|

市场调查报告书

商品编码

1639461

德国玻璃包装:市场占有率分析、产业趋势、成长预测(2025-2030)Germany Glass Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

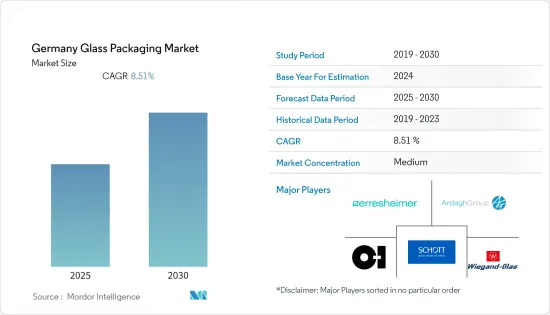

德国玻璃包装市场预计在预测期内复合年增长率为8.51%

主要亮点

- 玻璃製造商在德国的再利用和回收系统中发挥重要作用。例如,格雷斯海默 (Gerresheimer) 已开始在其位于德国的 Tetau 工厂生产玻璃,其中回收玻璃的比例增加。透过使用回收玻璃,我们的目标是创造新的高品质化妆品包装。与格雷斯海默一样,许多主要企业每天都在推动循环经济和资源节约。

- 透过严格的法律来提高国产药品的品质和完整性,是增加玻璃在药品包装产品中使用的动力。製药业对无菌医疗包装产品也有需求,预计这将在预测期内推动市场成长。以玻璃介质包装的药品数量不断增加也推动了对管瓶和安瓿的需求。

- 此外,在德国,所有销售饮料的商店都必须收回饮料并将押金退还给顾客,无论饮料是否购买。宝特瓶的押金为 0.25 欧元(0.256 美元),因其对环境的影响较大而受到认可。玻璃瓶的押金要低得多,从 0.08 欧元(0.082 美元)到 0.15 欧元(0.154 美元)不等。由于玻璃瓶可重复使用,顾客退回塑胶瓶可以获得更多回报,而较低的初始成本鼓励他们购买玻璃瓶产品。

- 根据德国玻璃工业联邦协会统计,德国10家最大的玻璃製造商的销售额约占玻璃产业总销售额的20%。目前,国际上很少有占据市场主导地位并有兴趣生产玻璃瓶的主要玻璃製造商。

- 此外,德国可口可乐已从宝特瓶转向玻璃瓶,需要大量玻璃瓶。该公司已投资 5,000 万欧元(5,129 万美元)在曼海姆和吕讷堡新建两条玻璃生产线。来自软性饮料行业的这些压力将进一步影响酒精饮料行业的玻璃瓶供应。

- 该国不断增长的可支配收入和优质包装的使用是玻璃包装行业的主要驱动力。此外,强制性废弃物分类法和极其有效的押金退款计画显着改善了废弃物管理并提高了回收率,促使各国政府采用玻璃包装。

- 然而,由于原材料成本上涨以及其他包装材料的激烈竞争,市场发展步伐可能会放缓。疫情对供应链的影响、玻璃材料的敏感度以及营运费用的增加预计将进一步阻碍市场成长。

- 随着COVID-19的爆发,德国政府大幅增加了对药用玻璃包装的需求,特别是对管瓶、瓶子和安瓿等疫苗的需求,并且针对COVID-19疫苗的研究已经开始迅速进行。起增加。

德国玻璃包装市场趋势

增加可支配收入并融入优质个人护理包装

- 各种客製化美容产品的强劲销售导致对高效包装的需求显着增加。此外,消费者对整装仪容意识的提高正在增加对化妆品的需求,这推动了该国的玻璃包装市场。

- 由于具有保湿、保湿、抗衰老、祛斑和修復皮肤的功效,过去五年对精华液和精油的需求不断增加。这些高级产品正受到老龄化人口的需求。这种需求的成长正在推动该国滴管瓶和推泵瓶的成长。

- 国内玻璃製造商也正在投资新技术,以快速改变颜色和形状,以说服精酿啤酒製造商和小品牌摆脱主导该行业的长期生产。

- 美容和香水行业的玻璃包装趋势之一是颠覆性设计的增加,其体现为外部和内部模製玻璃的创新形式。例如,Verescent 利用其专利的 SCULPT'in 技术,由 Vince Camuto(Parlux 集团)製造了精緻复杂的 100 毫升 Illuminare 瓶。这款瓶子的创新设计灵感来自穆拉诺岛的玻璃工坊。

