|

市场调查报告书

商品编码

1640545

北美数位鑑识:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)North America Digital Forensics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

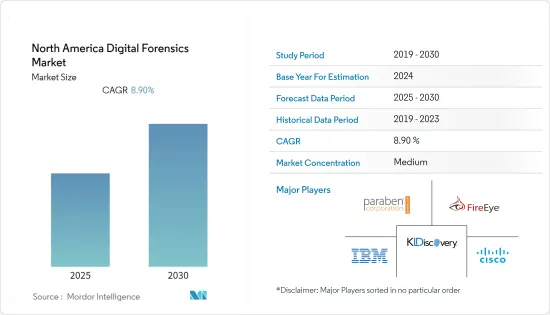

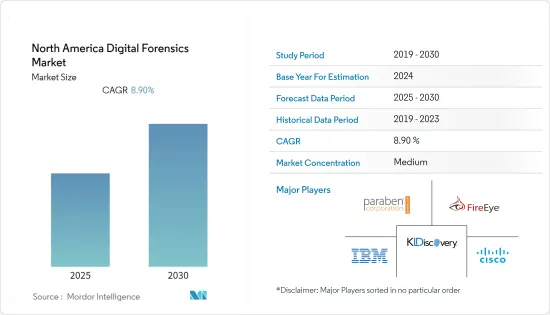

预测期内,北美数位鑑识市场预计复合年增长率为 8.9%

关键亮点

- 在组织压力和危机巨大的时期,新的诈欺和丑闻风险不断出现,内部控制跟不上不断变化的风险,法医调查的需求日益增加。 COVID-19 疫情反映了远距工作环境的新模式,需要符合法律和社会目标(例如社交距离和自我隔离)的调查技术。

- 数位取证允许透过分析和评估来自数位设备的资料来提取证据,并用于恢復和检查资料,同时保留资料原始性。识别资料重复和时间欺骗是这项技术面临的一些主要挑战。

- 物联网推动的运算技术的出现以及全部区域行动电话、电脑和其他电子设备的快速成长都促进了数位取证的需求。

- 技术进步和执法也是影响北美数位取证采用率的因素。相反,缺乏专业技能、使用专有作业系统以及新行动应用程式中的高加密等级等因素可能会阻碍市场成长。

- 此外,市场正在见证主要参与者进行各种併购活动,以加强产品系列扩大其影响力。例如,2020 年 8 月,网路安全公司 Palo Alto Networks 宣布已签署最终协议,收购事件回应、风险管理和数位鑑识顾问公司 The Crypsis Group。

北美数位取证市场趋势

网路取证预计将显着成长

- 北美地区一直是网路取证解决方案采用的主要创新者、先驱者和最大的市场之一。此外,该地区拥有强大的骨干力量和多家市场供应商。

- 互联网和数位通讯系统(尤其是物联网 (IoT))的使用日益增多,导致对网路取证领域功能的需求不断增加。

- IoT 和 BYOD 趋势的兴起也导致网路犯罪的增加,迫使许多组织采用这些解决方案。该地区连网设备的增加也使企业网路变得更加复杂。不断发展的网路环境也要求企业重新评估其网路安全基础设施并采用强大的网路解决方案。

- 根据 Verizon 最近的一项研究,安全漏洞的首要原因是「身份验证洩漏」。根据身分盗窃资源中心发布的研究资料,2020年仅美国就发生了1001起资料外洩事件,导致超过1.558亿笔记录暴露。

- 各行业资料外洩数量的大幅增加促使企业采用强大的取证解决方案。例如,根据白宫经济顾问委员会的数据,美国经济每年因危险的网路活动面临约 570 亿至 1,090 亿美元的损失。

预计美国将占据较大的市场占有率

- 一段时间以来,美国金融体系一直是外国网路对手的攻击目标。基于这一现象,美国政府最近向私营部门开放了专门的网路保护团队(CPT),以便在发生网路攻击时以高级分析、网路和端点取证的形式提供突波的能力。它。

