|

市场调查报告书

商品编码

1851372

欧洲数位鑑识:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Europe Digital Forensics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

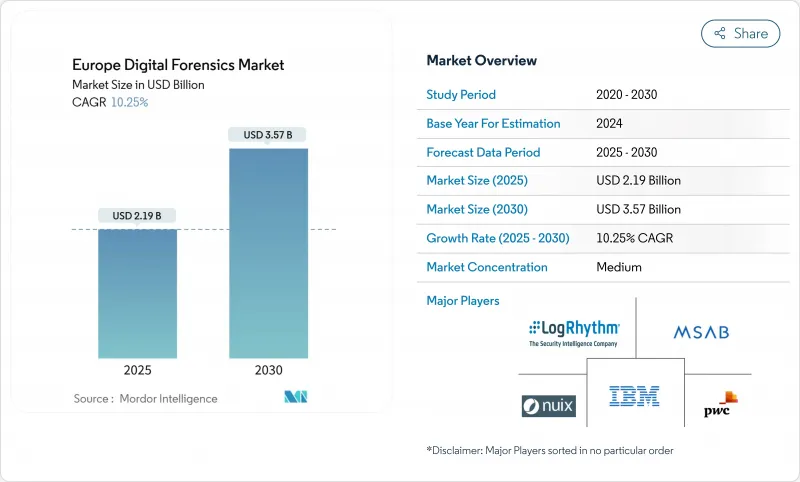

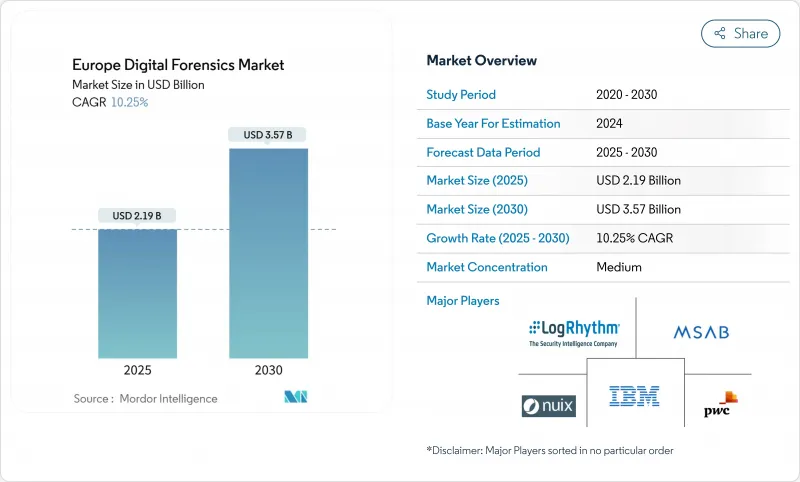

欧洲数位鑑识市场预计到 2025 年将达到 21.9 亿美元,到 2030 年将达到 35.7 亿美元,在此期间的复合年增长率为 10.25%。

持续的公共部门资金筹措、诸如《数位营运韧性法案》等强化韧性法规的出台,以及跨境网路犯罪的日益猖獗,正推动着调查平台领域的高额支出。随着人工智慧分析、云端证据收集和自动化案件管理取代传统的单点工具,技术更新周期不断缩短,促使供应商转向订阅模式和託管服务。德语区、比荷卢经济联盟和北欧地区丛集勒索软体活动的增加,迫使企业将取证准备纳入其事件回应流程。对智慧汽车和5G安全新兴企业的风险资金筹措,正在加速推动对专用于车载系统和高流量边缘节点的新型资料撷取探针的需求。

欧洲数位鑑识市场趋势与洞察

透过符合欧盟DORA和NIS2标准,加速法证准备工作。

自2025年1月17日起,欧盟各地的金融机构必须证明其持续监控、事件日誌记录和第三方监督能力,这将使取证准备从可选附加项转变为监管基准。监管机构目前正在审核资讯通讯技术(ICT)提供者的註册讯息,促使银行采购可直接连接其安全资讯和事件管理(SIEM)系统并自动发送违规通知的企业级证据库。与NIS2的协调将类似的义务扩展到能源公共和数位服务供应商,从而将欧洲数位鑑识市场扩展到核心金融领域之外。预算重组有利于提供监管链检验的多租户云端平台,从而增加软体供应商的经常性收入。

