|

市场调查报告书

商品编码

1639435

印度智慧电网网路 -市场占有率分析、产业趋势与统计、成长预测(2025-2030)India Smart Grid Network - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

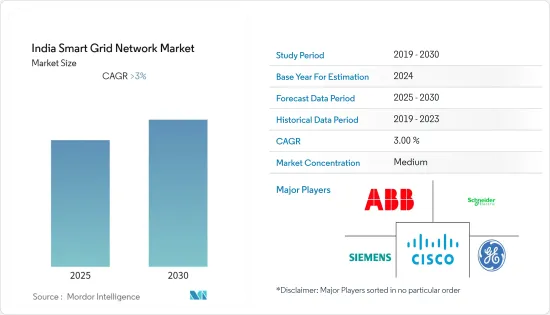

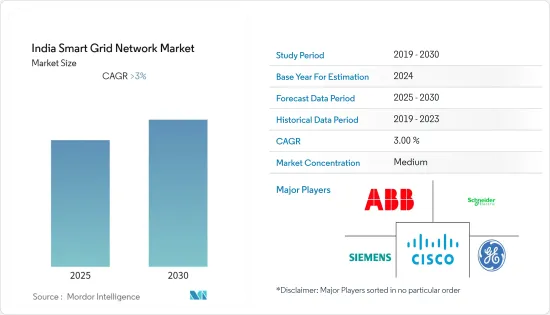

印度智慧电网市场预计在预测期内复合年增长率将超过 3%。

由于供应链中断,印度智慧电网市场受到了 COVID-19 的负面影响。然而,市场在2021年开始復苏。

主要亮点

- 就市场成长而言,智慧电錶、电动车充电器等智慧电网技术和其他智慧电网基础设施技术预计将在未来几年推动市场发展。这是因为越来越多的资金被投入到这类智慧电网技术中。此外,印度正在转向更多的可再生能源,智慧电网将在将其纳入电网方面发挥关键作用。

- 然而,建造和现代化发电、输电和配电网路需要巨额投资,而私营部门投资疲软可能会使印度智慧电网市场在预测期内保持低迷。

- 印度开始将智慧电网技术视为基础设施的战略投资,有助于维持长期经济成长并实现排放减排目标。因此,进入智慧电网市场的公司预计在不久的将来将有很多收益收入的机会。

印度智慧电网市场趋势

先进计量基础设施 (AMI) 预计将显着成长

- 进阶计量基础设施 (AMI) 或智慧计量是智慧电錶、通讯网路和资料管理系统的整合系统,可实现公用事业公司和客户之间的双向通讯。

- 近年来,计量产业取得了快速发展,从自动抄表(AMR)过渡到双向通讯的智慧电錶,为配电公司(DISCOM)、客户和社会带来了更大的利益。

- 印度政府正在推广先进的计量基础设施,以减少与记录仪表读数相关的电力浪费和人事费用。为了普及智慧电錶,政府启动了国家智慧电錶计画。

- 中央邦将于 2022 年 2 月获得德国復兴信贷银行提供的 1.575 亿美元资金,透过引入智慧电錶和智慧电网技术来扩展和升级其电网。

- 因此,随着电网现代化和减少输配电损失的加强力,印度政府正在投资先进的计量基础设施。预计这将在预测期内推动 AMI 市场。

加大投资拉市场需求

- 由于电力需求的不断增长以及利用可再生能源来节约和高效利用能源,智慧电网技术已成为满足日益增长的电力需求的关键要素。

- 透过政府主导的各种以「人人有电」为重点的计划,该国在改善农村和都市区社区智慧用电方面取得了重大进展。

- 为了进一步实现电网现代化和优化的目标,印度政府在「智慧城市使命」下为 2021-22 财年拨款 7.83 亿美元。智慧型能源系统和电网具有管理城市建筑能源供应的能力,正在推动智慧电网技术在全国各地的部署。

- 此外,2022 年 10 月,能源效率服务有限公司 (EESL) 宣布,根据政府的国家智慧电錶计划,已在印度完成 3,000 万个智慧电錶的安装。该公司还计划在 2023 年 12 月安装总合超过 47,000 个智慧电錶。

- 印度政府增加投资、私人公司实施绿色倡议以及智慧电网技术的持续采用可能会推动印度智慧电网市场的发展。

印度智慧电网网路产业概况

印度智慧电网市场适度细分。该市场的主要企业包括(排名不分先后)ABB Ltd、Seimens AG、施耐德电气 SE、通用电气公司和思科系统公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:百万美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- PESTLE分析

第五章依技术领域细分市场

- 传播

- 进阶测量基础设施 (AMI)

- 通讯技术

- 其他技术应用领域

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- ABB Ltd

- Accenture PLC

- Capgemini SE

- Cisco Systems Inc.