- 此外,政府机构还将支持位于德国洛曼的 Gerresheimer AG,透过引入新工艺为製药和化妆品行业生产高品质的初级玻璃包装,使玻璃生产永续且环保。 2021年12月,拜仁的玻璃产业将受益于德国联邦环境部支持的约990万欧元(1,015万美元)的计划。

- 此外,根据ITC的数据,2021年精油和树脂、香水、化妆品或洗护用品用品的出口额约为119.4亿美元,比2020年的约103.2亿美元增加15.6%。在预测期内,出口的大幅成长可能会为全国各地的供应商提供更多的玻璃生产机会。

医药板块预计将大幅成长

- 该供应商正在为全球 100 多个冠状病毒疫苗临床试验提供管瓶。例如,Schott AG为辉瑞/ 管瓶疫苗开发了一种可以承受-80至500摄氏度温度的硼硅酸玻璃材料,因为储存疫苗所需的温度为摄氏-70度。此外,Schott AG 的目标是到 2021年终生产 20 亿个用于 COVID-19 疫苗的管瓶。

- 此外,德国也受到了 COVID-19 传播的负面影响。例如,根据世界卫生组织的数据,自 2020 年 1 月以来,德国已确诊 3,473,503 例 COVID-19 病例,其中 84,126 人死亡。罗伯特·科赫研究所表示,该国也受到第三波疫情的打击,增加了对疫苗的需求。自 COVID-19 疫苗研究开始以来,对管瓶和安瓿的需求激增。

- 此外,根据世界卫生组织的数据,2021 年 5 月德国总合接种了 30,631,299 剂 COVID-19 疫苗,Astra Zeneca疫苗将从 2021 年 8 月开始向 12 至 18 岁的人群接种。卫生部长改变了这样做的决定。这些措施正在增加该国对玻璃包装的需求。

- 此外,根据ITC的数据,2021年药品进口额约为792.6亿美元,比前一年2020年(656亿美元)成长20.82%。进口的大幅增加代表了对医药产品的需求,并可能为该国各种药用玻璃包装产品创造投资机会。

- Bormioli Pharma 计划透过投资德国 Bad Konigshofen 工厂,到 2023 年 9 月将产能提高一倍,并安装一条新生产线。它还计划在 2023 年升级其 San Vito al Tagliamento 熔炉之一,进一步支持该公司在玻璃瓶製造业的成长目标。

德国玻璃包装产业概况

德国玻璃包装市场竞争中等,有大量地区和全球参与企业。然而,玻璃的特性及其在饮料、化妆品和其他行业中的优势导致玻璃瓶、容器、管瓶和安瓿的采用越来越多。市场参与企业透过采用产品创新、联盟、併购和收购等策略来引领市场,以增加市场占有率并进一步提高可回收性。

- 2022 年9 月:Gerresheimer AG 和Stevanato Group SpA(为製药、生物技术和生命科学产业提供药物密封、药物输送和诊断解决方案的全球公司)加入Stevanato Group 市场领先的EZ-fill 技术,宣布双方联合开发了管瓶EZ-fill 技术。透过这种合作关係,客户预计将受益于更高的效率、更高的品质标准、更快的上市时间、更低的总拥有成本 (TCO) 和更低的供应链风险。

- 2022 年 4 月:Wiegand-Glas 在德国施莱欣根工厂启动了一座新熔炉。儘管能源市场的供应和定价困难且难以预测,但 Wiegand-Glas 的经营团队仍决定在图林根州的新玻璃工厂启动第二座熔炉。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 评估 COVID-19 对德国玻璃产业的影响

第五章市场动态

- 市场驱动因素

- 增加可支配所得并融入优质包装

- 玻璃产品价值

- 市场问题

- 来自替代包装解决方案的激烈竞争

- 营运和物流问题

第六章 市场细分

- 按类型

- 瓶子/容器

- 管瓶

- 安瓿

- 罐

- 按行业分类

- 药品

- 个人护理

- 家居用品

- 农业

- 由其他最终用户

第七章 竞争格局

- 公司简介

- Ardagh Group SA

- OI Glass, Inc.

- Gerresheimer AG

- Verallia Packaging SAS(Horizon Holdings II SAS)

- BA Glass BV

- Wiegand-Glas Holding GmbH

- Piramal Glass Ltd

- Schott AG

- Stolzle Glass Group(CAG Holding GmbH)

- APG Europe

第八章投资分析

第9章 市场的未来

The Germany Glass Packaging Market is expected to register a CAGR of 8.51% during the forecast period.

Key Highlights

- Glass manufacturers have been critical players in Germany's reuse and recycling system. Gerresheimer, for instance, began producing glass with a higher proportion of recycled glass at the Tettau site in Germany. By using recycled glass, it aims to create new high-quality cosmetics packaging. Many prominent players, like Gerresheimer, drive circularity and resource savings daily.

- The introduction of stringent laws in the country to enhance the quality and integrity of domestically manufactured drugs is driving an increase in the use of glass for pharmaceutical packaging products. Also, there is a demand for sterile medical packaging products from the pharmaceutical industries, which is anticipated to drive the market's growth during the forecast period. Also, the growing number of drugs packaged in the glass medium is driving the demand for glass-based vials and ampoules.

- Moreover, all stores in Germany that sell beverages must take them back and return the deposit to the customer - whether or not that person bought that beverage from them. The warranty for plastic bottles is EUR 0.25 (USD 0.256), recognizing the higher environmental impact. The deposit for glass bottles is far lower - between EUR 0.08 (USD 0.082) and EUR 0.15 (USD 0.154) - because they can be reused, which will allow customers to give more of a reward for returning plastic and encourage them to buy products in glass bottles because it's cheaper upfront.

- According to The Federal Association of the German Glass Industry, ten big glass producers in Germany generate around 20% of the whole glass industry revenue. Few big international glassmakers are dominating the market presently and are interested in producing glass bottles.

- Further, Coca-Cola, Germany, shifted from PET bottles back to glass bottles; therefore, it needs enormous amounts of glass bottles. The company has invested EUR 50 million (USD 51.29 million) in two new glass production lines in Mannheim and Luneburg. This pressure from the soft drinks industry further affects the supply of glass bottles in the liquor segment.

- The country's expanding disposable income and incorporation into premium packaging are the main drivers of the glass packaging industry. Additionally, the government adopted increased glass packaging due to the mandated trash sorting laws and an incredibly effective deposit refund program that has considerably improved garbage management and raised recycling rates.

- However, shifts in the cost of raw materials and the fierce competition from other packaging materials may reduce the market's development pace. The pandemic's effects on the supply chain, the sensitivity of glass materials, and a rise in operational expenses will further hinder the market growth.

- With the outbreak of COVID-19, the country witnessed significant demand for pharmaceutical glass packaging from the government, which has increased the need for vaccines, especially for vials, bottles, and ampoules, surging since research began to find a vaccine against COVID-19.

Germany Glass Packaging Market Trends

Higher Disposable Income and Integration in Premium Personal Care Packaging

- The demand for efficient packaging increased significantly due to robust sales of various customized beauty products. Furthermore, the rising consumer awareness regarding personal grooming is driving the need for cosmetic products, which, in turn, is driving the glass packaging market in the country.

- Face serums and oils have witnessed demand over the past five years, as they offer hydration, moisturization, anti-aging, blemish-clearing benefits, and skin repair. These premium products have been witnessing demand among the aging population. Their increase in demand has increased the growth of dropper and push pump bottles in the country.

- Glassmakers in the country are also investing in new technology to quickly swap colors and molds to persuade craft brewers and small brands to break from the long production runs that have dominated the industry.

- Among the glass packaging trends in the beauty and fragrance industry is the uptick in disruptive designs, embodied by innovative shapes featured in the outer or inner molded glass. For instance, Verescence manufactured the sophisticated and complex 100 ml bottle for Illuminare by Vince Camuto (Parlux Group) using its patented SCULPT'in technology. The glassworks from Murano inspired the innovative design of the bottle.

- Further, the government agency is assisting Gerresheimer AG in Lohr am Main, Germany, with the implementation of a new process for producing high-quality primary glass packaging for the pharmaceutical and cosmetics industries to make glass production sustainable and environmentally friendly. In December 2021, the Bavarian glass industry will benefit from a project supported by around EUR 9.9 million (USD 10.15 million) from the Federal Environment Ministry of Germany.