加密即时通讯应用程式的兴起正在推动对行动取证的需求。

iOS 18 的端对端加密和讯息遗失预设设定促使调查人员采用复杂的绕过技术,这些技术结合了逻辑提取、备份分析和人工智慧模式匹配。研究表明,借助先进的工具,可以从通知痕迹中恢復 83.33% 的已删除 WhatsApp讯息。日益复杂的技术使得专业服务变得至关重要,从而推动了服务领域的两位数成长。

GDPR对证据取得的隐私限制

如今,大多数大型取证案件都需要进行隐私影响评估,这延长了合约週期,并迫使规模较小的实验室推迟处理复杂的跨国案件。各国监管解释的差异意味着,在一个州合法收集的证据在另一个州可能面临挑战,增加了法律审查的成本。投资正转向选择性资料撷取软体,该软体可以对个人识别资讯进行杂凑处理和标记,而不是提取整个磁碟镜像,从而使实践符合资料最小化法规。

细分市场分析

到2024年,软体将占据欧洲数位鑑识市场45%的份额,这主要得益于规模化的订阅定价模式以及涵盖行动、云端和SaaS平台的数据采集分析的持续功能更新。随着资料撷取任务转向虚拟机,硬体支出将会放缓,但用于晶片提取的专用加密狗和高速写入保护器对于棘手的刑事调查仍然必不可少。总体而言,以服务为中心的营运模式使服务提供者能够获得扩张预算,同时保护客户免受技能短缺的影响。

从2025年到2030年,随着企业将复杂的证据收集工作外包给营运远距实验室和提供按需分析的专业团队,服务业将以11.2%的复合年增长率实现最快成长。大型金融机构正在签署多年期的法务会计管理合同,并将顾问纳入DORA(资料保护条例)规定的弹性测试週期。供应商透过提供可直接用于法庭的文件工作流程和与电子取证套件的API整合来降低法律顾问的工作效率,从而实现差异化竞争。

到2024年,行动平台将占欧洲数位鑑识市场规模的35%,反映出智慧型手机在个人和企业工作流程中的普及程度。负责人正转向加密聊天记录、感测器融合资料和时间轴拼接等手段来重建使用者行为轨迹。穿戴式装置的加入进一步增加了证据层级,巩固了行动装置分析作为一门基础学科的地位。

随着多租户SaaS将关键证据迁移到云端,云端取证将以11.4%的复合年增长率成长。服务提供者现在提供简介工具来冻结虚拟执行个体并自动进行管辖权映射,以确保法律效力。虽然电脑取证的份额正在下降,但终端证据仍然是内部威胁和诈欺调查的核心。新兴的车辆和物联网证据类型正在推动整合平台的发展,这些平台可以将来自ECU、智慧感测器和中央云端的日誌资料整合到单一案件文件中。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 利用欧盟DORA和NIS2加速法证回应

- 加密即时通讯应用程式的兴起正在推动对行动取证的需求。

- 德国、奥地利和比荷卢经济联盟地区勒索软体事件激增,推动了事件回应取证工作的发展。

- 连网汽车的成长带来了新的车辆/物联网取证工作量

- 5G部署推动了基于人工智慧的网路取证投资。

- 市场限制

- GDPR对证据取得的隐私限制

- 端对端加密会增加调查时间和成本。

- 警务采购预算分散导致招募速度放缓。

- 欧洲缺乏 ISO/IEC 17025 认证的实验室

- 价值/供应链分析

- 监理展望

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按组件

- 硬体

- 软体

- 服务

- 按类型

- 电脑取证

- 行动装置取证

- 网路取证

- 云取证

- 资料库取证

- 物联网和嵌入式设备取证

- 透过工具

- 资料收集和存储

- 资料恢復与重建

- 法医数据分析

- 审查和报告

- 法证解密与密码破解

- 按公司规模

- 大公司

- 小型企业

- 按最终用户行业划分

- 政府和执法部门

- BFSI

- 资讯科技/通讯

- 卫生保健

- 零售与电子商务

- 能源与公共产业

- 製造业

- 运输与物流

- 国防/航太

- 教育

- 按国家/地区

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- MSAB AB

- LogRhythm Inc.

- IBM Corporation

- PricewaterhouseCoopers LLP

- Nuix Ltd.

- Cellebrite DI Ltd.

- Magnet Forensics Inc.