- General Electric Company

- HCL Technologies Ltd.

- Honeywell International Inc.

- Power Grid Corporation of India Limited

- Schneider Electric SE

- Siemens AG

第七章 市场机会及未来趋势

简介目录

Product Code: 49715

The India Smart Grid Network Market is expected to register a CAGR of greater than 3% during the forecast period.

The Indian smart grid network market was adversely affected by COVID-19 due to disruptions in the supply chain. However, the market rebounded in 2021.

Key Highlights

- In terms of market growth, smart grid technologies like smart meters, EV chargers, and other smart grid infrastructure technologies are expected to drive the market in the coming years. This is because more money is being spent on and put into smart grid technologies like these. Moreover, in India, the trend to add more renewable energy sources and smart grids will play an important role in integrating these into transmission and distribution grids.

- However, the huge investment that is required for setting up and modernizing power generation, transmission, and distribution networks and weak private sector investments may restrain the smart grid network market in India during the forecast period.

- India is starting to see smart grid technology as a strategic investment in its infrastructure that will help it maintain long-term economic growth and reach its goals for reducing carbon emissions. This, in turn, is expected to give companies in the smart grid network market a lot of chances to make money in the near future.

India Smart Grid Network Market Trends

Advanced Metering Infrastructure (AMI) is Expected to Witness Significant Growth

- Advanced metering infrastructure (AMI), or smart metering, is an integrated system of smart meters, communication networks, and data management systems that enable two-way communication between utilities and customers.

- The metering industry has taken rapid strides in the past few years by transitioning from automated meter reading (AMR) to smart metering using bi-directional communication, thereby enabling greater benefits to electricity distribution companies (DISCOMs), customers, and society.

- The Indian government is pushing for advanced metering infrastructure to reduce electricity waste and the labor costs associated with recording meter values. To promote smart meters, the government has started the "Smart Meter National Programme," which is expected to be the umbrella program for expanding smart meters in every electrified household in the country.

- With the USD 157.5 million it got from the German bank KfW, Madhya Pradesh was going to expand and update its electricity network in February 2022 by putting in place smart meters and smart grid technologies.

- Therefore, in light of the increasing efforts to modernize the electricity grid and reduce T&D losses, the Indian government is investing in advanced metering infrastructure. This is expected to drive the AMI market during the forecast period.

Increasing Investments are Driving the Market Demand

- Smart grid technologies are a key part of meeting the growing power needs because of the growing need for electricity and the use of renewable energy to save energy and use it more efficiently.

- The country has made major strides in improving smart access to power among rural and urban communities through various government-led schemes focused on "Power for All."

- To further meet the goal of modernization and optimization of the electricity grid, the Indian government, under the Smart City Mission, allocated USD 783 million for the financial year 2021-22. Smart energy systems and grids have the capability to manage the energy supply of buildings in cities, which boosts the deployment of smart grid technologies across the country.

- Furthermore, in October 2022, state-owned Energy Efficiency Services Ltd. (EESL) announced the completion of the installation of 30 lakh smart meters across India under the government's Smart Meter National Programme. The company further aims to install a total of over 47,000 smart meters by December 2023.

- The increased investments by the Indian government, private players implementing initiatives pertaining to environmental protection, and growth in the adoption of smart grid technologies are likely to boost the smart grid network market in India.

India Smart Grid Network Industry Overview

The Indian smart grid network market is moderately fragmented. Some key players in this market (not in particular order) are ABB Ltd, Seimens AG, Schneider Electric SE, General Electric Company, and Cisco Systems Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION BY TECHNOLOGY AREA

- 5.1 Transmission

- 5.2 Advanced Metering Infrastructure (AMI)

- 5.3 Communication Technology

- 5.4 Other Technology Application Areas

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ABB Ltd

- 6.3.2 Accenture PLC

- 6.3.3 Capgemini SE

- 6.3.4 Cisco Systems Inc.

- 6.3.5 General Electric Company

- 6.3.6 HCL Technologies Ltd.

- 6.3.7 Honeywell International Inc.

- 6.3.8 Power Grid Corporation of India Limited

- 6.3.9 Schneider Electric SE

- 6.3.10 Siemens AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219