|

市场调查报告书

商品编码

1639415

美国的 Li-Fi:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)USA Li-Fi - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

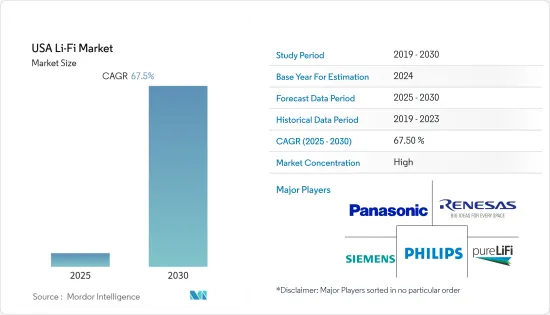

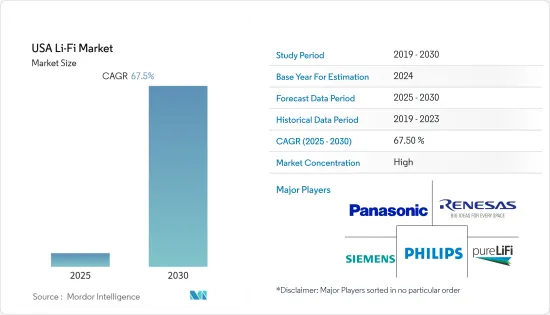

预计预测期内美国Li-Fi 市场复合年增长率将达到 67.5%。

对高速网路的需求不断增长以及对节能解决方案的需求不断增长是推动美国采用 Li-Fi 技术的关键因素。

主要亮点

- 在美国,智慧连网型设备的激增正在产生大量资料,将现有的Wi-Fi、4G和其他网路技术推向极限。因此,Li-Fi 技术可以透过提供更快的连接、额外的频宽和更高的安全性来帮助克服这些问题,从而为市场在整个预测期内的成长提供足够的槓桿。

- 在美国,随着更多创新和高效的解决方案的出现,Li-Fi 市场预计将呈指数级增长,主要在中小型住宅中。 Li-Fi可以安装在任何住宅、商业建筑、飞机、道路等。它在未来有广泛的应用和巨大的潜力。 Li-Fi 可与现有的 LED 灯泡一起使用,无需任何额外设定。它们还可以安装在路灯上,为每个沿街行走的人提供网路。此外,Li-Fi 可以取代 Wi-Fi 路由器透过 LED 灯泡和灯管安装住宅中,以更少的能耗安全地提供高速资料,从而促进整个预测期内市场的成长和扩张。的成长机会:

- 此外,Li-Fi 在海洋和海底应用方面的用途也日益多样化。例如,美国目前使用缓慢、过时的水下通讯系统。因此,美国正在开发一系列使用 Li-Fi 的先进通讯技术来应对海底通讯的挑战。此外,对于在石化工厂和飞机上使用,Li-Fi 发射被视为一种很好的解决方案,因为 Wi-Fi 往往会干扰机载电子设备。

- 然而,墙壁和门等物理障碍限制了 Li-Fi LED 灯的操作范围。因此,Li-Fi 产品传输的资料仍然局限于封闭空间内,因为光线无法穿透不透明物体且覆盖范围有限,从而限制了整体市场的成长率。

- 新冠肺炎疫情严重影响了各行各业组织的正常业务。然而,随着全球新冠肺炎病例激增,医院和医疗机构在治疗患者方面面临重大挑战。然而,在后疫情时代的市场情况下,市场见证了巨大的成长机会,这主要是由于该地区对专业网路技术的需求不断增长。

美国Li-Fi 市场趋势

LED 领域可望大幅成长

- 智慧建筑可以确定每个居住者的位置,并提供定位服务,如物流、智慧停车、健康监测和居住者,以改善居住者舒适度和使用者体验。除了协助室内购物外,定位服务在降低建筑物能源成本方面也发挥着重要作用。 Li-Fi技术的主要想法是利用LED灯泡发出的可见光将高速资料传输到连接到智慧型手机或平板电脑的光检测器。

- 建筑物中越来越多地使用LED灯进行照明也为基于 Li-Fi 的应用提供了重大机会。 Li-Fi的主要功能是将高速无线资料通讯与室内照明基础设施相结合,这对于智慧建筑来说非常具有成本效益。只要靠近附近的LED灯,智慧建筑的居住者就可以轻鬆存取网路服务,而无需产生额外的硬体成本(例如Wi-Fi路由器和电缆)。当居住者走过智慧建筑时,室内的LED照明为他们提供免费的无线网路连线服务。

