global trade flows. Competitive strategies now revolve around controlling both upstream feedstock and downstream purification, a shift that favors companies with vertically integrated operations.

Global Biosurfactants Market Trends and Insights

Expansion of Personal-Care and Cosmetics Demand in APAC

Regional income growth and a consumer pivot toward "clean label" ingredients have intensified demand for mild surfactants that are naturally derived. Glycolipid molecules meet this need through excellent dermatological compatibility, giving formulators a clear alternative to synthetic ethoxylates. BASF responded by unveiling Dehyton PK45 GA/RA, a Rainforest Alliance-certified coconut-oil surfactant that targets gentle skin-care products. Local manufacturers leverage proximity to palm kernel and coconut supply chains to further compress costs and shorten delivery cycles. This combination of rising consumer expectations and structural supply advantages accelerates the biosurfactants market toward mainstream personal-care adoption. Over time the shift is expected to rebalance global trade patterns by lowering Asia-Pacific's import dependence on European specialty surfactants.

Regulatory Push for Biodegradable Surfactants in EU and US

The European Union's updated detergent regulation introduces digital product passports, stringent biodegradability metrics, and phosphorus ceilings, measures that make fossil-based surfactants costlier to reformulate. In parallel, the U.S. Environmental Protection Agency expanded Toxic Substances Control Act registration to cover Locus Ingredients' full Amphi biosurfactant line, sending a clear acceptance signal for microbial surfactants across industrial uses. These synchronized policy moves create a trans-Atlantic compliance corridor in which biosurfactants hold an intrinsic advantage. Companies meeting the new criteria secure faster product approvals, protecting shelf space at major retailers that now rank sustainability scores alongside price and performance. Regulatory certainty, therefore, translates directly into rising biosurfactants market penetration.

Tight Purity Specs for Food and Pharma-Grade Material

Food and pharmaceutical end uses require low endotoxin levels and batch-to-batch consistency, which demand multistep downstream polishing. Each step adds capital expense and yield losses, inflating cost of goods. Regulatory bodies insist on safety dossiers and allergen studies before approving new biosurfactant excipients, slowing commercial timelines. Small firms often lack resources to fund these studies, allowing only well-capitalized incumbents to pursue these premium segments. The result is a bifurcated market in which bulk commodity demand grows steadily but ultra-high-purity niches remain protected by entry barriers.

Other drivers and restraints analyzed in the detailed report include:

- Brand-Level Sustainability Commitments by FMCG Majors

- Fermentation Scale-Up Lowering Cost Curves

- Patent Thickets Around Production Strains

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Glycolipids captured 69.28% of the biosurfactants market share in 2024, confirming their structural dominance in both volume and revenue terms. They also deliver the fastest 5.90% CAGR to 2030, underscoring how economies of scale continue to build around a single molecular class. Rhamnolipid commercialization at Evonik's Slovak plant shows that optimized Pseudomonas fermentation can sustain commodity output and drive down conversion costs. Sophorolipids represent the most advanced glycolipid variant and attract new entrants like Holiferm that commission pilot lines in 2025. Competitive differentiation now shifts toward intellectual-property breadth, covering strain engineering and integrated purification.

Lipopeptides such as surfactin gain share in agricultural biocontrol, where antimicrobial action offers dual utility as a surfactant and active ingredient. Phospholipids remain small but deliver outsized margins in wound-healing creams and intravenous formulations where their human-cell compatibility commands premium pricing. Polymeric biosurfactants and lichenysin occupy technical niches, industrial degreasing and high-temperature oil extraction, requiring thermal resilience. The evolving portfolio demonstrates that as the biosurfactants market size broadens, product diversity supports multiple price ladders, enabling suppliers to balance commodity volumes with specialty profits.

The Biosurfactants Report is Segmented by Product Type (Glycolipids, Phospholipids, Surfactin, Lichenysin, and More), Feedstock (Vegetable Oils, Industrial Waste Glycerol, Agricultural Residues, Others), Application (Detergents and Industrial Cleaners, Cosmetics, Food Processing, Oilfield Chemicals, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Europe anchored 52.15% of 2024 revenue through entrenched biotechnology infrastructure and stringent environmental policy that favors plant-based inputs. Updated detergent directives strengthen demand by mandating higher biodegradability thresholds, thereby expanding addressable volumes for European producers. Facilities such as Evonik's industrial rhamnolipid plant and BASF's RSPO-certified surfactant lines reflect capital commitment to maintaining home-region leadership.