- Furthermore, according to ITC, in 2021, the exports of essential oils and resinoids, perfumery, and cosmetic or toilet preparations were valued at around USD 11.94 billion, a 15.6% rise in exports from the previous year, 2020, which was recorded about USD 10.32 billion. The significant rise in exports may create increased opportunities for vendors across the country in considerable glass production over the forecast period.

Pharmaceutical Sector Expected to Witness Significant Growth

- Vendors have been supplying vials for more than 100 coronavirus vaccine trials worldwide. For instance, Schott AG introduced vials made of Borosilicate glass that can withstand temperatures from -80 to 500 degrees Celsius for the Pfizer/BioNTech vaccine as the temperature required to store the vaccine is -70 degrees centigrade. Furthermore, Schott AG aims to produce two billion glass vials for COVID-19 vaccine doses by the end of 2021.

- Furthermore, Germany has been adversely hit by the spread of COVID-19. For instance, according to WHO, the number of confirmed COVID-19 cases since January 2020 in Germany is 3,473,503, with 84,126 deaths. Also, according to the Robert Koch Institute, the country was struck by a third pandemic wave, which increases the need for vaccines. The demand for vials and ampoules has been surging since the research for a vaccine against COVID-19 began.

- Also, according to WHO, in May 2021, a total of 30,631,299 COVID-19 vaccine doses have been administered in Germany, and it is expected to rise further owing to the change in decisions made by 16 regional health ministers of the country to start initiating AstraZeneca's vaccine doses to age group 12 to 18 years from August 2021. Such initiatives increase the demand for glass packaging in the country.

- Furthermore, according to ITC, in 2021, the imports of pharmaceutical products were valued at around USD 79.26 billion, a 20.82% increase in the imports from the previous year, 2020, which recorded USD 65.6 billion. The significant rise in imports represents the demand for pharmaceutical products, which may create opportunities for various pharmaceutical glass packaging product investments in the country.

- Bormioli Pharma plans to double its production capacity by September 2023 and install new production lines by investing in its Bad Konigshofen plant in Germany. The company also plans to upgrade one of its San Vito al Tagliamento furnaces by 2023, further supporting its growth goals in the glass vial manufacturing industry.

Germany Glass Packaging Industry Overview

The German Glass Packaging Market is moderately competitive, with a considerable number of regional and global players. However, the properties of glass and its benefits to beverages, cosmetics, and other industries are leading to the increased adoption of glass bottles, containers, vials, and ampoules. Players in the market adopt strategies such as product innovation, partnerships, mergers, and acquisitions to increase their market share and further recyclability driving the market.

- September 2022: Gerresheimer AG and Stevanato Group S.p.A., a global provider of drug containment, drug delivery, and diagnostic solutions to the pharmaceutical, biotechnology, and life sciences industries, announced that they have jointly developed a high-end Ready-To-Use (RTU) solution platform with an initial focus on vials, based on Stevanato Group's market-leading EZ-fill technology. Customers are expected to benefit from increased efficiency, higher quality standards, quicker time to market, lower total cost of ownership (TCO), and reduced supply chain risk as a result of this partnership.

- April 2022: Wiegand-Glas started a new furnace in Germany's Schleusingen facility. The Wiegand-Glas management decided to start the second furnace at the new glass factory in Thuringia despite the energy market's severely unpredictable supply and pricing conditions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Germany Glass Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Higher Disposable Income and Integration in Premium Packaging

- 5.1.2 Commodity Value of Glass

- 5.2 Market Challenges

- 5.2.1 High Competition from Substitute Packaging Solutions

- 5.2.2 Operation and Logistical Concerns

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Bottles/Containers

- 6.1.2 Vials

- 6.1.3 Ampoules

- 6.1.4 Jars

- 6.2 By End-user Vertical

- 6.2.1 Pharmaceuticals

- 6.2.2 Personal Care

- 6.2.3 Household Care

- 6.2.4 Agricultural

- 6.2.5 Other End-user Vertical

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ardagh Group S.A.

- 7.1.2 O-I Glass, Inc.

- 7.1.3 Gerresheimer AG

- 7.1.4 Verallia Packaging SAS (Horizon Holdings II SAS)

- 7.1.5 BA Glass BV

- 7.1.6 Wiegand-Glas Holding GmbH

- 7.1.7 Piramal Glass Ltd

- 7.1.8 Schott AG

- 7.1.9 Stolzle Glass Group (CAG Holding GmbH)

- 7.1.10 APG Europe