- 此外,2018年11月,美国政府签署立法,成立网路安全与基础设施安全局(CISA),以加强国家对网路攻击的防御能力。该机构与联邦政府合作,提供网路安全工具、事件回应服务和评估能力,以保护支援合作机构关键业务的政府网路。因此,它为新旧公司投资专门针对该行业设计的取证解决方案开闢了新的途径。

- 花旗集团、美国银行、摩根大通和富国银行等美国银行都曾遭遇各种网路攻击,导致客户资料外洩。联邦当局建议银行监控网路活动。此类政府授权正在推动该地区对数位取证解决方案的需求。

- 预计美国将占据数位取证市场的大部分份额,政府和私人公民可以在刑事和民事案件中使用这项技术。联邦调查局和州警等机构正在使用这项技术来抓捕参与网路非法活动的犯罪分子和恐怖分子。私人公司使用该系统进行类似的调查。

北美数位取证行业概况

北美数位取证市场竞争激烈,有多家公司参与企业。市场集中度适中,主要参与企业采用併购、产品创新等策略来提供更好的产品并扩大影响力。该市场的主要企业包括 IBM Corporation、KLDiscovery Inc.、Paraben Corporation 和 Cisco Systems Inc.

- 2022 年 1 月-STG(FireEye 从其出售了其名称和产品业务)宣布推出Trellix,这是一家扩展的检测和回应公司,结合了 FireEye 和 McAfee 的企业业务。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 网路犯罪和先进窃盗手段增多

- 物联网设备的日益普及推动了对数位取证解决方案的需求

- 市场限制

- 专业技能人才短缺

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 工业影响评估

第五章 市场区隔

- 按组件

- 硬体

- 软体

- 服务

- 按类型

- 行动取证

- 电脑取证

- 网路取证

- 其他的

- 按最终用户产业

- 政府和执法部门

- BFSI

- 资讯科技和电讯

- 其他最终用户产业

- 按国家

- 美国

- 加拿大

第六章 竞争格局

- 公司简介

- IBM Corporation

- Binary Intelligence LLC

- Guidance Software Inc.(Opentext)

- AccessData Group LLC

- KLDiscovery Inc.

- Paraben Corporation

- FireEye Inc.

- LogRhythm Inc.

- Cisco Systems Inc.

- Oxygen Forensics Inc.

第七章投资分析

第八章 市场机会与未来趋势

The North America Digital Forensics Market is expected to register a CAGR of 8.9% during the forecast period.

Key Highlights

- During this period of significant organizational stress and crisis, newer frauds and misconduct risks have emerged, internal controls are lagging behind the evolving risks, and the need for forensic investigations have been witnessing an increase. The COVID-19 pandemic will require investigation techniques that reflect the new patterns of employee remote working environment and comply with the legal and societal goals such as social distancing and self-isolation.

- Digital forensic enables the extraction of evidence through analysis and evaluation of data from digital devices and is used to recover and inspect the data while maintaining the originality of the same. Identification of duplication of data and spoofing of timings are some of the major challenges for this technology.

- The emergence of computing shaped by the IoT and the rapid increase in the number of mobiles, computers, and other electronic devices across the region are contributing to the demand for digital forensics.

- Technological advancements and law enforcement are some of the other factors impacting the adoption rate of digital forensics in North America. In contrast, factors such as lack of specialized skills, usage of proprietary operating systems, and high level of encryption in new mobile applications may hinder the growth of the market.

- Moreover, the market has been witnessing various mergers and acquisition activities by big players in the market to enhance their product portfolio and expand their reach. For instance, in Aug 2020, Palo Alto Networks, a cybersecurity company, announced that it has entered into a definitive agreement to acquire The Crypsis Group, an incident response, risk management, and digital forensics consulting firm.

North America Digital Forensics Market Trends

Network Forensic is Expected to Witness Significant Growth

- The North American region is among the lead innovators and pioneers in terms of the adoption of network forensics solutions and is one of the largest markets. Moreover, the region also has a strong foothold of multiple vendors in the market.