Asia-Pacific is forecast to grow at 6.14% CAGR to 2030, turning into the primary demand center. China directs considerable state investment toward precision fermentation and industrial bio-park infrastructure, creating domestic capacity for large-volume biosurfactant output. India's expanding middle class drives personal-care spending, while proximity to vegetable-oil plantations keeps raw-material logistics efficient. Japanese formulators seek high-purity glycolipids for cosmeceuticals, leveraging the country's advanced regulatory system to command price premiums.

North America maintains a sizable base that benefits from favorable policy signals, including EPA approvals and federal bio-economy grants. Given the region's large manufacturing and energy sectors, industrial cleaning and oilfield chemicals remain the strongest pull factors. South America's feedstock abundance offers competitive manufacturing costs, but limited fermentation infrastructure keeps output small. Middle East and Africa develop niche opportunities; Gulf oil producers run pilot trials using rhamnolipids for reservoir stimulation, while African consumer goods companies test plant-based cleaners for urban markets.

- AGAE Technologies, LLC

- AmphiStar Biosurfactants

- BASF

- Biotensidon GmbH

- Croda International Plc

- Dispersa Inc.

- Ecover

- Evonik Industries AG

- Givaudan

- GlycoSurf

- Jeneil Biotech

- Kaneka Corporation

- Saraya.Co.Ltd

- Stepan Company

- Syensqo

- TeeGene Biotech

- TensioGreen

- WHEATOLEO

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of Personal-Care and Cosmetics Demand In APAC

- 4.2.2 Regulatory Push for Biodegradable Surfactants in EU and US

- 4.2.3 Brand-Level Sustainability Commitments by FMCG Majors

- 4.2.4 Fermentation Scale-Up Lowering Cost Curves

- 4.2.5 Carbon-Offset Credits for Biosurfactant-Based SKUs

- 4.3 Market Restraints

- 4.3.1 High Production Cost Vs Petro-Surfactants

- 4.3.2 Tight Purity Specs for Food and Pharma-Grade Material

- 4.3.3 Patent Thickets around Production Strains

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Glycolipids

- 5.1.2 Phospholipids

- 5.1.3 Surfactin

- 5.1.4 Lichenysin

- 5.1.5 Polymeric Bio-surfactants

- 5.1.6 Other Product Types

- 5.2 By Feedstock

- 5.2.1 Vegetable Oils (soy, palm, rapeseed)

- 5.2.2 Industrial Waste Glycerol

- 5.2.3 Agricultural Residues (molasses, whey)

- 5.2.4 Others (Animal Fat, Synthesised Sugars)

- 5.3 By Application

- 5.3.1 Detergents and Industrial Cleaners

- 5.3.2 Cosmetics (Personal Care)

- 5.3.3 Food Processing

- 5.3.4 Oilfield Chemicals

- 5.3.5 Agricultural Chemicals

- 5.3.6 Textiles

- 5.3.7 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 AGAE Technologies, LLC

- 6.4.2 AmphiStar Biosurfactants

- 6.4.3 BASF

- 6.4.4 Biotensidon GmbH

- 6.4.5 Croda International Plc

- 6.4.6 Dispersa Inc.

- 6.4.7 Ecover

- 6.4.8 Evonik Industries AG

- 6.4.9 Givaudan

- 6.4.10 GlycoSurf

- 6.4.11 Jeneil Biotech

- 6.4.12 Kaneka Corporation

- 6.4.13 Saraya.Co.Ltd

- 6.4.14 Stepan Company

- 6.4.15 Syensqo

- 6.4.16 TeeGene Biotech

- 6.4.17 TensioGreen

- 6.4.18 WHEATOLEO

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

![鼠李醣脂的全球市场评估,类别[单鼠李醣脂,双鼠李醣脂],各用途[界面活性剂,润滑剂,农业,食品产业,其他],各地区,机会,预测,2018年~2032年](/sample/img/cover/42/default_cover_mx.png)