- OpenText Corp.(Guidance Software)

- FireEye Inc.(Trellix)

- Envista Forensics

- Cellebrite(Digital Intelligence)

- ADF Solutions LLC

- AccessData(Exterro)

- Oxygen Forensics Inc.

- Paraben Corp.

- BAE Systems Applied Intelligence

- Atos SE(Evidian)

- Sytech Digital Forensics

- CCL Solutions Group Ltd.

- Evidence Talks Ltd.

第七章 市场机会与未来展望

The Europe digital forensics market size sits at USD 2.19 billion in 2025 and is forecast to reach USD 3.57 billion by 2030, advancing at a 10.25% CAGR during the period.

Consistent public-sector funding, tighter resilience rules such as the Digital Operational Resilience Act, and rising cross-border cybercrime keep spending on investigation platforms high. Technology refresh cycles are shortening as AI analytics, cloud evidence capture, and automated case management replace legacy point tools, prompting vendors to pursue subscription models and managed offerings. Heightened ransomware activity across DACH, Benelux, and Nordic banking clusters forces enterprises to embed forensic readiness in incident-response playbooks. Venture funding for smart-vehicle and 5G security startups accelerates demand for new data-capture probes focused on in-vehicle systems and high-traffic edge nodes.

Europe Digital Forensics Market Trends and Insights

EU DORA & NIS2 Compliance Accelerating Forensic Readiness

Since 17 January 2025, financial entities across the bloc must prove continuous monitoring, incident logging, and third-party oversight, turning forensic readiness from an optional add-on into a regulatory baseline. Supervisors now audit registers of ICT providers, so banks procure enterprise-wide evidence repositories that plug directly into SIEM stacks and automate breach notification. Harmonisation with NIS2 extends similar obligations to energy utilities and digital service providers, widening the European digital forensics market beyond core finance. Budget reallocations favour multi-tenant cloud platforms offering chain-of-custody validation, which lifts recurring revenue for software vendors.

Proliferation of Encrypted Messaging Apps Boosting Mobile Forensics Demand

End-to-end encryption in iOS 18 and disappearing-message defaults push investigators toward advanced bypass techniques that combine logical extraction, backup parsing, and AI pattern matching. Research shows 83.33% of deleted WhatsApp messages remain recoverable through notification artefacts when sophisticated tooling is used.Greater technical complexity makes professional services indispensable, fuelling the services segment's double-digit growth trajectory.

GDPR Privacy Limits on Evidence Acquisition

Privacy Impact Assessments now accompany most large-scale forensic cases, lengthening engagement cycles and pushing smaller labs to defer complex cross-border work. National differences in supervisory interpretation mean evidence gathered legally in one state may face challenge in another, adding legal-review overhead. Investment is shifting toward selective-collection software that can hash and flag personally identifiable data instead of extracting entire disk images, aligning practice with data-minimisation rules.

Other drivers and restraints analyzed in the detailed report include:

- Spike in Ransomware Incidents Across DACH & Benelux Elevating Incident-Response Forensics

- Connected-Vehicle Growth Creating New Vehicle/IoT Forensics Workloads

- End-to-End Encryption Increasing Investigation Time & Cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software retains the dominant 45% slice of the European digital forensics market in 2024, thanks to scaled subscription pricing and continuous feature updates covering mobile, cloud, and SaaS artefact parsing. Hardware spend slows as acquisition tasks shift into virtual machines, yet proprietary dongles for chip-off extraction and high-speed write-blockers stay necessary for severe criminal investigations. Overall, a service-centric operating model positions providers to capture expansion budgets while protecting customers from skills shortages.

Services recorded the quickest 11.2% CAGR between 2025-2030 as corporates outsource complex evidence collection to specialised teams that operate remote labs and on-demand analytics. Large financial institutions sign multi-year managed forensics contracts that embed consultants during resilience-testing cycles mandated by DORA.Vendors differentiate through court-ready documentation workflows and API integrations with e-discovery suites, reducing hand-off friction for legal counsel

Mobile platforms captured 35% of the Europe digital forensics market size in 2024, reflecting smartphone ubiquity across personal and enterprise workflows. Investigators focus on encrypted chat artefacts, sensor fusion data, and artefact timeline stitching to recreate user journeys. Companion wearables add another evidence layer, further cementing handset analysis as a foundational discipline.