- The increasing usage of the internet and digital communications systems, especially in the shape of the Internet of things (IoT), among others, is leading towards the increasing demand for competence in the network forensics field.

- The growing popularity of IoT and BYOD trends have also resulted in the growth of cyber-crimes, forcing multiple organizations to use these solutions. The rise in connected devices in the region has also made enterprise networks much more complex. The evolving network landscape has also generated the need among enterprises to reassess their network security infrastructure and adopt robust network solutions.

- A recent study by Verizon suggests that 'compromised identities' represent the top reason for security breaches. In the year 2020, the number of data breaches in the United States alone aggregated to 1,001, with more than 155.8 million records exposed, according to the survey data published by the Identity Theft Resource Center.

- The substantial increase in the number of data breaches across various industries boosts companies to adopt robust forensics solutions. For instance, according to the White House Council of Economic Advisers, the US economy faces losses of approximately USD 57 billion to USD 109 billion per annum due to dangerous cyber activities.

United states is Anticipated to Account for a Major Market Share

- The US financial system has always been a target for foreign cyber adversaries for a considerable period. Based on this phenomenon, the US government recently imposed laws for the private sector to have a dedicated cyber protection team (CPT) to provide surge capacity in the event of an ongoing cyberattack in the form of advanced analysis and network and endpoint forensics.

- Moreover, the United States government signed the law to establish Cybersecurity and Infrastructure Security Agency (CISA) in Nov 2018, in order to enhance national defense against cyber attacks. The agency works with the federal government to provide cybersecurity tools, incident response services, and assessment capabilities to safeguard the governmental networks that support essential operations of the partner departments and agencies. As a result, it will open new avenues for the new and existing companies to invest in forensics solutions primarily designed for this industry.

- The US banks, such as Citigroup, Bank of America, JPMorgan Chase, and Wells Fargo, have faced various cyberattacks that led to exposing the customer data. These banks were recommended, by the federal officials, to monitor network activities. Such government impositions are, therefore, driving the demand for digital forensics solutions in the region.

- The United States is expected to have a prominent share in the digital forensics market, where this technology can be used by governments and private citizens for criminal and civil cases. Agencies, like FBI and State Police departments, are using this technology to catch criminals and terrorists involved in illegal activities online. In the private sector, this system is used for similar investigations inside the companies.

North America Digital Forensics Industry Overview

The North America Digital Forensics Market is significantly competitive owing to the presence of multiple players. The market is moderately concentrated, with the major players adopting strategies such as mergers and acquisition product innovation to make their offerings better and expand their reach. Some of the major players operating in the market are IBM Corporation, KLDiscovery Inc., Paraben Corporation, Cisco Systems Inc., among others.

- January 2022 - STG, the company to which FireEye had sold its name and products business, announced the launch of Trellix, an extended detection and response company, which is a combination of FireEye and the McAfee enterprise business.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in Cyber Crimes and Advanced Theft Mechanisms

- 4.2.2 Growing Adoption of IoT Devices Driving the Demand for Digital Forensics Solutions

- 4.3 Market Restraints

- 4.3.1 Lack of Skilled Professionals

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Type

- 5.2.1 Mobile Forensic

- 5.2.2 Computer Forensic

- 5.2.3 Network Forensic

- 5.2.4 Other Types

- 5.3 By End-user Industry

- 5.3.1 Government and Law Enforcement Agencies

- 5.3.2 BFSI

- 5.3.3 IT and Telecom

- 5.3.4 Other End-user Verticals

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IBM Corporation

- 6.1.2 Binary Intelligence LLC

- 6.1.3 Guidance Software Inc. (Opentext)

- 6.1.4 AccessData Group LLC

- 6.1.5 KLDiscovery Inc.

- 6.1.6 Paraben Corporation

- 6.1.7 FireEye Inc.

- 6.1.8 LogRhythm Inc.

- 6.1.9 Cisco Systems Inc.

- 6.1.10 Oxygen Forensics Inc.