- 由于其高照度、长寿命和低功耗,LED 正在成为美国各地 Li-Fi 系统的关键组成部分。美国政府大力推广智慧LED灯泡,预计将为可见光通讯(VLC)系统供应商提供大规模的基础设施基础。

- 此外,LED照明的成长和寿命的延长正在为照明产业带来新的商业原型。在Li-Fi技术中,LED灯泡发出的可见光作为资料的载体,可以到达任何被LED灯泡照亮的装置。 LED 灯泡的闪烁会为接收设备产生讯号,然后接收设备会传输资料。这种无线光纤网路连结技术有可能以每秒 224GB 的速度传输资料,大约比 Wi-Fi 快 100 倍。

- 根据美国能源局预测,2020年至2035年间,LED照明将在美国越来越受欢迎。至2025年,LED照明将占住宅照明的73%,并将成为各领域最常见的光源。预计这将为市场在整个预测期内的成长和加强创造巨大的成长机会,从而为市场提供巨大的推动力。

美国互联网使用量的增加和室内定位服务的使用日益增多预计将推动市场成长

- Li-Fi 在海洋和海底应用方面也有广泛的用途。例如,美国目前使用的水下通讯系统速度慢且过时,且较不适合水下较差的声学环境。因此,美国正在开发利用 Li-Fi 的先进通讯技术来解决海底通讯问题。此外,对于在石化工厂和飞机上使用,Li-Fi 发射被视为更好的解决方案,因为 Wi-Fi 往往会干扰机载电子设备。

- 美国政府对 Li-Fi 未来用途的设想不仅限于水下、飞机和化工厂;它可以用于更大的用途。目前,随着无线电频谱开始填满,美国联邦通讯委员会正在警告无线通讯将出现拥塞。

- 此外,该地区的零售店和饭店也越来越多地采用嵌入照明设备的室内定位服务,预计这将成为推动该地区市场成长的关键因素之一。包括 GE Lighting 和 ByteLight Inc. 在内的一系列公司已经在超级市场部署了 VLC,让零售商能够追踪顾客的位置并管理他们的购物历史。

- 随着网路连线成为本世纪的必需品以及人们追求无忧的高速互联网,预计在整个预测期内美国Li-Fi 的采用将稳步增长。无线感测器网路、物联网(IoT)、巨量资料和智慧型手机等资讯技术的快速发展为该地区智慧建筑的发展做出了巨大贡献。由于多项技术的进步,该地区智慧家庭的采用预计将进一步增加,从而为该地区的 Li-Fi 提供许多机会。

- 根据 We Are Social 的数据,截至 2023 年,美国约有 92% 的人可以上网,高于 2012 年的约 87%。美国是世界上最大的线上市场之一,预计到 2022 年美国网路使用者数量将达到约 2.99 亿。随着美国网路用户数量的大幅增加,该地区对 Li-Fi 系统的需求将大幅增加,从而推动市场呈指数级增长。

美国Li-Fi 产业概况

虽然供应商名单不在范围内,但该行业的一些主要参与者包括Panasonic、飞利浦、瑞萨、西门子、pureLifi 等。这些公司的总部并不设在美国,但在美国设有多个办事处。主要企业正透过各种策略併购、技术创新和加强研发投入来增加市场扩张力度。

- 2023 年 10 月-光照上网技术(LiFi) 技术先驱 Nav Wireless Technologies 推出了 Nav Ocular,这是一款利用光在家庭中实现无缝互联网连接的突破性设备。

- 2023 年 5 月-pureLiFi 宣布与 Fairbanks Morse Defense 达成协议,部署安全的 LiFi 技术。与 FMD 的合作标誌着 LiFi 技术向纯 LiFi 大规模陆地部署以外的扩展迈出了重要一步。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 对专业互联网技术的需求庞大

- 低能耗

- 更快、更安全的资料传输

- 高频宽

- 应用范围广泛

- 市场限制

- 通讯距离限制

- 无法完全取代Wi-Fi

- 网路普及率分散

- 传输容易中断

- 市场机会

- 智慧家庭与城市

- 需要高速网路的办公室

- 铁路和航空公司

第六章 市场细分

- 按城市

- 纽约

- 洛杉矶

- 芝加哥

- 休士顿

- 费城

- 华盛顿

- 其他城市

- 按估计使用量

- 房子

- 公司办公室

- 铁路和航空公司

- 航空

- 零售店/超级市场/大卖场

- 饭店

- 其他的

- 按类型

- LED

- 光电二极体

- 微控制器

- 其他类型

第七章投资分析

第八章 最新趋势与发展

第九章:市场的未来

The USA Li-Fi Market is expected to register a CAGR of 67.5% during the forecast period.