Cloud forensics grows at 11.4% CAGR as multi-tenant SaaS moves key evidence off-premise. Providers now supply snapshot tooling that freezes virtual instances and automates jurisdiction mapping to maintain legal validity. Computer forensics share declines, though endpoint artefacts still anchor insider-threat and fraud probes. Emergent vehicle and IoT evidence types spur integrated platforms able to stitch log data from ECUs, smart sensors, and central clouds in a single case file.

The Europe Digital Forensics Market Report is Segmented by Component (Hardware, Software, Services), Type (Computer, Mobile Device, Network, Cloud, and More), Tool (Data Acquisition and Prevention, Data Recovery, and More), Enterprise Size (Large Enterprises, Smes), End-User (Government, BFSI, IT, Healthcare, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- MSAB AB

- LogRhythm Inc.

- IBM Corporation

- PricewaterhouseCoopers LLP

- Nuix Ltd.

- Cellebrite DI Ltd.

- Magnet Forensics Inc.

- OpenText Corp. (Guidance Software)

- FireEye Inc. (Trellix)

- Envista Forensics

- Cellebrite (Digital Intelligence)

- ADF Solutions LLC

- AccessData (Exterro)

- Oxygen Forensics Inc.

- Paraben Corp.

- BAE Systems Applied Intelligence

- Atos SE (Evidian)

- Sytech Digital Forensics

- CCL Solutions Group Ltd.

- Evidence Talks Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU DORA and NIS2 Compliance Accelerating Forensic Readiness

- 4.2.2 Proliferation of Encrypted Messaging Apps Boosting Mobile Forensics Demand

- 4.2.3 Spike in Ransomware Incidents Across DACH and Benelux Elevating Incident-Response Forensics

- 4.2.4 Connected-Vehicle Growth Creating New Vehicle/IoT Forensics Workloads

- 4.2.5 5G Roll-out Driving AI-based Network Forensics Investments

- 4.3 Market Restraints

- 4.3.1 GDPR Privacy Limits on Evidence Acquisition

- 4.3.2 End-to-End Encryption Increasing Investigation Time and Cost

- 4.3.3 Fragmented Police Procurement Budgets Slowing Adoption

- 4.3.4 Shortage of ISO/IEC 17025-Accredited Labs in Europe

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Type

- 5.2.1 Computer Forensics

- 5.2.2 Mobile Device Forensics

- 5.2.3 Network Forensics

- 5.2.4 Cloud Forensics

- 5.2.5 Database Forensics

- 5.2.6 IoT and Embedded Device Forensics

- 5.3 By Tool

- 5.3.1 Data Acquisition and Preservation

- 5.3.2 Data Recovery and Reconstruction

- 5.3.3 Forensic Data Analysis

- 5.3.4 Review and Reporting

- 5.3.5 Forensic Decryption and Password Cracking

- 5.4 By Enterprise Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises

- 5.5 By End-user Industry

- 5.5.1 Government and Law Enforcement Agencies

- 5.5.2 BFSI

- 5.5.3 IT and Telecom

- 5.5.4 Healthcare

- 5.5.5 Retail and E-commerce

- 5.5.6 Energy and Utilities

- 5.5.7 Manufacturing

- 5.5.8 Transportation and Logistics

- 5.5.9 Defense and Aerospace

- 5.5.10 Education

- 5.6 By Country

- 5.6.1 United Kingdom

- 5.6.2 Germany

- 5.6.3 France

- 5.6.4 Italy

- 5.6.5 Spain

- 5.6.6 Nordics

- 5.6.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 MSAB AB

- 6.4.2 LogRhythm Inc.

- 6.4.3 IBM Corporation

- 6.4.4 PricewaterhouseCoopers LLP

- 6.4.5 Nuix Ltd.

- 6.4.6 Cellebrite DI Ltd.

- 6.4.7 Magnet Forensics Inc.

- 6.4.8 OpenText Corp. (Guidance Software)

- 6.4.9 FireEye Inc. (Trellix)

- 6.4.10 Envista Forensics

- 6.4.11 Cellebrite (Digital Intelligence)

- 6.4.12 ADF Solutions LLC

- 6.4.13 AccessData (Exterro)

- 6.4.14 Oxygen Forensics Inc.

- 6.4.15 Paraben Corp.

- 6.4.16 BAE Systems Applied Intelligence

- 6.4.17 Atos SE (Evidian)

- 6.4.18 Sytech Digital Forensics

- 6.4.19 CCL Solutions Group Ltd.

- 6.4.20 Evidence Talks Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment