|

市场调查报告书

商品编码

1639506

英国工厂自动化和工业控制系统:市场占有率分析、行业趋势和成长预测(2025-2030)United Kingdom Factory Automation and Industrial Control Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

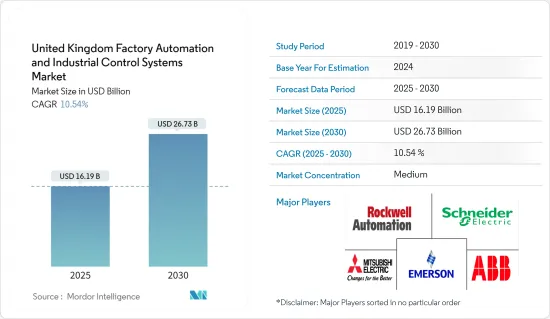

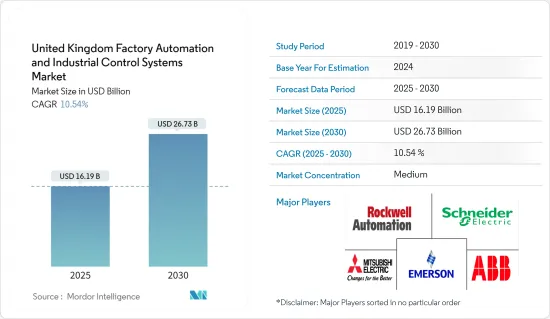

预计2025年英国工厂自动化和工业控制系统市场规模为161.9亿美元,2030年将达267.3亿美元,预测期内(2025-2030年)复合年增长率为10.54%。

COVID-19 的爆发和英国各地的封锁规定影响了全国各地的工业活动。该禁令的影响包括供应链中断、原材料供应、劳动力短缺、价格波动和运输问题。

主要亮点

- 随着该地区为 2019 年议会提出的第四次工业革命做准备,英国工业 4.0 市场预计将成长。第四次革命的特点是人工智慧、基因编辑和先进机器人等技术的融合。

- 随着竞争的迅速加剧和最终用户需求的不断变化,英国製造业也被迫采用更新的技术创新和数位转型解决方案,以使业务流程尽可能高效。例如,马达和感测器等现场设备为汽车行业提供了快速响应市场需求、减少製造停机时间、提高供应链效率和扩大生产力的机会。

- 此外,英国政府还启动了一个新计划,旨在创建全自动药物发现设施,以加速新药的生产并改造製药业。位于剪切机哈韦尔的罗莎琳德富兰克林研究所将启动免持分子发现,据信生产新药的速度比平常快 10 倍以上。

- 在供应方面,许多产业正在引入有望颠覆现有工业价值链的技术,例如工业物联网(IIoT)和机器人技术。

- 这些自动化系统的高成本与有效且强大的硬体和高效的软体有关。这些自动化设备需要高资本支出,投资自动化技术可能需要花费数亿美元来设计、製造和安装。

英国工厂自动化与工业控制系统市场趋势

製造执行系统(MES)可望推动市场成长

- MES 是一种用于製造业的电脑化系统,用于规划、安排、追踪和增强业务。 MES的功能是确保所有流程高效运作。随着製造流程变得越来越复杂,MES 软体变得至关重要。

- MES 系统的范围从调度任务到在整个製造过程中执行效能分析。组织一直在使用 MES 来协调整个工厂的活动。 MES 也充当流程管理系统和企业资源规划系统(ERP) 之间的桥樑。

- 製造公司面临着提高製造盈利、提高收益、降低业务风险和加强客户关係流程等挑战。公司开始采用 MES 来克服这些业务挑战,事实证明这是製造公司处理营运的传统方法。

- 透过将MES与ERP系统集成,製造企业可以有效地协调工作订单和其他资源需求,实现即时生产调整、准确的需求预测、准时交货和紧急订单,这有助于薄型化製造业,例如。问题并提供无缝变更指令。

- 在这个市场上,各行业的MES实施合约不断增加。例如,2020 年 7 月,普锐特冶金技术订单了为巴西米纳斯吉拉斯州 Ouro Blanco 的 Gerdau 综合工厂熔炼车间安装製造执行系统 (MES) 的合约。这项新解决方案取代了运行几年后提供有限升级选项的现有系统。该计划将由普锐特冶金技术与 PSI Metals 合作实施,汇集钢铁行业领先的自动化、冶金和软体专业知识。

汽车和运输业预计将推动该国市场成长

- 汽车工业是重要产业之一,在全球自动化製造设备中占有很大份额。各种汽车製造商的生产设施都实现了自动化,以保持效率。以电动车取代传统汽车的趋势日益明显,预计将进一步增加汽车产业的需求。

- 製造过程中越来越多地采用自动化、数位化和人工智慧的参与是推动汽车产业对工业机器人需求的关键因素。根据 IFR 的数据,英国汽车业是机器人最大的用户之一,截至 2019年终,占运作机器人总数 11,000 台的 52%。

- 具有高承重能力和可伸缩臂的大型工业机器人能够点焊重型汽车车身面板。小型机器人焊接轻型零件,例如安装座和支架。机器人钨极惰性气体焊接机和金属惰性气体焊接机可以在每个循环期间将焊枪定位在相同的方向。

- 物联网不仅帮助重新构想製造和设计,还帮助重新构想汽车洞察体验和分销服务。物联网 (IoT) 有助于提高汽车製造的生产效率、品质并最终降低成本。

- 根据汽车製造商和贸易商工业的数据,英国汽车工业是该地区最有价值的经济资产之一,每年为经济贡献约 227 亿美元。此外,该行业在国内僱用了数十万人从事高技能、高价值的工作。此类案例可能会促进该国市场的成长。

英国工厂自动化和工业控制系统产业概况

英国工厂自动化和工业控制设备市场适度整合。儘管大公司主导市场,但越来越多的新兴企业进入市场。这些新兴企业得到了英国政府计划的大力支持。

- 2021 年 9 月 - 数位转型和工业自动化领域的领导者罗克韦尔自动化公司已完成对 Plex Systems 的收购。此次收购将使罗克韦尔增强其云端交付的智慧製造解决方案,并将智慧製造带入客户的业务中。

- 2021 年 5 月-施耐德电机宣布在欧洲市场推出符合 IP 和 NEMA 标准的 EcoStruxure 微型资料中心 R 系列。这些资料中心提高了安全性、生产力和自动化能力,并为具有挑战性的製造和工业环境提供了快速且有弹性的解决方案。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场概况

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 自动化技术的兴起

- 积极的政府措施和充满活力的新兴企业生态系统

- 市场问题

- 行业法规政策

- 关键案例及实施场景

第六章 市场细分

- 按类型

- 工业控制系统

- 集散控制系统(DCS)

- 可程式逻辑控制器(PLC)

- 监控/资料采集(SCADA)

- 产品生命週期管理 (PLM)

- 製造执行系统(MES)

- 人机介面 (HMI)

- 其他工业控制系统

- 现场设备

- 机器视觉

- 工业机器人

- 马达和驱动器

- 安全系统

- 感测器和发射器

- 其他现场设备

- 工业控制系统

- 按最终用户产业

- 石油和天然气

- 化学/石化

- 电力/公共产业

- 饮食

- 汽车/交通

- 製药

- 其他的

第七章 竞争格局

- 公司简介

- Schneider Electric SE

- Rockwell Automation Inc.

- Honeywell International Inc.

- Emerson Electric Company

- ABB Ltd

- Mitsubishi Electric Corporation

- Siemens AG

- Omron Corporation

- Yokogawa Electric Corporation

- Fanuc Corporation

第八章投资分析

第9章 未来展望

The United Kingdom Factory Automation and Industrial Control Systems Market size is estimated at USD 16.19 billion in 2025, and is expected to reach USD 26.73 billion by 2030, at a CAGR of 10.54% during the forecast period (2025-2030).

The COVID-19 outbreak and lockdown restrictions across UK affected the industrial activities across the country. Some of the effects of lockdown include supply chain disruptions, lack of availability of raw materials, labor shortages, fluctuating prices, shipping problems, etc.

Key Highlights

- The market for Industry 4.0 in the United Kingdom is expected to grow in the future as the region gets ready for the Fourth Industrial Revolution, which was presented to the parliament in 2019. The fourth revolution is characterized by a fusion of technologies such as artificial intelligence, gene editing, and advanced robotics.

- With the rapid increase in competition and evolving end-user requirements, manufacturing units in the United Kingdom are also being forced to adopt newer technological innovations and digital transformation solutions to make their business process as efficient as possible. For instance, field devices, like motors and sensors, offer opportunities to the automotive industry to react faster to market requirements, reduce manufacturing downtimes, enhance the efficiency of supply chains, and expand productivity.

- Moreover, the government of UK has undertaken a new project to create a fully-automated drug discovery facility to speed up the production of new medicines and transform the pharma industry. The Rosalind franklin institute in Harwell, Oxfordshire, would initiate hands-free molecular discovery to generate new drugs at a speed more than ten times of the norm.

- On the supply side, many industries are already witnessing the introduction of technologies, such as Industrial Internet of Things (IIoT) and robotics, which are expected to disrupt the well-established industry value chains.

- The high cost of these automated systems is associated with the effective and robust hardware and efficient software. These automation equipment requires the high capital expenditure in order to invest in automation technologies which can cost millions of dollars to design, fabricate, and install.

United Kingdom Factory Automation and Industrial Control Systems Market Trends

Manufacturing Execution System (MES) are Expected to Drive the Growth of Market

- MES is a computerized system that is used in manufacturing to plan, schedule, track, and enhance operations. The function of MES is to ensure that all processes work in an efficient way. As the manufacturing process becomes more complex, MES software is essential.

- The scope of MES systems ranges from scheduling tasks to carrying out performance analysis across the entirety of the manufacturing process. Organizations have been using MES to coordinate activities across the factory floor. It also serves as a bridge between process control systems and enterprise resource planning (ERP).

- Manufacturing organizations face challenges in increasing manufacturing profitability, obtaining a higher return on assets, lowering business risk, and enhancing customer relationship processes. Companies started adopting MES to overcome these business challenges, which turned out to be a traditional approach toward handling the operations in manufacturing companies.

- The integration of MES with ERP systems enables manufacturers to coordinate work orders, and other resource needs effectively, as well as helps make manufacturing leaner with real-time production adjustments, accurate demand forecasts, just-in-time deliveries, the ability to avoid rush orders and seamless change orders.

- The market is witnessing an increase in contracts for the implementation of MES across different industries. For instance, in July 2020, Primetals Technologies received an order for the installation of a Manufacturing Execution System (MES) for Gerdau's integrated plant melt shop in Ouro Branco, Minas Gerais, Brazil. The new solution will replace an existing system, which offers only limited upgrade options after several years of operation. The project will be executed by Primetals Technologies in cooperation with PSI Metals, thus, combining leading automation, metallurgical, and software know-how in the steel industry.

Automotive and Transportation Industry Expected to Drive the Market Growth in the Country

- The automotive industry is among the prominent sectors that hold a significant share of the world's automated manufacturing facilities. The production facilities of various automakers are automated to maintain efficiency. The growing trend of replacing conventional vehicles with EVs is expected to further augment the automotive industry's demand.

- The growing adoption of automation in manufacturing processes and digitization and AI involvement are primary factors driving industrial robots' demand in the automotive sector. According to IFR, the automotive industry in the UK is one of the largest users of robots, accounting for 52% of robots' total operational stock at 11,000 units by the end of 2019.

- Large industrial robots with a higher payload and extended arms capabilities handle spot welding on heavy body panels. Smaller robots weld lighter parts such as mounts and brackets. Robotic tungsten inert gas and metal inert gas welders can position the torch in the same orientation for every cycle.

- IoT is helping reshape not only manufacturing and design but also vehicle insight experiences and distribution services. Internet of Things (IoT) helps improve automotive manufacturing production efficiency, improve quality, and, ultimately, reduce costs.

- According to the Society of Motor Manufacturers and Traders, the UK's automotive industry is one of the region's most valuable economic assets, contributing roughly USD 22.7 billion per year to the economy. In addition, the industry employs hundreds of thousands of people across the country in high-skill and high valued jobs. Such instances are likely to augment the market growth in the country.

United Kingdom Factory Automation and Industrial Control Systems Industry Overview

The UK factory automation and industrial controls market is moderately consolidated. The market is dominated by major players but is increasingly witnessing the entry of new start-ups. These start-ups are getting ample support from the UK government programs.

- September 2021 - Rockwell Automation, Inc., the largest digital transformation and industrial automation company completed the acquisition of Plex Systems. This acquisition allows Rockwell to strengthen their cloud-delivered intelligent manufacturing solutions and provide smart manufacturing in customer operations.

- May 2021 - Schneider Electric announced the availability of their IP and NEMA rated EcoStruxure Micro Data Center R-Series in the European market. These data centers offer quick to deploy and resilient solutions to challenging manufacturing and the industrial environment with increased safety, production, and automation capabilities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGTHS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID -19 impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Gaining Prominence for Automation Technologies

- 5.1.2 Proactive Government Policies and a Vibrant Startup Ecosystem

- 5.2 Market Challenges

- 5.3 Industry Policies and Regulations

- 5.4 Key Case Studies and Implementation Scenarios

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Industrial Control Systems

- 6.1.1.1 Distributed Control System (DCS)

- 6.1.1.2 Programable Logic Controller (PLC)

- 6.1.1.3 Supervisory Control and Data Acquisition (SCADA)

- 6.1.1.4 Product Lifecycle Management (PLM)

- 6.1.1.5 Manufacturing Execution System (MES)

- 6.1.1.6 Human Machine Interface (HMI)

- 6.1.1.7 Other Industrial Control Systems

- 6.1.2 Field Devices

- 6.1.2.1 Machine Vision

- 6.1.2.2 Industrial Robotics

- 6.1.2.3 Motors and Drives

- 6.1.2.4 Safety Systems

- 6.1.2.5 Sensors & Transmitters

- 6.1.2.6 Other Field Devices

- 6.1.1 Industrial Control Systems

- 6.2 By End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Chemical and Petrochemical

- 6.2.3 Power and Utilities

- 6.2.4 Food and Beverage

- 6.2.5 Automotive and Transportation

- 6.2.6 Pharmaceutical

- 6.2.7 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schneider Electric SE

- 7.1.2 Rockwell Automation Inc.

- 7.1.3 Honeywell International Inc.

- 7.1.4 Emerson Electric Company

- 7.1.5 ABB Ltd

- 7.1.6 Mitsubishi Electric Corporation

- 7.1.7 Siemens AG

- 7.1.8 Omron Corporation

- 7.1.9 Yokogawa Electric Corporation

- 7.1.10 Fanuc Corporation