The growing demand for high-speed networks and increasing demand for energy-efficient solutions are some of the major factors driving the adoption of Li-Fi technology in the United States.

Key Highlights

- The growing number of smart devices and connected devices in the United States resulted in the generation of a massive amount of data, which is pushing the existing Wi-Fi, 4G, and other networking technologies to their limit. Therefore, Li-Fi technology can help overcome these issues by providing high-speed connectivity, additional bandwidth, and higher security benefits, thereby creating ample scope for growth for the market to grow throughout the forecast period.

- In the United States, the Li-Fi market is expected to grow exponentially, primarily in small to medium-sized homes, making it more innovative and efficient. Li-Fi can be installed in any house, commercial building, aircraft, street, and others. It has vast usage in the future and holds immense potential. Without any new arrangement, Li-Fi can be used from existing LED bulbs in houses. It can be installed in streetlights as well and can provide internet to each person walking on the streets. Moreover, instead of a Wi-Fi router, customers can install Li-Fi in their houses through LED bulbs and tubes, which saves energy and provides high-speed data with security, creating ample growth opportunities for the market to grow and expand throughout the forecast period.

- Additionally, the utilization of Li-Fi in marine and subsea applications is also manifold. For instance, the US Navy presently uses a slow and antiquated system for underwater communication that could be better with the poor acoustics that lie underwater. As a result, the US Navy is developing various advanced communication technologies using Li-Fi to counter the problem of subsea communication. Further, for use in petrochemical plants or on airplanes, Li-Fi emissions are considered to be a great solution since Wi-Fi tends to interfere with onboard electronics.

- However, physical barriers, such as walls and doors, limit the operational scope of Li-Fi-enabled LED light. Thus, the data transmitted by a Li-Fi product remains confined within a closed space because light cannot penetrate opaque objects and has a shorter range, limiting the market's overall growth rate.

- The COVID-19 pandemic severely impacted a broad spectrum of organizations' regular business operations across a range of industries. Hospitals and medical facilities, however, confronted a significant problem in treating patients because of the large surge in COVID-19 cases globally. However, during the post-COVID-19 market scenario, the market witnessed significant growth opportunities, primarily due to the rising demand for specialized internet technologies within the region.

US Li-Fi Market Trends

LED Segment is Expected to Register a Significant Growth Rate

- Smart buildings have begun adapting to accommodate their residents to improve the resident's comfort and user experience by knowing the locations of each occupant and then providing location-based services, such as logistics, intelligent car parking, health monitoring, and shopping assistance. In addition to indoor shopping assistance, location-based services are also playing a crucial role in the reduction of building energy costs. The primary idea of Li-Fi technology is to utilize the visible light from an LED light bulb to transmit high-speed data to a photodetector, which is connected to a smartphone or tablet.

- The rising growth in the usage of LED lamps in buildings for lighting also provides enormous opportunities for Li-Fi-based applications. As Li-Fi primarily combines the functions of high-speed wireless data communication and indoor lighting infrastructure, it is very cost-effective to be utilized in smart buildings. As long as they are in close proximity to a nearby LED lamp, smart building residents can easily get access to internet service without extra hardware costs (such as a Wi-Fi router or cables). When smart building residents walk inside a smart building, the indoor LED lighting will offer free wireless internet connection service.

- High illumination, long life, and low power consumption have led to the implementation of LED as a primary component in Li-Fi systems across the United States. The government's promotions for smart LED bulbs in the United States are expected to provide a massive infrastructure base for Visible Light Communication (VLC) system providers.

- Moreover, the growth and increase in the lifetime of LED lighting have led to the formation of new commercial prototypes in the lighting industry. In Li-Fi technology, visible light coming from LED bulbs acts as a carrier for data and can reach any devices that are illuminated by it. The flickering of the LED bulb creates a signal for the receiver device, thereby transmitting data. This wireless optical networking technology has the potential to transmit data up to a speed of 224 GB per second and is about 100 times faster than Wi-Fi.

- As per the US Department of Energy, LED lights are forecast to be gaining popularity at a drastic rate between 2020 and 2035 in the United States. By 2025, LED lights should be installed in 73% of residential lighting and become the most common light source in all sectors. This will create enormous growth opportunities for the market to grow and enhance throughout the forecast period, which in turn will drive the market significantly.

Rise in the internet usage and increasing applications of indoor location-based services in the United States is Expected to Drive the Market Growth

- The utilization of Li-Fi in marine and subsea applications is also manifold. For instance, the US Navy presently uses a slow and antiquated system for underwater communication that does not quite jibe well with the poor acoustics that lie underwater. As a result, the US Navy is developing advanced communication technology using Li-Fi to counter the problem of subsea communication. Further, for use in petrochemical plants or on airplanes, Li-Fi emissions are considered to be a great solution since Wi-Fi tends to interfere with onboard electronics.

- The future applications that the US government has in mind for Li-Fi could serve a much bigger purpose than just for underwater, airplane, and chemical plant usage. Presently, the Federal Communications Commission has explained cautions of crowding in wireless communications since the radio frequency spectrum is beginning to get full.

- Also, the increasing applications of indoor location-based services embedded with light fixtures in retail shops and hotels in the region are anticipated to be one of the vital factors driving the growth of the market in the region. Various companies, such as GE Lightings and ByteLight Inc., have been deploying VLC installations in supermarkets, which, in turn, is helping retailers to tie customers' shopping history by tracking their location details.

- As Internet connectivity is becoming a necessity in this century and people are looking for hassle-free, fast internet, the spread of Li-Fi in the United States is expected to grow steadily throughout the forecast period. The rapid advancements in information technology, such as wireless sensor networks, the Internet of Things (IoT), Big Data, and smartphones, have significantly resulted in the development of smart buildings in the region. The penetration of smart homes in the region is further expected to rise owing to the advancement in multiple technologies, thereby offering several opportunities for Li-Fi in the region.

- As per We Are Social, as of 2023, approximately 92 % of individuals in the United States accessed the internet, up from nearly 87% in 2012. The United States was one of the largest online markets worldwide, and in 2022, with an overall count of around 299 million internet users in the United States. With this significant rise in the overall count of internet users in the United States, the demand for Li-Fi systems will rise considerably within the region, driving the market exponentially.

US Li-Fi Industry Overview

The vendor list is not provided as a part of the scope, but some of the major players operating in the industry include Panasonic, Philips, Renesas, Siemens, pureLifi, etc. These players do not have their headquarters in the United States but are well-positioned with multiple offices in the United States. The major players are increasingly seeking market expansion through various strategic mergers and acquisitions, innovation, and increasing investments in research and development.

- October 2023 - Nav Wireless Technologies, a pioneering force in Light Fidelity (LiFi) technology, launched 'Nav Ocular,' a groundbreaking device that leverages light to provide seamless internet connectivity within the comfort of the home.

- May 2023 - pureLiFi announced an agreement With Fairbanks Morse Defense to deploy secure LiFi technology. The collaboration with FMD represents a significant step towards expanding LiFi technology beyond pureLiFi's large-scale land-based deployments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Huge Demand for Specialized Internet Technologies

- 5.1.2 Low Energy Consumption

- 5.1.3 Faster and Safe Data Transfer

- 5.1.4 High Bandwidth

- 5.1.5 Vast Applications

- 5.2 Market Restraints

- 5.2.1 Limited Range

- 5.2.2 Cannot Substitute Wi-Fi Completely

- 5.2.3 Scattered Internet Penetration

- 5.2.4 Transmission can be Easily Disrupted

- 5.3 Market Opportunities

- 5.3.1 Smart Homes and Smart Cities

- 5.3.2 Offices Requiring High Speed Internet

- 5.3.3 Railways and Airlines

6 MARKET SEGMENTATION

- 6.1 Cities

- 6.1.1 New York

- 6.1.2 Los Angeles

- 6.1.3 Chicago

- 6.1.4 Houston

- 6.1.5 Philadelphia

- 6.1.6 Washington

- 6.1.7 Other Cities

- 6.2 Estimated Usage

- 6.2.1 House

- 6.2.2 Corporate Office

- 6.2.3 Railways and Airlines

- 6.2.4 Airways

- 6.2.5 Retail Stores/Supermarkets/Hypermarkets

- 6.2.6 Hotels

- 6.2.7 Others

- 6.3 Types

- 6.3.1 LED

- 6.3.2 Photodiodes

- 6.3.3 Microcontrollers

- 6.3.4 Other Types